Human Capital Management (HCM) Market Segmented By HCM Software, HCM Services Solution in Cloud-based HCM Solutions, On-premise HCM Solutions Deployment for Large Enterprises and Small & Medium Enterprises Size

Industry: IT and Telecommunication

Published Date: April-2022

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 482

Report ID: PMRREP33033

The size of the global human capital management (HCM) market is expected to rapidly increase from US$ 20.54 Mn in 2022 to US$ 43.1 Bn by 2032, at a high CAGR of 7.7%.

| Attribute | Key Insights |

|---|---|

|

HCM Market Size (2022) |

US$ 20.54 Mn |

|

Projected Year (2032) Market Value |

US$ 43.1 Bn |

|

Global Market Growth Rate (2022-2032) |

7.7% CAGR |

|

Market Share of Top 5 HCM Vendors |

40% |

Revenue from human capital management solutions accounted for almost 15% share of the global business process management market in 2021.

Growing demand for artificial intelligence and machine learning in various human capital management suites, rising need to reduce HR-related costs, prevalence of advanced solutions in the form of data processing and management, rising HCM usage for sourcing & recruiting, applicant tracking, time & attendance management, payroll & compensation, and others, will all accelerate demand growth of human capital management solutions over the coming years.

Also, rising need for workforce management and performance management services is expected to further boost the implementation of HCM solutions across the world.

The global market for human capital management expanded at the rate of 5.4% over 2017-2021. Increasing use of real-time performance management solutions and services have proven to be a game changer in workforce management.

Feedback-driven systems have been shown to be effective in a variety of sectors. Agile project management approaches are based on stage-by-stage feedback, which helps guarantee that the result meets the contract agreement.

Receiving continuous feedback on employee performance or satisfaction is not yet a current HR trend, but a number of large enterprises are adopting this rapidly. The good news is that, real-time performance management systems will provide employees and human resource professionals with more insights into their teams’ performance.

Talent managers are able to identify which employees struggle to contribute to the project, and develop strategies to more effectively incorporate them into the working environment.

Persistence Market Research identifies North America, followed by Europe, as the leading market for HCM. Expansion in South Asia & Pacific is supported by growth in the number of entry-level companies in the human capital management space.

Overall, the global HCM solutions market is predicted to surge ahead at 7.7% CAGR through 2032.

“High Adoption of AI/ML Technology for Optimizing Human Resource Activity”

Most business across verticals are facing the scarcity of high-skilled workforce as business operations become more complex due to the adoption of latest technologies. As such, HR managers are facing challenges in hiring the right personnel for respective job profiles.

Along with AI and ML technologies, HCM suites can aid HR managers in finding skilled workers. This can also help automate the recruitment process and provide more filters to find proper candidates. The study predicts that during the next ten years, up to half of all firms will have HR technology that gives daily suggestions and worker insights based on AI and machine learning.

While AI is widely utilized in recruiting, HR service delivery, and learning and development today, the world anticipates a larger adoption timetable in which AI grows into other areas of HR and becomes a mainstream practice, similar to how HR cloud technologies took approximately a decade to gain widespread use.

Talent acquisition is a critical responsibility for the HR department, since bringing in exceptional employees will contribute to the company's potential growth. The most visible application of artificial intelligence in HR may be in talent acquisition.

In 2020, Oracle predicted that by 2025, 70 percent of recruitment will be done over by AI and bots.

How are Sales of Human Capital Management Solutions Shaping Up in Asia?

“China HCM Market Leads East Asian Region”

The East Asia regional market is predicted to expand at a tremendous growth rate, after South Asia & Pacific, over the forecast period. According to the study, China is estimated to emerge as a most attractive market with a significant share of around 44% in 2022.

The human resource management environment in China has been undergoing significant changes due to institutional, demographic and technological changes, and heightened business competition domestically and internationally. Most domestic firms continue operating in a traditional personnel management mode with little or no planning or HR capability.

Nevertheless, work ethics have changed as China becomes economically stronger and has embraced international cultures, ably supported by ICT, which, in turn, is estimated to propel demand for HCM solutions in the country.

Will the MEA Region Emerge as a Prominent Market for HCM Solution Providers?

“GCC Countries to Provide Huge Opportunity for HCM Providing Companies”

Currently, GCC countries are anticipated to be one of the prominent markets in the human capital management industry in the MEA region, and the market size is expected expand 2.5X by 2032.

Most GCC countries have made progress in Human Capital Index (HCI) in the last decade. The UAE has been the frontrunner in human capital investments and formation in the region. All GCC countries have invested and continue to invest extensively (and expensively) in the education and development of its people. HCM solutions therefore play a key role in the economic and social achievements of national and organizational strategies.

Across GCC, human capital management needs to leverage various localization programs, such as Nitaqat in KSA, and take into account the need for e?ective utilization of large labor forces.

Which Market Should HCM Providers Keep an Eye on in Latin America?

“Brazil Market for HCM Solutions to Be Highly Lucrative”

Currently, the Brazil HCM market is set to register the highest growth in Latin America, and the market size is expected expand 2.2X, with an absolute $ opportunity of nearly US$ 1.16 Bn between 2022 and 2032.

Like in other countries, human resource departments of Brazilian organizations have become increasingly important in today’s industrialized economy. Major market share is mostly due to increased adoption of cloud technologies, automation, and so on.

Moreover, rising government initiatives toward digitalization and adoption of cloud technologies are further elevating demand growth of human capital management systems in Brazil.

Which Software is Most Attractive in HCM Solutions?

“Demand for Integrated Human Capital Management (HCM) Suites Rising Rapidly”

By software segment, the integrated human capital management (HCM) suite will dominate the market, and is set to witness the highest CAGR of close to 8% during 2022-2032.

Businesses all across the world are focusing on optimizing resource utilization while also increasing production. Implementing a single HCM system allows businesses to streamline HR and people procedures, while also delivering business plan alignment, team execution, and optimum employee performance. Modules including on boarding, social business & collaboration, performance management, and learning management are all part of the HCM solutions package.

Workforce management, staffing and hiring, payroll processing, time and attendance tracking, compensation management, feedback management, and other solutions can be proved by a single HCM solution suite, which is acceptable in large firms. Such suites decrease the workload of HR departments that deal with thousands of employees at a lower cost of operating.

What is the Path Ahead for HCM Solution Deployment?

“Cloud-based Human Capital Management Solutions the Way Ahead”

On the basis of deployment, cloud-based HCM solutions will be a dominating segment and is anticipated to surge at a CAGR of 8.6% from 2022 to 2032. In addition, the cloud-based segment is expected to show an absolute $ opportunity of US$ 11.7 Bn between 2022 and 2032.

The cloud-based deployment strategy has gained huge popularity. The strategy provides advantages such as profitability, ease and speed of deployment, and more flexible software administration and operations. By offering a consolidated platform, the cloud platform meets the demands of geographically distributed business divisions.

To reap the benefits of this technology, firms are migrating from on-premise HCM software to cloud-based HCM software. Given the growing demand for cloud software, HCM suppliers are concentrating on delivering SaaS-based software that may assist in reducing costs and achieving greater ROI.

Which Enterprise Size Should HCM Suppliers Focus on More?

“SMEs to Drive High Demand for Human Capital Management Solutions”

The small & medium enterprises (SMEs) segment is expected to emerge as the most attractive for human capital management solution providers, and is expected to expand at a CAGR of around 8.4% through 2032.

As options other than payroll and job boards become available for firms with less than 1,000 workers - even as few as 100 FTEs (Full Time Employees) -SMEs are rapidly adopting new HR technologies.

Now, we're witnessing the effects of social networks, social media, mobiles, and application consumerization across all product groups, making HR technology more accessible to SMEs.

Also, factors such as growing need to manage diverse workforces, increase employee productivity, and comply with regulations are factors responsible for high growth of this segment.

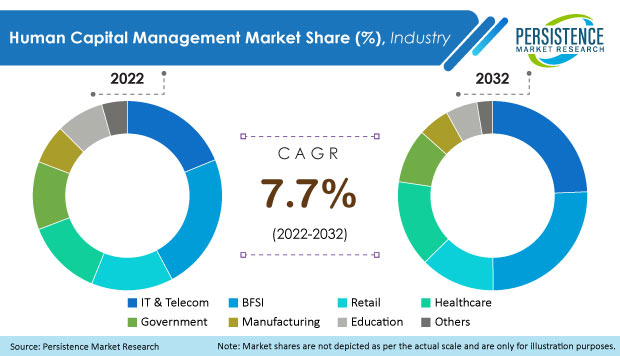

Which Industry Will Account for Highest HCM Demand?

“IT & Telecom Sector to Shape HCM Solutions Market Growth”

On the basis of industry, the IT & telecom sector in projected to showcase significant growth at 10.5% CAGR over the forecast period. The sector is also estimated to create an absolute $ opportunity of US$ 6.63 Bn by 2032.

This high growth rate can be attributed to rising need for sourcing candidates according to job profiles and growing demand for automation in systems across the IT industry.

An organization’s progress depends a lot on talent recognition, learning, and employee engagement. Company expansion can lead to complexities in workforce management. As such, demand for human capital management solutions in IT & telecom across the world is predicted to rise rapidly.

The COVID-19 pandemic had a positive impact on the market as employees were working remotely due to lockdown restrictions. HCM helped keep track of employees’ working statuses and helped HR department recruit remotely.

Moreover, since a digital workplace necessitates ongoing communication and cooperation among employees, having access to online communication tools and collaboration platforms is essential. Cloud-based HCM software enables professionals to effectively handle employee-management interactions and payroll activities.

The pandemic and its impacts on national economies and industries on a global scale are still unfolding in unpredictable ways.

Due to the COVID-19 pandemic, most organizations changed their pay. Also, this worldwide health crisis forced companies to consider long-term strategies across their pay programs, which has further driven demand for human capital management systems.

The human capital management market expanded around 5.2% to 6.7% Y-o-Y from 2019 to 2021.

The global human capital management market is fragmented with new vendors offering specific services over the cloud, such as employee on-boarding or application tracking. Legacy software giants and ERP providers are also gaining a significant market share by offering human resource management solutions.

| Attribute | Details |

|---|---|

|

Forecast Period |

2022-2032 |

|

Historical Data Available for |

2017-2021 |

|

Market Analysis |

USD Million for Value |

|

Key regions covered |

|

|

Key countries covered |

|

|

Key market segments covered |

|

|

Key companies profiled |

|

|

Report coverage |

|

|

Customization & pricing |

Available upon request |

HCM Market by Solution:

HCM Market by Deployment:

HCM Market by Enterprise Size:

HCM Market by Industry:

HCM Market by Region:

To know more about delivery timeline for this report Contact Sales

The global human capital management solution market was valued at over US$ 19.3 Bn in 2021.

From 2017 to 2021, human capital management demand increased at a CAGR of 5.4%.

Sales of human capital management solutions are projected to increase at 7.7% CAGR and be valued at US$ 43.1 Bn by 2032.

Key market trends include integration of Robotic Process Automation (RPA) with HR tools along with the adoption of AI and ML in human resource activities.

Oracle, SAP, Microsoft, Workday, and ADP are the top 5 providers of HCM solutions, accounting for around 40% market share.

India, Indonesia, and Australia & New Zealand, together, held almost 61% of the total South Asia & Pacific market share in 2021.

The U.S., Germany, Japan, India, and GCC Countries account for most revenue from human capital management solutions/ services.

The U.S., India, UAE, Germany, and Singapore are prominent providers of HCM solutions.

Total absolute opportunity for Japan will be US$ 1.82 Bn, whereas, India market value will top US$ 2.75 Bn by 2032.