Industry: Food and Beverages

Published Date: September-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 173

Report ID: PMRREP34811

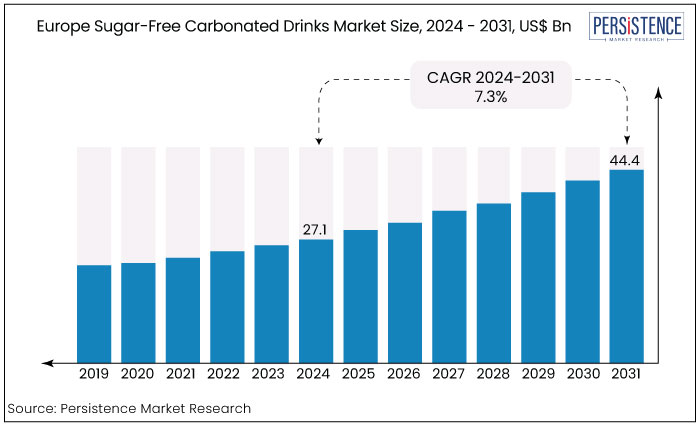

Europe sugar-free carbonated drinks market is estimated to increase from US$27.1 Bn in 2024 to US$44.4 Bn by 2031. The market is projected to record a CAGR of 7.3% during the forecast period from 2024 to 2031.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Europe Sugar-Free Carbonated Drinks Market Size (2024E) |

US$27.1 Bn |

|

Projected Market Value (2031F) |

US$44.4 Bn |

|

Europe Market Growth Rate (CAGR 2024 to 2031) |

7.3% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

5.3%. |

|

Region |

Market Share in 2024 |

|

United Kingdom |

29.4% |

United Kingdom has consistently maintained a substantial share in the Europe sugar-free carbonated drinks market. The U.S. market is estimated to account for around 29.4% share in 2024. This substantial share is owed to a strong base of health-conscious consumers and rising awareness associated with the benefits of low-calorie beverages.

The increasing trend of fitness culture and a shift toward healthy lifestyles have significantly driven demand for sugar-free options. Furthermore, innovative product offerings from major brands and the growing availability of natural sweeteners have further supported this trend. Retailers are also enhancing their marketing strategies to promote sugar-free alternatives, boosting their market presence.

|

Category |

Market Share in 2024 |

|

By Flavor- Cola |

54.8% |

As per the Europe sugar-free carbonated drinks market analysis based on flavor profile, the cola flavor has maintained its position as the largest contributor capturing a substantial 54.8% share in 2024. This dominance is due to its long-standing popularity and brand loyalty.

Cola-flavored beverages have established themselves as iconic choices among consumers, making them a staple in the beverage industry. Leading brands are continuously innovating their product portfolios to offer sugar-free cola options, thereby enhancing taste and quality to meet evolving consumer preferences. This strong market presence and ongoing promotional efforts have solidified cola's dominance.

|

Category |

Market Share in 2022 |

|

By Distribution Channel – Hypermarkets / Supermarkets |

48.8% |

Hypermarkets/supermarkets have established a substantial lead commanding an impressive 48.8% market share in terms of value. This segment's continued dominance can be attributed to their extensive product range and convenient shopping experiences.

Large retail formats provide consumers with a wide selection of sugar-free options within the carbonated beverage segment, thus catering to the growing demand for healthy beverages.

Strategic promotional activities, bulk purchasing discounts, and loyalty programs are further attracting consumers. Additionally, the presence of in-store tastings and marketing campaigns further enhance visibility and encourage trial solidifying their market dominance.

The sugar-free carbonated drinks market in Europe is driven by increasing health consciousness among consumers and a shift toward healthy beverage options. Growing concerns associated with high sugar intake and leading obesity cases have led consumers to shift toward alternatives like low- or zero-sugar beverages without compromising on the taste factor.

Companies are further experimenting with the flavor profiles by using natural sweeteners like stevia and monk fruit. Consequently, reshaping their product offerings and attracting a diverse consumer base. There is an increasing preference for beverages that align with wellness goals prompting leading brands to expand their sugar-free portfolios.

Targeted marketing strategies that emphasize the health benefits of sugar-free options resonate with an increasingly aware audience. Together, these trends are not only driving market growth but also reshaping the beverage landscape in Europe fostering a culture of healthy choices.

The increasing influence of e-commerce channels, the availability of sugar-free options in hypermarkets and supermarkets and increasing focus on providing sustainable packaging solutions are further appealing to environmentally conscious buyers. The combination of health trends and innovative marketing strategies positions Europe sugar-free carbonated drinks market for continued expansion.

The demand for sugar-free carbonated drinks in Europe is fueled by increasing awareness of health and wellness. Consumers have shifted away from traditional sugary beverages, driving demand for low-calorie alternatives. This transition has led to a surge in product innovation, with brands introducing a variety of sugar-free options that incorporate natural sweeteners and unique flavor profiles.

Europe market for sugar-free carbonated drinks recorded a CAGR of 5.3% indicating steady growth during the historic period. Expansion in E-commerce sector, and online shopping will provide great accessibility to a wide range of sugar-free products pushing retailers to enhance their offerings and marketing strategies to cater to this evolving consumer preference.

The sugar-free carbonated drinks market overview has shown consistent growth over the years, and its upward trajectory is expected to continue in the future. The market is projected to capture a CAGR of 7.3% during the period from 2024 to 2031.

Influence of Fitness and Wellness Trends

Europe sugar-free carbonated drinks market is significantly influenced by rising health consciousness, increased demand for low-calorie options, and the impact of fitness and wellness trends. With growing awareness regarding health risks associated with high sugar intake, consumers are actively seeking out beverages that align with their wellness goals fuelling the popularity of sugar-free drinks.

The fitness movement further propels this demand, as individuals look for products that complement their active lifestyles. Brands are responding by innovating with natural sweeteners and diverse flavour profiles, catering to health-savvy consumers who prioritize quality ingredients.

Effective Marketing Strategies and Promotions

Europe sugar-free carbonated drinks market is experiencing transformative growth driven by effective marketing strategies, increased availability of e-commerce platforms, and the expansion of retail channels. Brands are leveraging targeted advertising and promotional campaigns to highlight the benefits of sugar-free beverages appealing to health-conscious consumers.

Social media and influencer partnerships have become pivotal in reaching young demographics creating a buzz around new product launches. Simultaneously, the rise of e-commerce platforms has revolutionized how consumers access sugar-free options.

Online shopping offers convenience and a broad selection allowing consumers to explore niche products that may not be available in traditional retail settings. This accessibility is complemented by the expansion of retail channels including supermarkets and specialty health stores, which now prominently feature sugar-free drinks.

All these factors enhance market visibility and encourage trial among consumers. As brands continue to innovate and adapt their marketing efforts to suit evolving shopping behaviours, Europe sugar-free carbonated drinks market is well-positioned for sustained growth and diversification in the coming years.

Limited Consumer Awareness of Sugar Alternatives

Limited awareness of alternatives for sugared beverages, competition from traditional beverages and negative perception associated with artificial sweeteners are some of the key factors impeding the European sugar-free carbonated drinks market. The lack of knowledge regarding the benefits and availability of sugar alternatives stems from longstanding habits and preferences for familiar sugary drinks, which often dominate market visibility.

Competition from traditional beverages and perceptions surrounding artificial sweeteners further complicates the landscape, as traditional products benefit from established brand loyalty and widespread consumer acceptance.

Regulatory Challenges and Labeling Requirements

Europe sugar-free carbonated drinks market faces several challenges that could impede its growth, including regulatory challenges, inconsistent supply chains, and environmental concerns regarding packaging waste. Regulatory frameworks across different countries complicate the approval process for new products, especially those using novel sweeteners.

Stringent labeling requirements also pose a challenge as brands must navigate complex regulations to communicate health benefits effectively while ensuring compliance. Inconsistent supply chains disrupt the availability of raw materials and finished products, affecting production schedules and market responsiveness. This inconsistency leads to stock shortages or delays, impacting consumer access to sugar-free options.

The growing emphasis on sustainability has heightened scrutiny of packaging practices, pressuring brands to adopt sustainable packaging to reduce environmental impact. Together, these factors present significant hurdles for manufacturers and retailers in the sugar-free carbonated drinks market.

Collaboration with Health and Fitness Brands

Partnerships with health and fitness brands are enhancing their brand credibility and expanding reach among health-conscious consumers. These collaborations involve co-branded products, joint marketing initiatives, and sponsorship of fitness events effectively promoting sugar-free options as integral to a healthy lifestyle.

The rise of e-commerce and direct-to-consumer channels are further enabling brands to engage with consumers effectively, providing convenient access to a wide range of sugar-free beverages. This shift is allowing companies to tailor their marketing efforts and foster a personalized shopping experience enhancing customer loyalty. Using these channels, the brands can differentiate themselves in a crowded market and build stronger connections with targeted audiences ultimately driving growth in the sugar-free carbonated drinks sector.

Regional Market Expansion in Emerging Economies

Emerging markets across the globe are increasingly adopting healthier beverage choices, creating a ripe environment for sugar-free products. Furthermore, utilizing data analytics, market players can gain deep insights into consumer behavior and preferences. Companies can thus strategically enter these regions, tailoring their offerings to local tastes and preferences to capture new consumer segments. By analyzing purchasing patterns and demographic trends, brands can effectively cater to specific consumer needs, enhancing customer satisfaction and loyalty.

Europe sugar-free carbonated drinks market presents significant opportunities through regional expansion in emerging economies, leveraging data analytics for consumer insights, and targeting niche markets and specialty diets.

The Sugar-free carbonated drinks market is witnessing significant growth, as indicated by the market report, underscoring its dynamic nature. The competitive landscape for Europe market features leading players like Coca-Cola, PepsiCo, and Nestlé, alongside emerging brands focused on niche offerings.

Companies are increasingly investing in product innovation, utilizing natural sweeteners like stevia and monk fruit to meet consumer demand for healthy options. Additionally, marketing strategies emphasize lifestyle and wellness trends driving brand loyalty.

The rise of e-commerce and health-focused retailers further intensifies competition as brands seek to capture the growing segment of health-conscious consumers.

Recent Developments in the Sugar-Free Carbonated Drinks Market

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Million for Value |

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Product

By Flavor

By Distribution Channel

By Country

To know more about delivery timeline for this report Contact Sales

The market is estimated to increase from US$27.1 Bn in 2024 to US$44.4 Bn by 2031.

Increasing demand for low-calorie alternatives is a key driver for market growth.

Some of the leading players in the market are The Coca‑Cola Company, PepsiCo, Inc., Nestlé, Aldi Stores (Ireland) Limited, LIDL US, LLC., and Capri-Sun and Danone.

The market is projected to record a CAGR of 7.3% through 2031.

A key opportunity lies in the growing trend of natural sweeteners appealing to health-conscious consumers seeking clean-label products.