Industry: Food and Beverages

Published Date: November-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 186

Report ID: PMRREP34888

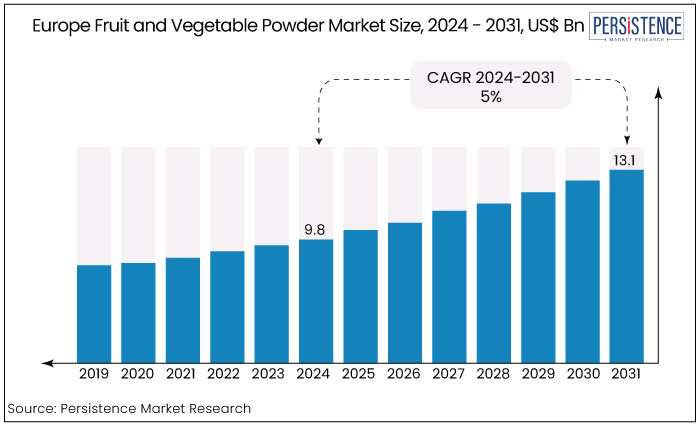

The Europe fruit and vegetable powder market is estimated to increase from US$ 9.8 Bn in 2024 to US$ 13.1 Bn by 2031. The market is projected to record a CAGR of 5% during the forecast period from 2024 to 2031.

Increasing prevalence of vitamin and mineral deficiency in Europe is anticipated to augment the fruit and vegetable powder market through 2031. VITALL, for instance, found that nearly 1 billion individuals across the globe suffer from low levels of vitamin D. Around 20% of the total population in the U.K. have at least one type of vitamin D deficiency. Around 60% of the population, on the other hand, live with insufficient levels of vitamin D. These numbers are anticipated to rise in the next ten years, thereby boosting the need for food fortification with fruit and vegetable powders.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Europe Fruit and Vegetable Powder Market Size (2024E) |

US$ 9.8 Bn |

|

Projected Market Value (2031F) |

US$ 13.1 Bn |

|

Market Growth Rate (CAGR 2024 to 2031) |

5% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

6.2% |

|

Country |

Market Share in 2024 |

|

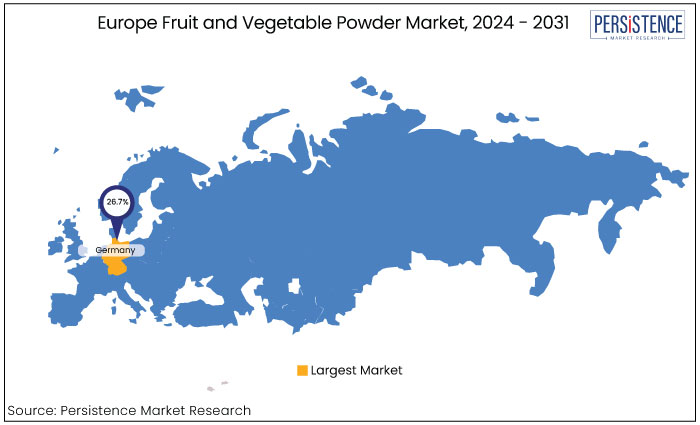

Germany |

26.7% |

Germany is expected to maintain a significant fruit and vegetable powder market share due to multiple factors. Growing focus of consumers on health and wellness, driven by rising awareness of natural, plant-based diets is set to fuel demand for powders. These are likely to be used in smoothies, supplements, and functional foods.

Germany’s established food processing industry also plays a critical role as manufacturers incorporate fruit and vegetable powders into packaged foods and beverages. They aim to enhance nutrition without compromising taste or shelf life. The rise of organic agriculture in Germany is also set to push demand for clean-label products, thereby augmenting growth.

Organic fruit and vegetable powders are gaining immense popularity in Germany, especially among consumers seeking minimally processed, pesticide-free options. The shift toward sustainable sourcing practices also gives the country a competitive edge. Companies are likely to focus on transparent supply chains and sustainable production methods, meeting both European Union (EU) regulations and consumer expectations.

|

Category |

Market Share in 2024 |

|

Product Type - Fruit Powder |

58.9% |

Fruit powder is anticipated to remain at the forefront in the forecast period in Europe due to rising demand for clean-label and natural ingredients in the food and beverage industry. Fruit powders, such as apples, berries, and citrus, are widely preferred as they retain essential nutrients, flavors, and colors without synthetic additives. This aligns with rising consumer preferences for healthy and minimally processed food options. Additionally, growing popularity of functional foods and beverages, including smoothies, health bars, and plant-based supplements, drives demand for natural fruit powders.

|

Category |

Market Share in 2024 |

|

Application – Food and Beverage |

44.2% |

The food and beverage segment holds a dominant position in the application category of the Europe fruit and vegetable powder market. It is due to growing consumer demand for convenient, healthy, and functional food products.

Consumers are increasingly prioritizing nutrition worldwide. Hence, manufacturers are leveraging freeze dried fruit and vegetable powders as natural ingredients to enhance product profiles with essential vitamins, antioxidants, and minerals. These powders provide an attractive alternative to synthetic additives, aligning with the market’s clean-label and plant-based trends.

Demand for plant-based nutraceuticals in Europe is witnessing rapid growth, driven by rising consumer awareness of preventive health and wellness. The powders have become essential components in health-focused products like smoothies, protein shakes, and functional foods. This is attributed to the growing shift of modern consumers toward natural and sustainable alternatives.

The appeal lies in their rich concentration of vitamins, minerals, antioxidants, and dietary fiber. This makes them ideal for consumers seeking whole-food nutrition without artificial additives. The aforementioned trend aligns with the increasing popularity of vegan and plant-based diets, particularly among millennials and Gen Z, who prioritize sustainable and ethical consumption.

Fruit powders like blueberry, acai, and pomegranate are integrated into energy-boosting formulas. Vegetable powders such as spinach, kale, and beetroot are gaining popularity in fitness supplements for their endurance-enhancing and detoxifying properties. Moreover, these powders are being incorporated into protein blends as plant-based protein alternatives like pea or hemp protein gain traction over animal-based products.

The Europe fruit and vegetable powder market surged at a CAGR of 6.2% in the historical period between 2019 and 2023. It was pushed by rising demand for natural and healthy food ingredients across industries like bakeries, beverages, dairy, and ready-to-eat products. The market benefited from increasing consumer interest in functional foods, along with the trend toward plant-based nutrition.

Forecasts suggest continued expansion throughout the future, with a focus on organic and clean-label options. This growth is set to be propelled by the popularity of powdered forms due to their longer shelf life and ease of storage compared to fresh produce. The adoption of fruit and vegetable powders in dietary supplements and infant nutritional products also contributes to this trajectory. This reflects changing consumer preferences for convenient and health-oriented products.

Food Service Industry to Adopt Fruits and Greens Powder for Convenience

The food service industry, including hotels, restaurants, and cafes, increasingly relies on fruit and veggie powder for their consistent quality, extended shelf life, and ease of use. These powders help eliminate the need for fresh produce, which can spoil quickly, ensuring kitchens maintain a steady supply of essential ingredients. This consistency is crucial for large-scale operations where maintaining flavor uniformity across dishes is non-negotiable. For example,

Companies in Europe Strive to Bag Organic Certifications to Gain Consumers’ Trust

Growing demand for organic and sustainable products in Europe is significantly driving the fruit and vegetable powder market. As consumers become more eco-conscious, they seek products with sustainable practices and minimal environmental impact.

Organic fruit and vegetable powders, produced without synthetic pesticides, fertilizers, or GMOs, align perfectly with these preferences. These are gaining traction across food, beverage, and nutraceutical industries. Europe’s customers view organic certifications as a mark of trust, further influencing purchasing decisions. It is especially significant across health-related segments, such as functional foods and infant nutrition.

Production Costs to Remain High as Processing Techniques Become Advanced

High production costs are a significant challenge for companies in Europe, primarily augmented by the sourcing of high-quality organic ingredients. Organic farming practices typically require labor-intensive methods and stricts adherence to sustainability standards, resulting in high costs for growers.

The premium pricing extends to the raw materials needed for powder production, which can inflate production expenses. Advanced processing techniques needed to maintain the nutritional integrity and flavor might add another layer of financial burden. For instance, freeze-drying and spray-drying methods, while effective in preserving the quality of the produce, require sophisticated technology and high energy consumption, thereby raising costs.

Rapid Climate Change May Affect Agricultural Yields

Short supply chain vulnerabilities pose a significant threat to the fruit and vegetable powder industry in Europe, with disruptions resulting from climate change and logistical challenges. Climate change has led to increasingly erratic weather patterns, impacting agricultural yields and the timely harvest of essential fruits and vegetables. For example,

As manufacturers rely on specific raw materials, any disruption in the supply chain can ripple through production schedules. It can further cause delays in product availability and negatively affect customer satisfaction.

Food Fortification to Prevent Micronutrient Deficiencies Creates New Avenues

Food fortification has become a key strategy for manufacturers aiming to enhance the nutritional value of their products. It is also enabling them to address public health concerns related to micronutrient deficiencies.

Fruit and vegetable powders emerge as versatile and innovative solutions that can seamlessly integrate into various food applications, including cereals, snack bars, and beverages. These powders are packed with essential vitamins, minerals, and phytonutrients, offering a concentrated source of nutrition without compromising flavor. For example, adding beetroot powder can boost iron levels, while spirulina can enrich products with protein and antioxidants. This not only raises the health profile of everyday foods but also caters to the rising demand for functional products that contribute to a person’s well-being.

Brands Focus on Establishing Online Presence to Connect Directly with Consumers

Rapid expansion of e-commerce has transformed how consumers shop, presenting a significant opportunity for companies in the Europe fruit and vegetable powder market. As online shopping becomes increasingly prevalent, companies are set to leverage e-commerce platforms to connect directly with consumers offering a broad reach than traditional retail channels.

By establishing user-friendly websites and engaging in popular marketplaces, they can showcase their diverse range of fruit and vegetable protein powders. These can be exhibited with detailed product descriptions, health benefits, and usage suggestions.

Direct-to-consumer sales models further allow brands to create personalized shopping experiences, enhancing customer engagement through targeted marketing strategies. Additionally, subscription services for regular delivery of these powders cater to the growing consumer demand for convenience and sustainability.

The competitive landscape of the Europe fruit and vegetable powder supplement industry is characterized by a mix of established players and emerging companies striving to capture high shares.

Key industry players, such as Döhler Group, Olam International, and Kerry Group, dominate the market by offering a diverse range of high-quality products. They are leveraging advanced processing technologies to maintain nutritional integrity. These companies focus on research and development to create unique blends and functional powders that cater to health-conscious consumers and evolving dietary trends.

Recent Industry Developments in Europe Fruit and Vegetable Powder Market

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Application

By Distribution Channel

By Region

To know more about delivery timeline for this report Contact Sales

It is estimated to increase from US$ 9.8 Bn in 2024 to US$ 13.1 Bn by 2031.

It is anticipated to rise at a CAGR of 5% through 2031.

They are considered a stepping stone to eating vegetables.

It usually lasts up to a year or more.

It can lead to weight gain, nutritional imbalance, and kidney stones if consumed excessively.