Industry: Chemicals and Materials

Published Date: November-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 186

Report ID: PMRREP34920

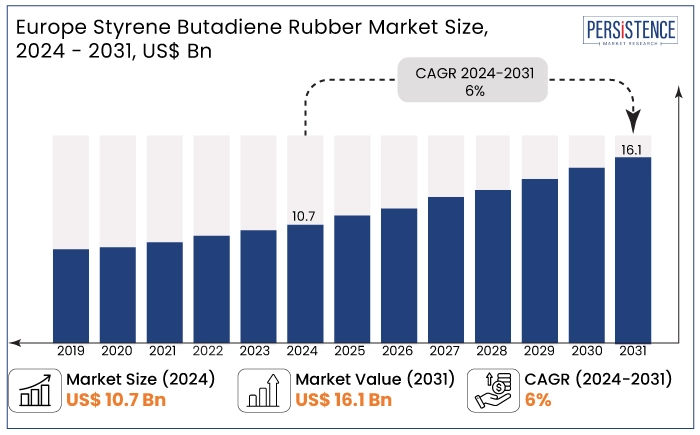

The Europe styrene butadiene rubber market is projected to witness a CAGR of 6% during the forecast period from 2024 to 2031. It is anticipated to increase from US$ 10.7 Bn recorded in 2024 to a staggering US$ 16.1 Bn by 2031. Increasing adoption of Styrene Butadiene Rubber (SBR) in the adhesives industry is significantly contributing to market expansion.

SBR's favorable properties help enhance adhesive performance in various applications. Additionally, the booming automotive market is bolstering demand, particularly in tire manufacturing, where its excellent elasticity and durability are crucial.

As per the International Council on Clean Transportation, in the European Union (EU), 9.3 million new cars were registered in 2022, a 5% drop from the year before. Growth was limited to the luxury and micro segments, with the luxury segment rising 63% over 2021. These rising numbers are anticipated to create a high demand for superior tires, thereby boosting growth.

SBR does have limitations, particularly its lack of oil resistance, which may affect its performance on certain applications. Despite this, rising demand from the construction industry is supporting market growth. SBR's versatility also makes it suitable for various construction applications, including sealants and coatings, thereby driving its consumption in this industry.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Europe Styrene Butadiene Rubber Market Size (2024E) |

US$ 10.7 Bn |

|

Projected Market Value (2031F) |

US$ 16.1 Bn |

|

Europe Market Growth Rate (CAGR 2024 to 2031) |

6% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

5.5% |

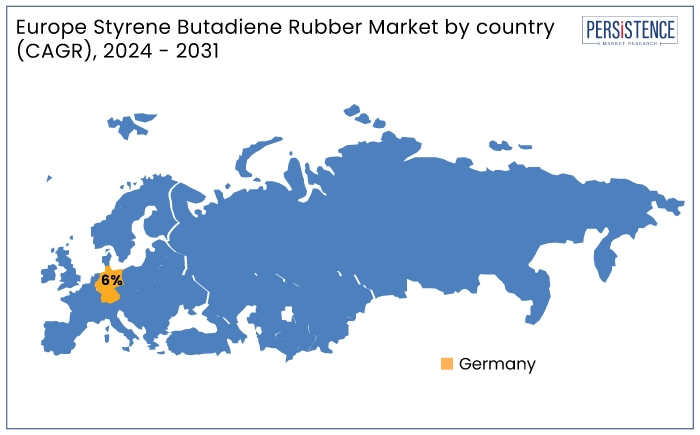

Germany is anticipated to witness a leading CAGR of 6% in the styrene butadiene copolymer latex industry through 2031. It is attributed to ongoing industrial activities and the presence of a well-established automotive industry. SBR is set to be extensively used in tire manufacturing and other applications. Germany's well-established manufacturing infrastructure and innovation in polymer technology is further set to enhance its position.

The Emulsion Styrene Butadiene Rubber (E-SBR) segment dominates the market primarily due to its low production costs, making it an attractive option for various applications. E-SBR is widely used in tire manufacturing and other products, benefiting from its cost-effectiveness.

Rising consumer demand for high-performance tires, however, is gradually shifting the focus of leading players toward Solution Styrene Butadiene Rubber (S-SBR). It is mainly known for its low rolling resistance properties. This transition reflects the automotive industry's push for more fuel-efficient and high-performing tires.

SBR is important in tire manufacturing due to its ability to enhance various performance characteristics. It helps reduce rolling resistance, leading to improved fuel economy. It also enhances wet grip and braking performance. SBR further helps in surging tire longevity by providing protection against wear and tear.

In 2021, as pandemic restrictions eased, the demand for adhesives, including rubber-based Pressure-Sensitive Adhesives (PSAs), began to recover. It surpassed pre-pandemic levels in 2022. This resurgence also increased SBR consumption in the adhesive industry.

Despite rapid growth in the automotive industry, replacement tire sales experienced a decline of more than 8% in 2023 compared to 2022, as reported by the European Tire and Rubber Manufacturers Association. This reduction in replacement sales highlights the improved durability of tires achieved through the application of unique technologies in conjunction with SBR.

The Europe styrene butadiene rubber market plays a key role in various industries, particularly automotive, construction, and adhesives. SBR's versatility makes it a popular choice for tire manufacturing due to its high elasticity, durability, and cost-effectiveness. The market is significantly driven by the rising demand for high-performance tires and increased usage in rubber-based pressure-sensitive adhesives.

Solution SBR (S-SBR), known for its low rolling resistance, is gaining traction due to its ability to enhance fuel efficiency in vehicles. This trend aligns with strict environmental regulations and consumer preferences for sustainable products. Technological innovations are improving SBR formulations, boosting performance and extending applications.

Despite challenges like fluctuating raw material prices and competition from alternative materials, Europe’s market is likely to surge in future. Recovery of the automotive and construction sectors post-pandemic further supports this positive outlook. It is predicted to position the market for continued expansion driven by innovation and evolving industry needs.

The Europe styrene butadiene rubber market recorded a decent CAGR of 5.5% in the historical period from 2019 to 2023. It was attributed to increased investments by key players in technological developments to innovative novel products and extend their production capabilities. For instance,

The market is estimated to record a CAGR of 6% during the forecast period between 2024 and 2031. It will likely be propelled by the rising emphasis on sustainability in several manufacturing processes. SBR is capable of providing better performance in terms of durability and recyclability compared to synthetic rubber.

Booming Automotive Market to Bolster Demand in Europe

Robust expansion of the vehicle market in Europe is a significant driver augmenting SBR latex emulsion sales. Surging vehicle production directly boosts the demand for SBR, which is primarily used in tire manufacturing.

It is important to note that while the market is recovering, vehicle registrations remain 19% lower than the pre-pandemic level of 13 million units in 2019. This indicates that while the market is booming, there is still room for growth as it continues to stabilize. Ongoing demand for high-performance tires further underscores SBR's critical role in the evolving automotive landscape. For instance,

SBR Suppliers to Witness High Demand from Footwear Brands

Demand for sports and casual footwear has increased as customers place a higher value on comfort and usefulness. Companies like Nike, Adidas, and Puma have benefited from this trend by producing fashionable yet cozy apparel and sneakers. They have been frequently launching footwear with SBR-based soles for increased wear resistance and durability. As customers choose more adaptable solutions for everyday use over formal footwear, these brands have witnessed a sharp rise in sales.

Sales of limited-edition and custom-made shoes have also increased as a result of consumers' growing desire for individualized footwear. More possibilities for design, color, and material customization are now available from footwear makers. In Europe, where customers have demonstrated a strong affinity for distinctive and customized products, this trend is especially well-liked.

High Susceptibility to Degradation May Hinder Demand

While SBR is widely used in tire manufacturing due to its excellent properties, several limitations limit its growth. Although it offers superior water and heat resistance as well as low-temperature flexibility, it has significant drawbacks. It is particularly poor in terms of resistance to oils, fuels, strong acids, fats, and greases. This drawback can limit its applications in environments where such substances are present.

SBR is also vulnerable to degradation when exposed to ozone, oxygen, and sunlight without proper additives. This susceptibility can lead to a shorter lifespan and reduced performance in outdoor applications. As industries increasingly seek materials that can withstand harsh conditions, the limitations of SBR may compel manufacturers to explore alternative rubber materials. These are set to offer better resistance to environmental factors and chemical exposure, thereby hampering demand.

Leading Companies to Launch New Products for Construction Industry

Growing demand for SBR in the construction industry presents a significant opportunity for market expansion. SBR is not only used in tire manufacturing but also in producing various items such as conveyor belts, hoses, footwear, and adhesives. Its superior versatility extends to critical applications in the construction industry, where it is employed in sealants and waterproofing membranes.

As the construction industry experiences substantial growth in both residential and commercial projects, the need for reliable materials like SBR is increasing. The ability of SBR to provide excellent water resistance and durability makes it an ideal choice for construction applications. This rising demand highlights SBR's adaptability and positions it as a valuable material in a booming industry.

The Europe Styrene Butadiene Rubber (SBR) industry is characterized by a competitive landscape featuring a mix of established players and emerging companies. Key manufacturers are focused on innovation, product quality, and extending their portfolios to meet the diverse needs of various industries, particularly automotive, construction, and adhesives.

Leading players in the market include global giants like SABIC, LANXESS, and ExxonMobil, which leverage unique manufacturing technologies and extensive distribution networks. These companies invest heavily in research and development to enhance SBR formulations, improve performance characteristics, and address sustainability concerns.

Regional players are also gaining traction by catering to specific market needs and emphasizing cost-effective solutions. The market is witnessing increased collaboration and strategic partnerships among manufacturers to develop specialized products like carboxylated styrene butadiene rubber tailored for niche applications.

Price fluctuations in raw materials and growing environmental regulations pose challenges, prompting companies to innovate and adopt sustainable practices. The competitive landscape is dynamic, with a focus on innovation, quality, and sustainability driving growth in Europe SBR.

Recent Industry Developments

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Application

By Country

To know more about delivery timeline for this report Contact Sales

Yes, the market is set to reach US$ 16.1 Bn by 2031.

It is used in tires, footwear, construction, belts, chewing gum, and electrical insulation.

Synthos S.A. is considered the leading player.

It has superior aging, crack endurance, and abrasion resistance properties.

Styrene and butadiene are the two main raw materials.