Industry: Consumer Goods

Published Date: February-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 187

Report ID: PMRREP12034

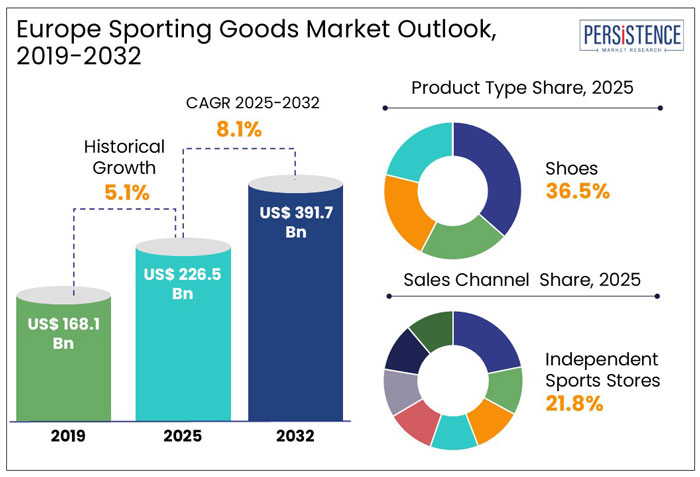

The sporting goods market size in Europe is anticipated to rise from US$ 226.5 Bn in 2025 to US$ 391.7 Bn by 2032. It is projected to witness a CAGR of 8.1% from 2025 to 2032.

The demand for sporting goods in Europe is developing, with rising health consciousness, increasing disposable income, and government initiatives promoting active lifestyles.

The athleisure trend is reshaping the industry, with companies like Adidas and Puma launching versatile sportswear that doubles as casual fashion.

Key Highlights of the Europe Sporting Goods Market

|

Global Market Attributes |

Key Insights |

|

Europe Sporting Goods Market Size (2025E) |

US$ 226.5 Bn |

|

Market Value Forecast (2032F) |

US$ 391.7 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

8.1% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.1% |

Sustainability Trend Blooms in Europe Amidst the Pandemic

As per Persistence Market Research, from 2019 to 2024, demand for sporting goods in Europe reported a CAGR of 5.1%, with Germany, France, Italy, Spain, and the U.K. holding significant shares. Manufacturers extended their products through initiatives like Adidas' Ultraboost 21, a sustainable running shoe made from recycled materials.

The COVID-19 pandemic impacted the market by reducing manufacturing activity and closing sales channels. Restricted outdoor activity and the cancellation of sporting events led to a significant decrease in the sales of sporting goods in Europe.

The trend is anticipated to improve in the post-pandemic era, with the sporting goods market in Europe expected to grow at a healthy rate in the forecast years. The removal of restrictions has helped the market recover quickly. For instance,

Rising Prevalence of Youth Sporting Events to Boost Sales through 2032

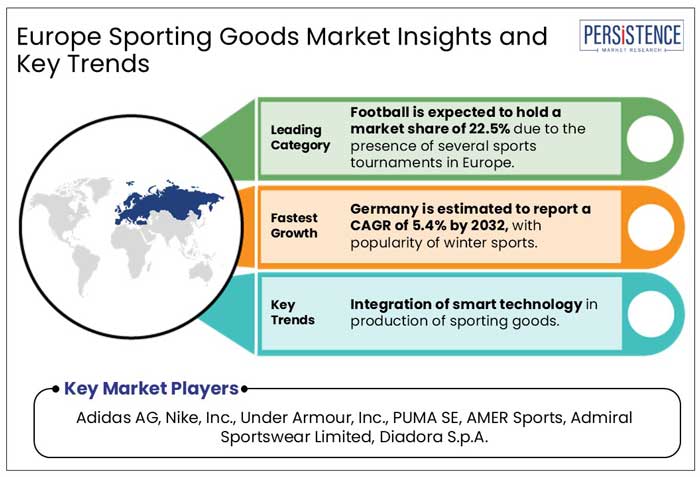

The rise in youth sports participation and demand for specialized equipment and apparel are driving the integration of smart technology in sporting equipment. Health consciousness, fitness trends, athleisure fashion, and sustainable manufacturing techniques are all contributing to the rise of the European sports sector.

European sporting goods manufacturers have committed to 100% sustainable materials by 2026, with Decathlon's eco-friendly product line showing 65% sales growth.

Outdoor recreation has seen a 45% growth in outdoor sports equipment sales, with hiking, cycling, and water sports segments showing strength across European countries.

Leading brands are boosting e-commerce growth, expanding the women's sports market, and introducing virtual fitting technologies, leading to 60% growth and 80% increased consumer interest in winter sports in Europe.

Growth Drivers

Booming Women’s Sportswear and Equipment Categories to Propel Market Growth

Demand for sporting goods, such as athletic clothing, footwear, fitness equipment, and related accessories, has increased due to Europe's rising health and fitness consciousness. As more individuals become aware of the advantages of consistent exercise and physical activity, this trend is anticipated to continue. For instance,

Key businesses expanded their categories of women's sports clothes and equipment, resulting in a 60% increase in female-focused sporting goods lines in January 2024.

Consumer interest in cutting-edge winter sports gear with novel materials and technology surged by 80% in March 2024, especially in the Alpine sports sector.

Counterfeit Sporting Goods to Undermine Brand Value and Erode Sales in Europe

In Europe, counterfeit sporting goods pose a significant threat to authentic brands, causing reputational damage and lost sales. Despite investments in anti-counterfeiting technology, collaborations with law enforcement, and consumer education, the issue persists.

High entry hurdles and the tendency of market consolidation in Europe, together with difficulties luring in foreign competitors like France and Germany, are predicted to impede market expansion.

Tech-enhanced Sports Gear to Revolutionize Performance Tracking and Personalized Training

The integration of smart technology into sporting equipment is revolutionizing the European sporting goods market, creating premium product segments.

For instance, Adidas introduced its smart soccer ball with embedded sensors to track kick speed and spin, while Nike expanded its fitness line with smart yoga mats that provide real-time posture feedback.

Leading sporting retailers, including Decathlon and JD Sports, reported a 40% rise in sales of technology-driven products in early 2024.

Developments in sports technology cater to the rising demand for health-conscious and tech-savvy consumers, enhancing performance and providing personalized sports experiences.

Product Type Insights

Athleisure’s Popularity to Fuel Shift toward Versatile and Performance-driven Sports Shoes

The demand for sports shoes in Europe is predicted to hold a market share of 36.5% in 2025 due to its critical role in performance and comfort.

Companies like Adidas and Nike continue to innovate, introducing lightweight, performance-oriented designs.

Decathlon expanded its affordable running shoe range in early 2024 to cater to diverse consumer needs. The popularity of athleisure drives demand, as consumers in Europe seek versatile footwear that combines style, comfort, and performance.

Sales Channel Insights

Quick Adaptation to Market Trends to Help Independent Sports Stores Compete with Large Chains

Independent sports stores in Europe are gaining popularity due to their personalized shopping experiences and ability to cater to niche and specialty product demands. In 2025, independent sporting goods stores in Europe are set to generate a share of 21.8%.

It is due to customer preference for personalized service and unique inventory. These stores often adapt quickly to trends, offering customized solutions for diverse sports enthusiasts. For example,

As consumers seek specialized products and experiences unavailable in large chains, independent sports stores continue to solidify their position in Europe.

Increasing Popularity of Alpine Destinations to Spur Demand for Premium Ski Gear in Germany

Germany dominates the winter sports market, holding 21.7% of the European sporting goods share in 2025, with a projected CAGR of 5.4% from 2025 to 2032. Germany's Alps region and facilities like Garmisch-Partenkirchen attract both domestic and international tourists, driving demand for high-performance equipment and apparel.

Germany's unique product offers and robust athletic culture are responsible for its supremacy in the European sporting goods sector.

Youth Sports Engagement to Augment Growth of Junior-specific Athletic Gear in the U.K.

The U.K.'s growing sports market, driven by increased participation of women and children, is expected to hold 14.3% of the European market share in 2025. The sports inclusivity industry is expected to register a CAGR of 5.8% from 2025 to 2032, driven by grassroots campaigns and government programs backed by the government of the U.K.

Government Support for Active Lifestyles to Create Opportunities in France through 2032

The sporting goods market in France is set to hold 10.6% of the European market share in 2025, with a forecast CAGR of 5.4% from 2025 to 2032, driven by rising sports and fitness participation.

France's sporting goods sector is thriving due to health awareness and government support for active lifestyles.

European sports goods producers are spending money on research and development to produce cutting-edge, custom items that satisfy customer demands. In order to enhance comfort, support, and recuperation, they are creating novel materials and designs.

Market participants are concentrating on partnerships, investment projects, mergers, and acquisitions in order to develop sports apparel and obtain a competitive edge. Companies like these are actively looking to grow in Europe with innovative marketing strategies.

Key Industry Developments

|

Report Attributes |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Sporting Category

By End User

By Sales Channel

By Country

To know more about delivery timeline for this report Contact Sales

The market is set to reach US$ 226.5 Bn in 2025.

The trends in sports apparel in 2025 are transforming Europe, with innovations like AI, AR, and sustainable practices, expanding beyond workouts to include high-tech sportswear.

Adidas AG, Nike, Inc., Under Armour, Inc., PUMA SE, and AMER Sports are few of the key players in Europe.

The industry is estimated to rise at a CAGR of 8.1% through 2032.

The market in the Germany is estimated to attain a market share of 21.7% in 2025.