Industry: Semiconductor Electronics

Published Date: April-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 188

Report ID: PMRREP33423

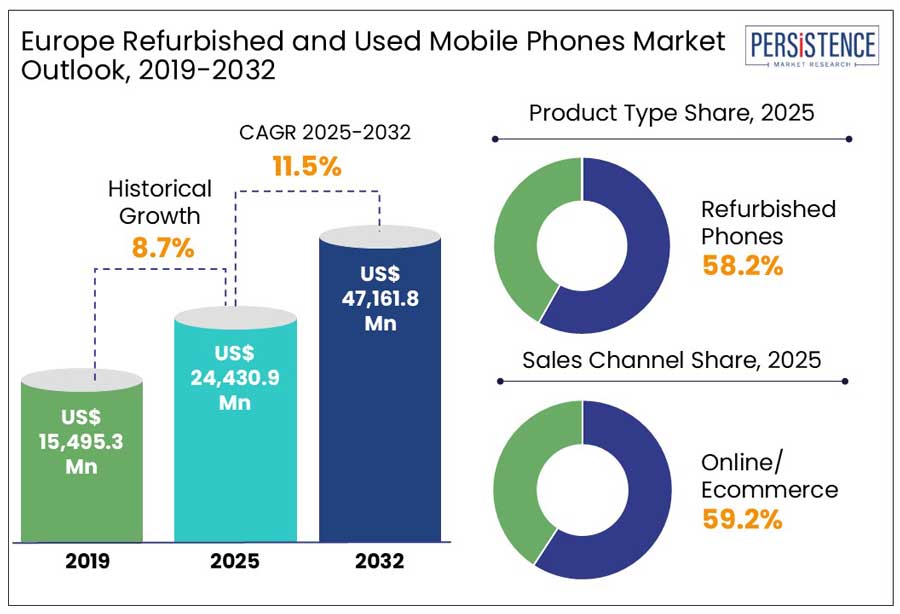

According to Persistence Market Research, the Europe refurbished and used mobile phones market is set for significant growth, projected to rise from USD 24,430.9 million in 2025 to USD 47,161.8 million at a CAGR of 11.5% by 2032. Rise in consumer demand for affordable smartphone options, sustainability, and advancements in refurbishment technology encourages the market growth.

Leading brands such as Apple, Samsung, Huawei, Google, and Xiaomi drive innovation through trade-in and buyback programs, and certified refurbished initiatives. E-waste reduction policies and regulatory support from the European Union further encourages the reuse and recycling of electronic devices. The Right to Repair movement, promotes longevity and repairability of smartphones has gained momentum, prompting manufacturers to expand their refurbishing ecosystems. This evolving regulatory landscape is expected to further fuel the growth in the coming years.

Key Industry Highlights:

|

Market Attribute |

Key Insights |

|

Market Size (2025E) |

US$ 24,430.9 Mn |

|

Projected Market Value (2032F) |

US$ 47,161.8 Mn |

|

Global Market Growth Rate (CAGR 2025 to 2032) |

11.5% |

|

Historical Market Growth Rate (CAGR 2019 to 2024) |

8.7% |

E-waste, or discarded electronics has become a growing concern. More consumers are choosing refurbished phones to save money and support waste reduction initiatives. European regulations particularly the Waste Electrical and Electronic Equipment (WEEE) Directive has played a crucial role in this transition. By mandating proper e-waste collection and recycling, these policies have encouraged manufacturers and retailers to implement take-back programs and refurbishment schemes.

The European Commission reports that these initiatives have significantly increased the access to refurbished electronics to the end-user, further aligning with the EU's broader goals for sustainability and resource efficiency.

In Europe, e-waste issues are thoroughly researched and is estimated that 11 out of every 72 electronic items in the average household are either out of service or non-functional. Moreover, citizens annually accumulate unused electrical and electronic products between 4 and 5 kg before they are ultimately discarded. With people becoming more conscious of sustainability, the refurbished phone market is set to grow.

Counterfeit mobile phones are designed to closely resemble genuine devices, but fail to match the quality and performance of a new device. According to the European Commission, counterfeit goods account for approximately five percent of all imports into the EU, with electronics ranking among the highly counterfeited product categories. As fake devices flood the consumer market, consumers become increasingly skeptical about the authenticity and reliability of refurbished phones. According to a recent EU report, a massive 86 million counterfeit products worth over €2 billion was seized in 2022, at EU borders and local markets. Italy witnessed a high number of seizures, making up over 50% of all fake goods confiscated and 33% of their total value (€660 million).

Manufacturer refurbishment programs are reshaping the refurbished mobile phone market in Europe. Leading manufacturers such as Apple and Samsung offer certified refurbishment programs, with warrantied and rigorously tested devices. For instance, Apple's certified refurbished program introduces iPhones that have undergone thorough testing under one-year warranty, making them appealing for budget-conscious consumers. These programs facilitate the device lifecycle and contribute to e-waste reduction, aligning with the European Union's sustainability objectives.

The European Union's "Right to Repair" legislation, adopted in 2021, requires manufacturers to prioritize reparability and provide spare parts for at least ten years. This policy encourages longer device lifecycles and supports the availability of refurbished products, fostering a more sustainable consumer electronics market.

Beyond refurbishment, subscription-based phone services are also gaining traction. Companies like Grover, Recommerce, and Fairphone allow consumers to rent refurbished phones for a monthly fee, making it easier to upgrade without a large upfront cost. This approach, particularly popular among younger, tech-savvy users, promotes sustainability by keeping phones in circulation longer.

The refurbished phones segment holds the largest share in the Europe market, accounting for 58.2% in 2024. Demand for refurbished mobile devices particularly peaked after the COVID-19 pandemic. Refurbished phones undergo rigorous testing, repairs, and quality checks to ensure they meet specific standards before being resold. This process makes them more reliable than used phones, which are typically sold "as-is" without guarantees.

Quality assurance and functionality makes refurbished phones more appealing to buyers seeking affordable alternatives to new devices. For instance, Swappie, a Finnish company specializes in refurbishing iPhones, has been recognized as one of the fast-growing companies. Swappie’s success reflects the rising consumer trust and demand for refurbished smartphones across Europe.

The Mid-Priced Band ($200-$500) pricing range is expected to achieve a CAGR 14.7% in 2025. Many European buyers prefer flagship or high-end devices from brands such as Apple and Samsung but at a lower cost. The mid-priced refurbished segment enables consumers to purchase premium models, such as the iPhone 16, Samsung Galaxy S25, or Google Pixel, at significantly lower prices compared to new ones. Majorly, the trade-in programs offered by major smartphone manufacturers and retailers such as Apple, Samsung, and other telecom operators provide trade-in deals where consumers exchange their old phones for discounts on new devices. These traded-in smartphones are then refurbished and resold at lower prices. Since many trade-ins involve flagship models from 2-3 years ago, their resale value typically falls within the $200-$500 range, fueling demand for mid-priced refurbished phones.

The evolution of digital marketplaces has made it easier than ever for consumers to access a wide range of refurbished and used mobile phones. Platforms like Amazon, eBay, and specialized retailers such as Back Market and Swappie offer extensive selections, allowing consumers to compare prices and features seamlessly, enabling them to make more informed purchasing decisions.

According to the International Trade Administration, Europe is the third-largest retail e-commerce market globally, with total revenues reaching approximately $631.9 billion. With an expected annual growth rate of 9.31%, European retail e-commerce sales are projected to reach US$902.3 billion by 2027. This rapid expansion of e-commerce further enhances the accessibility and visibility of refurbished mobile phones, making them an increasingly attractive option for consumers.

Western Europe is expected to account for 65.9% of the European refurbished and used smartphone market in 2025 driven by a strong consumer focus on sustainability and cost-effectiveness. The high cost of living in Western European countries encourages consumers to seek more affordable alternatives to new smartphones.

Frequent smartphone upgrades in the region contribute to a steady supply of used devices suitable for refurbishment. Western European consumers often trade in older models for newer ones due to rapid technological advancements, ensuring a continuous flow of pre-owned devices into the refurbished market. Additionally, growing awareness of electronic waste and resource conservation has further fueled demand for refurbished phones.

Russia and Belarus are poised for significant growth in the European refurbished and used mobile phone market, driven by economic shifts, changing consumer preferences, and evolving supply dynamics. In Russia, international sanctions have disrupted official sales channels for major brands, pushing consumers toward alternative options like parallel imports and refurbished devices. As a result, refurbished smartphones are becoming increasingly popular. Notably, despite security concerns and official bans, the Russian government has significantly increased its procurement of iPhones, with contracts reaching 6.9 million rubles between January and September 2024 a fourfold increase from the same period in 2023. This trend highlights the broader acceptance and growing reliance on refurbished devices across the country.

The Europe refurbished and used mobile phone market is consolidated, with key players accounting 80%–85% market share. To encourage customers to return old smartphones in exchange for discounts on new devices, retailers and telecom operators have launched trade-in and buy-back programs. Companies such as Back Market, Rebuy, and Swappie have capitalized on this strategy by offering competitive trade-in values and refurbishing devices for resale. Similarly, mobile network operators such as Vodafone and Deutsche Telekom run trade-in programs, integrating them into contract renewal offers to promote customer retention and align with circular economy initiatives.

Manufacturers and retailers tailor their pricing strategies and product offerings based on regional consumer preferences and purchasing power. In Western European markets such as Germany and France, demand is higher for high-end refurbished models like iPhones and Samsung Galaxy devices, whereas in Eastern Europe, budget-conscious consumers tend to prefer mid-range and entry-level used smartphones.

|

Attribute |

Details |

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2024 |

|

Market Analysis |

US$ Mn for Value Unit of Volume |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Product Type

By Pricing Range

By Sales Channel

By Region

To know more about delivery timeline for this report Contact Sales

The market is projected to witness a CAGR of 11.5%, growing from US$ 24,430.9 Million in 2025 to US$ 47,161.8 Million by 2032.

The Refurbished Phones segment is expected to hold a share of 58.2% in 2024.

Western Europe is poised to dominate the market during the forecast period.

Central & Eastern Europe is expected to capture a significant share of 22.1% in 2025.

The leading manufacturers include Apple, Samsung, Google, Huawei, Xiaomi, and Lenovo are the leading participants in Europe.