Industry: Healthcare

Published Date: September-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 163

Report ID: PMRREP34835

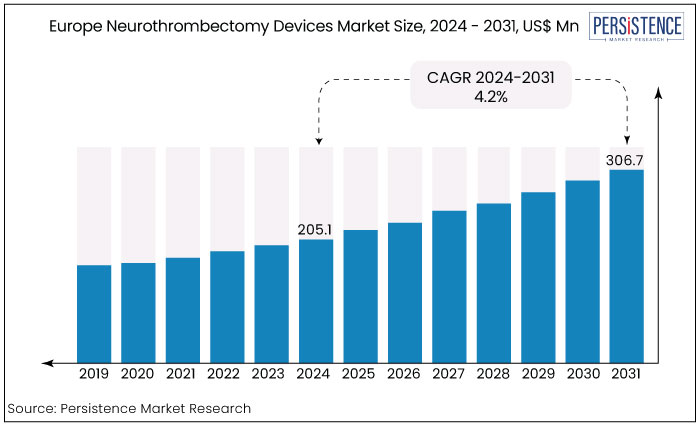

The Europe neurothrombectomy devices market is estimated to increase from US$205.1 Mn in 2024 to US$306.7 Mn by 2031. The market is projected to record a CAGR of 5.9% during the forecast period from 2024 to 2031. The market growth is attributed to increasing awareness of stroke management, advancements in device technology, and a focus on improving patient outcomes. This trend highlights the rising demand for effective treatment solutions in the healthcare sector across Europe.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Europe Neurothrombectomy Devices Market Size (2024E) |

US$205.1 Mn |

|

Projected Market Value (2031F) |

US$306.7 Mn |

|

Europe Market Growth Rate (CAGR 2024 to 2031) |

4.2% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

5.9%. |

|

Region |

Market Share in 2024 |

|

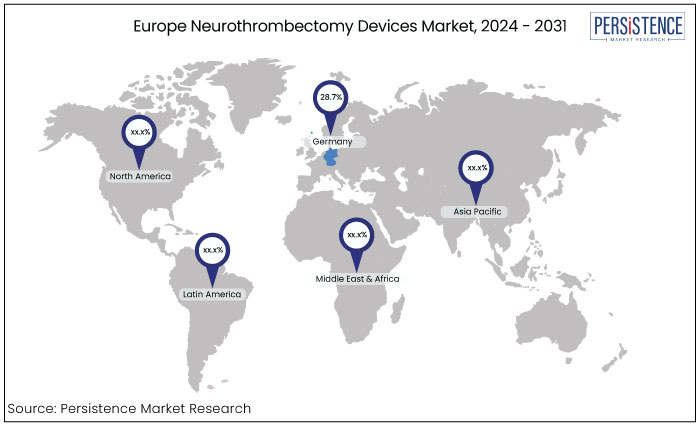

Germany |

28.7% |

Germany has consistently maintained a substantial share in the Europe neurothrombectomy devices market and estimated to account for around 28.7% in 2024. This dominance can be attributed to several factors such as a robust healthcare infrastructure, significant investments in medical technology, and a strong focus on research and development.

Germany's comprehensive stroke care initiatives and high prevalence of neurological disorders drive demand for advanced neurothrombectomy solutions, further solidifying its position in the market.

|

Category |

Market Share in 2024 |

|

Product - Stent Retrievers |

55.2% |

As per the Europe neurothrombectomy devices market analysis, stent retrievers maintained their position as the largest contributor capturing a substantial 55.2% share in 2024. This dominance is due to its effectiveness in removing clots during acute ischemic strokes.

Advancements in technology such as improved materials and deployment mechanisms have significantly improved patient outcomes leading to great adoption of stent retrievers clinically due to superior efficacy and safety profiles.

Stent retrievers are highly effective in mechanically removing thrombus in patients experiencing acute ischemic strokes, significantly improving patient outcomes. Their design allows for optimal capture and retrieval of clots, minimizing procedural complications. Supportive clinical guidelines and training for healthcare professionals further bolstering the use of stent retrievers.

|

Category |

Market Share in 2024 |

|

End User- Hospitals |

63.5% |

The hospitals have established a substantial lead commanding an impressive 63.5% market share in terms of value. This segment's continued dominance can be attributed to their robust infrastructure and focus on providing specialized care for neurothrombectomy procedures.

Access to advanced technologies and specialized resources in the hospitals facilities make them a preferred choice for neurothrombectomy procedures. Furthermore, the presence of multidisciplinary teams, including neurologists and interventional radiologists, allows for comprehensive management of stroke patients, leading to improved outcomes. This heightened focus on stroke treatment protocols and the critical need for swift intervention reinforces their dominant position in the market.

The Neurothrombectomy devices market in Europe is experiencing significant growth, driven by the rising incidence of acute ischemic strokes and advancements in minimally invasive surgical techniques. The neurothrombectomy devices are designed to remove blood clots from the brain and are becoming crucial in improving patient outcomes.

Key trends shaping the Europea market includes growing awareness regarding stroke management and advancement in technology leading to development of enhanced catheter designs and real-time imaging systems. Additionally, growing investments in the healthcare infrastructure and supportive regulatory environment are facilitating the adoption of these devices.

As healthcare providers emphasize rapid intervention to minimize stroke damage, the neurothrombectomy devices market is poised for continued expansion addressing the urgent need for effective treatment options in neurological care.

Europe neurothrombectomy devices market is significantly fueled by rising prevalence of stroke cases. Increase in surgical procedural volume, and an increasing awareness of stroke intervention strategies have led to the introduction of novel innovative devices such as mechanical thrombectomy devices. Thus, improving the effectiveness of thrombectomy procedures and transforming management of acute ischemic strokes. The market recorded a CAGR of 4.2%, indicating steady growth during the historic period.

Upward trajectory of the market driven by ongoing research, regulatory approvals for new devices, an aging population more susceptible to strokes, and growing integration of artificial intelligence and telemedicine into stroke care.

Europe neurothrombectomy devices market overview has shown consistent growth over the years, and its upward trajectory is expected to continue in the future. The market is projected to capture a CAGR of 5.9% from 2024 to 2031.

Increasing Incidence of Acute Ischemic Stroke

The rising incidence of acute ischemic stroke (AIS) is a significant driving factor for the neurothrombectomy market in Europe. As the aging population grows and lifestyle-related health issues, such as hypertension and diabetes, become more prevalent, the demand for effective stroke interventions intensifies.

Acute ischemic strokes require prompt treatment to minimize brain damage and improve outcomes, making neurothrombectomy devices crucial in clinical settings.

This increasing prevalence leads to higher procedural volumes and greater investment in specialized stroke care. Furthermore, enhanced awareness of stroke symptoms and the importance of rapid intervention encourages more patients to seek timely treatment. As a result, the neurothrombectomy market is poised for sustained growth addressing the urgent need for effective solutions in stroke management.

Growing Focus on Minimally Invasive Procedures

The growing focus on minimally invasive procedures is significantly driving the Europe neurothrombectomy market. Patients and healthcare providers increasingly prefer these techniques due to their associated benefits, including reduced recovery times, lower risk of complications, and less postoperative pain.

Neurothrombectomy, which involves the removal of blood clots using catheter-based devices, exemplifies this trend offering effective treatment for acute ischemic stroke without the need for open surgery.

As awareness of the advantages of minimally invasive options expands, more healthcare facilities are adopting neurothrombectomy practices leading to higher procedural volumes. This shift not only improves patient outcomes but also aligns with broad healthcare initiatives emphasizing patient-centered care further propelling market growth in the region.

High Cost of Neurothrombectomy Devices

Neurothrombectomy devices are specialized devices used to effectively treat acute ischemic strokes. However, the cost of providing these treatments especially using mechanical thrombectomy (MT) are substantially high, increasing the overall burden on healthcare facilities, particularly in regions with limited budgets.

The limited availability of thrombectomy centres and the ongoing restructuring of services across European countries, along with this financial barrier restrict access to advanced stroke interventions, especially in smaller hospitals and rural clinics. As a result, addressing the pricing challenges of neurothrombectomy devices is crucial for promoting wider adoption and improving stroke treatment outcomes across Europe.

Increasing Market Competition

Increasing market competition is a notable restraining factor in the European neurothrombectomy market. With numerous companies vying for the market share, the influx of new entrants and established players becomes a challenge. This heightened competition not only results in aggressive pricing strategies, diminishing profit margins for manufacturers but also makes it difficult for smaller companies to sustain business operations.

Increasing pressure from competitive pricing may compromise the R&D funding for novel innovative devices. Moreover, as competition intensifies, companies might focus on short-term gains rather than long-term advancements, potentially stalling progress in developing next-generation technologies.

Integration of Telemedicine Solutions

The integration of telemedicine solutions is emerging as a crucial driving factor in the European neurothrombectomy market. As stroke care relies heavily on timely intervention, telemedicine facilitates rapid consultations and decision-making, allowing specialists to evaluate patients remotely and recommend appropriate treatments. This is particularly vital in rural or underserved areas where immediate access to stroke care may be limited.

Telemedicine also enhances collaboration among healthcare providers, enabling multidisciplinary teams to coordinate care more effectively. With real-time data sharing and imaging capabilities, medical professionals are able to streamline the treatment process, ensuring that patients receive neurothrombectomy procedures without delay.

As the healthcare landscape continues to embrace digital solutions, telemedicine will play an increasingly important role in improving stroke outcomes and driving growth in the neurothrombectomy market.

Government Initiatives and Supportive Regulatory Landscape

Many countries in Europe are prioritizing stroke care improvement through national health strategies that emphasize rapid intervention and advanced treatment options. These initiatives often include funding for specialized stroke centres to enhance access to neurothrombectomy procedures.

A favourable regulatory environment facilitates quicker approvals for innovative devices, allowing manufacturers to bring their products to market more efficiently. Streamlined pathways for clinical trials and device assessments encourage investment in research and development, fostering innovation within the sector.

Initially applicable in May 2021, the transition period was set to end in May 2024, but was extended in January 2023 to range from May 2025 to May 2028, depending on device classification. (Stroke: Vascular and Interventional Neurology, 2024)

The Europea neurothrombectomy devices market is a significantly evolving market, driven by innovation and strategic collaborations. Technological advancements and growing demand for effective stroke treatments have led companies to introduce innovative devices to enhance procedural efficiency and patient outcomes.

Recent acquisitions and partnerships among key players are strengthening their market positions and expanding product portfolios. Additionally, new entrants are emerging, bringing fresh solutions to address the complexities of neurovascular care.

With a focus on safety and efficacy, the market is poised for continued evolution, driven by a commitment to improving treatment options for patients suffering from ischemic strokes and related conditions.

Recent Developments in the Neurothrombectomy Devices Market

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Million for Value |

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Product

By End User

By Country

To know more about delivery timeline for this report Contact Sales

The market is estimated to increase from US$205.1 Mn in 2024 to US$306.7 Mn by 2031.

Growing demand for minimally invasive treatment options remains a key driver for market growth.

Some of the top market players operating in the market are Medtronic, Stryker, Penumbra, Inc., Vesalio, LLC, and MicroVention, Inc.

The market is projected to record a CAGR of 5.9% through 2031.

A key opportunity lies in the development of advanced, and AI-driven devices that enhance precision and efficiency in stroke treatment.