Europe Managed Learning Services Market Segmented By Learning Administration, Learning Delivery, Learning Analytics, Measurement & Evaluation, Content Design & Development Services

Industry: IT and Telecommunication

Published Date: June-2022

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 303

Report ID: PMRREP33124

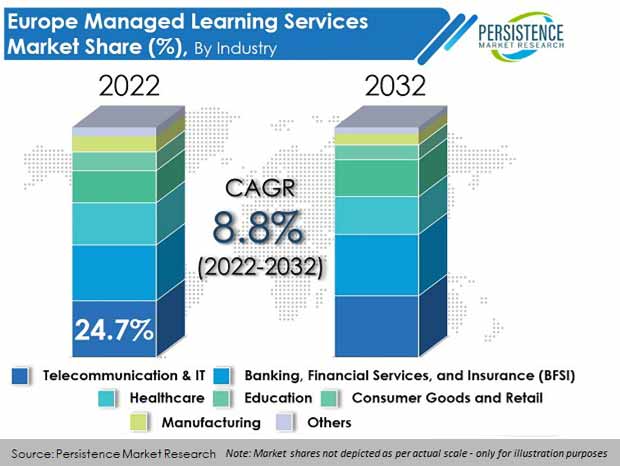

The Europe managed learning services market is estimated to be valued at US$ 36.65 Bn in 2022. Demand for managed learning services in Europe is projected to increase at a high CAGR of 8.8% to reach a market valuation US$ 85.35 Bn by the end of 2032.

Europe accounted for almost 25% share of the global managed learning services market in 2021. Growing demand for automation of workflow in Europe is creating the need for managed learning services. Also, growing need for leadership development, team development, and curriculum design and development in organizations across Europe will further drive the implementation of managed learning services (MLS) over the coming years.

Growing emphasis on personalized learning services happens to be one of the major factors responsible for driving market growth. Rise in the adoption of digital technology and Internet-enabled devices in education has contributed to the popularity of personalized learning in European countries over the last few years.

| Attribute | Key Insights |

|---|---|

|

Europe Managed Learning Services Market Size (2022) |

US$ 36.65 Bn |

|

Projected Market Value (2032) |

US$ 85.35 Bn |

|

Global Market Growth Rate (2022-2032) |

8.8% CAGR |

|

Top 5 Vendors’ Market Share |

20% |

The European market for managed learning services expanded at the rate of 6.3% from 2017 to 2021. Increasing use of learning and development (L&D) services has proven to be a game-changer in workforce training in Europe.

In European nations such as the United Kingdom, Germany, and France, end-to-end L&D process outsourcing to managed learning services providers (MLSPs) is common. The L&D market is mature, and a majority of the big service providers have their headquarters in these locations. However, MLSPs are increasingly appearing in other parts of Europe as well, such as Spain and BENELUX.

Internet penetration in European countries happens to be excellent in Germany, Italy, France, and Spain, among others. Overall, Internet usage is expected to rise, with mobile Internet connections, in particular, seeing significant year-on-year growth since its early stages. Moreover, this growth is expected to continue, with more than 80% of Europeans expected to have access to mobile Internet by 2025. As such, increasing Internet penetration is expected to fuel the demand for managed learning services in the region.

Persistence Market Research identifies the U.K, followed by Germany, as the leading MLS market for the forecast period. Overall, consumption of managed learning services in Europe is expected to surge at 8.8% CAGR through 2032.

“Rapid Growth of Training & Development Activities in Enterprises”

Owing to the diverse benefits offered by training activities, leading organizations and SMEs across Europe are increasing their investments in L&D activities. Employee training is becoming a crucial strategy, not only in terms of employee retention, but for the skilled workforce as well.

With clear goals of improvements in productivity and accuracy in current processes, learning and development activities are becoming the link between business success and a skilled workforce.

The attraction of high-calibre talent, competitive edge, and lower employee turnover are some of the major reasons for surge in the demand for training activities in European countries, as these activities assist organizations in adopting new technologies while keeping pace with changing industry trends.

Furthermore, to improve worker mobility, vocational education quality certification methods are becoming harmonized with European norms, and the European Social Fund (ESF) is aiding in the development of flexible paths through education and training systems, as well as the production of European-level diplomas.

Will Germany See a Rise in Demand for Managed Learning Services?

The Germany managed learning services market is expected to progress at a significant growth rate during the forecast period. According to the study, Germany is estimated to emerge as an attractive market with a significant share of around 19% by the end of 2022.

Because of the advantages of learning services outsourcing, many German firms have moved to working with global integrated training providers to automate the L&D lifecycle.

Why is the U.K. Expected to Be a Prominent Market for Managed Learning Services?

The U.K. is anticipated to be one of the prominent markets for managed learning services in Europe, and its market size is expected to expand 2.8X by 2032, evolving at a robust CAGR of 10.8% during the forecast period.

The U.K. has made good progress in the Human Capital Index (HCI) in the last decade. The U.K has been the front-runner in human capital investments and formations in the region. Managed learning services, therefore, have a key role to play in the economic and social achievements of the U.K’s national and organizational strategies.

Why are Managed Learning Service Providers Targeting BENELUX?

The BENELUX managed learning services market is set to register growth at a CAGR of 7.1%, and its market size is expected to expand approximately 2.1X, with an absolute $ opportunity of nearly US$ 2.23 Bn between 2022 and 2032.

Rising initiatives by governments in the region toward digitalization and adoption of digital learning tools are elevating demand growth of managed learning services in BENELUX.

Why is Demand for Learning Administration Services High in Europe?

The learning administration segment is expected to dominate the European managed learning services market and will contribute the largest share in 2022. This segment and is expected to grow 2.7X in market value from 2022 to 2032 and create a $ opportunity of over US$ 28 Bn during the forecast period.

Organizations across Europe are outsourcing training and learning activities as it allows them to need to tackle fewer challenges and eliminate time wastage and inefficiency, while reinvesting the cost in other business domains. Such a path increases the demand for learning administration services in Europe.

Will Large Enterprises Continue to Rule the Market Landscape?

The large enterprises segment is expected to dominate Europe’s managed learning services market and contribute the largest share of 73% in 2022. Learning and development programs have become a high priority for business leaders in the European region.

Working with managed learning service providers is helping businesses in streamlining their business processes and deliver quality learning processes to the workforce in a quick and effective manner.

Many leading organizations have shifted to engaging training partners in order to automate the learning and development lifecycle of their organization. This happens to be one of the major factors driving market growth.

Will the IT & Telecom Sector Play a Crucial Role in Market Growth?

On the basis of industry, the IT & telecom segment is expected to grow 2.5X in market value from 2022 to 2032.

High demand can be attributed to the requirement to source candidates as per job profiles and organizational structure and the rising demand for automation of training systems across the IT sector.

The COVID-19 pandemic caused havoc across businesses, including the managed learning services industry. Many corporate and public sector firms permitted their staff to work from home during lockdowns, creating huge demand for remote training services.

European businesses are increasingly outsourcing learning and development services to third-party suppliers in order to reduce training expenditure. The managed learning services industry is expected to surge with a rise in demand as remote working and learning become the new standard in the wake of the COVID-19 crisis.

The war in Ukraine has had a large impact on organizations, institutions, and international students. European universities have been suspending and cancelling exchange programs in Russia.

The ripple effects of the invasion have been seen largely in the education sector. Educators and learning service vendors are addressing the issue with an emphasis on virtual classes and training activities.

The fragmented geographic location of educators and vendors is resulting in the exponential growth and demand for digital learning activities, increased learning time through video conferencing applications, and eventually fuelling e-learning market growth.

The Europe managed learning services market is fragmented with new vendors offering different learning services. The emerging new concept of Learning-as-a-Service (LaaS) is also the result of competition between these vendors.

Also, various partnerships and acquisitions are taking place across Europe for learning and development.

| Attribute | Details |

|---|---|

|

Forecast Period |

2022-2032 |

|

Historical Data Available for |

2017-2021 |

|

Market Analysis |

USD Million for Value |

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

Europe Managed Learning Services Market by Service:

Europe Managed Learning Services Market by Enterprise Size:

Europe Managed Learning Services Market by Industry:

Europe Managed Learning Services Market by Country:

To know more about delivery timeline for this report Contact Sales

Demand for managed learning services in Europe was valued at US$ 34.25 Mn at the end of 2021.

Attraction of high-calibre talent, competitive edge, and lower employee turnover are some of the major reasons for the surge in demand for training activities in Europe.

From 2017 to 2021, consumption of managed learning services in Europe increased at a CAGR of 6.3%.

Sales of Europe Managed Learning Services solutions is projected to increase at 8.8% CAGR and be valued at over US$ 85,352.9 Mn by 2032.

There has been a substantial increase in outsourcing of training services in the European market. Intricate strategic management and involvement of critical steps that assist in reducing organizational risks are the key reasons for this.

TUV Rheinland, BTS, DDI, Hemsley Fraser Group Ltd, and CEGOS are the top 5 providers of MLS solutions, accounting for around 20% market share.

The U.K. held around 24.3% of the European market in 2021.

The U.K. is a key managed learning service provider in Europe.

Total absolute opportunity expected from BENELUX is US$ 2.23 Bn by 2032.