Europe Logging Trailer Market Segmented By Small-size, Medium-size, Large-size in Off-road Logging Trailers, Highway Logging Trailers Type

Industry: Automotive & Transportation

Published Date: April-2022

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 244

Report ID: PMRREP33034

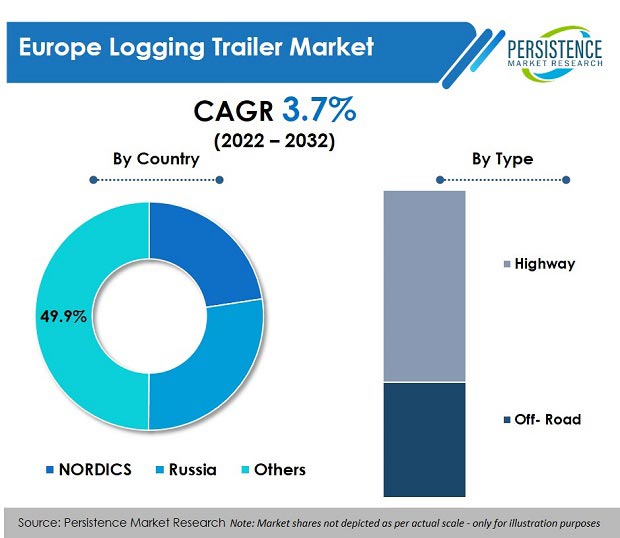

The Europe logging trailer market was valued at US$ 105.9 Mn in 2021, and is predicted to expand steadily at a CAGR of 3.7% to reach a valuation of US$ 156.7 Mn by the end of 2032.

| Attribute | Key Insights |

|---|---|

|

Europe Logging Trailer Market Size (2021A) |

US$ 105.9 Mn |

|

Projected Market Value (2032F) |

US$ 156.7 Mn |

|

Value CAGR (2022-2032) |

3.7% |

|

Collective Value Share: Top 3 Countries (2021A) |

65.3% |

From 2017 to 2021, sales of logging trailers in the European market increased at 0.9% CAGR, but saw a decline in demand in 2020 during the COVID-19 pandemic. Europe is one of the largest logging trailer manufacturers in the world, but the fall in production due to the pandemic affected sales in the region. The market is slowly recovering after the pandemic with the resumption of manufacturing facilities in Europe.

Increasing trailer fleet in Europe for transportation activities is a principal factor driving the timber trailer market in the region. Manufacturers of logging trailers are focusing on providing high strength and durability in trailers. Key market players are aiming to develop lightweight and reliable logging trailers that give better stability and provide higher safety for users.

Increasing demand for used logging trailers in the European region that have high payload capacity is also being seen. Overall sales of logging haulers in Europe are estimated to increase at 3.7% CAGR over the next 10 years.

“Demand for Higher Capacity Trailers and e-Trailers Rising”

With increasing residential and commercial construction in Europe, demand for wood is growing in the region, which is a key growth opportunity for forestry trailer manufacturers.

Logging trailer manufacturing companies are aiming at providing several models of logging machinery that have high payload capacities for the transportation of wood and other materials as they improve the economic feasibility of log transportation from remote areas.

Many key market players also aiming to provide features such as 360-degree rotation of the trailer that allows them to load and reach greater distances. One of the major growth opportunities for logging truck manufacturers is the electrification of logging trailers as many companies are working on developing logging e-trailers that will reduce CO2 emissions.

“High Vehicle Cost and Dearth of Skilled Logging Trailer Drivers”

Shortage of qualified drivers is a major drawback for logging trailer owners. It is not easy to drive a logging trailer, and hence, it is important that a highly-skilled driver who can handle the crane along with the trailer is employed.

Availability of alternative in-forest vehicles to access wood and other forest products that are smaller and lighter can hamper the demand for timber trailers in Europe.

High cost of logging trailers can also be a restraint for market growth as both, medium-size logging trailers and large-size logging trailers are expensive, and their pricing can reach up to US$ 60,000 and above. Not all end users can pay this large amount for machinery. This factor can impact the sales of logging trailers in the European region to some extent.

Rising fuel prices and increasing cost of qualified workforce for machinery handling are factors that may hamper demand for logging trailers in the European region.

Where Does Russia Stand in the European Market for Logging Haulers & Trailers?

“High Round Wood Production Drives Need for Log Hauling Trailers”

Russia held almost 1/4 of the Europe logging trailer market share in 2021.

The market is predicted to be driven by the fact that Russia has the highest round wood production in the European region, which, in turn, is accelerating demand for logging haulers in the country.

Russia is a prime exporter of timber and other forestry products in Europe, which is an important factor driving logging trailer usage in the country.

Why is NORDICS a Lucrative Market in Europe for Forestry Trailer Suppliers?

“Logging Trailer Rental Services Popular in the Region”

Over the forecast period, the NORDICS region is expected to be one of the most lucrative markets for logging trailers in Europe. According to the analysis, the NORDICS logging trailer market is expected to expand at a CAGR of 3.7% over the forecast period. Manufacturers are redesigning their logging trailers by extending the vehicle range of the trailer.

Many companies in NORDICS provide rental services for logging trailers for short- term or long-term requirements. They have strong focus on customer satisfaction and also offer a versatile range of logging trailer accessories. As such, NORDICS is considered a profitable market for quad logging trailer providers in the European region.

Which Logging Trailer Size Enjoys High Demand in Europe?

“Demand for Medium-size Logging Trailers Set to Be Prominent”

Medium-size logging trailers have the highest potential for growth, and are expected to register an absolute incremental opportunity of US$ 22.1 Mn during the forecast period of 2022-32. The log trailer type used for log transportation is dependent on the size of the logs being transported and the condition of the roads.

Increasing preference for medium-size logging trailers with grapples that have a payload capacity of 8 to 15 tons is being witnessed in Europe. Transportation accounts for 50% of the forest industry’s costs, and higher vehicle payload capacity can reduce fuel costs as well.

Which Logging Trailer Type is Preferred by Drivers for Transportation?

“European Market Dominated by Off-road Logging Trailers”

Off-road logging trailers are predicted to account for more than 3/4 market share in 2022.

Off-road vehicles are generally preferred for driving on unsurfaced terrains that are unstructured. Logging trailers for off-road transportation and ATV logging trailers use robust cranes that ensure optimal operation for wood logging and other materials.

Off-road log trailers have attached cranes that are used for loading and unloading large logs in forest areas.

The COVID- 19 crisis harmed several industries on a global level. The pandemic led to huge losses for the automotive sector as all manufacturing activities were closed due to lockdowns. Closure of production plants in many countries in Europe added to the pressure on small- and medium-scale. Many manufacturing industries also faced raw material shortages due to closed borders.

According to studies, the European market experienced a large economic hit in 2020, but is recovering as less severe restrictions are in place now by governments on industries and their production facilities. The same was the case for logging trailers for grapples, besides other types.

Major manufacturers of logging trailers in Europe are aiming to provide customized logging machinery for customers according to specific requirements. Their main focus is to increase their customer base as well as their market share. Market participants are developing new technologies that will boost the efficiency of logging trailers on difficult roads as well as increase the safety of users.

The Europe logging trailer market has witnessed a range of growth strategies employed by major market players over the previous years, including acquisitions, mergers, and collaborations. Manufacturers are also focusing on growing their distribution networks to expand their business worldwide.

Technological improvements and increased online presence of manufacturers have propelled logging trailer industry expansion in numerous ways. Manufacturers focus on making reliable and tested logging trailer models that have high end-use applications across industries.

| Attribute | Details |

|---|---|

|

Forecast Period |

2022-2032 |

|

Historical Data Available for |

2017-2021 |

|

Market Analysis |

|

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon Request |

Europe Logging Trailer Market by Size:

Europe Logging Trailer Market by Type:

Europe Logging Trailer Market by Country:

To know more about delivery timeline for this report Contact Sales

The Europe logging trailers market was valued at US$ 105.9 Mn in 2021.

Sales of logging trailers are slated to increase at a value CAGR of around 3.7% from 2022 to 2032.

The European market for logging trailers witnessed a CAGR of 0.9% from 2017 to 2021.

Russia, NORDICS, and Germany are lucrative markets for logging trailer manufacturers in the European region.

Tier-1 log trailer producers are Kesla, DOLL Fahrzeugbau, Fors MW, Vitli KRPAN d.o.o, and Fontaine Trailer Company, who accounted for around 40%- 45% market revenue in 2021.

The market for logging trailers in Germany is expected to increase at 3.8% CAGR through 2032.

The market in Russia is projected to register growth at 3.4% CAGR through 2032.