Industry: Healthcare

Published Date: October-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 169

Report ID: PMRREP34841

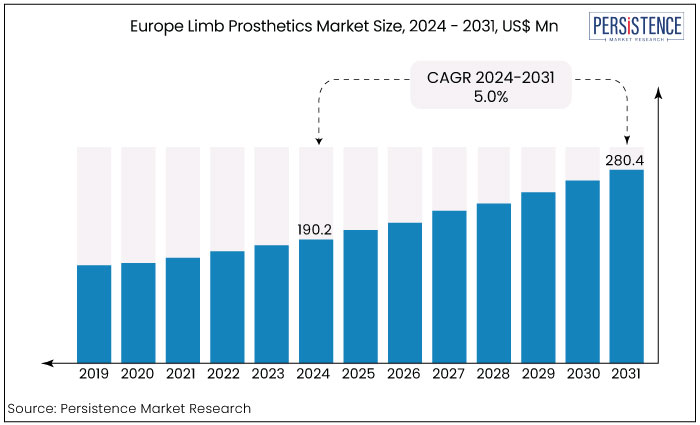

Europe limb prosthetics market is estimated to increase from US$190.2 Mn in 2024 to US$280.4 Mn by 2031. The market is projected to record a CAGR of 5.0% during the forecast period from 2024 to 2031.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Market Size (2024E) |

US$190.2 Mn |

|

Projected Market Value (2031F) |

US$280.4 Mn |

|

Future Market Growth Rate (CAGR 2024 to 2031) |

5.0% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

6.2%. |

|

Country |

Market Share in 2024 |

|

Germany |

26.7% |

The growth of the limb prosthetics market in Germany is driven by several key factors. Germany's advanced healthcare infrastructure plays a pivotal role providing patients with access to state-of-the-art prosthetic devices and rehabilitation services.

The country has a high rate of technological adoption, which accelerates the use of innovative solutions such as myoelectric and microprocessor-controlled prosthetics. Additionally, Germany has a rapidly aging population, increasing the prevalence of age-related conditions such as diabetes and vascular diseases that often lead to amputations. This demographic shift significantly boosts demand for both upper and lower limb prosthetics.

|

Category |

Market Share in 2024 |

|

Product Type - Lower limb |

58.9% |

Lower limb prosthetics are expected to be the largest contributor in the Europe limb prosthetics market due to several key factors. The high incidence of lower limb amputations, often resulting from vascular diseases, diabetes, and trauma, drives significant demand for these prosthetic solutions.

Europe’s aging population, particularly in countries like Germany, Italy, and the UK is a key factor in this trend, as older individuals are more prone to conditions leading to amputation. Additionally, advancements in lower limb prosthetic technology such as microprocessor-controlled knees, energy-storing feet, and lightweight, durable materials have enhanced functionality and mobility, encouraging more individuals to adopt prosthetics.

|

Category |

Market Share in 2023 |

|

End User – Prosthetic Clinics |

44.2% |

Prosthetic clinics are the largest contributor to the Europe limb prosthetics market due to their specialized services, patient-centric care, and advanced technological integration. These clinics cater to a diverse population, including individuals who require custom-made prosthetic limbs following traumatic injuries, congenital disabilities, or chronic diseases like diabetes, which can lead to amputations.

Prosthetic clinics possess the expertise and equipment necessary to deliver highly personalized prostheses that are tailored to individual anatomical and functional needs.

The Europe limb prosthetics market is primarily driven by an increasing incidence of limb amputations due to factors such as diabetes, vascular diseases, and traumatic injuries. The rise in chronic conditions like diabetes, which can lead to complications necessitating amputations, is a significant contributor to the growing demand for prosthetic limb.

The increasing focus on rehabilitation and personalized care for amputees is leading to a great emphasis on integrating prosthetic solutions into comprehensive treatment plans, thereby driving demand.

3D printing technology is revolutionizing the limb prosthetics market in Europe by enabling the creation of highly customized prosthetic limbs. Traditionally, prosthetic fabrication was a lengthy and complex process involving multiple fittings and adjustments to achieve an optimal fit.

With 3D printing, clinics and manufacturers can now produce prosthetics that are tailored to the exact measurements of the patient’s anatomy, significantly improving comfort, functionality, and aesthetics. This technology allows for greater precision in design, leading to better alignment and reduced pressure points, ultimately enhancing the wearer’s mobility and quality of life.

The Europe limb prosthetics market has experienced significant growth over the past decade, driven by advancements in medical technology, an aging population, and an increasing number of amputations due to chronic conditions such as diabetes and vascular diseases.

The market saw steady expansion as prosthetic technologies improved, leading to great patient satisfaction and demand for more advanced prosthetic solutions. During this period, key trends included the rise of bionic limbs, enhanced customization, and the growing integration of robotics and smart technologies.

Future market growth will be propelled by further technological advancements like 3D printing, AI-powered prosthetics, and increasing awareness of limb replacement options. As European healthcare systems continue to invest in rehabilitative care, the demand for high-quality prosthetic services is expected to rise particularly in regions with aging population.

Rise in Sports-Related Injuries

The rise in sports-related injuries has become a significant driver in the European limb prosthetics market, particularly as more people engage in physically demanding activities. The growing popularity of extreme sports like mountain biking, skiing, and snowboarding and contact sports such as rugby and football has led to an increase in the incidence of traumatic injuries. These activities expose participants to higher risks of severe fractures, dislocations, or ligament tears, which in extreme cases can necessitate amputation.

Professional athletes who suffer traumatic injuries often seek advanced prosthetic solutions to regain their mobility and continue leading an active lifestyle, which in turn pushes demand for highly functional and adaptive prosthetics.

Integration of Smart Technologies

The integration of smart technologies in prosthetics is revolutionizing the limb prosthetics market, making devices more functional, responsive, and appealing to users.

Prosthetics equipped with Internet of Things (IoT) capabilities, sensors, and machine learning algorithms enable real-time data collection and feedback, allowing for more intuitive control and better adaptability to the user’s movements. For instance, sensors embedded in smart prosthetics can detect muscle signals and adjust limb positioning based on the wearer’s intent, improving the overall experience and precision of movements.

A very recent example is the integration of smart technology in Össur's Myoelectric Proprio Foot. This bionic foot utilizes smart sensors and AI algorithms to automatically adjust the ankle joint, offering stability and improved gait in real-time.

The foot’s microprocessor learns from the wearer’s movements, adjusting dynamically to various terrains and speeds, enhancing mobility and comfort. This innovation demonstrates how smart technology is making prosthetics more advanced and functional, addressing both mobility and lifestyle needs of amputees.

High Costs of Advanced Prosthetics

The high costs associated with technologically advanced prosthetics, particularly bionic limbs, present a significant barrier to access for many patients in the Europe limb prosthetics market. Advanced prosthetic devices often integrate cutting-edge technologies, including robotics, artificial intelligence, and sophisticated materials, which enhance functionality and user experience.

However, these innovations come at a steep price, often reaching tens of thousands of euros. For many individuals, especially those without comprehensive health insurance or financial support, affording such devices becomes a daunting challenge.

Long Waiting Times for Custom Prosthetics

Long waiting times for custom prosthetics present a substantial challenge in the Europe limb prosthetics market, particularly for patients requiring immediate solutions following amputation or injury.

The production of custom-made prosthetics often involves a lengthy process, including detailed assessments, 3D scanning, design, and manufacturing. While advancements in technologies like 3D printing have improved efficiency, the overall timeline can still span several weeks to months, depending on the complexity of the device and the materials used.

For patients eager to regain mobility, these delays can be frustrating and disheartening. During this waiting period, individuals may face physical limitations that affect their daily lives, mental health, and overall well-being. Additionally, prolonged waiting times can hinder rehabilitation efforts, as timely access to a functional prosthetic limb is crucial for effective physical therapy and reintegration into daily activities.

Telehealth and Remote Monitoring

The development of telehealth platforms represents a significant opportunity in the Europe limb prosthetics market, enhancing accessibility and patient care through remote consultations, monitoring, and adjustments.

As the demand for personalized prosthetic solutions continues to rise, telehealth technologies facilitate ongoing communication between patients and healthcare providers without the need for frequent in-person visits. This is particularly beneficial for patients living in rural or underserved areas, where access to specialized prosthetic clinics may be limited.

Telehealth platforms allow for real-time monitoring of patients' use of prosthetics, enabling clinicians to gather valuable data on performance, comfort, and functionality. This data-driven approach allows for timely adjustments and interventions, ensuring that patients receive optimal support throughout their rehabilitation journey.

Bio-integrated Prosthetics

The research and development of bio-integrated prosthetics is a transformative opportunity within the Europe limb prosthetics market, focusing on enhancing the interaction between prosthetic devices and the human body. These advanced prosthetics utilize smart materials and bioengineering techniques to create devices that mimic natural limb movement and respond dynamically to the user's physiological conditions.

By integrating sensors and adaptive technologies, bio-integrated prosthetics can adjust to changes in pressure, temperature, and movement, providing a more natural and intuitive user experience.

The competitive landscape of the Europe limb prosthetics market is characterized by a mix of established multinational companies and innovative local firms. Key players include Otto Bock, Hanger Clinic, and Össur, known for their advanced prosthetic technologies and comprehensive service offerings. These companies focus on research and development to enhance product functionality and patient satisfaction.

Small specialized clinics and startups are emerging, driving innovation through customized solutions and affordable options. Collaborations between manufacturers, healthcare providers, and research institutions further intensify competition, as they seek to leverage cutting-edge technologies and improve patient outcomes in the rapidly evolving market.

Recent Developments in the Limb Prosthetics Market

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Million for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Product Type

By Technology

By End User

By Region

To know more about delivery timeline for this report Contact Sales

The market is estimated to increase from US$190.2 Mn in 2024 to US$280.4 Mn by 2031.

The rise in specialized rehabilitation centers and prosthetic clinics across Europe drives market growth.

Some of the prominent market players are Ottobock SE & Co. KGaA, Össur, Blatchford Group, and Proteor Group.

The market is projected to record a CAGR of 5.0% through 2031.

A prominent opportunity lies in the development and adoption of smart and bionic prosthetics.