Europe Cathode Material Market

Industry: Chemicals and Materials

Published Date: November-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 185

Report ID: PMRREP34918

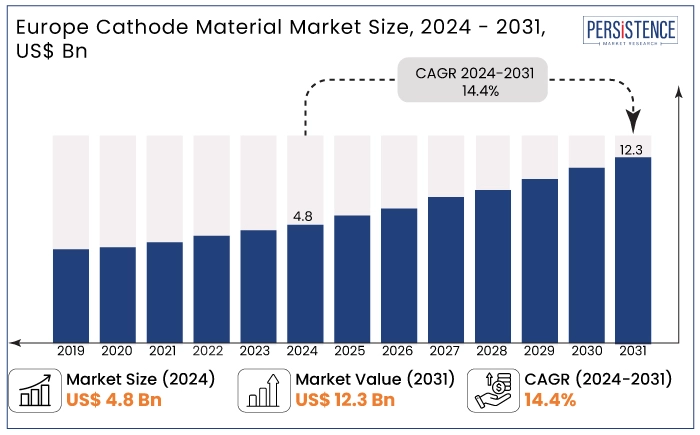

The Europe cathode material market is projected to witness a CAGR of 14.4% during the forecast period from 2024 to 2031. It is anticipated to increase from US$ 4.8 Bn recorded in 2024 to a staggering US$ 12.3 Bn by 2031.

The market is showcasing a robust growth phase driven by several factors. Surging electric vehicle adoption is creating a significant demand for high-performance batteries, which rely on cutting-edge cathode materials for efficiency and energy density. Furthermore, recent global supply chain disruptions have prompted manufacturers in Europe to seek alternative sources, leading to partnerships to enhance supply chain stability.

Rising demand for batteries in the clean energy sector is further propelling the market. As Europe focuses on achieving ambitious climate goals, the need for efficient energy storage solutions in renewable energy systems, such as solar and wind, is rising.

The Netherlands, Germany, and France all have ambitious goals of their own. For example, Germany intends to phase out coal by 2038 and become carbon neutral by 2045, while France wants to raise its proportion of renewable energy to 40% by 2030. This combination of increasing EV demand, supply chain adaptations, and growth of clean energy applications is positioning the market for substantial expansion in the next ten years.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Europe Cathode Material Market Size (2024E) |

US$ 4.8 Bn |

|

Projected Market Value (2031F) |

US$ 12.3 Bn |

|

Europe Market Growth Rate (CAGR 2024 to 2031) |

14.4% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

12.7% |

Germany is witnessing significant growth, fueled by a surge in Electric Vehicle (EV) registrations. According to the International Energy Agency (IEA), new electric car registrations in Europe reached nearly 3.2 million in 2023, reflecting a 20% increase from 2022. In the European Union (EU), sales totaled 2.4 million, indicating similar growth rates across the region.

The aforementioned numbers show that Germany is anticipated to be a leading hub for EV manufacturing and sales, thereby bolstering cathode material demand. New materials are being developed to enhance the performance of EV batteries. Due to these factors, the country is projected to exhibit a CAGR of 14.6% through 2031.

|

Category |

CAGR through 2031 |

|

Battery Type- Li-ion |

14.5% |

The Lithium-ion (Li-ion) battery segment is poised for significant expansion. It will likely rise at a CAGR of 14.5% from 2024 to 2031. This growth is attributed to the rapid development of electric vehicles and renewable energy storage solutions.

Manufacturers are increasingly investing in Europe to solve supply chain issues. They are also aiming to underscore the importance of local production to meet the increasing requirements of several markets such as the EV sector. For instance,

Similar strategic moves are indicative of the broader trend of enhancing manufacturing capabilities in Europe to support the transition to sustainable energy solutions. It is hence positioning the lithium-ion battery cathode and anode materials segment for robust growth in the coming years.

|

Category |

CAGR through 2031 |

|

Application- Automotive |

14.9% |

The automotive application segment is projected to experience notable growth of 14.9% CAGR between 2024 and 2031. It is set to be fueled by a vibrant recovery of the EU car market in the post-pandemic period.

In 2023, the market rose by an impressive 13.9% compared to 2022, reaching a volume of 10.5 million units. This strong performance was reflected across key EU markets, with Italy (+18.9%), Spain (+16.7%), France (+16.1%), and Germany (+7.3%) all witnessing significant increases.

The upward trend underscores the rising demand for electric and hybrid vehicles, further enhancing the need for unique cathode materials. As the market continues to evolve and adapt to changing consumer preferences, the automotive application segment is positioned as a key driver for future growth. It will likely showcase a positive trajectory that aligns with the shift toward sustainable transportation solutions.

Increasing demand for Electric Vehicles (EVs) and energy storage solutions is propelling the need for high-performance cathode materials. As Europe transitions toward sustainable energy and transportation, manufacturers are investing heavily in local production capabilities to meet the rising requirements. Initiatives by companies like Johnson Matthey, which has established a new plant in Poland, highlight the strategic efforts to enhance supply chain resilience and increase production capacity.

There is also a growing emphasis on developing eco-friendly cathode materials and recycling technologies. Manufacturers are exploring alternatives to traditional materials to reduce environmental impact, aligning with Europe’s climate goals. Increased investments in research and development are driving innovation in cathode technology, improving energy density and performance while reducing costs.

The Europe cathode material market recorded a considerable CAGR of 12.7% during the period from 2019 to 2023. It was attributed to increasing investments by key players in business expansion and technological innovations. It was particularly prominent in developing high-efficiency silicone solutions for applications in leather and textiles, thereby enhancing performance and sustainability.

The market is estimated to record a steady CAGR of 14.4% during the forecast period between 2024 and 2031. Cathode materials with high energy storage capacity are set to gain momentum as research activities into next-generation batteries, such as solid-state batteries, continue.

Demand is also projected to be driven by innovations in cathode chemical engineering, such as a decreased need for cobalt, as battery producers look for more economical, efficient, and sustainable alternatives. For instance,

Increasing Demand for EVs to Boost Sales through 2031

The Europe cathode material market is set to be driven by the robust growth of Electric Vehicle (EV) registrations, significantly influencing demand for high-performance cathode materials. Germany has emerged as a key hub, becoming the third country globally after China and the U.S., to register over half a million new battery EVs in a single year. In 2023, battery electric vehicles accounted for 18% of car sales, with an additional 6% for plug-in hybrids.

The rest of Europe also showed a positive trend, with electric car sales and market share increasing in countries like France, the U.K., the Netherlands, and Sweden. For instance,

Booming Consumer Electronics Industry to Foster Demand in Europe

The market for cathode materials in Europe is being impacted by developments in consumer electronics in the region. It is mainly attributed to the region’s strong dedication to sustainability and cutting-edge technology.

High-performance, energy-efficient gadgets are a top priority for local customers. Hence, the electronics sector is constantly coming up with new ways to satisfy these needs by producing batteries that can last longer and charge more quickly.

Unique lithium-ion batteries are being used by prominent players in the regional consumer electronics market. Market leaders, including Scan Computers, Bosch, Nokia, and Philips, are adopting these for manufacturing a variety of products, such as laptops, cell phones, and home automation systems.

High Demand for Alternative Cathode Materials to Hinder Sales

A key challenge in the Europe cathode material market is manufacturers' growing concern over supply chain issues, particularly regarding critical materials like cobalt. These concerns are driving a shift toward innovation and increased investments in alternative cathode materials.

Cobalt, often sourced from politically unstable regions, poses significant supply risks, leading manufacturers to seek substitutes that can enhance supply chain resilience. As a result, companies are focusing on developing new cathode formulations that rely less on cobalt or exploring entirely different materials, such as Lithium Iron Phosphate (LFP) or manganese-rich compositions.

The rapid shift aims to reduce dependency on cobalt, mitigate supply chain vulnerabilities, and improve sustainability. While this transition can pose challenges in terms of research and development, it also presents opportunities for manufacturers to innovate and adapt to changing demands. Consequently, the drive for alternative cathode materials is reshaping the landscape of the Europe lithium cathode materials market, influencing production strategies and long-term planning.

Rising Demand for Batteries in Clean Energy Sector to Create Fresh Prospects

Rising demand for batteries in the clean energy sector presents a significant opportunity for the Europe cathode material market. According to the International Energy Agency (IEA), the European Union (EU) is accelerating ` (PV) and wind energy deployment in response to the energy crisis. It plans to add over 50 GW of capacity in 2022, which is an almost 45% increase compared to 2021. This surge is driven by initiatives like the REPowerEU Plan and the Green Deal Industrial Plan, which set ambitious targets for renewable energy investments.

The solar PV market in Europe has experienced remarkable growth, supported by the region’s Green Deal and the REPowerEU initiative, both aimed at achieving a climate-neutral continent by 2050. These frameworks have led to increased solar capacity in countries like Germany and Spain. These have also resulted in substantial EU funding for solar projects and innovations in technology that enhance efficiency and affordability.

The competitive landscape of the Europe cathode metal industry is marked by key players such as Johnson Matthey, BASF, and Umicore. They are all investing in innovation to enhance their existing product offerings. Continuous developments in cathode materials, including alternatives like lithium iron phosphate, are addressing supply chain concerns related to critical materials like cobalt.

Strategic partnerships with battery manufacturers and automakers are becoming common to strengthen supply chains and drive technological innovations. Additionally, EU initiatives like the Green Deal are fostering investments in sustainable technologies, shaping market dynamics. As local production increases in response to supply chain challenges, companies prioritizing sustainability and innovation will gain a competitive edge in this evolving market.

Recent Industry Developments

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization and Pricing |

Available upon request |

By Battery Type

By Application

By Country

To know more about delivery timeline for this report Contact Sales

The market is set to reach US$ 12.3 Bn by 2031.

Automotive is the leading sector that companies need to target.

BASF is considered the leading player in Europe.

Lithium nickel manganese cobalt oxide, lithium iron phosphate, lithium manganese oxide, and lithium cobalt oxide are a few main materials.

Nickel, manganese, and cobalt are the key cathode materials.