Industry: Automotive & Transportation

Published Date: December-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 177

Report ID: PMRREP34979

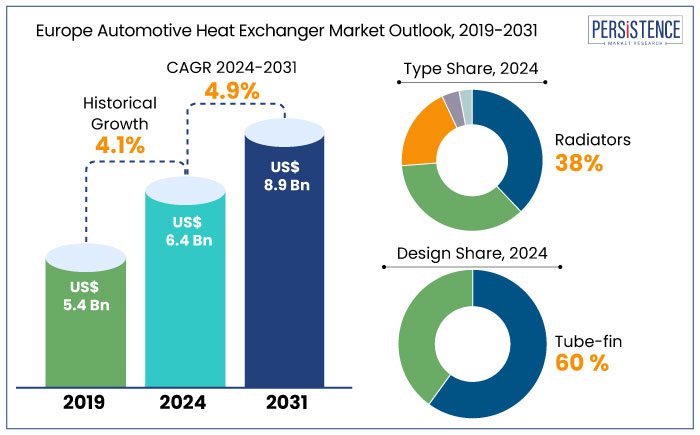

The Europe automotive heat exchanger market is estimated to increase from US$ 6.4 Bn in 2024 to US$ 8.9 Bn by 2031. The market is projected to record a CAGR of 4.9% during the forecast period from 2024 to 2031.

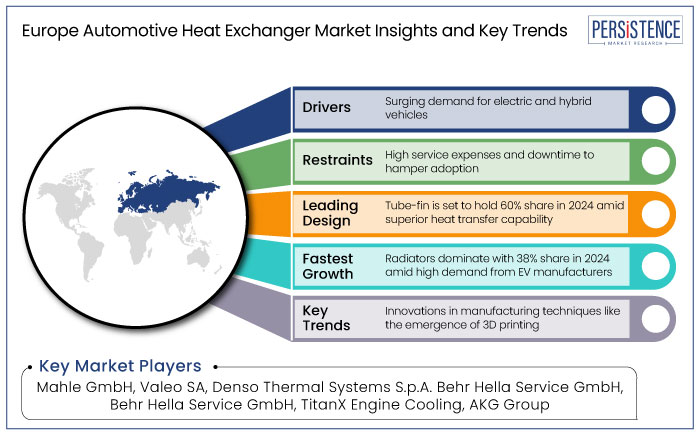

The European Union's (EU) rigorous emission standards are compelling automakers to adopt unique heat exchangers to enhance engine efficiency and reduce emissions. Developments in materials and manufacturing processes, such as lightweight alloys and additive manufacturing, enable the production of more efficient and durable heat exchangers.

To restrict pollutants like CO2, NOx, and particulate matter, the EU establishes strict emission regulations (Euro 1 to Euro 7) for automobiles. These stringent restrictions are imposed by each new standard. Euro 7 is anticipated to place a strong emphasis on electrification and decarbonization.

In comparison to 2021 levels, the EU has set precise CO2 reduction targets for new vehicles, such as a 50% reduction for vans and a 55% reduction for cars by 2030. This supports the EU Green Deal's 2050 climate neutrality targets.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Europe Automotive Heat Exchanger Market Size (2024E) |

US$ 6.4 Bn |

|

Projected Market Value (2031F) |

US$ 8.9 Bn |

|

Europe Market Growth Rate (CAGR 2024 to 2031) |

4.9% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

4.1% |

Germany is the dominant country in the Europe automotive heat exchanger market due to its robust automotive industry, which is the largest in the region. This country is estimated to account for 35% market share in 2024. The presence of leading automobile manufacturers, such as Volkswagen AG, Daimler AG, and BMW AG, contributes significantly to the country's domimnance.

Germany's automotive industry emphasizes innovation in design and production, ensuring that heat exchanger systems meet the latest efficiency, performance, and environmental standards. With the shift toward electric and hybrid vehicles, local manufacturers have been at the forefront of developing new-generation heat exchangers optimized for these vehicles.

Government initiatives support the growth of Germany's automotive sector through incentives for research and development. It is particularly evident in energy-efficient and sustainable automotive technologies. The country's strong focus on reducing emissions and meeting EU climate goals has driven the development of unique thermal management systems.

Based on type, the Europe automotive heat exchanger market is segregated into radiators, oil coolers, air conditioning systems, intercoolers, and EGR coolers. Among these, radiators dominate the market while accumulating around 38% of the total share in 2024.

Radiators are the most popular type of heat exchanger in the Europe automotive industry. This is primarily due to their essential role in maintaining optimal engine temperatures across all vehicle categories. Radiators are essential in ICE and EVs, where these help manage the heat generated by various components.

Following radiators, air conditioning systems hold a significant market share of 36%, reflecting the rising demand for passenger comfort and climate control in vehicles. Oil coolers, intercoolers, and Exhaust Gas Recirculation (EGR) coolers also contribute to the market but serve more specialized functions, leading to comparatively smaller market shares.

Based on design, the Europe automotive heat exchanger market is further divided into plate-fin and tube-fin. Out of these, the tube-fin design dominates the market due to its excellent heat transfer capabilities and suitability for various types of vehicles.

Tube-fin heat exchangers facilitate effective heat dissipation, which is crucial for maintaining optimal engine and component temperatures. The manufacturing processes and materials used in tube-fin designs are generally less expensive, making them a cost-effective solution for automotive manufacturers.

Tube-fin heat exchangers are adaptable to various vehicle types and applications, including radiators, oil coolers, and intercoolers, enhancing their widespread adoption. The compact size of tube-fin exchangers allows for easy integration into vehicle designs without compromising performance. This is particularly beneficial given the space constraints in modern vehicles.

Plate-fin designs, on the other hand, are utilized, especially in high-performance and heavy-duty applications requiring superior durability and performance. However, due to their high manufacturing costs and complexity, these designs hold a smaller share of the market relative to tube-fin designs. These designs are anticipated to hold a share of around 40% in 2024.

A heat exchanger is a device that is used to transmit heat between two or more process fluids. These are utilized extensively in both industrial and home settings. Various heat exchangers have been engineered for steam power plants, chemical processing facilities, building heating and air conditioning systems, transportation power systems, and refrigeration units.

The automotive heat exchanger is an important element of a vehicle's thermal management system. It is specifically engineered to effectively transfer heat between two or more fluids at varying temperatures.

The design of an automotive heat exchange unit can be refined for enhanced thermal exchange, flow efficiency, reduced weight, and versatile geometry. The automotive heat dissipation equipment facilitates the attainment of optimal operating temperature, efficiency, safety, and durability in the most demanding conditions. Several companies are focusing on launching unique products by joining hands with prominent players. For instance,

During the historical period from 2019 to 2023, the Europe automotive heat exchanger industry experienced steady expansion at 4.1% CAGR. It was primarily driven by innovations in Internal Combustion Engine (ICE) vehicles and increasing adoption of hybrid vehicles.

Key factors for the growth also included rising vehicle production in countries like Germany, the U.K., and France. In addition, stringent European Union (EU) emission regulations necessitated efficient thermal management systems.

Rising focus on lightweight and energy-efficient heat exchangers, particularly in radiators and air conditioning systems, further propelled market expansion. The gradual shift toward Electric Vehicles (EVs) and the need for unique battery cooling systems started shaping demand patterns.

Over the forecast period, the market is anticipated to witness accelerated growth due to the rapid electrification in the automotive industry and increasing EV sales in Europe. With the EU's ambitious climate goals, manufacturers focus on developing innovative heat exchangers optimized for battery thermal management and power electronics in EVs.

The market will likely benefit from the emergence of novel materials and additive manufacturing technologies. These are anticipated to enable the development of lightweight, efficient, and customizable heat exchangers.

Collaborations among key players, such as Conflux Technology and GKN Additive, are further set to drive innovation and market competitiveness. The forecast period till 2031 marks a significant transformation toward sustainability and cutting-edge heat management solutions in Europe.

Increased Adoption of Electric Vehicles to Boost Market Growth

High adoption rate of electric vehicles in recent times has surged the Europe automotive heat exchanger market revenue. This is due to its cost-effectiveness, environmental sustainability, and efficient mobility attributes.

Various rules and regulations act as incentives for increasing electric vehicle manufacturing. The International Energy Agency (IEA) report, for example, indicated that over 16.5 million electric vehicles were on the road by the end of 2021.

Various developing economies in Europe are prioritizing reducing vehicular pollution emissions by entirely eradicating fossil fuel vehicles from their roadways. According to studies, in 2022, over two-thirds of newly sold passenger vehicles in Norway were entirely electric.

Innovations in Material and Manufacturing Technologies to Propel Demand

Development of novel materials and manufacturing technologies is a key driving factor for the Europe automotive heat exchanger market growth. Innovations such as lightweight alloys, aluminum brazing, and additive manufacturing or 3D printing enable the production of highly efficient and durable heat exchangers.

Such developments address the rising demand for lightweight vehicles, which require compact and high-performance thermal management systems to enhance fuel efficiency and reduce emissions. 3D-printed heat exchangers offer superior heat transfer efficiency and design flexibility, catering to the needs of both traditional and electric vehicles.

The ability to customize designs for specific applications enables manufacturers to differentiate their products, creating new growth opportunities. With ongoing research efforts and collaborations, the market is poised for sustained innovation and expansion. For example,

Technological Challenges and Maintenance Difficulties to Hinder Demand

Increased complexity of contemporary automotive heat exchangers, propelled by developments like small configurations and multifunctional systems, impedes growth of the market. Novel technologies, such as additive manufacturing, provide highly personalized components that may necessitate specialist maintenance and repair proficiency.

Complexity may result in high downtime and increased service expenses for end users, especially for fleets and big commercial vehicles. The absence of standardization across various heat exchanger designs and materials presents obstacles to interoperability and scalability, complicating manufacturers' efforts to serve a wide customer base.

The challenging learning curve for technicians and the need for ongoing training hinder the extensive use of these systems. It is especially evident in areas with underdeveloped automotive repair infrastructure. Although advantageous, technical improvements provide obstacles that may impede the market's growth trajectory.

Surging Adoption of Electric and Hybrid Vehicles to Create Avenues

Rising adoption of electric and hybrid vehicles in Europe is a significant trend reshaping the automotive heat exchanger industry. As governments across the region enforce stringent emission regulations and promote eco-friendly transportation, demand for EVs and hybrid vehicles has surged.

The rapid shift necessitates unique thermal management systems, including innovative heat exchangers designed to handle the unique thermal loads of batteries, electric motors, and power electronics. Unlike traditional internal combustion engines, EVs require specialized cooling systems to ensure battery efficiency, safety, and longevity. Heat exchangers for EVs should be lightweight, compact, and efficient to meet the performance demands of these vehicles while adhering to sustainability goals.

Manufacturers are investing in research and development to design innovative exchangers that enhance energy efficiency and integrate seamlessly into EV architectures. Integrating multi-functional heat exchangers, such as those combining cooling for batteries and cabin climate control, is a notable trend that aligns with the booming EV market in Europe. For instance,

The Europe automotive heat exchanger market is marked by intense competition, driven by the presence of established players and innovative newcomers. Key players such as MAHLE GmbH, Bosch Mobility, Hanon Systems, DENSO Corporation, and Valeo dominate the landscape with extensive product portfolios and cutting-edge technologies. Leading companies focus on developing lightweight, efficient, and durable heat exchangers to cater to the growing demand for electric and hybrid vehicles.

Partnerships and acquisitions, such as Conflux Technology's collaboration with GKN Additive for 3D-printed heat exchangers, highlight the industry's focus on innovation. Meanwhile, stringent EU emission regulations and the push toward sustainable mobility create opportunities for differentiation.

Recent Industry Developments

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization and Pricing |

Available upon request |

By Type

By Design

By Vehicle Type

By Country

To know more about delivery timeline for this report Contact Sales

The market is estimated to be valued at US$ 6.4 Bn in 2024.

Alfa Laval Packinox is the largest heat exchanger.

Automotive heat exchanger is a device used in vehicles to help chill the coolant and heat the incoming air.

The industry is predicted to be valued at US$ 8.9 Bn by 2031.

The market is estimated to exhibit a CAGR of 4.9% over the forecast period.