Industry: Chemicals and Materials

Published Date: December-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 182

Report ID: PMRREP34997

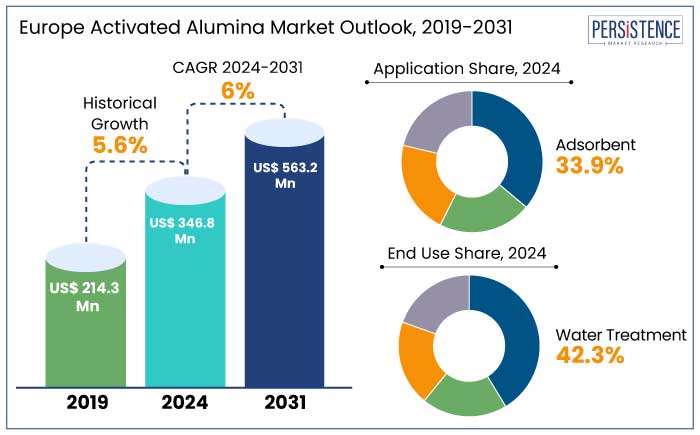

The Europe activated alumina market is projected to witness a CAGR of 7.3% during the forecast period from 2024 to 2031. It is anticipated to increase from US$ 346.8 Mn recorded in 2024 to a decent US$ 563.2 Mn by 2031.

The market has experienced significant growth due to diverse applications of activated alumina across industries such as water treatment, air purification, and chemical processing. It is a highly porous material primarily composed of aluminum oxide.

It is widely used for moisture removal, heavy metal removal, and as a catalyst support in various industrial processes. Its unique properties, including a high surface area, thermal stability, and the ability to adsorb moisture and contaminants, make it a preferred choice in these applications.

The market faces challenges due to the availability of substitute materials, particularly in water treatment, where alternatives like activated carbon and zeolites are commonly used. Despite this competition, ongoing research and development into new applications, especially in industries such as textiles and cosmetics, is anticipated to create new growth opportunities.

In Europe, activated alumina used in water treatment applications must comply with stringent regulatory standards to ensure safety and environmental protection. Under the European standard for leaching tests (EN 12902), it must not release residues into water that result in concentrations exceeding the limits outlined in Directive 2003/40/EC. If no limits are specified in this directive, compliance with Directive 98/83/EC or relevant national legislation is required.

Concentration of aluminum ions in treated water, resulting from the release of aluminum- the primary component of activated alumina- must not exceed 200 µg/L. It is in line with the requirements of Directive 98/83/EC. These regulations help ensure the safe use of activated alumina in water treatment processes, maintaining water quality and protecting public health.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Europe Activated Alumina Market Size (2024E) |

US$ 346.8 Mn |

|

Projected Market Value (2031F) |

US$ 563.2 Mn |

|

Europe Market Growth Rate (CAGR 2024 to 2031) |

6% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

5.6% |

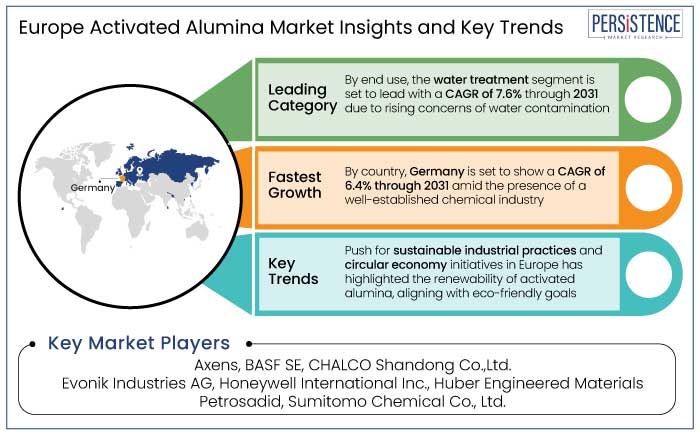

Germany’s dominance in the market is supported by its expansive chemical industry, where activated alumina serves as both an adsorbent and catalyst. The country is anticipated to witness a CAGR of 6.4% through 2031.

The chemical sector, encompassing various specialties from basic chemicals to pharmaceuticals, has shown resilience, with increasing turnover over recent years. Despite setbacks in 2022 due to the Russia-Ukraine conflict, which led to the shutdown of several chemical plants, the market is set to rebound. This is due to rising investments and government policies fostering industry stability.

A prominent example of investment in Germany’s chemical industry is the upcoming acetonitrile facility by Ineos in Cologne, announced in April 2022. It has an annual capacity of 15 kilotons. Additionally, the pharmaceutical sector in Germany, a global leader in drug manufacturing, is a key user of activated alumina.

Ongoing developments in Germany’s chemical and pharmaceutical sectors underscore its position as a dominant player in the Europe market. It is set to be driven by robust demand across multiple end-use industries.

Based on end use, the water treatment segment is projected to exhibit a CAGR of 7.6% during the period from 2024 to 2031. Activated alumina is extensively used in water purification, particularly for removing impurities such as fluoride, arsenic, and other heavy metals from drinking water.

Its high surface area and porous structure make it highly effective in adsorption processes. This further makes it an ideal material for water treatment applications.

Increasing demand for clean drinking water, stringent environmental regulations, and growing awareness of water contamination have contributed to the widespread adoption of activated alumina in Europe. Additionally, its use is rising in wastewater treatment as part of broader environmental protection initiatives.

Regulatory drivers, such as regional environmental standards that mandate the removal of harmful substances from water, have pushed utilities and industries to implement it in their purification systems. Rising awareness of waterborne diseases and the need for safe drinking water has accelerated demand for water treatment technologies, including activated alumina.

Its cost-effectiveness, compared to other filtration materials, has also made it a preferred choice for both large-scale municipal water treatment plants and smaller, localized applications. While activated alumina is used in other industries like petrochemical and chemical processing, the water treatment sector remains the most significant source of demand in Europe.

The Europe activated alumina market is experiencing steady growth, driven by its use in water treatment, oil and gas, and chemical industries. Its high adsorptive capacity, chemical stability, and regenerability make it indispensable for applications like dehumidification, fluoride removal, and catalytic processes.

Increasing environmental concerns and stringent regulations in Western Europe have amplified its adoption in water purification systems. Booming petrochemical and oil and gas sectors in countries like Germany and the Netherlands are boosting its demand as a desiccant and adsorbent.

Innovations in catalytic applications, such as novel hydrogenation catalysts, are further propelling market growth. Key players like BASF SE and Evonik Industries are leading innovations.

The push for sustainable industrial practices and circular economy initiatives in the EU has also highlighted the renewability of activated alumina, aligning with eco-friendly goals. With strong demand in Western Europe and emerging opportunities in Eastern Europe, the market is set for sustained growth, supported by strategic investments and technological developments.

The Europe activated alumina market recorded a decent CAGR of 5.6% in the historical period from 2019 to 2023. The market has demonstrated consistent growth over the past decade, primarily fueled by its rising applications in water treatment, gas drying, and catalyst support.

Surging awareness of water quality issues and stringent environmental regulations have driven its adoption in municipal and industrial water treatment operations. Additionally, the region’s robust chemical and petrochemical industries have amplified demand for activated alumina in critical desiccation and purification processes.

Key markets such as Germany, the U.K., and France have capitalized on novel manufacturing capabilities and a strong industrial base to cater to domestic needs and export opportunities. The market is well-positioned for continued growth, supported by increasing investments in green technologies and renewable energy initiatives. These require unique filtration and adsorption solutions.

Rising focus on fluoride removal and arsenic mitigation, bolstered by regulatory compliance and public health priorities, will likely accelerate demand. Moreover, developments in product customization and efficiency enhancements are set to unlock new opportunities in high-value industrial applications. These help in ensuring a competitive edge for market players in the activated alumina landscape across Europe.

Increasing Investment in Water Treatment Facilities to Propel Demand

Demand for activated alumina in Europe is witnessing a significant upswing, fueled by increasing investments in water treatment infrastructure.

EU countries collectively invested around €67 Bn in environmental protection, including wastewater treatment plants, with corporate entities contributing 60% of these funds. Growing demand for wastewater treatment services is driven by the urgent need to ensure clean drinking water and combat waterborne diseases.

Upcoming initiatives such as Water Innovation Europe 2024 are set to bolster demand by prioritizing developments in circular water management, digital water technologies, and resilient water solutions. These developments underscore the key role of novel materials like activated alumina in meeting Europe's evolving water treatment needs and addressing environmental sustainability goals.

Oil and Gas Industry Creates Demand Amid Need to Reduce Emissions

Activated alumina is extensively used in the oil and gas sector as an adsorbent for sulfur recovery. It is a critical process for reducing emissions and meeting stringent environmental regulations in Europe.

The region's high focus on achieving carbon neutrality by 2050 is compelling industries to adopt technologies that rely on adsorbents like activated alumina. These help to improve operational efficiency and environmental compliance. For example,

High Costs and Regeneration Complexity to Hamper Demand

A significant restraint for the Europe activated alumina market is the complexity and cost associated with its regeneration and replacement. It is particularly evident in industrial applications such as hydrogen peroxide production.

Activated alumina requires periodic replacement when its adsorption capacity decreases, which can lead to significant downtime and increased operational costs. The regeneration process, which involves high-temperature treatment to restore the desiccant's moisture-absorbing properties, is energy-intensive and requires specialized equipment.

Activated alumina's fine particles often create dust during handling, necessitating specialized procedures to prevent contamination and ensure safe operation. This can further add to the operational complexity and costs. Presence of alternative desiccants like silica gel, which offer easier regeneration at lower temperatures and are more cost-effective, can limit the adoption of activated alumina.

Rising Concerns over Water Contamination to Create New Opportunities

The Europe activated alumina industry presents a significant opportunity driven by the increasing demand for sustainable and efficient water treatment solutions. Concerns over water contamination are rising.

Regulatory standards across the region are becoming stringent. These factors are enhancing activated alumina’s effectiveness in removing contaminants such as fluoride and arsenic. This makes it a valuable asset in municipal and industrial water purification systems.

The European Union's emphasis on environmental sustainability and stringent water quality regulations further accelerates the adoption of activated alumina in these sectors. Additionally, surging applications in industries like air purification, chemical processing, textiles, and cosmetics create new avenues for growth.

The market is poised to benefit from both regulatory pressures and a shift toward eco-friendly technologies. Hence, activated alumina is positioned to play a key role in meeting the region's evolving environmental as well as industrial requirements.

The Europe activated alumina market is highly competitive. Several key players are operating across various industries such as water treatment, air purification, and chemical processing.

Leading manufacturers in the market focus on developing novel products that cater to diverse applications, including energy-efficient desiccants, water treatment systems, and catalyst support materials. These companies are investing in research and development to improve the adsorption capacity and regeneration efficiency of activated alumina.

Key players are also adopting strategies such as product diversification, geographical expansion, and partnerships to strengthen their market presence. Rising demand for sustainable solutions has led companies to offer eco-friendly activated alumina products that meet regulatory standards and enhance performance. It is set to be driven by strict environmental regulations.

Key Activated Alumina Providers in Europe

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization and Pricing |

Available upon request |

By End Use

By Application

By Country

To know more about delivery timeline for this report Contact Sales

Yes, the market is set to reach US$ 563.2 Mn by 2031.

Water treatment companies are the main consumers that companies need to target.

Germany is estimated to witness a high market share in 2031.

Axens, BASF SE, CHALCO Shandong Co., Ltd., and Evonik Industries AG are considered the leading players.

It is mainly used for various catalysts and adsorbent applications.