Industry: Healthcare

Published Date: January-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 182

Report ID: PMRREP12988

The global dysphagia management market is predicted to reach a size of US$ 4.9 Bn by 2025. It is anticipated to witness a CAGR of 6.3% during the forecast period to attain a value of US$ 7.5 Bn by 2032.

The forecast period is set to witness a shift toward preventive care with an increased focus on early screening. Routine screening programs for high-risk groups will become standard practice with adoption rate of screening programs set to increase by 35%. Proactive swallowing therapies and dietary interventions will gain popularity, reducing the incidence of severe dysphagia cases.

Companies are likely to prioritize sustainable and biodegradable packaging for dysphagia products to meet the global environmental goals. By 2032, 40% of dysphagia product packaging is likely to be eco-friendly.

Key Highlights of the Industry

|

Market Attributes |

Key Insights |

|

Dysphagia Management Market Size (2025E) |

US$ 4.9 Bn |

|

Projected Market Value (2032F) |

US$ 7.5 Bn |

|

Global Market Growth Rate (CAGR 2025 to 2032) |

6.3% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

5.2% |

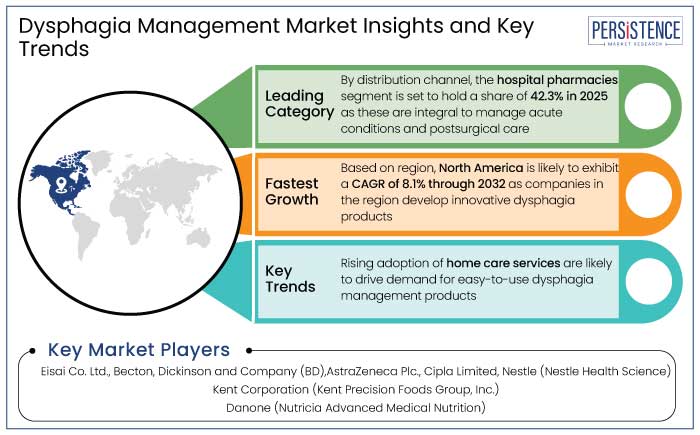

North America dysphagia management market is estimated to hold a share of 32.4% in 2025. The region has a significant aging population, thereby bolstering growth. According to the U.S. Census Bureau, in 2022, adults aged 65 and older account for 17% of the population in the U.S. For instance,

Parkinson’s disease impacts nearly 1 million Americans, with 40% to 80% reportedly experiencing dysphagia. Increasing awareness of dysphagia and the availability of specialized products drive demand in this region.

Companies in North America are pioneers in developing innovative dysphagia products, such as thickening agents, oral supplements, and therapeutic devices. Brands like Thick-It and SimplyThick dominate the market, with a wide range of products tailored for dysphagia patients.

Nutritional solution is anticipated to hold a share of 58.2% in 2025. Dysphagia patients often face difficulty swallowing solid foods, necessitating the use of liquid or semi-solid nutritional solutions to meet their dietary needs. Studies show that up to 85% of dysphagia patients are at risk of malnutrition and dehydration, making nutritional solutions a critical component of dysphagia management. For instance,

Companies are introducing ready-to-drink formulas and fortified nutritional supplements that are both convenient and tailored to specific dietary needs. Products like enriched protein shakes and pre-thickened beverages have shown double-digit growth rates in North America and Europe. Awareness campaigns and healthcare initiatives have increased market penetration of nutritional solutions by 20% in the last five years.

Oropharyngeal dysphagia is projected to account for a share of 82.2% in 2025. Oropharyngeal dysphagia is commonly observed in populations with neurological disorders, post-surgical complications, and aging-related conditions.

Oropharyngeal dysphagia leads to life-threatening complications, such as aspiration pneumonia, malnutrition, and dehydration, necessitating effective management. Aspiration pneumonia, a primary complication of oropharyngeal dysphagia is reported to account for 13% to 48% of pneumonia cases in elderly individuals. The use of video fluoroscopy for diagnosing oropharyngeal dysphagia has increased by 25% over the past decade.

Hospital pharmacies are anticipated to account for a share of 42.3% in 2025. Hospital pharmacies are integral to managing acute conditions and post-surgical care, where dysphagia management is often a priority. For instance,

Hospital pharmacies stock specialized dysphagia management products, including thickening agents, pre-thickened beverages, and medical devices, ensuring immediate availability. Over 70% of hospitals in developed regions maintain an inventory of dysphagia-specific products to meet the demand for inpatient and outpatient care.

Potential development in the global dysphagia management industry is predicted to be driven by growth in telehealth services for dysphagia therapy and monitoring. Manufacturers are estimated to develop region specific products catering to dietary preferences and cultural practices.

The forecast period is also anticipated to undergo greater integration of AI in diagnostic tools, thereby improving accuracy of results. By 2032, AI-driven diagnostic systems are set to account for 25% of all dysphagia assessments. The forecast period is also anticipated to witness growth in demand for portable devices for real-time swallowing function assessment.

The dysphagia management market growth was considerable at a CAGR of 5.2% during the historical period. Rising prevalence of dysphagia among the elderly and those with neurological disorders during the period bolstered growth. Companies progressively introduces innovative dysphagia diagnostic tools, such as videofluoroscopy and fiberoptic endoscopic evaluation of swallowing (FEES).

The COVID-19 pandemic raised awareness about dysphagia, especially in post-ICU patients recovering from ventilator-associated complications. There was a greater adoption of digital tools for dysphagia screening and therapy monitoring. The period also witnessed can expansion in the use of ready-to-drink thickened beverages and fortified nutritional solutions.

The forecast period is anticipated to witnessing launches of plant based and allergen free thickening agents. Companies are predicted to expand their portfolios of prethickened beverages and oral supplements.

Need for Preventive Screening and Early Diagnosis to Push Demand

Dysphagia significantly increases the risk of aspiration pneumonia, which accounts for 15% to 20% of hospital-acquired infections worldwide. Early screening can reduce this risk by facilitating timely interventions.

Early screening programs targeting these populations are essential. AI-powered tools are increasingly used to identify swallowing irregularities. These tools are capable of analysing patterns in speech, breathing, and swallowing mechanics.

Compact devices designed for bedside use, such as acoustic sensors and manometers, are making screening more accessible in hospitals and outpatient settings. Community based initiatives including public health campaigns are raising awareness about dysphagia and promoting early screening in primary care and outpatient settings. For instance,

Demand for Specialized Care for Paediatric and Rare Cases to Skyroket

Dysphagia affects approximately 1 in 25 children globally, particularly those with developmental disorders, prematurity, or genetic conditions. Rare disorders including oesophageal dysphagia is caused by conditions such as achalasia or strictures, affecting 5% to 10% of dysphagia patients. Rare cases like tracheoesophageal fistula or laryngeal cleft necessitate highly specialized interventions.

Businesses are developing flavored and hypoallergenic thickening agents suitable for children. In the U.S., dysphagia screening is now part of routine care for children in neonatal intensive care units (NICUs). Japan and South Korea have implemented nationwide pediatric dysphagia screening programs. Subsidized care programs for children with congenital dysphagia are expanding, particularly in emerging economies.

High Treatment and Care Costs May Hinder Growth

The process of diagnosing dysphagia can be complex, involving a range of tests. These diagnostic imaging tests can cost anywhere from $200 to $3,000 depending on the complexity of the procedure and geographical location. Many dysphagia patients require enteral feeding to ensure proper nutrition. The costs associated with feeding tubes include both the initial placement and ongoing supplies.

Patients with feeding tubes are at risk of complications such as infections or tube dislodgement, which can increase healthcare costs due to hospital stays or additional medical procedures. Dysphagia patients are at a high risk of complications such as aspiration pneumonia, malnutrition, and dehydration, often leading to hospitalizations. For chronic patients who face ongoing complications, frequent hospital stays may be necessary, significantly increasing the overall cost of care.

Insurance Coverage and Policy Support to Create New Avenues

The cost of managing dysphagia, especially long-term care, is high, with treatments such as enteral feeding, specialized nutritional products, and swallowing therapies often being out-of-pocket expenses. For example, enteral feeding can cost US$ 10,000 to US$ 20,000 per year. Insurance providers are starting to offer broader coverage for diagnostic assessments, nutritional support, and therapies related to dysphagia, helping reduce the financial burden on patients.

In the U.S., Medicare is a major source of healthcare coverage for elderly patients, many of whom suffer from dysphagia. Medicare Part B generally covers speech therapy services, which are essential for managing dysphagia, provided that a healthcare provider deems them medically necessary. Private insurers are increasingly covering dysphagia treatments as part of comprehensive care packages. For instance,

Governments in countries such as the U.S., Canada, and parts of Europe are providing policy support to increase access to dysphagia management services. The National Institutes of Health (NIH) in the U.S. has funded research into dysphagia treatment, which has led to more inclusive healthcare policies and reimbursement models.

Shift toward Home Healthcare Services to Create Novel Opportunities

It is projected that by 2030, one in six people globally will be over the age of 60, and up to 80% of individuals over 75 may experience dysphagia due to age-related changes in swallowing function. As the number of elderly individuals rises, the demand for home healthcare services tailored to dysphagia management is set to grow. There is an increasing preference for receiving care at home, especially among elderly individuals, due to the comfort, convenience, and lower costs associated with home care.

Studies show that 70% to 80% of elderly patients prefer home care over institutional care, particularly for long-term chronic conditions. Home healthcare allows for more individualized attention, with healthcare providers offering tailored swallowing therapy, nutritional support, and monitoring of feeding devices, which is especially important for managing chronic dysphagia.

The integration of telemedicine has revolutionized home healthcare, enabling speech therapists and other specialists to monitor dysphagia patients remotely, offering consultations and therapy sessions via digital platforms. Wearable devices and mobile apps are increasingly being used to track swallowing functions in real-time, allowing caregivers and healthcare providers to monitor progress and intervene promptly if complications arise.

Companies in the dysphagia management market are working on developing unique formulations, like thickening agents, oral supplements, and ready-to-drink products tailored to different severity levels of dysphagia. They are also incorporating natural, allergen-free, and organic ingredients to cater to consumer preferences.

Businesses are leveraging novel technology to create user-friendly diagnostic and therapeutic devices. They are progressively collaborating with healthcare providers, nutritionists, and speech-language pathologists to improve product efficacy and reach.

Manufacturers are also partnering with universities or research institutions for cutting-edge research and development. They are expanding into emerging markets where the prevalence of dysphagia is increasing due to aging populations and rising healthcare awareness.

Recent Industry Developments

|

Attributes |

Detail |

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization and Pricing |

Available upon request |

By Product

By Indication

By Distribution Channel

By Region

To know more about delivery timeline for this report Contact Sales

The market is anticipated to reach a value of US$ 7.5 Bn by 2032.

Managing dysphagia includes making a mealtime management plan that describes how one can eat and drink safely.

Treatments for dysphagia include medicines to treat acid reflux and swallowing therapy.

Prominent players in the market include Eisai Co. Ltd., Becton, Dickinson and Company (BD), and AstraZeneca Plc.

The market is predicted to witness a CAGR of 6.3% throughout the forecast period.