ASEAN Dysphagia Diet Thickening Agents Market Segmented By Gel Type Thickeners, Powder Thickeners Form for Hospital Pharmacies, Retail Pharmacies, Online Pharmacies

Industry: Healthcare

Published Date: April-2022

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 201

Report ID: PMRREP33043

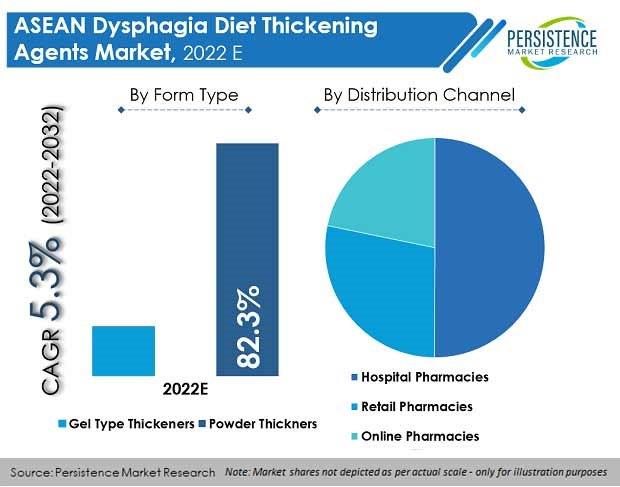

The ASEAN dysphagia diet thickening agents market was valued at US$ 19.9 Mn in 2021, and is predicted to expand at a CAGR of 5.3% through 2032. Powder thickeners held a market value of US$ 16.4 Mn, accounting for nearly three-fourths of the overall market by form.

| Attribute | Key Insights |

|---|---|

|

ASEAN Dysphagia Diet Thickening Agents Market Size (2021) |

US$ 19.9 Mn |

|

Estimated Market Value (2022) |

US$ 20.8 Mn |

|

Projected Market Value (2032) |

US$ 34.9 Mn |

|

Global Market Growth Rate (2022-2032) |

5.3% CAGR |

|

Market Share of Top 5 Countries |

84.2% |

The ASEAN dysphagia diet thickening agents market expanded at a CAGR of 4.2% over the last five years (2017-2021) and accounted for a revenue share of 4.4% in the global dysphagia diet thickening agents market, which was valued at US$ 457 Mn in 2021.

Growing prevalence of dysphagia along with rising geriatric population are key factors driving demand for dysphagia diet thickening agents across the ASEAN region. In addition, developments in the field of elderly medication have also fuelled market growth.

The volume of dysphagia patients in the ASEAN region has increased over the years, majorly due to an increase in the occurrence of strokes as well as the growing aging population in the region. Strokes are one of the main reasons for dysphagia with an occurrence rate of 30%-40%. Studies on the epidemiology of strokes in Asia have shown varying levels of prevalence, incidence, mortality, and burden of disease.

Also, various government organizations and corporates are actively conducting awareness programs to create awareness about dysphagia.

For instance, June is considered as National Awareness Month, wherein, members from the National Foundation of Swallowing Disorders share facts and figures that are supported by research. This provides insights towards understanding the current scenario of swallowing disorders and presenting appropriate solutions.

Key companies are foraying into the dysphagia supplements market in the ASEAN region to benefit from the large pool of existing dysphagia patients. Investments in research & development to introduce new products is a major strategy being adopted manufacturers of dysphagia diet thickening agents in the ASEAN market.

The market for dysphagia diet thickening agents in the ASEAN region is expected to expand at a CAGR of 5.3% over the forecast period and record sales worth US$ 34.9 Mn by the end of 2032.

“High Demand for Dysphagia Management in Children”

The forecast period is set to witness many lucrative opportunities for manufacturers of dysphagia diet thickening agents within the ASEAN region.

Research proposes that around 1% of children in the common population will suffer from swallowing difficulties, although the occurrence rate is much more in some clinical populations (e.g. children with airway malformations, traumatic brain injury, and cerebral palsy). This number indicates high demand for dysphagia management in children.

Moreover, the need for dysphagia treatment in children generates huge opportunities for market players to introduce paediatric-specific dysphagia diet products. Presently, several dysphagia treatment products are available in the market. Only a few products are focusing on paediatric dysphagia conditions.

Most thickening products target the adult population. Introduction of paediatric-focused thickening agents for swallowing disorders can generate significant opportunities for players in the market.

“Absence of Diagnostic Testing & High Preference for Home Remedies”

Lack of standard diagnostic tests to diagnose dysphagia conditions and increasing preference for home remedies and alternate therapies are key factors restraining the growth of the ASEAN dysphagia diet thickening agents market.

Dysphagia is diagnosed by using X-ray, flexible endoscopy, and video-fluoroscopy procedures. However, these are not feasible to conduct every time in dysphagia patients.

For instance, video-fluoroscopy only detects a portion of the mouth via the pharynx to the upper part of the chest. It will not detect irregularities in the oesophagus. In order to detect such abnormalities, the barium swallow exam is conducted. Due to the lack of standard diagnostic testing procedures for dysphagia diagnosis, consumption of dysphagia diet thickening agents is experiencing a restraint.

Home remedies and other alternate therapies are preferred over marketed products by consumers for providing relief from dysphagia in the ASEAN region, which is also restraining market growth.

In the region of Asia, post stroke dysphagia conditions are most commonly treated with acupuncture techniques and Chinese herbal medicines over available branded thickener products present in the market. Furthermore, in low-income countries of Southeast Asia, home-based therapies, such as Ayurveda and homeopathy, are commonly used to manage dysphagia conditions.

Why is Indonesia the Largest Market for Dysphagia Diet Thickening Agents in the ASEAN Region?

Indonesia is estimated to account for around 22.6% of the ASEAN market for dysphagia diet thickening agents in 2022, owing to better healthcare infrastructure and facilities, easy availability of treatment options, increasing prevalence of dysphagia, and growing government initiatives to increase awareness regarding dysphagia.

Additionally, increasing prevalence of head and neck cancers is also leading towards more cases of dysphagia. This is because Indonesia has the highest male smoking prevalence in the world. Consequently, there are many awareness programs conducted to educate smokers in the country.

How is Demand for Dysphagia Diet Thickening Agents Evolving in the Philippines?

The Philippines is estimated to account for 18.2% share of dysphagia diet thickening agents market in ASEAN in 2022.

Growing prevalence of several cancers, specifically oral cancer and head and neck cancer, increases the risk of dysphagia in several people, thus acting as a major factor driving the market in the Philippines.

In addition, some cancer therapies may also lead to swallowing difficulties as a side effect, resulting into increased demand for proper dysphagia treatment products to prevent further problems.

As per the Philippine Cancer Facts and Estimates by the DOH and Philippine Cancer Society, there are approximately 8,488 new cases, positioning head and neck cancer (HNC) as number 3.

Will Thailand Emerge as a Prominent Market for Dysphagia Diet Thickening Agents?

The Thailand dysphagia diet thickening agents market is estimated to be worth US$ 2.1 Mn in 2022.

Factors such as growing geriatric population together with increasing government initiatives to improve ageing healthcare are boosting demand for dysphagia diet thickening agents in Thailand.

In Thailand, 8.6 million people are more than 65 years of age. Over the coming 15 years, more elderly Thai people will demand healthcare support, increasing the annual healthcare expenditure to US$ 44.8 Bn to meet their needs. This is increasing demand growth of dysphagia diet thickening agents in the country.

What Is the Outlook for Singapore in the ASEAN Dysphagia Diet Thickening Agents Market?

Demand for dysphagia diet thickening agents in Singapore is expected to rise at around 6.3% CAGR over the forecast period, owing to growth in government initiatives for increasing awareness and growing prevalence of dysphagia conditions.

For instance, in Singapore, several private institutions are coming forward to create awareness about dysphagia and also to improve the quality of life of people suffering from dysphagia.

In Singapore, Sodexo helps in the care of the elderly through the IDDSI (International Dysphagia Diet Standardization Initiative) standards. IDDSI is an organised framework that includes a continuum of 8 stages with food texturized to changing levels as per the therapeutic needs of a person. Through this global standard, Sodexo enhances quality of life and improves the safety of patients with swallowing difficulties and dysphagia.

Will Demand for Powder Thickeners to Continue Gaining Traction?

By form, powder thickeners are anticipated to hold a high market share of 82.3% in 2022, expanding at the rate of nearly 5.2% over the forecast period.

Powder thickeners can be mixed with liquids such as water to prepare a thickened liquid. Powdered dysphagia diet thickening agents is an easily available substitute to gel-type thickeners for the treatment of dysphagia in most cases, as they can be used without the requirement of mixing equipment.

In addition, there happens to be no danger of improper delivery of medicine (such as that with gels), where liquid medicines can possibly become trapped within the combination before ingestion, resulting in medication errors.

Why Do Hospital Pharmacies Hold the Highest Market Share?

By distribution channel, hospital pharmacies are anticipated to hold a high share with a value of about 50.1% in 2022, expanding at rapid rate of 5.6% CAGR value during the forecast period.

Growth of the hospital pharmacies segment is owed to sufficient supply of a broad variety of dysphagia diet thickening agents, as well as the presence of skilled professionals who understand the liquid consistency required for dysphagia patients.

Hospitals are recognized as chief care centers operating through the presence of well-skilled support staff and professionals that aid patients with potential treatment options. Adoption of prescribed therapy in clinics and hospitals assists in managing prescribed drug delivery securely by a professional, and is one of the primary factors boosting the sales value of the hospital pharmacies segment.

The outbreak of COVID-19 had a negative impact on dysphagia diet thickening agent sales in the ASEAN region. During the pandemic, the ASEAN dysphagia diet thickening agents market growth rate declined significantly, but is expected to become stable by 2023.

Patients with dysphagia who were not infected by COVID-19 faced a negative impact as the reallocation of materials and human resources for the care of patients infected with the virus resulted into reduction in treatment rates, diagnosis, and follow-ups, thus witnessing a decreasing effect on dysphagia diet thickening agents market growth.

Leading dysphagia diet thickening agent suppliers are entering into collaborations and joint ventures as part of their efforts to strengthen their market presence. Strategies of gaining approvals from various regulatory authorities around the world, new product launches, and acquisitions for increasing their market presence are being adopted by key players in the dysphagia diet thickening agent industry.

| Attribute | Details |

|---|---|

|

Forecast Period |

2022-2032 |

|

Historical Data Available for |

2017-2021 |

|

Market Analysis |

US$ Million for Value |

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon Request |

ASEAN Dysphagia Diet Thickening Agents Market by Form:

ASEAN Dysphagia Diet Thickening Agents Market by Distribution Channel:

ASEAN Dysphagia Diet Thickening Agents Market by Country:

To know more about delivery timeline for this report Contact Sales

The ASEAN dysphagia diet thickening agents market is valued at US$ 19.9 Mn, and is expected to grow 1.7X over the forecast period.

The ASEAN market for dysphagia diet thickening agents is set to witness a high growth rate of 5.3% and be valued at US$ 34.9 Mn by 2032.

Dysphagia diet thickening agent consumption increased at 4.2% CAGR during 2017 to 2021.

Powder thickeners are expected to hold 82.3% of the total market share in 2022.

Indonesia, the Philippines, Vietnam, Myanmar, and Thailand currently hold more than three-fourths share of the ASEAN market.

The Indonesia dysphagia diet thickening agents market is one of the fastest-growing in ASEAN and is anticipated to account for 22.6% of the regional market share in 2022.

The Singapore dysphagia diet thickening agents market is expected to expand at a CAGR of 6.3%, while Thailand is expected to hold a share of 10.2%.