Industry: Healthcare

Published Date: January-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 181

Report ID: PMRREP3594

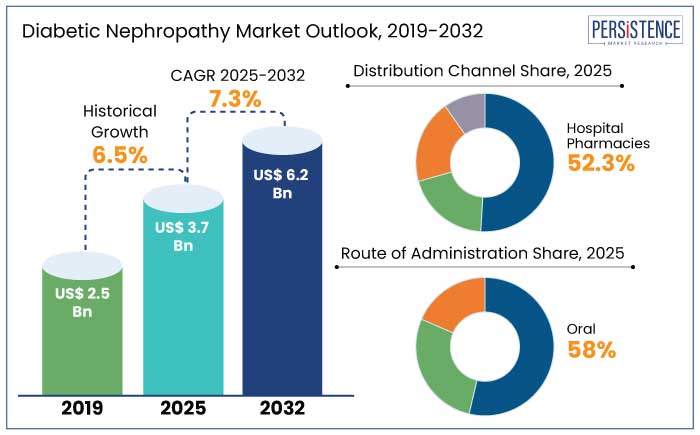

The global diabetic nephropathy market is estimated to reach a size of US$ 3.7 Bn in 2025. It is predicted to rise at a CAGR of 7.3% through the assessment period to attain a value of US$ 6.2 Bn by 2032.

Rising incidence of diabetes is fueling the global healthcare industry because of diabetic nephropathy, a serious diabetes complication that causes kidney damage and proteinuria. According to the International Diabetes Federation, the number of diabetes cases is projected to increase from 415 million in 2015 to 642 million by 2040, with Europe and the Western Pacific accounting for the highest numbers.

The global pandemic disrupted clinical trials and pharmaceutical supply chains, in China and India, which host 40% of drug manufacturing sites, causing temporary shortages. After the market rebound, several pharma institutes are estimated to extend their product inventory. For instance,

Key Highlights of the Markets

|

Market Attributes |

Key Insights |

|

Diabetic Nephropathy Market Size (2025E) |

US$ 3.7 Bn |

|

Projected Market Value (2032F) |

US$ 6.2 Bn |

|

Global Market Growth Rate (CAGR 2025 to 2032) |

7.3% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

6.5% |

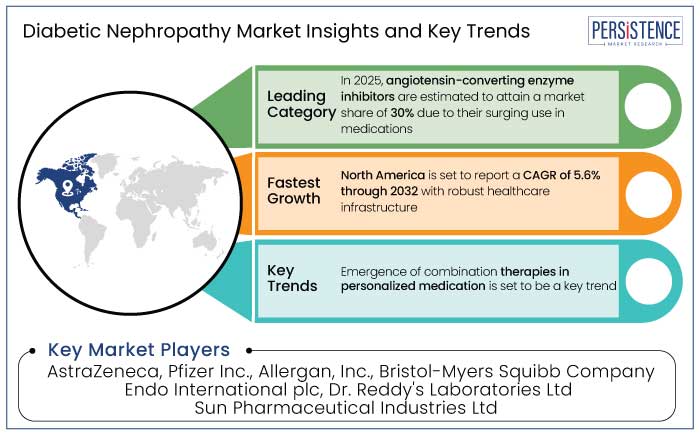

North America is likely to dominate the global diabetic nephropathy market, accounting for 35% of the share by 2025, with a projected CAGR of 5.6% from 2025 to 2032. For instance,

The region’s robust healthcare infrastructure, high healthcare expenditure, and advanced diagnostic tools contribute to its market leadership. For example,

Europe's diabetic nephropathy market is set to dominate the global market by generating 28.7% share in 2025. This is largely due to its high prevalence of diabetes, obesity, and related complications, including chronic kidney disease. For instance,

Increased healthcare spending and early detection methods, together with Europe's extensive healthcare systems and greater emphasis on controlling comorbidities, are fueling the need for nephropathy medications.

In 2025, angiotensin-converting enzyme inhibitors are anticipated to account for 30% of the market, mainly because of their use in the treatment of diabetic nephropathy. In diabetic patients, these drugs decrease the course of kidney damage by relaxing blood arteries and lowering blood pressure.

Because of their cost and effectiveness, ACE inhibitors continue to be a mainstay treatment even in the face of the emergence of more recent medication classes like SGLT2 inhibitors. Pfizer and AstraZeneca have strengthened their position in the diabetic nephropathy therapy industry by extending the availability of Ramipril to underprivileged areas.

In 2025, oral administration is predicted to account for 58% of diabetic nephropathy treatment industry share, due to its convenience, ease of use, and reduced risks. Oral drugs, primarily absorbed in the small intestine, ensure improved bioavailability, crucial for managing chronic conditions like diabetic nephropathy. For instance,

Patients and healthcare professionals frequently choose oral administration since it effectively raises insulin portal levels, lowers the risk of skin infections, and minimizes adverse effects.

Globally, diabetes prevalence is increasing, leading to a surge in diabetic nephropathy cases, with early screening campaigns and increased healthcare expenditure enhancing disease management. For instance,

In addition to improving affordability, raising market competition, and impacting pricing tactics, the emergence of generic drugs, lifestyle changes, and sophisticated diagnostic technologies is increasing demand for specialized therapies.

The global diabetic nephropathy market recorded a CAGR of 6.5% in the historical period from 2019 to 2023. New diabetic drugs approved by the FDA in underdeveloped nations are opening up new markets. To reduce the risk of ESRD, deteriorating renal function, cardiovascular mortality, and heart failure hospitalization in people with type 2 diabetes and DKD, for instance, the SGLT2 inhibitor canagliflozin was authorized in 2019.

Demand for diabetic nephropathy is estimated to record a considerable CAGR of 7.3% during the forecast period between 2025 and 2032.

Upsurge in Diabetes Cases to Push Demand in Healthcare Sector

On a global scale, the case of diabetes is envisioned to fuel demand for different therapies. The common indication of diabetic nephropathy is diabetes mellitus; individuals with this illness are ten times more likely to get end-stage renal failure, which increases the need for angiotensin-converting enzyme inhibitors. For example,

The global diabetic kidney disease market is driven by increasing incidence of diabetes and the geriatric population. The number of people with diabetes is projected to rise from 415 million in 2015 to 642 million by 2040. Advances in treatment and increased awareness about diabetic kidney disease diagnosis and management are expected to provide lucrative growth opportunities for market players.

Progression in Diagnostic Procedures to Present Novel Avenues

The industry is estimated to bloom with the development of innovative therapies for diabetes cure. For example,

The advancement in diagnostic procedures is anticipated to fuel the research and development practices in the healthcare sector. The diagnostic category was driven by Roche's introduction of a new biomarker panel in February 2024, which increased diagnosis rates by 40% and was widely adopted in major medical facilities.

High Medical Expenses Affects the Patient Care Industry

The cost of the therapies for patient care and research and development for the novel solutions are estimated to be high.

A survey found that 40% of patients do not adhere to their treatment programs, which affects the market expansion and care efficacy. As a result, developing efficient treatment programs and combination medications is being given increased importance.

Development in Targeted Therapies for Personalized Medication Opens Fresh Avenues

The development of targeted therapeutics and personalized medicine is transforming diabetic nephropathy therapy by delivering precise, effective interventions based on patient-specific data such as genetic markers and biomarkers, resulting in better results.

Since hospital pharmacies continue to be the major distribution channel for cutting-edge treatments, the need for diabetic nephropathy is anticipated to expand globally, with a 52.3% market share in 2025. For example,

Increased research and development investments in precision medicine are revolutionizing the management of diabetic nephropathy.

Novel Research in Biomarkers for Early Detection to Create Growth Prospects

The research into the use of biomarkers for diabetic nephropathy early detection is expanding diagnostic possibilities, enabling earlier treatment and better patient outcomes. The potential of biomarkers such as albuminuria, serum creatinine, and genetic markers is being investigated. For instance,

Such initiatives align with the growing demand for personalized healthcare solutions, aiming to improve disease monitoring and facilitate timely, targeted therapeutic interventions in diabetic nephropathy care.

The global diabetic nephropathy industry is experiencing a surge of investment focused on the research and development of groundbreaking medications. Manufacturers are placing a strong emphasis on producing high-quality, essential healthcare products that can improve patient outcomes.

To enhance their market presence, some companies are strategically pursuing alliances and mergers, creating stronger networks and resources in the field. Emerging start-ups are poised to introduce innovative solutions that promise to reshape and support the industry in addressing the challenges associated with diabetic nephropathy.

Recent Industry Developments

|

Attributes |

Details |

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization and Pricing |

Available upon request |

By Drug Class

By Diabetes Type

By Route of Administration

By Distribution Channel

By Region

To know more about delivery timeline for this report Contact Sales

The market size is set to reach US$ 6.2 Bn by 2032.

Diabetic nephropathy, a severe complication of type 1 and type 2 diabetes, affects around one in three Americans with the condition.

In 2025, North America is set to attain a market share of 35%.

In 2025, the market is estimated to be valued at US$ 3.7 Bn.

AstraZeneca, Pfizer Inc., Allergan, Inc., Bristol-Myers Squibb Company, and Endo International plc are a few key players.