Industry: Healthcare

Published Date: January-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 193

Report ID: PMRREP26248

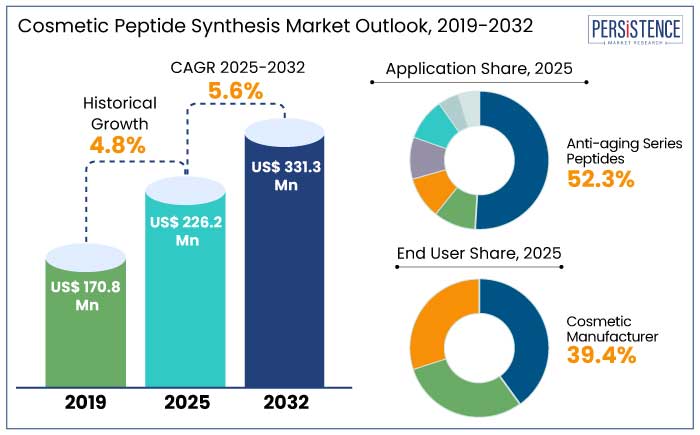

The global cosmetic peptide synthesis market is estimated to reach a size of US$ 226.2 Mn in 2025. It is predicted to rise at a CAGR of 5.6% through the assessment period to attain a value of US$ 331.3 Mn by 2032..

Demand for peptide synthesis is rising because of personalized therapies, investment in biotechnology, increasing demand for unique skincare products, and high disposable income in the beauty industry. Biotechnology breakthroughs, such as L'Oréal Research's novel molecular engineering techniques, have attracted US$ 450 Mn in research investments.

Prominent skincare brands have launched comprehensive peptide-based product lines targeting specific skin concerns, with Estée Lauder reporting 55% increased consumer interest in scientifically developed peptide formulations.

In 2025, cosmetic manufacturers are set to generate 39.4% end user share. Personalized skincare solutions have seen 45% growth, with brands offering customized peptide formulations based on individual genetic and environmental factors.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Cosmetic Peptide Synthesis Market Size (2025E) |

US$ 226.2 Mn |

|

Projected Market Value (2032F) |

US$ 331.3 Mn |

|

Global Market Growth Rate (CAGR 2025 to 2032) |

5.6% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

4.8% |

In 2025, North America is estimated to hold a market share of 38.5%. Given the rising incidence of skin, hair loss, and eye conditions as well as increased research and development and investment in the area, North America is anticipated to lead the cosmetic peptide synthesis market.

The market is rising due to research initiatives like the discovery of SCUBE3. It is anticipated that the use of cosmetic peptides for anti-aging benefits would grow as the population ages.

Key companies, such as ADOREYES, are expanding their products in new areas, improving their market position. The cosmetic peptide synthesis market in North America is anticipated to record a CAGR of 5.7% through 2032. In response to growing consumer demand for cutting-edge skincare products, the U.S. is likewise seeing a boom in the discovery and production of active ingredients.

In 2025, Europe is estimated to hold a market share of 37.4%, due to strategic infrastructure, research, and regulatory standards. It is projected to witness a CAGR of 3.6% from 2025 to 2032. The peptide synthesis industry, which is driven by the biopharmaceutical sector, research institutions, and government backing, is dominated by the skincare customs and high-end beauty product customer base of Europe.

The U.K. peptide synthesis sector is anticipated to surge due to substantial investments in research and development, urbanization, and enhancements in healthcare infrastructure. Increased diversification in the manufacturing sector is also set to boost demand.

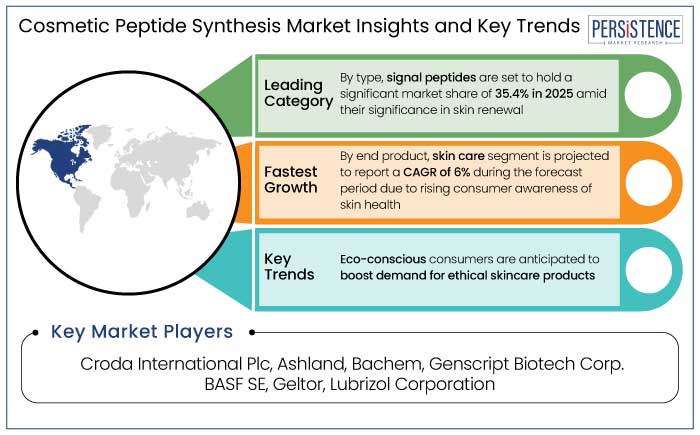

Signal peptides are the most important category in the cosmetic peptide manufacturing industry because of their significance in cellular communication and skin renewal. In 2025, signal peptides are estimated to attain a market share of 35.4% on the global scale.

Signal peptides increase skin elasticity and resilience by boosting collagen synthesis and facilitating cell signaling pathways. They are frequently used to treat wrinkles and fine lines in anti-aging products.

The market's fastest-growing segment is synthetic antimicrobial peptides (AMPs), which are being driven by customer demand for skincare products with improved antimicrobial and protective qualities. Formulations that fight microbial threats and preserve a healthy skin microbiome employ synthetic AMPs. Because of their advantages, scientific legitimacy, and capacity to solve important skincare issues, signal peptides are a crucial component in the creation of cutting-edge cosmetic products.

In 2025, anti-aging series peptides are estimated to achieve the highest application share of 52.3%. The cosmetic peptide production market is dominated by anti-aging applications, which are fueled by consumer demand for goods that treat aging symptoms.

Peptides are well-recognized for increasing skin suppleness, decreasing wrinkles, and boosting collagen. Due to customer preferences for both hair growth solutions and complete hair care, hair growth solutions are the category with the quickest rate of growth.

Anti-aging series peptides are extensively utilized because of their broad anti-aging properties, support for skin regeneration, promotion of collagen synthesis, and versatility in skincare products. To create patented cosmetic peptides for a range of skin diseases, businesses are implementing strategic measures, such as collaborations with Korean brands. This will likely spur growth and transform the cosmetics industry.

The cosmetic peptide synthesis market is set to grow due to the prevalence of eye and skin disorders and research and development activities. Cosmetic peptides, such as Acetyl Tetrapeptide-5 and Dipeptide-2, improve lymphatic circulation and are used in eye creams to combat dark and puffy under-eye circles. Peptides like oligopeptide-34 and nonapeptide-1 are used to treat skin pigmentation, promote wound healing, and have applications in eye care, aging, and pigmentation.

Clinical trials are underway to validate the advantages of peptides in the anti-aging segment, which promotes the production of dermal extracellular matrix proteins like collagen. Companies are leveraging strategic initiatives like partnerships and innovation in cosmetic peptides to drive market growth, with dermo-cosmetic peptides expected to revolutionize the industry.

The global cosmetic peptide synthesis market recorded a CAGR of 4.8% in the historical period from 2019 to 2023. Key brands working in the cosmetics industry are estimated to develop novel innovation to cater the growing demand. For instance,

The industry's response to particular skincare demands was reflected in the market's sharp increase in demand for these cutting-edge cosmetic peptides.

Such innovations have influenced the growth of the market and opened the door for further breakthroughs in the production of cosmetic peptides. Demand for cosmetic peptide synthesis is estimated to record a considerable CAGR of 5.6% during the forecast period between 2025 and 2032.

Rising Popularity of Collagen-boosting Cosmetic Products

Since collagen synthesis declines with age, resulting in wrinkles and drooping, the skincare industry is seeing a boom in demand because of the growing popularity of cosmetics that stimulate collagen. Companies like L'Oréal and Estée Lauder are introducing collagen-enriched creams, serums, and masks to meet this demand. For instance,

As consumers become more aware of collagen’s benefits, there is a rising demand for innovative formulations, propelling the market.

Breakthrough in Biotechnology to Launch Unique Formulations

Innovations in biotechnology have significantly boosted the market growth in cosmetic peptide manufacturing. Innovative techniques like solid-phase peptide synthesis and recombinant DNA technology have enabled manufacturers to create peptides with enhanced efficacy and specificity for skincare applications. The technological evolution has improved manufacturing efficiency and facilitated the development of novel peptides with targeted skincare benefits. For example,

As biotechnology continues to push boundaries, the cosmetic peptide manufacturing market experiences accelerated growth, meeting the demand for high-performance peptides in the cosmetic and skincare industry.

Fragility of Peptides in Complex Cosmetic Products Limits Adoption

The cosmetic peptide manufacturing industry faces significant challenges due to high production costs, regulatory challenges, and supply chain disruptions.

Compliance with international guidelines is crucial for market players to maintain growth and consumer trust, as their reliance on raw materials can be disrupted by factors like climate change. Ensuring a stable and diversified supply chain for essential ingredients is paramount, but manufacturers may face difficulties in consistently sourcing high-quality raw materials, impacting production timelines and potentially leading to increased costs.

Innovations in Sustainable Peptide Formulations Present Growth Prospects

The move to eco-friendly, sustainable formulations, driven by a rise in green technology investment and production techniques, is driving development in the cosmetic peptide manufacturing industry. Developing peptides from renewable sources or biodegradable materials aligns with these trends, opening up new markets and enhancing brand reputation.

Biotechnology firms are introducing sustainable peptide synthesis methods, reducing environmental impact by 55%, and leveraging the growing trend of personalized skincare solutions to create bespoke formulations.

The industry can enhance revenue, and customer loyalty, and be at the forefront of the personalized skincare revolution by incorporating AI-driven analysis and customizable peptide blends.

Popularity of Skin Care Products Offers Lucrative Results

Growing need for focused, efficient skincare products is expected to propel the skin care sector to a 47.3% market share in 2025, dominating the cosmetic peptide production industry. Cosmetic peptides are renowned for their anti-aging properties, promoting collagen production and reducing wrinkles, making them a key ingredient in premium skincare products. The skin care product's projected CAGR of 6% reflects rising consumer awareness of skin health and the preference for science-backed products.

Companies like BASF and Croda International are leading innovation by developing unique peptide formulations tailored to address specific concerns like hydration, elasticity, and pigmentation. For example,

The development of skincare peptides is attributed to the popularity of multifunctional products containing peptides and sustainability initiatives in formulation and packaging.

Manufacturers of cosmetic peptides maintain their market leadership by combining smart product releases and partnerships. These releases enable businesses to provide innovative formulas and demonstrate creativity and response to changing customer requirements.

Businesses may use competitive intelligence to analyze product introductions, track rival activity, and evaluate technology developments. This aids in spotting market trends, identifying specialized possibilities, and improving product offers. With a focus on innovation and sustainable practices, a strong business strategy synchronizes product development with changing customer demands.

Businesses use their alliances with contract manufacturers and cosmetic manufacturers to modify their tactics in response to new trends like clean beauty and customized skincare. Consumer trust and a smooth market entry are guaranteed by regulatory compliance.

Recent Industry Developments

|

Attributes |

Details |

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization and Pricing |

Available upon request |

By Type

By Application

By End Product

By End User

By Region

To know more about delivery timeline for this report Contact Sales

The market size is set to reach US$ 331.3 Mn by 2032.

Developments in therapeutic peptide development have led to the approval of over 85 peptide-based drugs for clinical use, indicating an interest in bioactive peptides among researchers.

In 2025, North America is set to attain a market share of 38.5%.

In 2025, the market is estimated to be valued at US$ 226.2 Mn.

Croda International Plc, Ashland, Bachem, and Genscript Biotech Corp. are a few key players.