Industry: Packaging

Published Date: October-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 163

Report ID: PMRREP34843

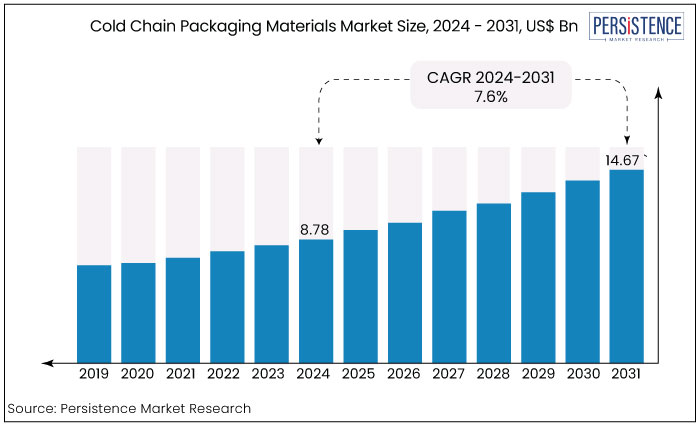

The cold chain packaging materials market is estimated to increase from US$8.78 Bn in 2024 to US$14.67 Bn by 2031. The market is projected to record a CAGR of 7.6% during the forecast period from 2024 to 2031. The market is driven by rising pharmaceutical demand, the frozen food industry, and sustainability efforts. Key players focus on eco-friendly innovations and real-time monitoring with emerging markets offering significant growth potential.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Cold Chain Packaging Materials Market Size (2024E) |

US$8.78 Bn |

|

Projected Market Value (2031F) |

US$14.67 Bn |

|

Global Market Growth Rate (CAGR 2024 to 2031) |

7.6% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

6.7% |

|

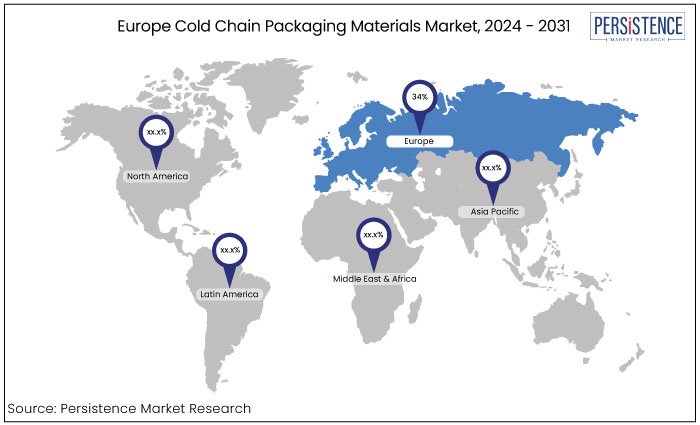

Region |

Market Share in 2024 |

|

Europe |

34% |

Europe cold chain packaging materials market is predicted to witness high growth rate over the forecast period and dominates the market with a substantial market share. The region's growth can be attributed to the significant variations in temperature profiles among countries, resulting in increased demand for sophisticated packing materials and temperature monitoring technologies.

European developing nations provide substantial growth prospects through economic advancement and expansion initiatives. The cold chain packaging materials market in Europe is propelled by advancements in the cold chain logistics sector.

|

Category |

Market Share in 2024 |

|

Material - Paper & Paperboard |

42% |

The market is classified into expanded polystyrene, polyurethane, and paper & paperboard, based on material. Among these, the paper & paperboard segment dominates the market. The paper and paperboard category to experience the significant share in the global market.

The expansion of this segment is ascribed to the characteristics of paper and paperboards including their lightweight nature, robustness, and biodegradability. Paperboard is utilized to manufacture multi-layered cold-chain containers such as pallet shippers. The enforcement of strict environmental restrictions and the growing preference for sustainable packaging solutions will result in segmental expansion.

The polyurethane sector has witnessed significant growth in the cold chain packaging market, primarily due to the rising demand from producers of cold chain containers. This material, known for its high reusability and recyclability has a minimal environmental impact making it a preferred choice. The eco-friendly attributes of PUR are driving its integration into the cold chain packaging sector.

|

Category |

Market Share in 2024 |

|

Application - Food |

65% |

The market is segmented into food, pharmaceutical and industrial based on application. Among these, the food application segment dominates the market. The food sector is estimated to account for 65% of the market share in 2024. The substantial quantity of food carried globally is the primary element propelling the expansion of this market.

Frozen meat, exotic fruits, pulp, beverages, dairy goods, agricultural produce, and other items are globally shipped via cold chain packaging. Moreover, the escalating international and domestic trade activities worldwide enhance segment expansion.

The pharmaceutical sector is expected to demonstrate the high growth rate during the projection period, largely due to technological advancements. These improvements are facilitating the transportation of temperature-sensitive pharmaceutical items using cold-chain packaging. The increasing number of organ transplantation procedures and the rising prevalence of hormone therapy will also contribute to the sector's expansion.

The increasing need for cold chain packaging goods in the global pharmaceutical sector is propelling market expansion. The increase in surgeries utilizing a particular EPS-based packaging for organ transplantation is driving the widespread adoption of innovative materials in cold chain packaging.

Developments in medical technology result in increased utilization of these materials to develop effective cold chain packaging solutions. The increase in disposable income and the escalating demand for packaged food from the expanding young demographic are driving the usage of cold chain packaging materials.

Governmental rules in several countries about the excessive usage of eco-friendly packaging are anticipated to enhance the paper and paperboard sector. Nonetheless, elevated expenses and intricate rules regarding materials utilized in cold chain packaging will impede market growth.

The cold chain packaging materials market has seen substantial growth pre-2023 driven by the rising demand for temperature-sensitive products across various sectors including pharmaceuticals, food and beverages, and biotechnology.

The global pandemic further accelerated this demand particularly in the pharmaceutical sector for vaccine distribution. Key packaging materials such as insulated containers, refrigerants, and phase change materials became crucial to maintain product integrity.

The growing emphasis on reducing food waste and preserving product quality also pushed growth in the food industry. Between 2018 and 2022, the market expanded steadily, with innovations in sustainable materials including biodegradable and reusable packaging solutions, gaining traction due to increasing environmental concerns.

Post-2024, the cold chain packaging materials market is projected to experience high growth, primarily driven by technological advancements and strict food and pharmaceutical storage regulations. Increasing global trade of perishable goods will contribute to market expansion, particularly in emerging markets.

The pharmaceutical industry's continued focus on biologics and personalized medicines, which require stringent cold chain logistics is expected to boost demand. Sustainability concerns will propel innovations in eco-friendly packaging materials.

Rising Demand for Temperature-Sensitive Pharmaceuticals Remains a Key Driver

One of the key growth drivers for the cold chain packaging materials market is the increasing demand for temperature-sensitive pharmaceuticals, particularly biologics, vaccines, and specialty drugs. Biologics, including vaccines, gene therapies, and monoclonal antibodies, require stringent temperature control from production to patient delivery to maintain efficacy.

The COVID-19 pandemic underscored the need for efficient cold chain logistics, with massive vaccine distribution efforts highlighting gaps in the supply chain. As the pharmaceutical industry continues to shift toward personalized medicine and biologics, the need for reliable and innovative cold-chain packaging materials has surged. This trend is expected to continue as pharmaceutical companies develop complex drugs that require specialized storage and transportation driving significant growth in the market.

Growth in the Global Frozen Food Industry

The global frozen food industry has expanded rapidly, driving demand for cold chain packaging materials. Consumers' shifting preferences toward convenience foods, rising urbanization, and busy lifestyles have led to increased consumption of frozen and ready-to-eat meals.

As consumers prioritize food quality and safety, the importance of temperature-controlled packaging has grown. This demand extends beyond developed markets to emerging economies, where increased disposable income is contributing to the frozen food sector growth.

Manufacturers rely on advanced packaging solutions that provide consistent temperature control during storage and transportation to maintain these products quality and shelf life. The globalization of food supply chains has increased the need for more robust cold chain packaging solutions to ensure that perishable goods can be transported over long distances without compromising quality.

High Costs of Advanced Cold Chain Packaging Solutions

One of the primary restraints for the cold chain packaging materials market is the high cost associated with advanced packaging solutions. Technologies like phase-change materials (PCMs), vacuum-insulated panels (VIPs), and reusable packaging systems offer superior temperature control. Still, they are significantly expensive than traditional materials like expanded polystyrene (EPS).

Adopting high-end solutions can be prohibitive for small and medium-sized companies, especially in developing markets limiting their ability to invest in advanced packaging options. The initial investment required for reusable packaging systems, despite long-term savings, is often a barrier for companies with limited capital.

The cost challenge is compounded by rising raw material prices, impacting profit margins for businesses operating in competitive sectors like food and pharmaceuticals. As a result, the high cost of cold chain packaging materials can deter widespread adoption, especially in price-sensitive regions.

Sustainable and Eco-Friendly Packaging Solutions

One of the most transformative opportunities in the cold chain packaging materials market lies in developing and adopting sustainable and eco-friendly packaging solutions. With increasing global awareness around environmental conservation, there is a growing demand for packaging materials that are biodegradable, recyclable, or reusable.

Companies that can innovate in this space offering materials like plant-based insulators, recycled plastics, or reusable phase-change materials (PCMs) stand to capture significant market share.

Eco-conscious consumers influence this shift with businesses increasingly prioritizing sustainability in their operations. This presents an opportunity for packaging manufacturers to differentiate themselves by developing solutions that reduce carbon footprints while maintaining high performance in temperature control.

The ability to meet environmental standards without compromising product integrity will likely to be a game-changer offering competitive and regulatory advantages in the coming years.

Technological Innovations in Packaging and Monitoring

Another transformative opportunity is the integration of advanced technologies into cold chain packaging systems. Internet of Things devices, RFID tags, and smart sensors that can monitor temperature, humidity, and other environmental factors in real-time are revolutionizing cold chain logistics. Such innovations enable better visibility and control throughout the supply chain, reducing the risk of temperature deviations leading to product spoilage.

As more companies invest in high-value biologics, specialty drugs, and perishables that require precise temperature control, smart packaging solutions that provide real-time data and alerts will become increasingly critical. It also opens up opportunities for predictive analytics, where data collected can optimize logistics, reduce waste, and ensure product integrity.

Combining advanced packaging materials with smart technology will elevate the value of cold chain packaging transforming it from a passive containment system into an active, data-driven part of the supply chains.

The cold chain packaging materials market is highly competitive with several key players vying for market share through innovation and sustainability. Leading companies like Sonoco ThermoSafe, Cold Chain Technologies, and Pelican BioThermal dominate the space, offering advanced temperature-controlled packaging solutions for pharmaceuticals, food, and biotechnology.

Market players focus on sustainable packaging innovations such as reusable materials and eco-friendly insulation, to meet rising environmental standards. Small and regional companies also compete by offering cost-effective and customized solutions for emerging markets.

Strategic mergers, acquisitions, and partnerships are common as companies aim to expand their global reach and product portfolios. Increasing demand for real-time monitoring and smart packaging further intensifies competition, driving technological advancements in the market.

Recent Industry Developments in the Cold Chain Packaging Materials Market

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Material

By Application

By Region

To know more about delivery timeline for this report Contact Sales

The market is estimated to be valued at US$14.67 Bn by 2031.

The market is projected to exhibit a CAGR of 7.6% over the forecast period.

Some of the leading industry players in the market are Huntsman Corporation, Dow Chemical Company, and Covestro AG.

Europe region dominates the market for cold chain packaging materials.

Paper & paperboard material type leads the market with significant market share.