ID: PMRREP16849| 224 Pages | 7 Apr 2025 | Format: PDF, Excel, PPT* | Healthcare

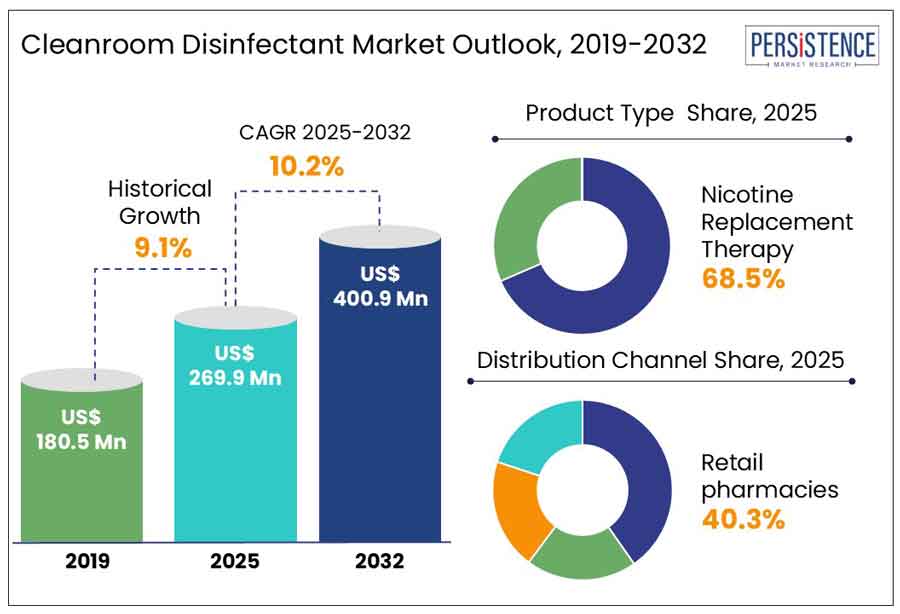

The global cleanroom disinfectant market size is projected to witness a CAGR of 5.8% from 2025 to 2032. It is anticipated to increase from US$269.9 Mn recorded in 2025 to a staggering US$400.9 Mn by 2032.

The cleanroom disinfectant market is expanding rapidly due to the growing need for stringent contamination control in pharmaceuticals, biotechnology, and healthcare industries. Rising regulatory standards, increasing cleanroom adoption, and heightened awareness of infection prevention drive market demand. Key players are innovating with eco-friendly, residue-free, and broad-spectrum disinfectants.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Market Size (2025E) |

US$ 269.9 Mn |

|

Market Value Forecast (2032F) |

US$ 400.9 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

5.8% |

|

Historical Market Growth (CAGR 2019 to 2024) |

3.5% |

Driver- Increased Adoption of Globally Harmonized System of Classification and Labelling of Chemicals

?The increasing adoption of the Globally Harmonized System (GHS) of Classification and Labelling of Chemicals is a key driver for the cleanroom disinfectant market, ensuring standardized safety protocols and regulatory compliance across industries. GHS implementation has enhanced the clarity of hazard communication, prompting manufacturers to develop disinfectants with improved formulations and transparent safety labeling. This has particularly benefited the pharmaceutical, biotechnology, and healthcare sectors, where contamination control is critical.

For example, the pharmaceutical industry follows stringent Good Manufacturing Practices (GMP), and the GHS framework ensures that disinfectants meet international safety and efficacy standards. Similarly, in semiconductor manufacturing, where ultra-clean environments are required, the use of GHS-compliant disinfectants reduces risks associated with chemical handling and exposure. Additionally, healthcare facilities worldwide are aligning with GHS standards to minimize hospital-acquired infections (HAIs) by using disinfectants with clear hazard classifications, enabling better training and handling by staff.

Restraints- Residue Buildup & Surface Contamination

Residue buildup and surface contamination pose a significant challenge in the cleanroom disinfectant market, as many disinfectants leave behind chemical residues that can interfere with critical processes. These residues, if not properly removed, can accumulate on surfaces, equipment, and air filtration systems, potentially compromising product quality, sterility, and regulatory compliance. In industries such as pharmaceuticals, biotechnology, and semiconductor manufacturing, even trace amounts of residual chemicals can alter formulations, affect drug stability, or introduce defects in microelectronics production.

For instance, quaternary ammonium-based disinfectants, commonly used for their broad-spectrum antimicrobial efficacy, often leaves a sticky residue that can harbor microbial contaminants if not adequately rinsed. Similarly, sporicidal agents such as hydrogen peroxide and peracetic acid causes oxidation or surface degradation over time, necessitating frequent surface compatibility testing. In highly sensitive environments, such as sterile injectable drug manufacturing, residue control is crucial, requiring additional cleaning validation steps using residue-free detergents or purified water rinses.

Opportunity- Robust Expansion in Biopharmaceutical Manufacturing to Fuel Growth Opportunities

The rapid expansion of biopharmaceutical manufacturing in emerging markets presents a highly unique and lucrative opportunity for the cleanroom disinfectant industry. Countries such as India, Brazil, Indonesia, and South Africa are ramping up local drug and vaccine production and spearheading towards becoming global contract manufacturing hubs. This shift is driven by favorable government policies, low production costs, and rising demand for advanced healthcare solutions. However, these regions face challenges related to tropical climates, variable infrastructure, and evolving regulatory frameworks.

Cleanroom disinfectant providers can capitalize by developing region-specific solutions that perform effectively in high-humidity and high-temperature environments while complying with both local and international GMP standards. Moreover, global pharma shifts towards decentralization and localized production, emerging markets are set to achieve long-term growth, making this one of the most strategically significant opportunity in the cleanroom disinfectant space.

Product Type Insights

Oxidizing disinfectants are commonly used in cleanroom operations because of their speedy outcomes. Due to their quick action and capacity to degrade into harmless compounds while maintaining adherence to strict validation standards, these disinfectants are preferred across various industries. Micro-organisms, including bacteria, viruses, fungi, and spores, can be efficiently eradicated using oxidizing disinfectants such as hydrogen peroxide and chlorine dioxide, known for their potent microbial-killing characteristics. Consequently, these disinfectants find utility in diverse cleanroom settings to guarantee comprehensive sterilization.

End-use Insights

The pharmaceutical industry adheres to stringent quality standards during drug manufacturing to ensure product efficacy and safety. Product contamination has the potential to compromise both the integrity and safety of drugs. Disinfectants play a crucial role in maintaining controlled sterile environments to prevent cross-contamination

Good Manufacturing Practices (GMP) are mandated by regulatory agencies such as the United States Food and Drug Administration (USFDA) and the European Medicines Agency (EMA). As a result, cleanrooms are required to meet strict cleanliness criteria, requiring rigorous disinfection. Disinfection prevents contamination of these sensitive materials, preserving their viability. Clinical trials require a clean environment to ensure accurate results and participant safety, which again requires frequent disinfection.

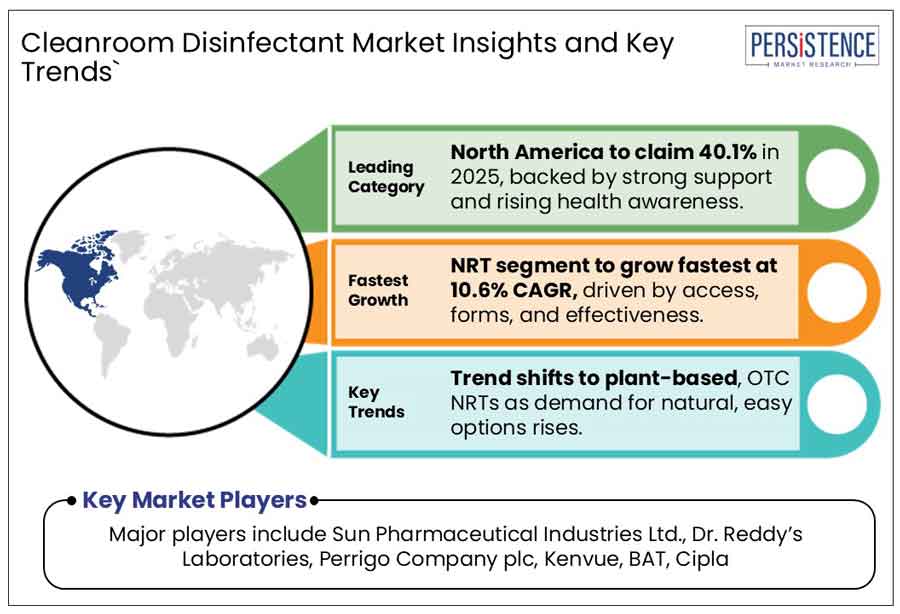

North America Cleanroom Disinfectant Market Trends

The U.S. cleanroom disinfectant market is poised for a large share in 2025. Cleanroom disinfectants are essential in maintaining a clean environment, preventing infections linked to healthcare, and ensuring patient safety. Hospitals, clinics, and other healthcare facilities in the country follow strict infection control protocols. The use of cleanroom disinfectants in healthcare facilities in the United States is growing because they rely on stringent infection control protocols owing to the widespread use of antimicrobial cleaners..

Adherence to regulations and ensuring patient safety are central to disinfection practices in hospitals and clinics. The significance of cleanroom disinfectants has heightened as the emphasis shifts toward upholding sterile environments, thereby bolstering infection control endeavors across the healthcare sector. The emergence of several new pharmaceutical and biotech enterprises in the United States, in addition to the existing ones, to cater to the escalating demand for innovative drugs and life science products, is contributing to market expansion. The cleanroom disinfectant market is poised for growth in the U.S. in the coming decade.

Europe Cleanroom Disinfectant Market Trends

The growing medical device manufacturing industry in Germany is pushing the demand for cleanroom disinfectants. Maintaining sterile conditions is essential for ensuring the safety and quality of medical devices as production facilities expand to meet the increased demand. This increase in manufacturing scale requires the use of efficient cleanroom disinfectants that successfully prevent contamination while meeting strict regulatory criteria and protecting product integrity.

The growing need to meet regulatory standards for controlled environment disinfectants to boost consumer confidence, lower the danger of contamination, and guarantee product safety is driving sales of cleanroom disinfectants in Germany. For instance, Sanner Group announced the expansion of its production sites in China & Germany. With this strategic action, the company is planning to increase its contract development and manufacturing activities and assembly of medical technology.

Asia Pacific Cleanroom Disinfectant Market Trends

Asia Pacific is emerging as a key region in the cleanroom disinfectant market due to rapid industrial expansion, growing pharmaceutical and biotechnology sectors, and increasing regulatory enforcement for contamination control. Countries such as China, India, and Japan witness significant investments in drug manufacturing, medical device production, and semiconductor industries, which require stringent cleanroom hygiene standards.

The region’s booming biopharmaceutical sector is further driving demand for high-performance cleanroom disinfectants, especially with the rise in vaccine production and biosimilar development. Additionally, government initiatives to improve healthcare infrastructure and manufacturing capabilities are fueling market growth.

The global cleanroom disinfectant market is highly competitive, with several global and regional players striving to expand their market share through product innovation, regulatory compliance, and strategic partnerships. The competition is driven by the increasing demand for high-efficacy disinfectants across pharmaceutical, biotechnology, healthcare, and semiconductor industries.

Key Industry Developments

The global cleanroom disinfectant market is estimated to increase from US$ 269.9 Mn in 2025 to US$ 400.9 Mn in 2032.

The rapid growth of biopharmaceuticals, vaccine production, and sterile drug manufacturing is fueling the need for GMP-compliant cleanroom disinfectants.

The market is projected to record a CAGR of 5.8% during the forecast period from 2025 to 2032.

Increasing environmental concerns and regulatory pressure creates demand for biodegradable, non-toxic, and low-residue disinfectants that reduce chemical waste.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Mn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product

By End-use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author