Industry: Healthcare

Published Date: March-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 233

Report ID: PMRREP32146

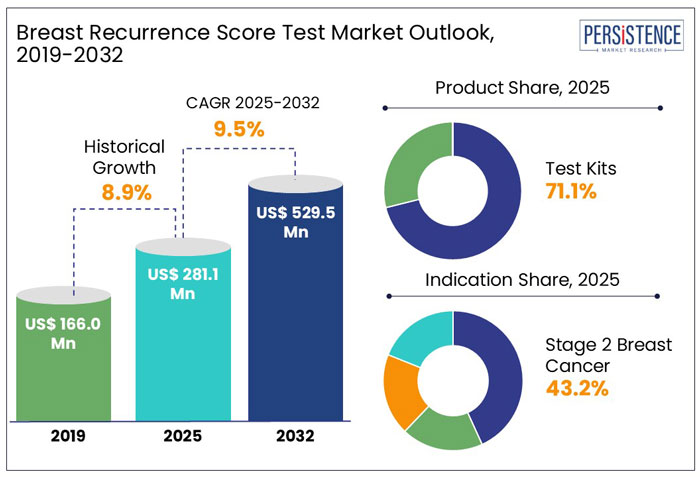

The Global Breast Recurrence Score Test market is projected to rise from US$ 281.1 million in 2025 to US$ 529.5 million in 2032. The market is anticipated to exhibit a promising CAGR of 9.5% during the forecast period from 2025 to 2032.

|

Global Market Attributes |

Key Insights |

|

Breast Recurrence Score Test Market Size (2025) |

US$ 281.1 Mn |

|

Market Value Forecast (2032F) |

US$ 529.5 Mn |

|

Projected Growth (CAGR 2025-2032) |

9.5% |

|

Historical Market Growth (CAGR 2019 to 2024) |

8.9% |

In early-stage breast cancer patients, adjuvant tamoxifen combined chemotherapy is linked with a considerable decrease in recurrence and breast cancer-specific mortality (BCSM). However, not all patients benefit in the same way, making predicting distant recurrence (DR) risk and adjuvant treatment a critical therapeutic choice. Standard clinicopathological parameters are insufficient to assess chemotherapy efficacy, resulting in over- or under-treatment. To overcome this restriction, multigene assays such as the 21-gene recurrence score test have been created.

The recurrence score, which consists of 21 genes, is a predictive test for 9-year distant recurrence and predicts adjuvant treatment effectiveness in patients with early-stage breast cancer. It has been found to be cost-effective in many countries due to improved clinical outcomes and reduced chemotherapy use.

The global market for breast recurrence score test recorded a historic CAGR of 8.9% from 2019 to 2024.

The Breast Recurrence Score Test has witnessed significant growth over the years, driven by advancements in genomic testing and increasing emphasis on personalized cancer treatment. Historically, traditional risk assessment tools were widely used, but they had limitations such as inconsistent interpretation and overtreatment risks.

The introduction of genomic tests like the 21-gene recurrence score test revolutionized breast cancer management by providing precise recurrence risk predictions and guiding chemotherapy decisions. Large-scale clinical trials, such as TAILORx and RxPONDER, validated its effectiveness, leading to its inclusion in major guidelines from ASCO, NCCN, and ESMO.

As genomic testing gained credibility, evolving insurance and reimbursement policies in developed markets improved financial accessibility, driving wider adoption. Integrating digital health and telemedicine has further enhanced availability, making recurrence score testing more accessible to diverse patient populations. Looking ahead, ongoing AI-driven research and next-generation genomic assays promise even greater accuracy in risk assessment. Expanding applications in emerging markets and younger patient groups will further solidify the test’s role in modern breast cancer care.

“Rising Adoption of Non-Invasive Prognostic Tests for Enhanced Breast Cancer Management and Treatment”

The shift toward non-invasive prognostic diagnostics is gaining momentum. Traditional methods like tissue biopsies can be invasive, costly, and uncomfortable. In contrast, genomic-based recurrence score testing offers a risk-free way to guide treatment decisions.

A New England Journal of Medicine study found that early-stage HR+ breast cancer patients with a low recurrence score could safely avoid chemotherapy without affecting survival rates. This has boosted physician confidence and global adoption.

Advancements in liquid biopsy, analyzing ctDNA in blood, further enhance recurrence risk prediction. A JAMA Oncology study showed ctDNA assessments could detect relapse months before imaging, improving early intervention.

Regulatory support, including NCCN endorsement, is accelerating market growth. As demand for personalized diagnostics rises, non-invasive prognostic tests will play a crucial role in breast cancer management.

“Complex Impact of Patient Age and Hormone Receptor Expression on 21-Gene Recurrence Score Test”

Patient age significantly impacts the 21-gene recurrence score methodology, emphasizing the importance of considering patient age, especially for women under 50, in genomic-based algorithms for breast cancer care. This complexity increases the likelihood of misinterpretation, as physicians are required to evaluate multiple factors before analyzing results.

Hormone receptor protein expression changes during the menstrual cycle due to estrogen and progesterone concentrations, impacting recurrence score test signature genes like PGR, MKI67, CCNB1, BIRC5, and MYBL2. In vitro research suggests co-treatment with estrogen and progesterone increases recurrence scores, further complicating interpretation and treatment decisions.

Why is there an Increasing Demand for Breast Recurrence Score Testing in the North America?

“Rising Prevalence of Invasive Breast Cancer in the Country”

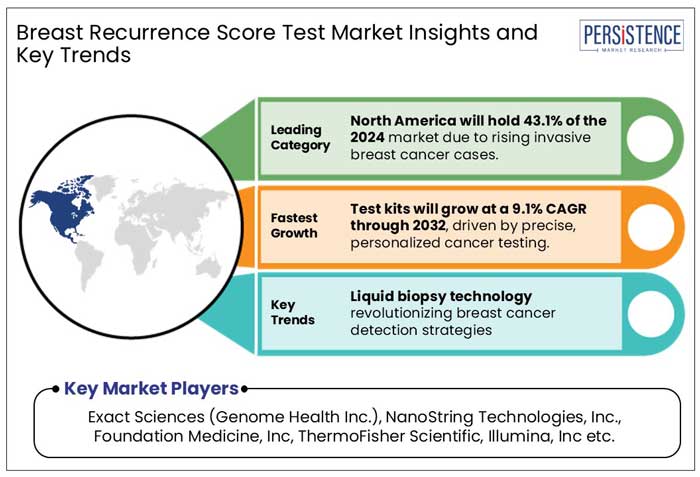

North America held a significant share of 30.6% in the global breast recurrence score test market in 2024. Breast cancer is the most commonly diagnosed cancer among women in the U.S. and is the second leading cause of death. However, advances in hormone therapy and other adjuvant therapies have significantly reduced the risk of breast cancer recurrence.

What is the Demand Outlook for Breast Recurrence Score Tests in Europe?

“Large Cancer Patient Pool and Favorable Reimbursement Policies”

Europe accounted for a substantial 25.4% share of the global breast recurrence score test market in 2024. The presence of a large patient pool, favorable reimbursement policies, and increasing awareness initiatives by public entities are the key factors behind market growth in Europe.

What Makes South Asia a Lucrative Market for Breast Recurrence Score Test Providers?

“Aggressive Breast Cancer Patterns in South Asia Population Necessitating Early Cancer Recurrence Screening”

South Asia contributed a significant 17% share to the global breast recurrence score test market in 2024. Breast cancer in the Indian population is generally more aggressive than in the West, with a mean age of around 47 years, a decade younger than in the West. The biology of breast cancer in the Asian population is different compared to the West, with significant cases of triple-negative breast cancers.

Social factors such as lack of awareness, lack of screening programs, and limited access to quality healthcare contribute to this disparity. However, the growing cancer burden and rising need for cancer screening are likely to provide players with lucrative growth opportunities in India.

Which Product is Widely Adopted for Breast Recurrence Score Testing?

“Personalized Test Kits Providing Accurate Recurrence Prediction and Tumor Aggressiveness”

By product, test kits accounted for 71.1% of overall product sales in 2024.

Recurrence test kits predominantly estimate the likelihood of breast cancer recurrence. These tools evaluate the genetic composition of tumor cells using modern molecular profiling methods. When compared to traditional clinical and pathological criteria, these tests give a more accurate prediction of the chance of cancer recurrence by detecting the expression level of particular genes linked with cancer recurrence.

The test results give further information on the tumor's aggressiveness and the chance of recurrence. Thus, facilitating custom treatment approach, including identifying the necessity for additional medications like chemotherapy or hormone therapy, while guiding the duration and intensity of the treatment regimen.

Why Does Stage II Breast Cancer Account for a Prominent Market Share?

“Increased Stage II Breast Cancer Recurrence Risk, Demand for Early Detection, and Advanced Treatment Options”

By indication, stage 2 breast cancer accounted for 43.2% of the global breast recurrence score test market in 2024.

The likelihood of recurrence is higher for stage II cancer, characterized by a large tumor that has spread to nearby lymph nodes. Despite surgical excision and lymph node clearing, tiny cancer cells may continue to develop and cause recurrence. The presence of hormone receptors, such as HER-2, is critical for molecular-targeted therapy in breast cancer. HER-2 overexpression instances had a high response rate, according to studies. Hence, stage II is more prevalent and recurrent than other stages of cancer.

Which End User Dominates the Breast Recurrence Score Test Market?

“Specialized Infrastructure for Breast Recurrence Score Diagnostics in Hospitals”

By end user, hospital settings accounted for a 45.1% share of the global breast recurrence score test market in 2024.

Hospitals provide full medical services for breast cancer patients, including diagnosis, treatment, and follow-up care. Breast recurrence score testing is an essential component of the diagnostic procedure, and hospitals often have extensive laboratory facilities and technology needed to perform recurrence score examinations. The analysis requires a multidisciplinary team of healthcare specialists to collaborate on patient treatment, assuring a holistic approach to breast cancer therapy that includes recurrence score testing.

Several players are currently active within the breast recurrence score test market offering products and services at both local and global levels. These businesses are using strategies such as enhanced research and development and expansion to meet patients’ demands and grow their customer base.

| Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis Units | Value: US$ Bn/Mn Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

|

Key Companies Covered |

|

| Report Highlights |

|

|

Customization & Pricing |

Available upon Request |

Product:

Indication:

End User:

Region:

To know more about delivery timeline for this report Contact Sales

The market is expected to grow from US$ 281.1 million in 2025 to US$ 529.5 million by 2032, at a CAGR of 9.5%.

Test kits accounted for 71.1% of the market share in 2024 due to their accuracy in recurrence prediction.

Rising adoption of non-invasive prognostic tests, advancements in genomic testing, and regulatory approvals are fueling growth.

North America led with 30.6% market share in 2024 due to the high prevalence of breast cancer and strong healthcare infrastructure.

Exact Sciences, NanoString Technologies, Foundation Medicine, and Abbott are leading players in this market.