Industry: Chemicals and Materials

Published Date: September-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 155

Report ID: PMRREP34807

The wax emulsion market is estimated to increase from US$1.91 Bn in 2024 to US$2.48 Bn by 2031. The market is projected to record a CAGR of 3.8% during the forecast period from 2024 to 2031. The rapid industrialization and urbanization in Asia Pacific and Latin America are creating significant growth opportunities in these regions. Growing demand for sustainable and eco-friendly wax emulsions drive the market forward.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Market Size (2024E) |

US$1.91 Bn |

|

Projected Market Value (2031F) |

US$2.48 Bn |

|

Global Market Growth Rate (CAGR 2024 to 2031) |

3.8% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

3.3% |

|

Region |

Market Share in 2023 |

|

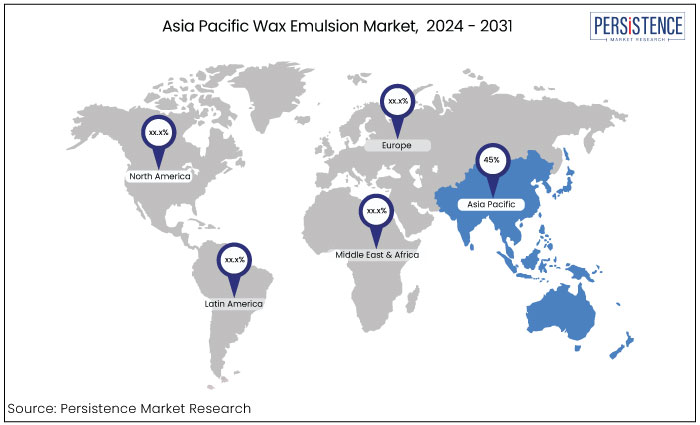

Asia Pacific |

45% |

Asia Pacific led the market accounting for a revenue share of 45%. This region is pivotal in the manufacturing of paints and coatings thus possessing the most significant percentage of global product consumption.

According to Coatings World, Asia Pacific paint and coatings market was the largest and most significantly expanding geographic area. The swiftly expanding end use industries are anticipated to augment product demand in the region.

Great China constitutes the predominant section of Asia Pacific coatings market comprising 55% of the region's geographical share. Japan and South Korea followed with Japan accounting for around 10% and South Korea for 5%, resulting in a total of 15% for the sub region.

In recent years, this region has experienced the most robust growth globally primarily attributable to the expansion of India market. India has overtaken Japan as Asia's second-largest market for paints and coatings and is the significantly growing market globally.

|

Category |

Market Share in 2023 |

|

Material - Synthetic |

68% |

Based on material, the wax emulsion market is classified into synthetic and natural materials. Among these, synthetic material dominates the market. The synthetic kind of product commanded a market share of 68% attributed to its consistent quality and purity.

Synthetic waxes provide superior stability and performance in formulations relative to natural waxes especially in demanding conditions or applications necessitating resistance to harsh temperatures, chemicals, or UV exposure.

Natural waxes originate from botanical sources (such as carnauba) or animal sources (such as beeswax) and include distinct attributes like inherent stickiness, lustre, and hydrophobic properties. Synthetic waxes are produced by chemical procedures enabling exact control over attributes such as melting temperature, hardness, and uniformity.

|

Category |

Market Share in 2023 |

|

Product - Paraffin |

52% |

Based on product, the wax emulsion market is further classified into paraffin, carnauba, and polyethylene. Among these, the paraffin product segment dominates the market. Paraffin wax emulsion commanded market share of 52% in 2023. It is favoured over alternative waxes due to its cost-effectiveness.

The paraffin product is exceptionally adaptable and used in several domains such as paints & coatings, paper packaging, adhesives, and textiles. The product consists mainly of paraffin wax suspended in water with emulsifiers resulting in a stable emulsion that is manageable and easy to apply.

Paraffin emulsion wax is recognized for its hydrating and safeguarding properties. It is essential in lotions, creams, and ointments formulated to alleviate and moisturize the skin in cosmetics.

Wax emulsions are prepared additives consisting of finely dispersed and stabilized wax particles uniformly distributed in water. Non-ionic or ionic emulsifiers stabilize wax emulsions.

Wax emulsions are widely utilized in numerous aqueous compositions. They are utilized in many applications including paints and coatings, packaging, printing inks, textiles, and rubber and plastic processing.

Wax emulsions serve as additives in coatings, paints, and varnishes to enhance surface characteristics, including scratch resistance, water repellence, and gloss. It functions as a matting agent or anti-blocking agent in coatings. Wax emulsions are used in the textile sector to bestow qualities, including water repellence, wrinkle resistance, and textile fabric softening.

Wax emulsions are utilized in paper coatings and packaging materials to provide moisture resistance, gloss, and barrier characteristics. They are utilized in printing inks to alter rheological characteristics and improve printability.

Wax emulsions are utilized in the creation of personal care goods, such as creams, lotions, and hair care items, to impart thickening and conditioning attributes. In paints and coatings, it offers superior waterproofing and protection against severe environmental conditions, making it widely favoured. In the adhesive and sealant sector, it functions as an anti-caking agent for thermoplastics and hot melts.

The wax emulsion market has experienced steady growth historically, driven by increasing demand from industries such as paints, coatings, adhesives, textiles, and cosmetics. Pre-2023, the market experienced growth due to the rising adoption of wax emulsions as eco-friendly alternatives to solvent-based products as well as their versatility in various applications.

Technological advancements in the formulation of stable emulsions contributed to their widespread use. From 2024 onward, the wax emulsion market is expected to continue its upward trajectory with an increasing focus on sustainable and green products.

The growing demand for water-based emulsions, especially in regions with stringent environmental regulations, is anticipated to boost market growth. The construction, automotive, and packaging sectors will drive demand particularly as these industries increasingly adopt eco-friendly materials.

The market may also benefit from innovations in bio-based wax emulsions, which align with global sustainability trends. The market is projected to witness a CAGR of around 4.6% during the forecast period depending on regional developments and advancements in formulation technologies.

Surging Demand for Eco-Friendly and Sustainable Materials

With growing global concerns over environmental impact, industries are increasingly transitioning to sustainable alternatives. Wax emulsions particularly water-based ones have become highly desirable due to their low levels of volatile organic compounds (VOCs) making them eco-friendly compared to solvent-based systems.

It is crucial in industries like paints, coatings, adhesives, and textiles where stringent regulations regarding emissions are being enforced. Governments across regions especially in Europe and North America are adopting policies that encourage the use of green materials.

Consumer awareness pushes companies to adopt environmentally responsible products, increasing demand for bio-based and biodegradable wax emulsions. This shift toward sustainability is expected to drive significant market growth as more industries align with environmental standards.

Diverse Applications Across Multiple End Use Industries

Wax emulsions offer various functionalities such as water resistance, surface smoothness, gloss, and anti-blocking properties making them suitable for various industries. In the construction industry, for example, wax emulsions are used to enhance the durability and aesthetics of building materials.

In textiles, they improve fabric softness and protect finishing processes. Similarly, wax emulsions enhance moisture resistance and surface protection essential for food packaging and other sensitive products.

The versatility allows manufacturers to cater to specific industrial needs, ensuring continuous demand. The expansion of critical automotive, construction, and packaging industries, especially in emerging markets is expected to drive the wax emulsion market.

Volatility in Raw Material Prices and Supply Chain Disruptions

The wax emulsion market highly depends on raw materials such as petroleum-based waxes (paraffin) and natural waxes (carnauba, beeswax). Fluctuations in crude oil prices directly affect the cost of petroleum-based waxes making price stability a persistent challenge for manufacturers.

Global geopolitical tensions, economic shifts, or changes in oil production policies can lead to unpredictable price hikes, which increase manufacturing costs and squeeze profit margins.

Natural waxes though eco-friendly are subject to supply chain disruptions due to agricultural factors and limited geographical availability. These factors make it difficult for manufacturers to maintain cost-effective production, especially when facing competition from other material alternatives. Consequently, price volatility creates uncertainty for manufacturers and end-users, impacting overall market growth.

Technical Limitations in Specific High-Performance Applications

While wax emulsions offer a range of beneficial properties, such as water resistance and surface protection, they have technical limitations that restrict their adoption in specific high-performance applications. The mechanical durability and chemical resistance required often exceed what wax emulsions can provide for automotive, construction, and industrial coatings.

Alternative materials like synthetic polymers or solvent-based coatings may offer better performance in harsh environments, where wax emulsions struggle with extreme temperatures, UV exposure, or chemical corrosion. Such performance constraints limit the widespread adoption of wax emulsions in critical sectors, where companies are more inclined to use materials that offer superior long-term protection and resilience, thereby restraining the market’s growth potential.

Advancement of Bio-Based and Sustainable Wax Emulsions

With the growing emphasis on sustainability among sectors and consumers, a substantial opportunity exists for bio-based wax emulsions. Such emulsions, sourced from natural materials such as carnauba wax, beeswax, and soy wax, correspond to the increasing need for environmentally sustainable products, especially in areas with rigorous environmental requirements.

The transition to minimizing carbon footprints and utilizing renewable resources fosters innovation in bio-based wax compositions. Companies investing in developing sustainable, biodegradable wax emulsions are poised to secure a more significant market share in industries such as packaging, cosmetics, and food coatings, where environmental issues are essential.

The increasing prevalence of green certifications and sustainability-oriented branding enhances this opportunity, establishing bio-based wax emulsions as a significant catalyst for future growth.

Technological Progress in Specialized Applications

The creation of superior wax emulsions with improved performance attributes offers significant potential. Investigations to enhance the qualities of wax emulsions, including thermal resistance, abrasion resistance, and chemical durability, facilitate novel applications in high-demand industries such as automotive, electronics, and industrial coatings.

Customizable formulations tailored to specific industrial requirements are gaining popularity, enabling firms to access specialized markets. Advancements in hybrid emulsions that amalgamate the advantageous characteristics of wax with polymers or other additives can generate novel prospects for companies pursuing materials that provide exceptional performance while maintaining environmentally sustainable benefits.

Organizations that leverage these technology innovations will be strategically positioned to address varied and changing market demands.

A mix of large multinational companies and regional players characterizes the competitive landscape of the wax emulsion market. Key market leaders such as BASF SE, The Dow Chemical Company, and ExxonMobil Corporation dominate due to their strong research and development capabilities, broad product portfolios, and extensive distribution networks. Such companies focus on product innovation especially in eco-friendly and bio-based emulsions to stay competitive and meet growing environmental regulations.

Regional players, particularly in Asia Pacific also contribute significantly to market competition offering cost-effective solutions and catering to local industries. Small firms often focus on niche markets or customized solutions targeting specific industrial needs such as coatings, textiles, and packaging. Strategic partnerships, mergers, and acquisitions are common as companies aim to expand their product lines and geographic reach.

Companies increasingly focus on sustainable formulations, becoming a key differentiator in the market as demand for green alternatives grows.

Recent Industry Developments in the Wax Emulsion Market

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Material

By Product

By End Use

By Region

To know more about delivery timeline for this report Contact Sales

The market is driven by the surging demand for eco-friendly and sustainable materials.

The market is projected to exhibit a CAGR of 3.8% through 2031.

Asia Pacific region holds the largest market share.

Some of the leadings industry players in the market are BASF SE, Nippon Seiro Co., and Altana AG.