PMR’s Market Study Foresees a Healthy Outlook for Therapeutic Medical Guidewire Market Based on IoT-Enabled Sensors, and Robotically Steerable Guidewire Solutions for Enhanced Safety

Industry: Healthcare

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Report Type: Ongoing

Report ID: PMRREP34624

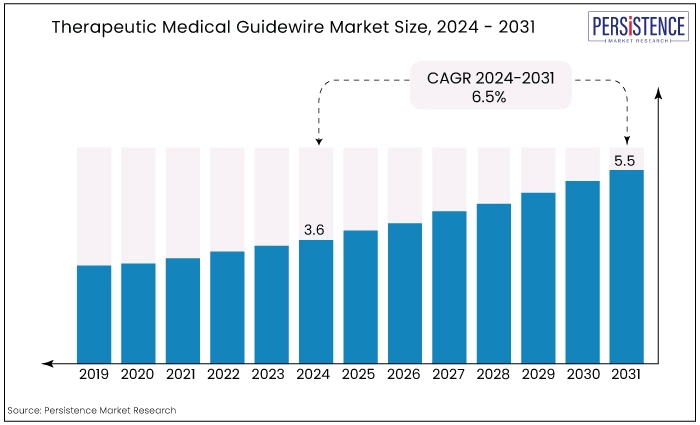

The global therapeutic medical guidewire market is estimated to value at US$5.5 Bn by the end of 2031 from US$3.6 Bn recorded in 2024. the market is expected to secure a CAGR of 6.5% in the forthcoming years from 2024 to 2031.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Market Size (2024E) |

US$3.6 Bn |

|

Projected Market Value (2031F) |

US$5.5 Bn |

|

Forecast Growth Rate (CAGR 2024 to 2031) |

6.5% |

|

Historical Growth Rate (CAGR 2018 to 2023) |

5.9% |

Guidewires are indispensable tools in various medical procedures, including vascular interventions, endoscopy, and catheter placements. They enable precise navigation and positioning of medical instruments within the body, enhancing the safety and efficacy of these procedures.

Guidewires play a crucial role in a variety of medical interventions, from heart surgery to brain surgery, by providing a controlled path for instruments. This precision is vital for successful outcomes in complex anatomical structures.

The demand for guidewires is driven by their versatility and the growing preference for minimally invasive techniques, which offer numerous advantages such as reduced recovery times, lower risk of complications, and shorter hospital stays.

Guidewires offer several benefits that enhance their utility across various medical fields. They provide precision and control over the placement and navigation of medical instruments, enable minimally invasive techniques, reduce tissue trauma, and enhance procedural safety.

Additionally, guidewires facilitate access to complex areas, provide visual guidance through radiopaque markers, and improve success rates of medical procedures.

They are utilized in cardiology, radiology, endoscopy, urology, neurovascular interventions, orthopedics, gynecology, pulmonology, ENT procedures and gastrointestinal procedures, demonstrating their indispensable role in modern medicine.

Proper maintenance is crucial for the optimal performance and longevity of guidewires. Contaminants such as blood, tissue, and debris can compromise their flexibility and shape memory.

Effective cleaning with appropriate cleaners, including enzyme and ultrasonic cleaners, ensures that guidewires remain in top condition for repeated use.

The therapeutic medical guidewire market is poised for continued growth, driven by advancements in medical technology, the increasing prevalence of chronic diseases, and the shift towards minimally invasive procedures.

The historical growth of the therapeutic medical guidewire market has been marked by continuous advancements in medical technology and an increasing preference for minimally invasive procedures.

Over the past few decades, the market has evolved significantly, driven by innovations in materials, coatings, and design, which have improved the performance and versatility of guidewires.

The rise in chronic diseases such as cardiovascular and neurological disorders has also contributed to the growing demand for guidewires, as these conditions often require complex interventions that benefit from precise navigation and control provided by guidewires.

Initially, guidewires were simple, stainless-steel wires used primarily for basic navigation. However, as medical procedures became more sophisticated, the need for specialized guidewires with enhanced properties emerged. This led to the development of hydrophilic and hydrophobic coatings, which improve lubricity and reduce friction, making it easier to navigate through the body's pathways.

Additionally, advancements in materials like nitinol, which offers excellent flexibility and kink resistance, have further propelled the market forward.

The present market is characterized by a wide variety of guidewires designed for specific applications, including angioplasty, neurovascular interventions, urology, and gastrointestinal procedures.

Companies are increasingly focusing on product differentiation, offering guidewires with unique features such as radiopaque markers for better visualization and varied tip designs to navigate complex anatomical structures.

The therapeutic medical guidewire market is poised for continued growth. Several factors will drive this expansion, including the aging global population, the rising prevalence of chronic diseases, and ongoing technological advancements.

Emerging markets, particularly in Asia, and Latin America, present significant opportunities due to improving healthcare infrastructure and increasing access to advanced medical technologies.

Increasing Prevalence of Cardiovascular Diseases

Cardiovascular diseases, including heart attacks and strokes, are the leading cause of death worldwide, responsible for an estimated 17.9 million deaths in 2019. This represents 32% of all global deaths, with 85% of these fatalities attributed to heart attacks and strokes.

The burden of CVDs is particularly heavy in low- and middle-income countries, which account for over three-quarters of CVD-related deaths. The high incidence of these conditions underscores the critical need for effective diagnostic and treatment solutions.

Guidewires play a crucial role in procedures such as percutaneous transluminal coronary angioplasty (PTCA) and percutaneous transluminal angioplasty (PTA), which are essential for managing and treating various cardiovascular conditions.

As these minimally invasive procedures gain traction due to their high success rates and low complication risks, the demand for advanced guidewires is on the rise. Guidewires' push ability, steerability, torque, and opacity are vital characteristics that enhance the precision and effectiveness of cardiovascular interventions.

Increasing Healthcare Expenditure and Access to Advanced Medical Devices

In 2021, global healthcare spending reached a record high of US$9.8 Tn, accounting for approximately 10.3% of the global GDP. This surge in spending was largely fueled by increased government funding and out-of-pocket expenses due to the COVID-19 pandemic.

The substantial investment in healthcare across various nations underscores the growing prioritization of health and medical services.

Countries allocate different proportions of their GDP to healthcare, reflecting their commitment to improving health outcomes. For example, the US dedicates around 16.57% of its GDP to healthcare, while Germany, and France allocate approximately 12.65% and 12.31% respectively.

Significant expenditure facilitates the adoption of advanced medical technologies and devices, including therapeutic guidewires.

As healthcare systems globally strive to enhance patient outcomes and the efficiency of medical procedures, the demand for high-quality, reliable guidewires continues to rise.

These devices are essential for minimally invasive surgeries and various cardiovascular interventions, which are becoming more prevalent due to increasing rates of cardiovascular diseases and other health conditions.

Consequently, the rising healthcare expenditure fuels the growth and development of the therapeutic guidewire market, ensuring the availability and advancement of these critical medical tools.

Stringent Regulatory Requirement

The US Food and Drug Administration (FDA) recently issued two final guidances detailing performance tests and labeling recommendations for guidewires used in coronary, peripheral, and neuro-vasculature, as well as intravascular catheters, wires, and delivery systems with lubricious coatings.

These guidances, revised in response to public consultations, set forth comprehensive expectations for performance testing to support 510(k) submissions, including device description, predicate comparison, biocompatibility, sterility, pyrogenicity, shelf-life, packaging, non-clinical bench testing, and clinical performance testing.

Additionally, the FDA mandates detailed labeling considerations, particularly for devices with coatings, due to safety concerns related to coating separation and associated adverse events.

The requirement to include specific descriptions of device coatings, regions of intended use, warnings, precautions, and potential adverse events in the labeling further complicates the approval process.

These rigorous regulations, while essential for ensuring patient safety, increase the complexity, time, and cost associated with bringing new guidewires to market, thereby acting as a restraint on the growth and innovation within the therapeutic medical guidewire market.

Harnessing Telemedicine and Remote Procedures

Telemedicine allows healthcare providers to remotely consult with patients, diagnose conditions, and even guide minimally invasive procedures using guidewires.

Thorough market analysis reveals that this trend is bolstered by improvements in telecommunications infrastructure and wearable devices that enable real-time monitoring and consultation.

For guidewire manufacturers, this opens avenues to develop specialized products that are compatible with remote procedures, ensuring precision and safety even when physical presence is limited.

As healthcare systems worldwide embrace telehealth solutions, the demand for guidewires suitable for remote interventions is expected to grow, driving innovation and market expansion in the coming years.

|

Category |

Projected CAGR through 2031 |

|

Core Material Category – Stainless Steel |

5.3% |

|

Application – Vascular Surgery |

6.2% |

Stainless Steel Segment to Account for the Significant Share

The stainless-steel segment is projected to hold a significant share in the core material market for therapeutic medical guidewires. Stainless steel is favored for its high strength, excellent torque control, and reliable performance, which are critical for navigating complex vascular pathways.

Its cost-effectiveness compared to other materials like nitinol also contributes to its widespread use. The durability and biocompatibility of stainless steel ensure that it remains a preferred choice among healthcare providers, supporting its dominant position in the market.

Vascular surgeries are expected to witness significant growth as a primary application for therapeutic medical guidewires. This growth is driven by the increasing prevalence of cardiovascular diseases and the rising demand for minimally invasive procedures.

Guidewires play a crucial role in navigating and accessing complex vascular systems, making them indispensable in various vascular interventions.

Advances in guidewire technology, such as improved flexibility, steerability, and enhanced visibility, further support their expanding use in vascular surgeries, contributing to the market's overall growth.

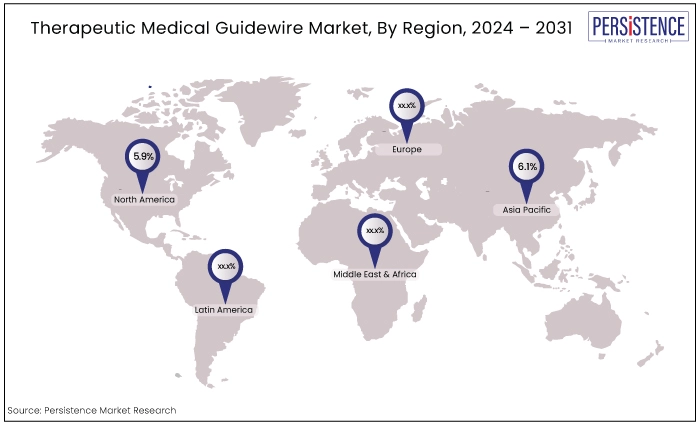

|

Region |

CAGR through 2034 |

|

North America |

5.9% |

|

Asia Pacific |

6.1% |

North America Captures the Largest Market Share

North America is expected to hold a substantial share in the therapeutic medical guidewire market due to its advanced healthcare infrastructure, high prevalence of cardiovascular diseases, and increasing adoption of minimally invasive surgical procedures.

The region's strong presence of key market players, ongoing technological advancements, and robust regulatory frameworks further bolster its dominant position.

Additionally, significant investments in research and development, along with favorable reimbursement policies, contribute to the region's leadership in the global therapeutic medical guidewire market.

Asia Pacific to Exhibit a Notable CAGR Through 2031

The Asia Pacific region is poised to exhibit a notable CAGR in the therapeutic medical guidewire market, driven by increasing healthcare expenditure, growing awareness of minimally invasive procedures, and a rising prevalence of cardiovascular diseases.

Rapid economic development, improving healthcare infrastructure, and government initiatives to enhance medical services further support this growth.

Additionally, the expanding geriatric population and increasing adoption of advanced medical technologies are expected to contribute significantly to the market's expansion in the region.

Acquisitions and partnerships, along with the development of innovative products and the expansion of production capacities, are key growth strategies followed by major players in the therapeutic medical guidewire market.

Innovations in this sector include smart waste tracking with IoT capabilities for remote monitoring and control, and integration robotics technologies.

June 2024

Medtronic announced the launch of its Steerant aortic guidewire in the US, and Canada following the first patient cases.

March 2024

Baylis Medical Technologies announced the 510(k) clearance and launch of the PowerWire Pro radiofrequency (RF) guidewire in the US, facilitating venous stent recanalisation for total occlusions.

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2018 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Core Material

By Type

By Region

To know more about delivery timeline for this report Contact Sales

The report highlights several key market drivers, including the increasing prevalence of cardiovascular diseases, rising healthcare expenditure, and technological advancements in guidewire design.

The report outlines several key innovations and trends, such as the increasing use of nitinol core wires, the development of hybrid guidewires, the incorporation of sensors and fiber optics for real-time feedback, and the exploration of robotically steerable guidewires.

Therapeutic medical guidewires are governed by strict regulations worldwide, such as FDA requirements in the United States for 510(k) clearance or premarket approval (PMA), and adherence to Quality System Regulation (QSR).

Future trends include advancements in materials such as nitinol for improved flexibility and shape memory, integration of smart technologies like sensors for real-time feedback, and development of robotically steerable guidewires for enhanced precision.

North America to account for the significant share in the market.