Spinal Stenosis Implants Market Segmented By Interspinous spacer devices, Pedicle screw-based stabilization systems product type with Metallic, Biomaterial materials, by Decompression Surgery, Stabilization Surgery or Spinal Fusion Surgical Procedure

Industry: Healthcare

Published Date: May-2022

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 219

Report ID: PMRREP15376

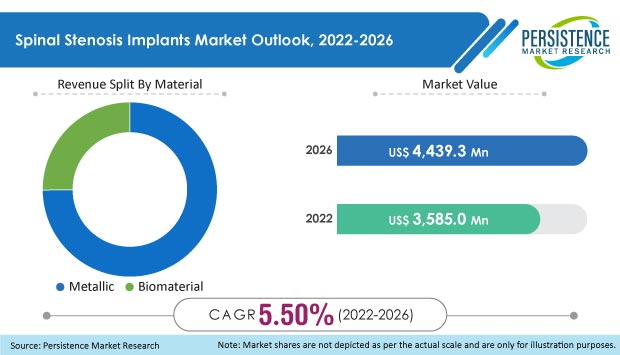

Spinal Stenosis Implants Market witnessed a CAGR of 5.5% between 2013 and 2021. The global Spinal Stenosis Implants Market is expected to witness a 5.5% CAGR between 2022 and 2026. In 2022, the global Spinal Stenosis Implants Market size was worth US$ 3,585 million, which is projected to reach US$ 4,439.3 million by the year 2026.

| Attribute | Key Insights |

|---|---|

|

Spinal Stenosis Implants Market Size (2022) |

US$ 3,585 Mn |

|

Projected Market Value (2026) |

US$ 4,439.3 Mn |

|

Global Market Growth Rate (2022-2026) |

5.5% CAGR |

|

Share in parent market |

37.4% |

Spinal Stenosis Implants Market is expected to witness a CAGR of 5.5% during the forecast period between 2022 and 2026. The rise in spinal deformity and adoption of sedentary lifestyle are contributing to the increase in demand for Spinal Stenosis Implants Market. Furthermore, the rising cases of spinal trauma are expected to drive the growth for Spinal Stenosis Implants Market.

The rising incidences of spinal deformities like degenerative spondylolisthesis and degenerative scoliosis among older population and obese people is increasing the need for spine surgeries, which is driving the demand for Spinal Stenosis Implants. These days, minimally invasive spinal stenosis implants surgery for treatment is gaining popularity among patients and surgeons due to better outcomes when compared to traditional open techniques for spinal stenosis implants surgery. The growing cases of spinal trauma and the increasing preference for minimally invasive surgery are expected to boost the Spinal Stenosis Implants Market significantly throughout the forecast period.

Apart from the growing geriatric population, the frequency of lifestyle-related disorders in the younger population is rising globally. Lack of physical exercise and sedentary lifestyle are two of the most important factors leading to the rise in the prevalence of these disorders. Lifestyle-related diseases are also linked to various orthopaedic conditions such as OA and spinal stenosis, which are predicted to boost the expansion of the spinal stenosis implants market.

The high cost of spinal surgeries is the most significant impediment to market expansion in developing nations. The overall growth of the Spinal Stenosis Implants Market has slowed down in developing economies due to high surgery costs, which are not affordable for the majority of low and middle-class household population. Apart from the high surgery cost, the other obstacles that are likely to limit the market growth include higher medication, therapy, test, and rehabilitation expenses.

“Drop in the sales due to lockdown”

The COVID-19 pandemic had a negative impact on the global economy due to strict lockdowns to stop the spread of the virus. The Spinal Stenosis Implants Market witnessed a significant drop in sales and disruptions in import and export activities of spinal implants and surgical devices around the world.

Spinal Stenosis Implants industry is very competitive and highly consolidated due to the presence of several large players. Key players in the market are focusing on mergers and acquisitions as the industry is in the growth phase. Companies are making strategic decisions to engage in these modes of inorganic expansion in order to expand their product portfolios and grow their market share.

| Attribute | Details |

|---|---|

|

Forecast Period |

2022-2026 |

|

Historical Data Available for |

2013-2021 |

|

Market Analysis |

US$ Mn/Bn for Value |

|

Key Regions Covered |

|

|

Key Countries Covered |

|

|

Key Market Segments Covered |

By Material |

|

Key Companies Profiled |

|

|

Customization & Pricing |

Available upon Request |

Spinal Stenosis Implants Market by Material

Spinal Stenosis Implants Market by Region

To know more about delivery timeline for this report Contact Sales

In 2022, the Spinal Stenosis Implants Market stands at USD 3,585 million, and it is expected to reach USD 4,439.3 million by 2026 at a CAGR of 9.5%.

Spinal Stenosis Implants Market exhibited a 9.5% CAGR between 2013 and 2021.

High surgery cost is the key restraint to the Spinal Stenosis Implants Market.

An increase in the number of spinal deformities and the growing preference for Minimally Invasive Surgery are the key factors driving the growth of the market.

Vertiflex Inc., Premia Spine, Ltd., Paradigm Spine, LLC, and Zimmer Biomet Holdings Inc., are among the top players in the market.