Industry: Healthcare

Published Date: March-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 388

Report ID: PMRREP19993

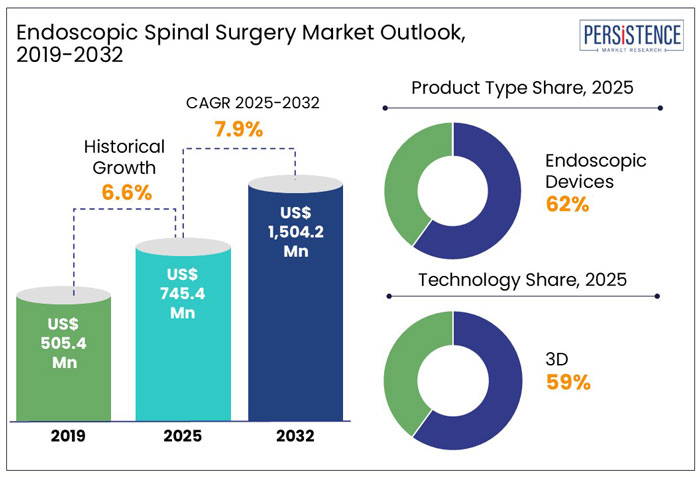

The global endoscopic spinal surgery market size is anticipated to rise from US$ 745.4 Mn in 2025 to US$ 1504.2 Mn by 2032. It is projected to witness a CAGR of 7.9% from 2025 to 2032.

One of the primary growth drivers for the market is the increasing prevalence of spinal disorders and the major technological evolutions in the sector.

The integration of 3D imaging and robotic-assisted navigation systems has revolutionized surgical precision. These innovations have enhanced the accuracy of procedures and reduced recovery times, making surgeries less daunting for patients.

The evolution of endoscopic spinal surgery offers hope for a pain-free future with minimal disruption to their lives. As the medical community continues to innovate and overcome existing barriers, the horizon looks promising for those seeking relief from spinal ailments.

Key Highlights of the Endoscopic Spinal Surgery Market

|

Global Market Attributes |

Key Insights |

|

Endoscopic Spinal Surgery Market Size (2025E) |

US$ 745.2 Mn |

|

Market Value Forecast (2032F) |

US$ 1504.2 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

7.9% |

|

Historical Market Growth (CAGR 2019 to 2024) |

6.6% |

Expansion of Minimally Invasive Procedures Aided Market Growth Pre-2024

During the historical period from 2019 to 2024, the endoscopic spinal surgery market steadily grew, driven by increasing awareness of minimally invasive procedures (MIS).

Patients and healthcare providers recognized the benefits of reduced hospital stays, minimal scarring, and faster recovery times. However, challenges such as high costs, a lack of skilled professionals, and limited accessibility in developing regions slowed the market’s expansion.

Despite these hurdles, demand for less invasive alternatives to traditional open spinal surgeries laid the foundation for growth.

Rising Healthcare Investments & Technological Advancements to Spur Market Growth

Over the forecast period, the market is expected to surge, fuelled by technological advancements and rising healthcare investments.

Integrating robotic-assisted navigation, 3D imaging, and AI-powered analytics has revolutionized surgical precision, reducing complications and improving outcomes.

Further, North America, Europe, and Asia-Pacific markets are experiencing a boom in medical tourism, making endoscopic spinal surgery more accessible to a global patient base.

Growth Drivers

Increasing Preference for Minimally Invasive Surgeries (MIS) Boosts Market Prospects

Imagine a scenario where a patient undergoes spinal surgery in the morning and walks out of the hospital the same day. Seems difficult, but it is the promise of minimally invasive endoscopic spinal surgeries.

Patients today are more aware than ever and actively seek procedures that minimize pain, scarring, and downtime. Traditional spinal surgeries often involve lengthy hospital stays and extended recovery periods, whereas MIS techniques reduce hospital stays by nearly 50% and lower complication rates by up to 30%.

Surgeons, too, prefer these procedures as they offer greater precision and quicker recovery times, making them a win-win for both patients and medical professionals. As more healthcare providers shift towards these patient-centric approaches, the market for endoscopic spinal surgeries continues to expand, paving the way for the future of spinal care.

High Costs and Limited Reimbursement Policies to Hinder Market Growth

For many patients, endoscopic spinal surgery represents a promising, less invasive alternative to traditional open procedures. However, the high cost of advanced endoscopic equipment and surgical procedures remains a major barrier to widespread adoption.

The price of an endoscopic spine surgery system can range from US$150,000 to US$500,000, making it a significant investment for healthcare facilities. The procedure cost can be 25-50% higher than conventional spinal surgeries, creating financial strain for patients.

Reimbursement policies vary across regions, with some countries offering limited or no coverage for minimally invasive spinal procedures. It makes it challenging for patients, particularly in middle- and low-income regions, to afford these advanced treatments.

Until insurance providers and healthcare systems improve coverage, the high financial burden will slow market growth, preventing wider accessibility of endoscopic spinal surgery.

Advancements in Robotics and AI Integration Propels Market Growth

With the integration of robotics and artificial intelligence (AI) in endoscopic spinal surgery, spine surgeries are performed with unmatched precision, reducing human error and ensuring faster patient recovery.

Robotic-assisted navigation systems allow surgeons to plan procedures with millimetre accuracy, reducing complications and improving patient outcomes.

AI-powered imaging and real-time data analytics further enhance surgical precision, predict complications, and optimize treatment plans.

According to industry experts, the adoption of robotic-assisted endoscopic surgeries is expected to increase by over 30% in the next five years, making procedures safer and more accessible. As hospitals and surgical centers invest in this cutting-edge technology, the market is set for a significant transformation, opening doors to new possibilities in spinal care.

Product Insights

Endoscopic Devices Lead the Product Segment with 62% of the Market Share

In the endoscopic spinal surgery market, endoscopic devices are the dominant product segment. The dominance of endoscopic devices is attributed to the surge in spinal disorders and the growing preference for minimally invasive surgical procedures.

With an increasing number of individuals experiencing spinal ailments, there's a growing demand for effective surgical interventions.

Patients and healthcare providers increasingly favour surgeries that offer reduced recovery times and minimized risks, positioning endoscopic devices as the tools of choice.

Technology Insights

3D Technology Dominates the Technology Segmentation with 59% of the Market

In the endoscopic spinal surgery market, 3D technology has emerged as the leading segment, accumulating around 59% of the market share.

The depth perception of 3D visualization enables surgeons to perform intricate procedures with greater accuracy, improving patient outcomes.

Further, continuous innovations have led to developing sophisticated 3D endoscopic systems, making them more accessible and user-friendly for medical professionals.

The benefits of 3D technology, including reduced operation times and minimized invasiveness, have increased its adoption among surgeons and patients alike.

As the medical community continues to recognize the advantages of 3D endoscopic technology, its prominence in spinal surgeries is expected to grow, further solidifying its position as the leading segment in the market.

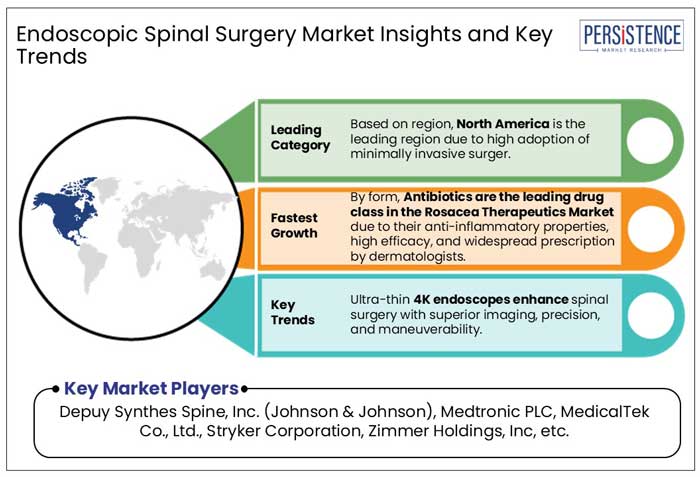

North America is Leading the Charge to Own 40% of the Market Share with Advanced Medical Technologies in Patient Care

North America dominated the endoscopic spinal surgery market, holding around 40% of the global revenue share. The dominance of North America is primarily attributed to the advanced healthcare infrastructure and the growing prevalence of spinal disorders.

The region boasts state-of-the-art medical facilities equipped with cutting-edge technologies, enabling the adoption of minimally invasive surgical techniques. Further, the region is prone to have the highest number of patients suffering from spinal ailments, which is a key growth element for the region’s growth.

Patient-Centric Care & Favorable Policies Aid European Region to Own a Substantial Market Share

Europe holds a substantial share of the market, driven by favorable reimbursement policies and a growing aging population. European healthcare systems often provide coverage for advanced surgical procedures, making them accessible to a broader population.

As the median age rises, so does the incidence of degenerative spinal conditions, necessitating effective surgical solutions.

European medical practitioners prioritize minimally invasive techniques that reduce hospital stays and enhance patient comfort. With such beneficial policies for patients, the market for endoscopic spinal surgery in Europe is gaining a substantial market share.

Rising Awareness of Minimally Invasive Surgeries Make Asia Pacific to Witness Fastest Growth

The Asia Pacific region is experiencing the fastest growth, with projections indicating an 8% compound annual growth rate (CAGR) during the forecast period.

Improving healthcare infrastructure and raising awareness about minimally invasive surgeries is a major factor for the region's growth. Countries like China and India invest heavily in healthcare, expanding access to advanced surgical options. Further, there is a growing recognition of the benefits of minimally invasive surgeries, leading to increased patient acceptance.

The endoscopic spinal surgery market is witnessing rapid advancements, driven by the growing demand for minimally invasive procedures. With cutting-edge innovations in endoscopic spinal surgery, patients can undergo a procedure with minimal incisions and faster healing.

Companies are heavily investing in robot-assisted technologies, AI-driven navigation systems, and precision endoscopes to improve outcomes. With a rising aging population and increasing cases of spinal disorders, competition is intensifying, pushing the industry toward safer, more efficient, and patient-friendly solutions.

Key Industry Developments

|

Report Attributes |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product

By Technology

By Procedure

By End User

By Region

To know more about delivery timeline for this report Contact Sales

The market is set to reach US$ 745.4 million in 2025.

Depuy Synthes Spine, Inc., Medtronic PLC, MedicalTek Co., Ltd., are a few leading players.

The industry is estimated to rise at a CAGR of 7.9% through 2032.

North America is projected to hold the largest share of the industry in 2025.

The market for is anticipated to reach a valuation of US$ 1504.2 million by 2032.