Smart Grid Sensors Market Segmented By Voltage/Temperature Sensors, Outage Detection Sensors, Transformer Monitoring Sensors, Dynamic Line Rating Sensors for Smart Energy Meter, SCADA, Advanced Metering Infrastructure

Industry: Semiconductor Electronics

Published Date: January-2022

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 236

Report ID: PMRREP3962

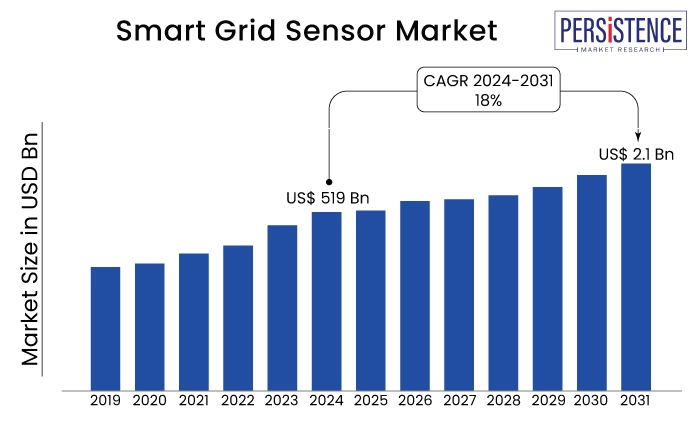

The Smart Grid Sensor Market size in 2024 is US$ 519 million, projected to reach US$ 2.1 billion by 2031, with a global market growth rate of 18% CAGR from 2024 to 2031

| Attribute | Key Insights |

|---|---|

|

Market Size (2024) |

US$ 519 Mn |

|

Projected Year (2031) Market Value |

US$ 2.1 Bn |

|

Global Market Growth Rate (2024-2031) |

18% CAGR |

|

Market Share of Top 5 Smart Grid Sensor Manufacturers |

30% |

Smart grid sensor sales accounted for almost 4% share of the global sensor market in 2021, with voltage smart grid sensors and temperature smart grid sensors set to account for over 2/3 market share.

The global market for smart grid sensors expanded at the rate of 13% over 2018-2023. Smart grid sensor demand has grown due to integration of Internet of Thing (IoT) technology across smart grids and smart energy infrastructure development.

Going forward, the global smart grid sensor market is expected to show significant growth in coming years at 18% CAGR, owing to growing adoption of voltage/temperature sensors, outage detection sensors, transformer monitoring sensors, and dynamic line rating sensors.

These sensors are used across various smart grid applications such as smart energy meters, Supervisory Control and Data Acquisition (SCADA), Advanced Metering Infrastructure (AMI), and others, which is driving overall demand for smart grid sensor systems.

“Phasing Out of Traditional Grids Complementing Market Growth”

Rising adoption of smart grids over traditional grids and grid sensors is driving demand for smart grid sensors. Government mandates, growing product awareness, supportive policies about energy conservation, and adoption of smart grid technologies are smart grid sensor sales growth. Governments across the globe are changing rules and regulations to reduce carbon emissions and dependence on fossil fuels.

Developments in the energy sector across the globe are expected to propel demand growth of smart grid sensors. Smart grid technology uses information & communication technology for the purpose of electricity transmission, generation, and distribution. Also, smart grid software and distribution management software helps improve the reliability, adaptability, and efficiency of grid systems.

How Will Sales of Smart Grid Sensors Shape Up in the U.S.?

“SGIG Program to Drive Need for Smart Sensors in Grids”

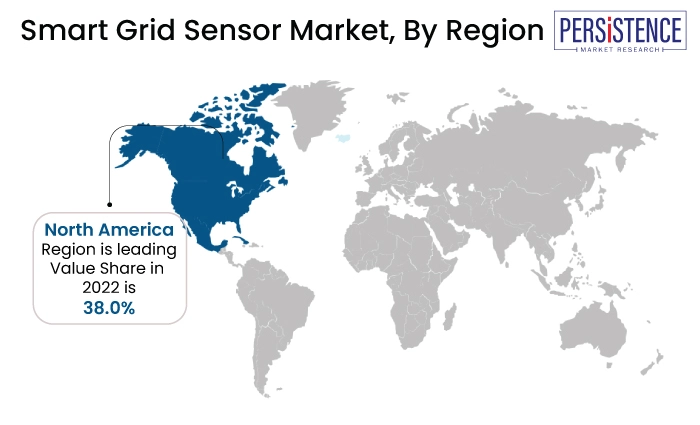

Currently, the U.S. is anticipated to constitute largest market share in the North America smart grid sensor market, with the market expected to grow at the rate over 16% through 2031.

The U.S. market is proliferating owing to government initiatives toward smart cities and the presence of smart infrastructure in the country.

The Smart Grid Investment Grant (SGIG) program helps accelerate the upgradation of electric distribution and transmission systems in the U.S.

Such developments are set to drive demand for smart grid technologies in the country.

Why is India a Prominent Market for Smart Grid Sensor Suppliers?

“Smart City Projects to Drive Smart Sensor Demand”

The India smart grid sensor market accounts for large consumption in the APAC region, and the market size is expected expand 1.5X over the forecasted period. India’s market is expected to surge at a high CAGR of nearly 17%, owing to factors such smart city project development and strict regulations by the government for the energy sector.

For instance, in October 2021, the National Smart Grid Mission by the Ministry of Power, Government of India (MPGI), developed a smart grid awareness film named “Smart Grid and its Transformative Impact on Utility Operations and Customer Energy Empowerment”, to make citizens aware about energy consumption.

Such initiatives taken by the Indian government will fuel demand for smart grid sensor platforms in the country.

Which Country is Driving Growth of the Europe Smart Grid Sensor Market?

“Demand for Smart Sensors in Smart Grids Surging in the U.K.”

The U.K. market for smart sensors in smart grids is set to register the highest growth in Europe and the market size expected to surge by nearly 15% CAGR during 2024-2031.

Adoption of smart grid technologies has increased in the U.K. owing to the integration of low-carbon technologies and the energy security offered by smart grid technology systems. Key electricity providers such as UK Power Networks serve around 18 million customers in London, the South East, and East of England.

Thus, government support to private operators for low carbon emission is anticipated to drive demand for sensors used in smart grids in the U.K.

Which Smart Grid Sensor Type is Leading Market Expansion across the World?

“Demand for Voltage/Temperature Sensors to Remain High”

By product type, voltage/temperature sensors will dominate the market, and the segment is set to expand at a high CAGR around nearly 17% during 2024-2031.

Voltage/temperature sensors are used to detect voltage fluctuations in smart grids. Power companies needs to adjust and monitor the power levels (e.g. current, voltage, phase angle) flowing in each section of underground and above-ground power lines. In order to monitor voltage or temperature fluctuations in smart grids, they use automatic load break switches or voltage/temperature sensors.

Which Application is Exhibiting High Demand for Smart Grid Sensors?

“Popularity of Smart Energy Meters Rising Rapidly”

On the basis of application, smart energy meters will be a dominating segment over the forecasted period. Market size of smart energy meters is expected to expand almost 1.3X by 2031.

Smart energy meters integrated with smart grid technology provides efficient power supply management, power demand reduction, and optimization of management resources. It enables data analysis that deals with communication, data acquisition, elucidation, and processing benefits to consumers as well as power companies.

What’s Driving the Need for Smart Grid Sensors for Private Grid Operators?

Private grid operators will dominate smart grid sensor demand, and the segment is expected to expand at a high CAGR around 18% through 2031.

As per Electricrate data, maximum electricity is supplied by private operators in the U.S. across 7 million miles each year through transmission and distribution lines. The U.S. is one of the prominent countries in terms of development of smart grid technology.

Overall, rising adoption of advanced technology in smart grids is anticipated to drive demand for smart grid sensor services across the globe.

The COVID-19 pandemic has had a significant impact on nearly all spheres on the global economy. The pandemic drove most of the affected nations into shutdowns, restricting their commercial and industrial activities.

The global energy & power industry is one of the industries that suffered disruptions owing to travel bans, factory shutdowns, border lockdowns, and trade bans.

In addition, the supply chain and production were not fully reopened due to COVID-19 restrictions, which affected energy & power demand. As many countries have restarted their supply chains and travelling & transport industries, the market for smart sensors in smart grids is set to witness significant growth over the coming years.

Key smart grid sensor market providers are inclined at investing heavily in product innovation, research, and development in energy and smart infrastructure. With the use of technology, market players are also focusing on ensuring safety, quality, and customer satisfaction for capturing an increased customer base.

| Attribute | Details |

|---|---|

|

Forecast Period |

2024-2031 |

|

Historical Data Available for |

2018-2023 |

|

Market Analysis |

USD Million for Value |

|

Key Regions Covered |

|

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report coverage |

|

|

Customization & pricing |

Available upon request |

By Sensor:

By Application:

By End User:

By Region:

To know more about delivery timeline for this report Contact Sales

The size of the smart grid sensor market in 2024 is projected to be US$ 519 million.

Government mandates, growing awareness about energy usage, supportive policies about energy conservation, and adoption of smart grid technologies are driving the smart grid sensors technology demand growth.

From 2024 to 2031, sales of smart grid sensors are projected to increase at a CAGR of 18%.

Sales of smart grid sensor services are projected to increase at 18% CAGR and be valued at over US$ 2.1 Bn by 2031.

Key market trends include adoption of IoT technology with smart grids and energy infrastructure across the globe.

ABB, Aclara Technologies, General Electric, Honeywell International Inc., and Eaton are the top 5 smart grid sensor service providers, accounting for around 30% market share.

The U.K. and Germany together held almost 50% share of the Europe market in 2021.

The U.K., U.S., Italy, China, and Japan are major demand centers for smart grid sensors.