Industry: Healthcare

Published Date: February-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 184

Report ID: PMRREP33803

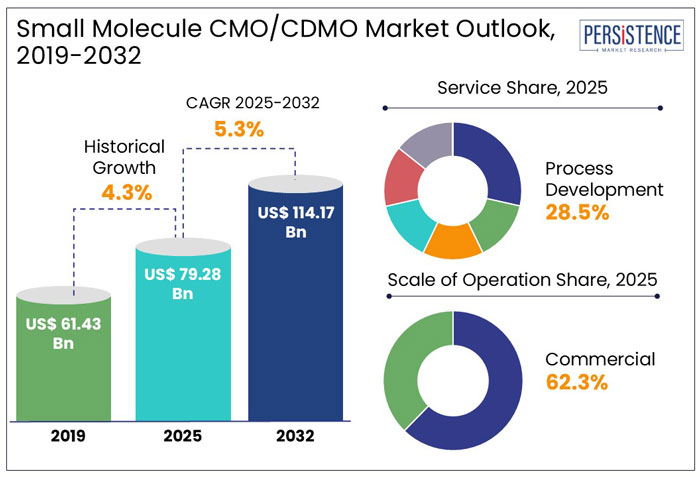

The global small molecule CMO/CDMO market size is anticipated to rise from US$ 79.28 Bn in 2025 to US$ 114.17 Bn by 2032. It is projected to witness a CAGR of 5.3% from 2025 to 2032.

As per Persistence Market Research (PMR), biotechnology and biopharmaceutical companies utilize CDMOs to streamline operations and reduce costs in research and manufacturing services, including fill finishing, packaging, and development, often outsourcing drug manufacturing and research.

Key Highlights of the Small Molecule CMO/CDMO Market

|

Global Market Attributes |

Key Insights |

|

Small Molecule CMO/CDMO Market Size (2025E) |

US$ 79.28 Bn |

|

Market Value Forecast (2032F) |

US$ 114.17 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

5.3% |

|

Historical Market Growth (CAGR 2019 to 2024) |

4.3% |

Investments in New Facilities and Cutting-edge Technologies Boosted Growth from 2019 to 2024

The global small molecule CMO/CDMO industry witnessed a CAGR of 4.3% in the historical period between 2019 and 2024. To develop new product lines and increase their clientele, small molecule CMO/CDMO businesses are giving acquisitions and growth first priority. Additionally, they are using new technology in the research, manufacturing, and packaging of drugs. They are also focusing on the development of innovative facilities to extend their production capacities. For example,

Specialized Expertise in High-potency APIs and Continuous Manufacturing to Fuel Demand through 2032

In the estimated timeframe from 2025 to 2032, the global market for small molecule CMO/CDMOs is likely to showcase a CAGR of 5.3%. Demand for complex small molecule drugs is creating opportunities for contract manufacturing organizations with specialized expertise in high-potency APIs, continuous manufacturing, and innovative formulation technologies.

Growing demand for oncology, cardiovascular, and CNS drugs is driving investments in specialized CMO/CDMO capabilities, positioning key players to benefit from innovative drug development trends.

Growth Drivers

Expanding Cancer Drug Pipeline to Push Growth in Complex Molecule Manufacturing Services

The need for complex molecule manufacturing services is rising owing to the surging medication pipeline in cancer and other therapeutic areas.

Several companies are striving to broaden their presence across developed countries and regions. They are doing so with the help of product launches, capacity expansions, and investment strategies. For instance,

Trust and IP Protection Issues May Impact Long-term Collaboration in Drug Development

Pharmaceutical businesses, CMOs, and CDMOs may find it difficult to collaborate due to Intellectual Property (IP) issues, which can restrict information exchange and impede creative problem-solving and process optimization. This may reduce the advantages of outsourcing and obstruct candid dialogue. Long-term collaborations and open communication can also be hampered by trust concerns.

IP protection agreement drafting may be difficult and time-consuming, which could have an impact on project budgets and schedules. Pharmaceutical businesses would be reluctant to work together if intellectual property issues are not resolved, which might restrict market development in the projected period. For medication research and production to be effective, IP issues must be addressed.

Shift toward Virtual Pharma Models to Augment Demand for Integrated CDMO Services

As more businesses outsource research and development, clinical trials, and production to CMOs and CDMOs, the growing use of virtual pharma business models is opening substantial prospects for end-to-end drug development and manufacturing services. For example,

To assist completely virtual biotech companies, WuXi AppTec extended its integrated research and development as well as production facilities in December 2023. Emerging biotech companies are able to launch treatments more quickly because of the move toward asset-light pharmaceutical models, especially in the areas of biologics and complicated small molecules. These companies rely on specialist CDMO partners to ensure smooth medication development and commercialization.

Product Insights

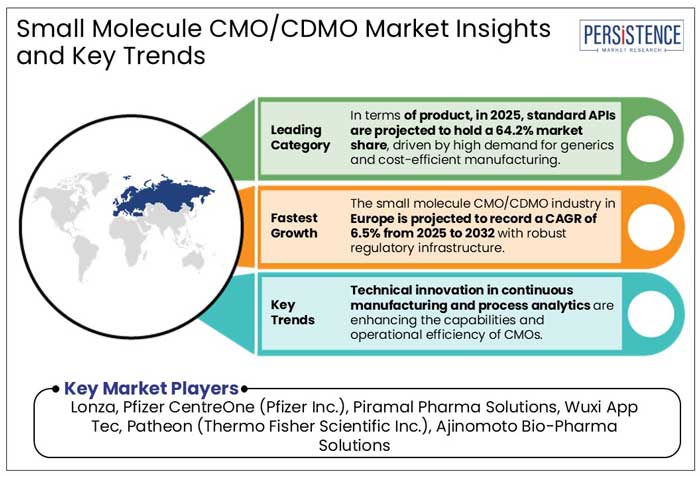

Cost-efficient Manufacturing is Pushing Widespread Adoption of Standard APIs

In terms of product, in 2025, standard APIs are projected to hold a 64.2% market share, driven by high demand for generics and cost-efficient manufacturing. Global sales of APIs are set to reach US$ 265 Bn by 2028, with standard APIs dominating due to economies of scale, according to a few studies.

Various companies are taking several steps to strengthen their position in the field of standard APIs. For example,

Surging Pressure to Reduce Drug Development Costs to Fuel Demand for Outsourced Process Development

In 2025, the process development segment is anticipated to lead the market with a 28.5% share. It is driven by increasing demand for scalable and cost-effective manufacturing of small molecule drugs.

With pressure to reduce drug development costs, pharma companies are outsourcing early-stage and late-stage process development to CMOs/CDMOs. These service providers help in streamlining synthesis pathways, reducing waste, and improving yield efficiency, making production more cost-effective. One such example is WuXi STA-

Strict Regulatory Framework in Europe Bolsters Competitiveness and Creates Opportunities for CMO/CDMO Providers

In 2025, Europe is projected to dominate the small molecule CMO/CDMO market with a 38.2% share. It is mainly driven by its strong pharmaceutical manufacturing infrastructure, innovative technologies, and strict regulatory standards. The market is set to report a CAGR of 6.5% from 2025 to 2032. A few examples of stringent norms are-

The aforementioned strict regulatory norms in Europe’s market are bolstering quality improvements and global competitiveness. While compliance with GMP, ICH Q7, and Ph. Eur. standards presents challenges, these regulations are also creating positive opportunities for CMO/CDMO service providers.

Well-established Biotechnology and Pharmaceutical Industry to Strengthen North America's Position

North America, a key contributor to the global market, is set to account for a 26% share in 2025. The region is estimated to record a CAGR of 4.7% from 2025 to 2032. The region is renowned for its well-established biotechnology and pharmaceutical firms, as well as rising investments in research and development, which are set to push demand.

Increasing prevalence of illnesses like diabetes, cardiovascular disease, and cancer is also set to create new opportunities for North America. The U.S., with the largest global healthcare spending, is increasing outsourcing and supporting CDMOs to reduce operational and capital expenses, while promoting new therapies. For instance,

These factors contribute to growth opportunities for domestic CDMOs in North America.

Global Pharma Companies to Invest in Asia Pacific as High-quality Manufacturing Expands

In 2025, Asia Pacific is projected to hold a 24.7% share in the small molecule CMO/CDMO market, with a CAGR of 7.8% from 2025 to 2032. Growth is fueled by lower manufacturing costs and increasing pharmaceutical research and development investments in emerging nations such as India and China.

Stringent regulatory frameworks from agencies like PMDA (Japan) and MFDS (South Korea) are ensuring high-quality production standards, attracting global pharma companies. For instance,

Small molecule Contract Manufacturing Organizations (CMOs) and Contract Development and Manufacturing Organizations (CDMOs) are strategically focusing on acquisitions and expansions. They aim to develop innovative product lines and broaden their customer base.

The foremost companies in the sector are not only enhancing their service offerings but are also keen on integrating cutting-edge technologies into various aspects of drug manufacturing, development, and packaging processes. This proactive approach not only helps them stay ahead in the market but also enables them to meet the evolving demands of their clients and the pharmaceutical industry at large.

Key Industry Developments

|

Report Attributes |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product

By Service

By Company Size

By Scale of Operation

By Region

To know more about delivery timeline for this report Contact Sales

The market is set to reach US$ 79.28 Bn in 2025.

CMO/CDMOs offer a range of services such as drug development, quality control, clinical trial support, and technology transfer.

Lonza, Pfizer CentreOne (Pfizer Inc.), Piramal Pharma Solutions, Wuxi App Tec, and Patheon (Thermo Fisher Scientific Inc.) are a few leading players.

The industry is estimated to rise at a CAGR of 5.3% through 2032.

Europe is projected to hold the largest share of the industry in 2025.