Industry: Food and Beverages

Published Date: March-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 400

Report ID: PMRREP10283

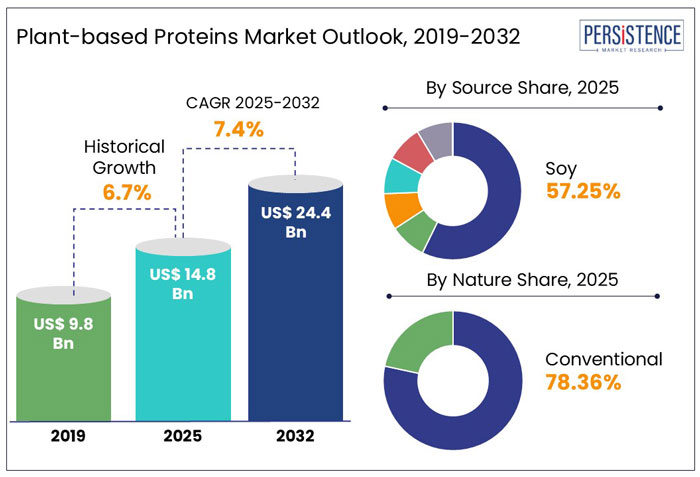

According to Persistence Market Research, the global plant-based proteins market is estimated to increase from US$ 14.8 Bn in 2025 to US$ 24.4 Bn by 2032. The market is projected to record a CAGR of 7.4% during the forecast period from 2025 to 2032

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Plant-based Proteins Market Size (2025E) |

US$ 14.8 Bn |

|

Projected Market Value (2032F) |

US$ 24.4 Bn |

|

North America Market Growth Rate (CAGR 2025 to 2032) |

7.4% |

|

Historical Market Growth Rate (CAGR 2019 to 2024) |

6.7% |

The global plant-based proteins market was valued at US$ 13.8 Bn at the end of 2024 after having progressed at a CAGR of 6.7% during 2019-2024.

Proteins are the most important nutrients for the human body as they provide all the essential amino acids required. Plant-based proteins are derived from plant and vegetable sources such as soy, wheat, and peas, which are high in protein content.

Demand for plant-based proteins is increasing owing to the growing vegan and vegetarian population and rising lactose intolerance among consumers. Plant-based proteins are used as a meat alternative as they can mimic the taste and texture of meat.

Plant-based proteins are the only source of nutrition for vegans and vegetarians. People choose a vegan diet because they believe it is beneficial for their health. For vegans and vegetarians, plant-based proteins are the healthiest source of nourishment. When it comes to improving their health through food, vegan and vegetarian consumers continue to prioritize nutrition.

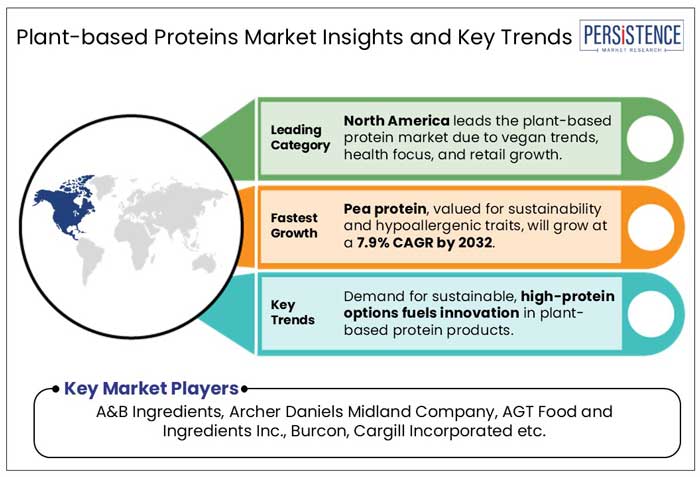

This trend is projected to drive plant-based proteins market growth across the world. Veganism has been popular in well-established markets such as North America and Europe. In growing economies such as South Asia and East Asia, this practice is gaining traction. The growing popularity of vegan trend is predicted to boost demand for plant-based proteins on a global scale.

Currently, the global value of plant-based proteins is estimated at US$ 14.8 Bn, with a predicted CAGR of 7.4% from 2025 to 2032.

With the rise in the number of health-conscious consumers, food produced from plant proteins and developed to match the taste and texture of meat has surged into the mainstream market. As established food companies and start-ups are introducing plant-based meat products, plant proteins are gaining acceptance among the general public.

For example, Beyond Meat, an American company, has expanded into Europe to sell its plant-based burgers that look, taste, and cook like beef.

In developed economies around the world, food allergies are on the rise. Food sensitivities are increasingly influencing consumer interests. Plant proteins are consumed mainly by vegetarians, while allergies to gluten, soy, and others are preventing a large number of people from doing so.

Plant proteins are gaining popularity as dairy protein alternatives due to their significant nutritional value. They also have the advantage of being non-GMO and allergen-free. As a result, the global market for plant protein food products is predicted to rise as demand for dairy-free and lactose-free food grows.

Plant-based proteins contain essential muscle-building ingredients and proteins in concentrations ranging from 50% to 85%. They stand out when compared to other protein sources since they are environmentally sustainable.

Consumers are becoming more aware of the benefits of plant-based proteins, and, as a result, demand natural, environment-friendly, and allergen-free products. Growing consumer concerns about animal-based goods and the environment are leading to an increase in the number of people following a flexitarian diet, which is expected to have a beneficial impact on the target market.

The cropping system of plant proteins is eco-friendly and hence preferred by consumers. Moreover, plant-based proteins are not made from any commonly allergenic foods such as milk and eggs. Consumers are becoming aware of the beneficial properties of plant-based proteins, thereby augmenting market expansion.

To tackle the problem of obesity and the rising prevalence of diseases, brought about by changing lifestyles, the need for nutritious food will continue to increase across the world. Increasing use of plant-based protein diet plans, health and fitness clubs, as well as increased education and awareness about obesity, are all driving the growth of the health and wellness sector.

Plant-based proteins are considered the most effective for weight loss. An increasing need for weight management among consumers is expected to boost the demand for plant-based proteins over the forecast period.

The landscape of consumer health is shifting rapidly, with consumers constantly making changes in their healthcare routines and demanding alternatives to animal proteins. Rising concerns regarding dairy allergens are also expected to fuel the demand for plant-based protein products.

The plant-based products market has witnessed rapid growth in the past few years, and manufacturers, suppliers, retailers, and food brands have been facing tight competition.

Due to this increasing competition, market players are forced to invest, innovate, and introduce new products. This has resulted in the expansion of their plant-based protein portfolios. As such, growing competition and innovation in the industry are creating lucrative growth opportunities for market players. For instance, Cargill is researching cost-effective corn protein, an alternative to traditional protein ingredients such as soy, wheat, and peas.

|

Category |

CAGR through 2032 |

|

By Source - Soy |

7.3% |

Soy protein plays a leading role in the plant-based protein market due to its diverse benefits and widespread usage. Recognized for its rich nutritional profile, it is a complete protein source, providing all essential amino acids necessary for human health. Its cost-effectiveness compared to other plant-based proteins makes it accessible to a wide consumer base. Additionally, soy protein is highly versatile, serving as a key ingredient in products such as tofu, soy milk, meat substitutes, energy bars, and baked goods, making it a preferred choice for manufacturers.

Health benefits further strengthen soy protein’s market position, as studies suggest it supports heart health, lowers cholesterol, and may even help reduce cancer risks. Its sustainability advantages, including a significantly lower environmental footprint compared to animal-based proteins, align with the increasing demand for ethical and eco-conscious food options. These attributes collectively reinforce soy protein’s dominance in the evolving plant-based protein industry.

The demand outlook for conventional plant-based proteins remains strong, driven by cost-effectiveness, established supply chains, and broad consumer acceptance. Conventional plant-based proteins, such as soy, wheat, and pea protein, continue to dominate the market due to their affordability and extensive application in food and beverage products. Despite the growing interest in organic and non-GMO alternatives, conventional options maintain a larger market share, particularly in emerging economies where price sensitivity is higher. Additionally, manufacturers are investing in improving processing techniques to enhance taste, texture, and nutritional profiles, further sustaining demand. As plant-based diets gain traction, conventional proteins will remain a key market segment.

|

Region |

CAGR through 2032 |

|

Europe |

~7.9% |

The rising popularity of plant-based diets across Europe, particularly in Germany, is fueling demand for plant-based proteins. In 2024, around 8.43 million Germans identify as vegetarians or primarily avoid meat. Additionally, 3% of the country's population follows a strictly vegan diet. This shift is further highlighted by the growing number of vegan restaurants, which increased from 75 in 2013 to 393 in 2024.

These developments indicate a rapidly expanding market for plant-based proteins in Germany, driven by heightened awareness of health benefits, environmental sustainability, and ethical considerations regarding food consumption.

|

Country |

CAGR through 2032 |

|

U.S. |

7.1% |

North America's growing demand for healthy alternative protein sources highlights a shift toward sustainable and nutritious food choices. The US and Canada form a substantial market with consumers actively seeking plant-based protein alternatives to traditional animal products. This trend is fuelled by rising health awareness, as individuals become more conscious of their dietary habits. Additionally, the fast-paced nature of modern lifestyles is increasing the need for convenient, protein-rich options that deliver both nutrition and ease of consumption.

Key suppliers of plant-based proteins are focusing on new product launches and product innovation to broaden their product portfolios and strengthen their market position. In the past five years, there have been several products launched by various brands, such as,

Recent Developments in the Global Plant-based Proteins Market

|

Attributes |

Details |

|

Current and Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2024 |

| Market Analysis Units | Value: US$ Bn/Mn, Volume: As applicable |

|

Key Country Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

| Report Highlights |

|

|

Customization & Pricing |

Available upon request |

By Source

By Form

By Nature

By Application

By Region

To know more about delivery timeline for this report Contact Sales

The Plant-based Proteins are estimated to increase from US$ 14.8 Bn in 2025 to US$ 24.4 Bn by 2032.

Rising health consciousness, demand for ethnic cuisines, clean-label trends, and expanding food processing industries worldwide.

A&B Ingredients, Archer Daniels Midland Company, AGT Food and Ingredients Inc., Burcon, and Cargill Incorporated are some of the leading industry players.

The market is projected to record a CAGR of 7.4% during the forecast period from 2025 to 2032.

Expanding demand for sustainable, clean-label proteins in functional foods and sports nutrition drives market growth.