Industry: Automotive & Transportation

Published Date: June-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 148

Report ID: PMRREP30819

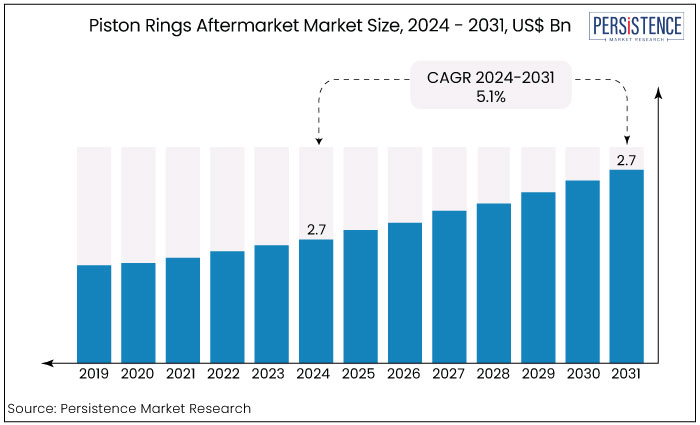

The global piston rings aftermarket is expected to rise from US$2.7 Bn in 2024 to US$3.8 Bn by the end of 2031. The market is anticipated to secure a CAGR of 5.1% during the forecast period from 2024 to 2031.

Key Highlights of the Market

|

Attributes |

Key Insights |

|

market Size (2024E) |

US$2.7 Bn |

|

Projected Market Value (2031F) |

US$3.8 Bn |

|

Global Market Growth Rate (CAGR 2024 to 2031) |

5.1% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

4.4% |

The piston rings market growth is correlated with the expansion of automotive industry and the aftermarket. The demand for piston rings in aftermarket is primarily driven by the unprecedented growth in demand for vehicle repair and maintenance.

Increasing vehicle ownership is one of the key factors driving the market growth. Advancements in automotive technology plays an important part.

Innovations in piston ring materials including ceramic composites, steel alloys and chrome coatings are enhancing both the performance and durability.

The aftermarket benefits from a well-established distribution network and service infrastructure. Access to a wide array of aftermarket suppliers, distributors, retailers, and online platforms ensures that piston rings are readily available to consumers and repair facilities globally.

This accessibility, coupled with competitive pricing and the availability of quality products from reputable brands, fosters a vibrant aftermarket ecosystem that supports sustained growth in the piston rings segment.

The swelling market size of auto and engine parts can be straightaway attributed to the considerably increased vehicle life.

While the aftermarket is prominently driven by China, and Europe, the industry has been experiencing a slowdown in developing South Asian economies, in the recent past. However, it reflects clear signs to gain the initial impetus in the near future.

The study covers a complete study of the market with an analysis of types of piston rings used in automobiles and two-wheelers. The report summarizes the parent market for piston rings, i.e., automotive aftermarket sizing for different regions.

This is expected to impact the piston rings aftermarket growth. There will be a plunge in terms of growth rate in the near future though piston ring sales in aftermarket are on a constant surge.

Advancements in piston ring materials, manufacturing processes, and design have improved durability, efficiency, and performance over the years. This has supported growth in the aftermarket as older vehicles and equipment are retrofitted with newer, more efficient components.

The growth of the automotive industry globally has significantly contributed to the demand for piston rings. Increasing vehicle production, coupled with longer vehicle lifespans and higher mileage driven, has driven aftermarket sales as vehicles require replacement parts over time. The piston rings aftermarket exhibited a CAGR of 4.4%.

The growing adoption of digital technologies in aftermarket sales including e-commerce platforms, data-driven customer insights and predictive maintenance solutions are estimated to streamline operations and augment customer engagement.

Such digital transformation is estimated to support aftermarket growth by enhancing accessibility as well as service efficiency. Sales of piston rings are estimated to record a CAGR of 5.1% during the forecast period from 2024 to 2031.

Increasing Demand for Commercial and Passenger Vehicles

As global population and urbanization continue to rise, so does the demand for transportation. This leads to an expanding vehicle fleet comprising both commercial vehicles (such as trucks, buses, and vans), and passenger vehicles (including cars and SUVs).

Each of these vehicles relies on internal combustion engines (ICEs), which require piston rings for efficient operation.

Increasing demand for commercial and passenger vehicles is one of the key drivers for market growth.

The need for many spare parts increases with the increasing demand for these vehicles so does the demand for piston rings increases. There are many manufacturers emphasizing more on fulfilling the demand for piston rings in the aftermarket.

Advances in automotive technology including enhancements in performance, engine efficiency and emissions control contribute to the evolution of piston ring designs.

Modern engines, whether for passenger vehicles or commercial vehicles often need piston rings, which can withstand operational stresses and high temperatures. Such technological development in engine design can support the demand for advanced piston rings in the aftermarket.

The Growing Boom Around Hybrid Vehicles – Created by Governments

Governments are stimulating both the adoption and manufacturing of hybrid vehicles by taking various initiatives aimed at lessening greenhouse gas emissions and enhancing fuel efficiency.

Such initiatives include investments in infrastructure, subsidies, regulatory mandates and tax incentives supporting hybrid and electric vehicles.

Investment is done by government in infrastructure including charging stations and battery recycling facilities to support the growth of EVs and hybrids.

As the charging infrastructure improves, consumer confidence in hybrid vehicles increases, leading to high sales and subsequently demand for aftermarket components like piston rings increases.

Governments prioritize environmental sustainability through policies promoting clean transportation options. Hybrid vehicles, with their reduced fuel consumption and lower emissions compared to conventional vehicles, align with these policies.

The piston rings aftermarket benefits as hybrid vehicle sales grow and these vehicles enter their maintenance phases.

Rising Popularity of Electric Vehicles

The shift toward electric vehicles reduces the demand for internal combustion engines (ICEs), and associated components, including piston rings.

As more consumers and governments prioritize EV adoption for environmental reasons, the market share for ICE vehicles, and thus the aftermarket for piston rings, could face a gradual decline in the long-term.

Electric vehicles generally require less maintenance compared to ICE vehicles. They have fewer moving parts, no traditional engine oil changes, and typically longer intervals between maintenance visits.

This reduces the frequency of aftermarket servicing and replacement parts, including piston rings, which are critical components in ICE engine maintenance but have no equivalent in electric powertrains.

Innovations in Piston Ring Materials

Innovations in piston ring materials including ceramic composites, advanced coatings and high-strength steel alloys present key opportunities to reduce friction, enhance overall engine performance and enhance durability.

Manufacturers are also able to develop as well as provide next-generation piston rings, which fulfil stringent emissions standards, prolong service intervals and increase fuel efficiency.

Introducing innovative materials allows aftermarket players to differentiate their products from standard offerings.

Unique materials such as high-strength steel alloys, chromium-based alloys, and even ceramics can cater to specific customer needs, such as durability in high-performance engines or compliance with stringent emissions regulations. This differentiation helps aftermarket players attract customers looking for specialized solutions.

Expansion into Other Sectors Including Industrial and Marine Engines

Industrial and marine engines represent substantial markets with diverse needs for piston rings. By entering these sectors, aftermarket suppliers can tap into a larger customer base and expand their market reach beyond automotive applications.

Industrial and marine sectors are global industries with operations in various regions worldwide. Expansion into these sectors allows aftermarket suppliers to leverage their global distribution networks and establish a presence in new geographic markets, thereby increasing their market share and competitiveness.

Similar to automotive applications, industrial and marine engines are subject to stringent emissions regulations globally.

Aftermarket piston rings that help improve fuel efficiency and reduce emissions can help engine operators comply with these regulations, driving demand for compliant products.

Grey Iron Still the Preferred Material

As it does not scuff the cylinder bore, grey cast iron or grey iron has been the popular material choice for piston rings.

Grey iron piston rings have accounted for nearly 50% of the market revenue registered in 2018 and continues to be the most appropriate piston ring material for most passenger car accessories applications.

Nonetheless, more power out of small displacement engines and the change to thinner low tension rings have increased the operating loads on the piston rings, especially the top compression ring that receives the brunt of the punishment.

Consequently, predominant adoption of grey iron based piston rings for various automobiles is expected to continue in the upcoming years.

Compact and Mid-Size Passenger Cars Set to Benefit

Consumer preferences in target geographies are witnessing a shift toward passenger cars, particularly mid-size and compact vehicles. The automotive fleet is thus anticipated to see significant expansion by the end of 2029.

Automotive markets in Eastern Europe and Asia Pacific have an enormous automobile fleet and robust annual sales volume; mirroring a substantial growth scenario for market in the near future.

Expanding disposable income of consumers across the Middle East & Africa and other developing regions has bolstered the sales of new compact and mid-size cars. However, the entry of electric vehicles is being perceived as a significant limiter to piston rings aftermarket.

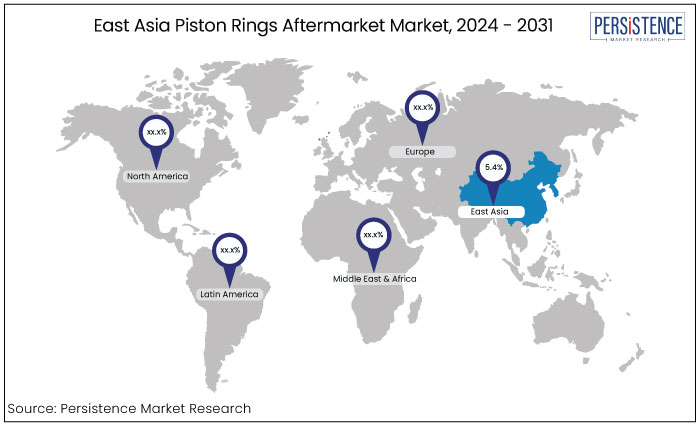

East Asian Market to Expand at a CAGR of 5.4% over the Projection Period

|

Region |

CAGR through 2031 |

|

East Asia |

5.4% |

East Asia, encompassing economies including Japan, China, South Korea, and others, has been exhibiting significant economic growth. China is one of the leading players operating in the automotive industry both as consumer and manufacturer.

The increasing automobiles production in East Asia drives the demand for elements including piston rings, mainly with the increasing focus on emissions reduction and fuel efficiency.

One of the key elements driving the market growth in East Asia is the industrial sector in East Asia. Industrial sectors in this region such as marine, power generation and manufacturing is expanding significantly.

Such industrial growth fuels the demand for industrial equipment and machinery, thereby fuels the demand for piston rings employed in engines and compress.

Governments in East Asia are increasingly emphasizing on environmental regulations and emission standards.

This further impels the demand for piston rings that contribute to improved fuel efficiency and reduced emissions, aligning with regulatory requirements and creating opportunities in the aftermarket for compliant products.

Dynamics of the automotive industry have been posing their potential impact on suppliers of piston rings. Moreover, a plausible manufacturing outlook for automobiles and piston rings have boosted the sentiments of manufacturers.

In terms of market structure, the market exhibits a highly competitive scenario, where leaders are facing fierce competition for the market share.

Just about 20% of the global market is led by top 8-10 brands which is the consequence of sustained consumer demand for cheaper products during repair and maintenance.

Key strategies adopted by market players are many. These strategies include expansion of production capacities, branding of new products, enhancing the distributor network, and partnerships and joint ventures with regional market leaders.

These strategies are cited to remain some of the adopted strategies in the piston rings aftermarket.

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Ring

By Material

By Engine

By Region

To know more about delivery timeline for this report Contact Sales

The global piston rings aftermarket is expected to rise from US$2.7 Bn in 2024 to US$3.8 Bn by the end of 2031.

Increasing demand for commercial and passenger vehicles is key factor driving market growth.

A few of the leading players in the market are Federal-Mogul LLC, MAHLE Aftermarket GmbH, and Nippon Piston Ring co., Ltd.

Innovations in piston ring materials provides key opportunity for the market players.

East Asia market to expand at a CAGR of 5.4% over the projection period.