Pharmaceutical Isolators Market Segmented By Product Type such as Closed Isolator Systems, Open Isolator Systems with Product Class such as Class III and ISO Class 5

Industry: Healthcare

Published Date: August-2022

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 279

Report ID: PMRREP24067

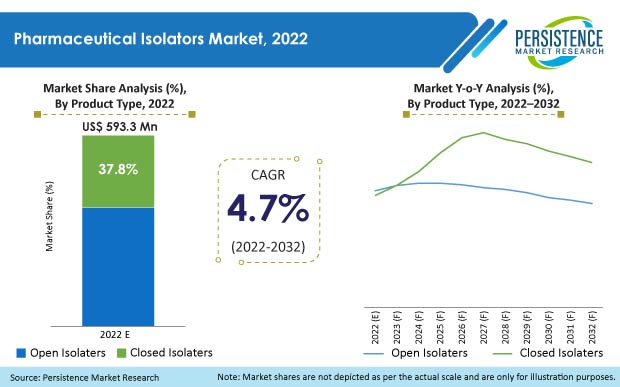

The global pharmaceutical isolators market has reached US$ 593.3 Mn in value and is predicted to evolve at a CAGR rate of 4.7% to end up at US$ 943 Mn by the end of 2032. Open pharmaceutical isolators lead the market and enjoyed a share of 62.2% in 2021.

The market value for pharmaceutical isolators was 4.7% of the global aseptic pharma processing equipment market at the end of 2021.

| Report Attribute | Details |

|---|---|

|

Pharmaceutical Isolators Market Size (2021) |

US$ 568.8 Mn |

|

Estimated Market Value (2022) |

US$ 593.3 Mn |

|

Projected Market Value (2032) |

US$ 943 Mn |

|

Global Market Growth Rate (2022-2032) |

4.7% CAGR |

|

Market Share of Top 5 Countries |

46.4% |

Worldwide sales of pharmaceutical isolators increased at a CAGR of 3.8% from 2015 to 2021.

Pharmaceutical isolators are widely used in a variety of settings, including R&D centers, hospital pharmacies, cosmetics & food industries, and pharmaceutical & medical device industries. Maintaining the utmost vigilance during the product manufacturing process is crucial in the pharmaceutical isolators business. An optimal level of sterility is provided during the product manufacturing process by several types of isolators available in the market.

In recent years, the desire to increase process integrity has been the main industry driver creating interest in isolators. As part of this, operators must be shielded from dangerous substances, and, in the case of manufacturing sterile products, there needs to be less chance that a particular operation will result in the production of contaminated non-sterile units.

Only substances and materials in direct contact with the production processing system are permitted in the bio-decontaminated environment provided by the isolators in the pharmaceutical isolators sector. Pharmaceutical isolators, thus, make it possible to protect the user from medication exposure, eliminate cross-contamination risks, and maintain drug quality standards.

Due to the global health crisis, there was a significant increase in the creation of new medicines and the number of drugs needed to treat illnesses, which increased the demand for pharma isolators in the healthcare industry. Furthermore, expanding pharmaceutical industry, rising research & development costs, and strict government laws & regulations aimed at ensuring the safety and efficacy of drugs have supported market growth.

Isolators are utilized for aseptic production processes (weighing, filling, formulation, bulking, etc.), and for microbiological tests (sterility testing, worker protection).

The use of pharmaceutical isolators across the healthcare sector is estimated to grow strongly over the forecast duration owing to the positive outcomes associated with their use and minimal drawbacks. The development of novel technologies to cater to the demand for high-quality isolators will drive the overall pharmaceutical isolators market at a CAGR of 4.7% through 2032.

“Low Operating Cost of Pharmaceutical Isolators & Growing Demand in Biopharma Industry”

Most pharmaceutical isolators are created to meet the requirements of manufacturing or research facilities. Increased collaborative relationships and a thorough product approval process drive market expansion. Another important factor influencing market growth is the low operating expenses of pharmaceutical isolators. Pharmaceutical businesses can purchase isolators for a small portion of the price of typical clean rooms from reliable suppliers.

An operator can contaminate a spot that has been thoroughly cleaned and disinfected. Contrarily, pharmaceutical isolators reduce contamination so that only production materials and medicines are in contact with the full management system in a bio-decontaminated environment.

Moreover, the expansion of the biotechnology industry has been driving the demand for pharmaceutical isolators. The biotechnology sector has advanced significantly and is currently one of the biggest in the world. Both large biotech organizations such as Pfizer, Novartis, Abbott, Biogen Inc., etc., as well as smaller biotech firms, are scattered across the medical industry in areas covering medication development, genomics, biofuels, and food products. With time, biotechnology has also entered the biopharmaceutical industry, aiding these businesses in their R&D efforts.

Furthermore, important developments in pharmaceutical isolators such as improved mobility, improved coherence with active pharmaceutical ingredients or APIs, and a large sterility guarantee will boost the market in the future. These elements have worked together to accelerate the market for pharmaceutical isolators.

“High Cost of Installation & Limited Adoption of RABS”

Pharmaceutical isolators play an important role in healthcare facilities delivering safety and efficiency in pharma-biotech companies. Pharmaceutical isolators have superior qualities, yet come with a few drawbacks.

In future years, the pharmaceutical isolators sector will undoubtedly grow rapidly. However, several obstacles may prevent the market from reaching its full potential. Because pharmaceutical isolators are expensive to install and maintain, the market may not expand as quickly as it might have otherwise.

Another obstacle to the expansion of pharmaceutical isolator technology is the limited adoption of restricted access barrier systems (RABS) in healthcare manufacturing systems, preventing contamination of sterile products through minimal contact with the operating personnel since these systems require larger operation areas.

Thus, higher installation costs and requirements for appropriate space will be restrictive factors for the growth of the market, posing additional infrastructural and operational overhead expenses.

What Makes the U.S. the Largest Market for Pharmaceutical Isolators?

“Large-scale Pharma & Biologic Manufacturing Facilities in the U.S.”

The U.S. dominates the North American pharmaceutical isolators market with a market share of 89.7% in 2021 and is expected to continue to experience the same growth pace throughout the forecast period.

The U.S. market for pharmaceutical isolators holds a high-value share due to robust development and research in the field of novel gene therapies and vaccine development. This development has been brought upon by the recent surge in global chronic and infectious disease burden.

With developed industrial units for pharmaceutical manufacturing, as well as emerging guidelines for infection control and proliferation management during the production of pharmaceuticals, the U.S. is expected to hold a dominant position in the overall market, leading to the increasing adoption of pharmaceutical isolators

How is Germany Emerging as a Prominent Market for Pharmaceutical Isolators?

“Increasing Adoption of Pharmaceutical Isolators in Pharma Manufacturing Units”

The Germany pharmaceutical isolators market is set to exhibit a CAGR of 3.2% over the decade.

Germany is set to establish itself as a prominent player in pharmaceutical isolators with the presence of a large number of established players in the country, being a prominent producer of novel aseptic processing equipment.

Moreover, with growing pharmaceutical manufacturing in the country, increasing adoption and installation of pharmaceutical isolators will further aid the overall growth of the market in the country.

What is the Japan Pharmaceutical Isolators Market Outlook?

“Revised Proposal to Operate Isolator Systems Flexibly Improving Productivity, a Project to Develop Guidelines for Medical Devices”

Japan held 27.6% share in the East Asia pharmaceutical isolators market in 2021 and is projected to exhibit growth at a CAGR of 4.5% during the forecast period.

Japan’s revenue is generated by improvements in productivity; this, in turn, is linked to the population of Japan and its workforce.

This international standard covers the fundamental concepts, design, validation, and operation of the "aseptic connection" for the isolator systems required for aseptic pharmaceutical manufacturing. The application of the worldwide standard is anticipated in the production and management of pharmaceutical manufacturing facilities, which will considerably enhance the environment for producing pharmaceuticals and supply stable, high-quality pharmaceutical goods.

Which Product is Driving High Growth of the Pharmaceutical Isolators Market?

“Easy Operability of Open Isolators in Aseptic Products Transfer”

Demand for open pharma isolators is expected to increase at a CAGR of 4.4% through 2032, after having a market share of 62.2% in 2021.

The continuous or semi-continuous entrance and/or egress of materials is permitted by open isolators used in aseptic pharmaceutical filling while retaining a level of environmental protection. Due to their ability to protect products while enabling vials to enter and depart the work area, open isolators are becoming more and more common in fill areas.

Which End User Benefits the Most from Adoption of Pharmaceutical Isolators?

“Growing Applications in Aseptic Handling of Drugs and Solutions within Biotech & Pharmaceutical Industry”

Biotech & pharmaceutical companies accounted for the highest market share of 31.3% at the end of 2021.

The use of pharmaceutical isolators in biotech & pharmaceutical companies is mostly for manufacturing and control. They are applied for handling drugs that are solid or in powder form, or while filling infusions and solutions in an aseptic environment.

Further uses of pharmaceutical isolators include the aseptic handling of tissues, infectious samples, and biological production systems, among others. With several applications, this segment enjoys the highest market share by value, as an end user.

With several competitors in the pharmaceutical isolator production sphere, the market is highly fragmented. To meet consumer demand and expand their customer base, companies are implementing various strategic methods, of which, collaborations, manufacturing expansion, and participation in conferences and events to showcase new developments are the leading strategies.

Instances of key developmental strategies by industry players in the pharmaceutical isolators market are:

Similarly, the team at Persistence Market Research has tracked recent developments related to companies manufacturing pharmaceutical isolators, which are available in the full report.

|

Attribute |

Details |

|---|---|

|

Forecast Period |

2022-2032 |

|

Historical Data Available for |

2015-2021 |

|

Market Analysis |

USD Million for Value |

|

Key Regions Covered |

|

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon Request |

Pharmaceutical Isolators Market by Product:

Pharmaceutical Isolators Market by End-User:

Pharmaceutical Isolators Market by Region:

To know more about delivery timeline for this report Contact Sales

The global pharmaceutical isolators market reached US$ 568.8 Mn in 2021 and is set to expand 1.6X over the next ten years.

Sales of pharmaceutical isolators are expected to reach US$ 943 Mn by 2032, increasing at 4.7% CAGR.

The shift from manual disinfecting to automated processes for better outcomes, increasing use of sterilized procedures, growing demand in biopharma industry, and strict regulations to ensure safety & drug efficacy will drive market growth.

North America is a key market for pharmaceutical isolators, with the U.S. accounting for 89.7% share at the end of 2021.

Germany’s pharmaceutical isolators market is expected to exhibit healthy growth at 3.2% CAGR during the forecast period.

Japan, the U.S., Germany, U.K., and India are expected to drive high demand for pharmaceutical isolators.

Skan AG, COMECER S.p.A, Hosokawa Micron Ltd, Getinge AB, Azbil Telstar, Robert Bosch GmbH, Klenzaids, Nuaire, Iso Tech Design, M. BRAUN INERTGAS-SYSTEME GMBH, I.M.A. SpA, Syntegon Technologies GmbH, and Esco Micro Pte. Ltd. are key suppliers of pharmaceutical isolators.