Industry: Automotive & Transportation

Published Date: February-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 182

Report ID: PMRREP35125

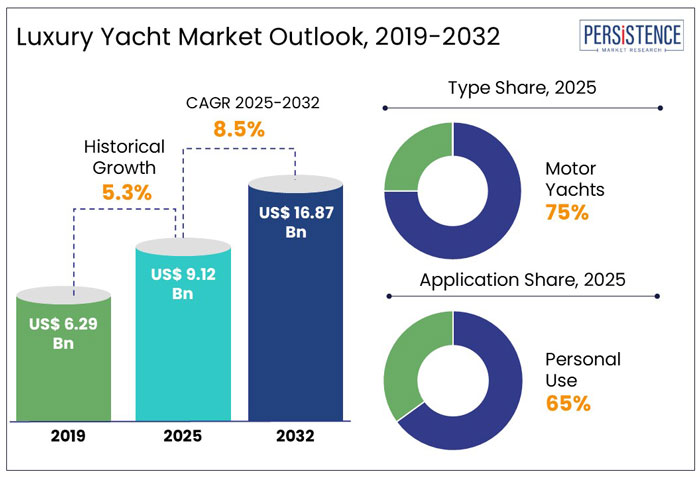

The global luxury yacht market size is anticipated to rise from US$ 9.12 Bn in 2025 to US$ 16.87 Bn by 2032. It is projected to witness a CAGR of 8.5% from 2025 to 2032.

The luxury yacht market is experiencing significant growth, driven by increasing demand for personalized and opulent maritime experiences. As per Persistence Market Research (PMR), companies are focusing on eco-friendly technologies, such as hybrid engines and solar panels, to cater to environmentally conscious clients, which is boosting market growth.

Key Industry Highlights

|

Global Market Attributes |

Key Insights |

|

Luxury Yacht Market Size (2025E) |

US$ 9.12 Bn |

|

Market Value Forecast (2032F) |

US$ 16.87 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

8.5% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.3% |

Bespoke Designs and Exclusive Leisure Experiences Fueled Demand in Historical Period

From 2019 to 2024, the luxury yacht market witnessed a steady rise in high-net-worth individuals (HNWIs) and ultra-luxury tourism. The market showcased a CAGR of 5.3% in the same period. Europe-based manufacturers dominated production, particularly in Italy and the Netherlands, while North America led in superyacht ownership.

Bespoke yacht designs, exclusive leisure experiences, and the prestige of ownership primarily drove the market. The charter market gained traction, offering an alternative for luxury travelers who preferred flexibility over ownership.

Eco-conscious Consumers and On-demand Charter Services to Make Luxury Yachting Accessible in Future

Over the forecast period, the luxury yacht industry is set to witness a transformation. Sustainability has taken center stage, with hybrid propulsion systems, solar-powered yachts, and AI-driven navigation becoming industry norms.

The rise of eco-conscious consumers and on-demand charter services makes luxury yachting more accessible. Asia Pacific is emerging as a key growth region, with rising wealth in China, India, and Southeast Asia fueling demand.

Introducing digital yacht booking platforms and AI-powered experiences is reshaping customer engagement, making yacht rentals and purchases more seamless. As technology and sustainability redefine the market, the luxury yachting industry is set for a dynamic and customer-driven evolution.

Rising Global HNWI and UHNWI Population to Spur Growth as Exclusivity Demand Surges

Surging number of high-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs) worldwide is one of the primary drivers of the luxury yacht industry. As wealth increases, affluent individuals seek exclusive leisure experiences, and yacht ownership is regarded as a symbol of status and luxury. The U.S., China, and Europe remain the leading areas contributing to the market's growth. For example,

Increasing affluence, combined with a rising interest in marine tourism, personalized travel experiences, and high-end entertainment, propels luxury yacht sales and rentals. Yacht manufacturers also invest in customization, smart technology, and hybrid propulsion systems to cater to this elite clientele, further boosting market growth.

Annual Upkeep Expenses Reaching 10% of Yacht Value, Making Ownership Financially Demanding

Despite high demand, the luxury mini yacht industry faces significant barriers, the most notable being high operational and maintenance costs. Yacht ownership involves substantial expenditures beyond the initial purchase price, including annual maintenance, insurance, docking fees, fuel costs, and crew salaries. For instance,

Stringent environmental regulations and emission standards imposed by organizations like the International Maritime Organization (IMO) add compliance costs. Depreciation remains a challenge, as luxury yachts lose a significant portion of their value within 5 to 10 years. Such factors discourage new buyers from entering the market, often leading to increased resale activity rather than new yacht sales.

Digital Platforms to Transform Yacht Chartering with Seamless On-demand Booking

The luxury yacht charter segment is emerging as a key opportunity in the market, allowing customers to experience high-end yachting without the financial burden of ownership. Several HNWIs and corporate clients prefer chartering over purchasing due to the flexibility and lower commitment involved. This trend has led to a rising number of luxury yacht charter companies offering customized itineraries, crewed yachts, and premium on-board experiences.

The rise of digital platforms and mobile applications has further revolutionized the yacht chartering experience, making it easier for clients to book luxury yachts through on-demand services. Emerging travel trends such as eco-tourism, remote work from yachts, and luxury adventure tourism fuel demand. For example,

The Mediterranean, Caribbean, and Southeast Asia remain key charter destinations, with surging interest in polar and expedition yachts for unique experiences. Rising yacht chartering is projected to boost market growth while reducing barriers associated with traditional yacht ownership.

Type Insights

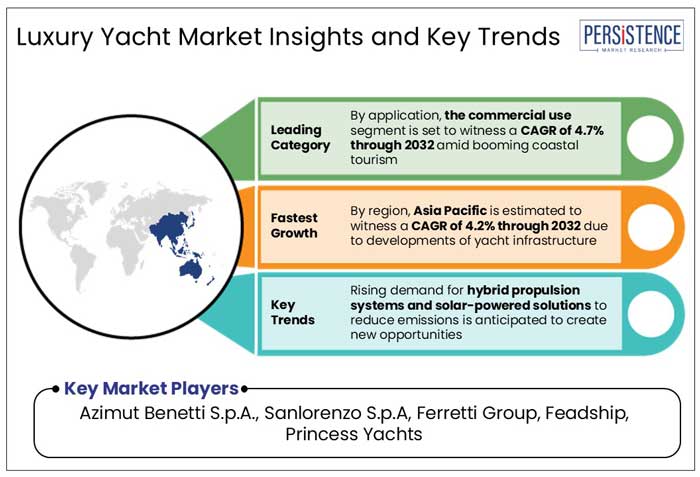

Motor Yachts with Long-distance Cruising Capabilities and Superior Amenities to Gain Popularity

Motor yachts dominate the market, holding a total share of about 75% in 2025. These high-powered vessels are preferred by ultra-high-net-worth individuals (UHNWIs) due to their speed, comfort, novel technology, and superior onboard amenities.

Motor yachts are built for powerful performance and long-distance cruising, making these ideal for high-net-worth travelers who value speed and efficiency. Several superyachts (40m+) and mega yachts (100m+) fall under this category, offering lavish interiors, infinity pools, helipads, and state-of-the-art entertainment systems.

With sustainability in focus, luxury yacht companies like Ferretti, Azimut-Benetti, and Lürssen are integrating hybrid propulsion systems and solar-powered solutions into their designs. For example,

Application Insights

Rising HNWI Population in Southeast Asia Seeking Privacy to Bolster Personal Ownership

Personal ownership remains the leading application in the luxury yacht industry with a share of 65% in 2025. It is projected to be augmented by ultra-high-net-worth individuals (UHNWIs) who seek exclusivity, customization, and the ultimate maritime lifestyle. Owners mainly prefer bespoke designs, high-end interiors, and unique technologies for privacy and luxury. For example,

Rising demand for hybrid propulsion systems and solar-powered solutions to reduce emissions is anticipated to create new opportunities. An increasing number of HNWIs in China, India, and Southeast Asia is fueling demand for personal luxury yachts.

Firms in Europe Invest in Electric Yachts to Commit to Green Yachting Initiatives

Europe is the largest regional player in the field of luxury cabin cruisers, with its rich maritime heritage, world-class yacht manufacturers, and extensive coastline. The region hosts few of the most prestigious yacht builders, including Ferretti Group (Italy), Azimut-Benetti (Italy), Feadship (Netherlands), and Lürssen (Germany).

Italy is a leader in luxury yacht production, with companies like Azimut, Benetti, and Ferretti Group consistently delivering high-end vessels worldwide. Italian craftsmanship and design expertise continue to attract global buyers. For example,

The French Riviera, Monaco, Greece, and Spain remain top luxury yacht destinations. The Mediterranean yachting season (May to September) sees an influx of ultra-high-net-worth individuals (UHNWIs) chartering yachts. Owing to the aforementioned factors, Europe luxury yacht market is estimated to hold a share of 47% in 2025.

Renowned Yacht Shows in Marinas across North America to Spur Demand for Luxury Tug Boats

North America luxury yacht market is set to hold a share of 35% in 2025. The region has a well-established yachting culture, particularly in the U.S., where coastal states like Florida, California, and New York contribute significantly to the market.

The region is also home to few of the world's wealthiest individuals, who view yachts as a status symbol and a prime luxury investment. The U.S. alone accounts for about 25% of global superyacht purchases, solidifying its position as a dominant force in the industry.

North America boasts few of the world's best marinas and luxury yacht hubs, including Miami, Fort Lauderdale, Newport, and the Bahamas. These locations host renowned yacht shows, such as the Fort Lauderdale International Boat Show (FLIBS), attracting buyers from around the world.

Asia Pacific Emerging as a Premier Yachting Hub with Government-backed Tourism Initiatives

Asia Pacific is witnessing rapid growth in the luxury yacht market with 18% of the total share in 2025. It is projected to be pushed by the rise of HNWIs, booming coastal tourism, and developments of yacht infrastructure. The region is projected to witness a CAGR of 4.2% through 2032.

China’s population of HNWIs increased by 4.4% in 2023, with significant interest in luxury assets, including yachts. The country’s regulations on private yacht ownership and limited marina infrastructure, however, pose challenges. On the other hand, India is set to create new opportunities for companies in the luxury catamaran industry.

Countries like Thailand, Indonesia, and the Philippines are positioning themselves as top yachting destinations, owing to their pristine coastlines and government-backed tourism initiatives. Digital platforms offering on-demand yacht rentals are further accelerating market growth. For example,

The luxury watercraft or yacht industry is highly competitive, driven by innovation, customization, and sustainability trends. Leading players leverage unique design, eco-friendly propulsion systems, and digital connectivity to remain competitive.

Europe remains the key manufacturing hub, with Italian and Dutch shipbuilders setting industry standards. North America leads in superyacht sales and charters, while Asia Pacific is witnessing rapid growth due to increasing HNWI wealth.

Leading players focus on hybrid and electric yachts to meet environmental regulations and surging consumer demand for sustainable luxury travel. Digital booking platforms and on-demand charter services further intensify competition, enhancing customer accessibility and personalization in the yachting experience.

Key Industry Developments

|

Report Attributes |

Details |

|

Historical Data/Actuals |

2019 – 2024 |

|

Forecast Period |

2025 – 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Type

By Size

By Application

By Region

To know more about delivery timeline for this report Contact Sales

The market is set to reach US$ 9.12 Bn in 2025.

Azimut Benetti S.p.A., Sanlorenzo S.p.A, and Ferretti Group are a few key players.

The industry is estimated to rise at a CAGR of 8.5% through 2032.

Europe is projected to hold the largest share of the industry in 2025.

The market is estimated to be valued at US$ 16.87 Bn by 2032.