Comprehensive Snapshot for India Taxi Market Including Regional and Segment Analysis in Brief.

Industry: Automotive & Transportation

Published Date: April-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 120

Report ID: PMRREP35215

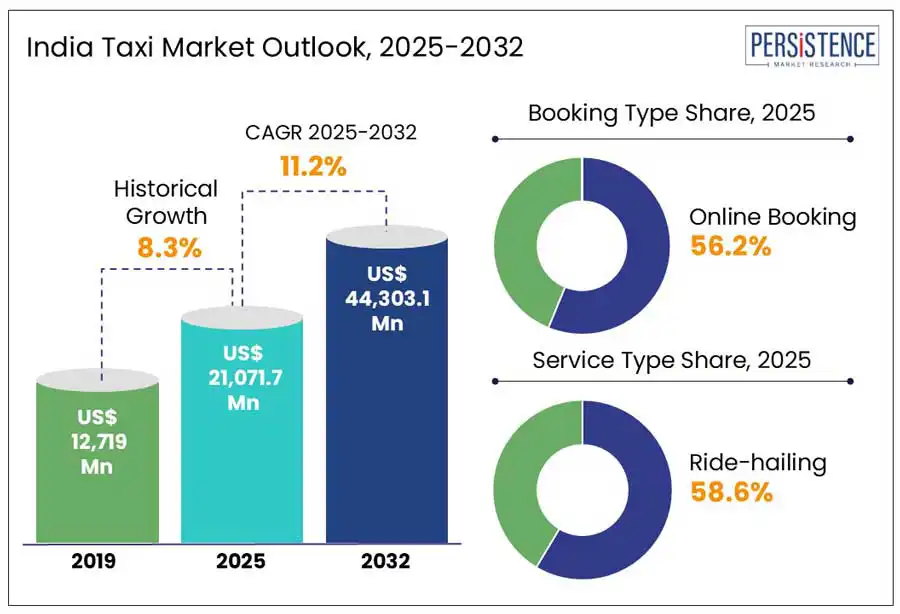

India taxi market size is projected to rise from US$ 21,071.7 Mn in 2025 to US$ 44,303.1 Mn by 2032. It is anticipated to witness a CAGR of 11.2% during the forecast period from 2025 to 2032.

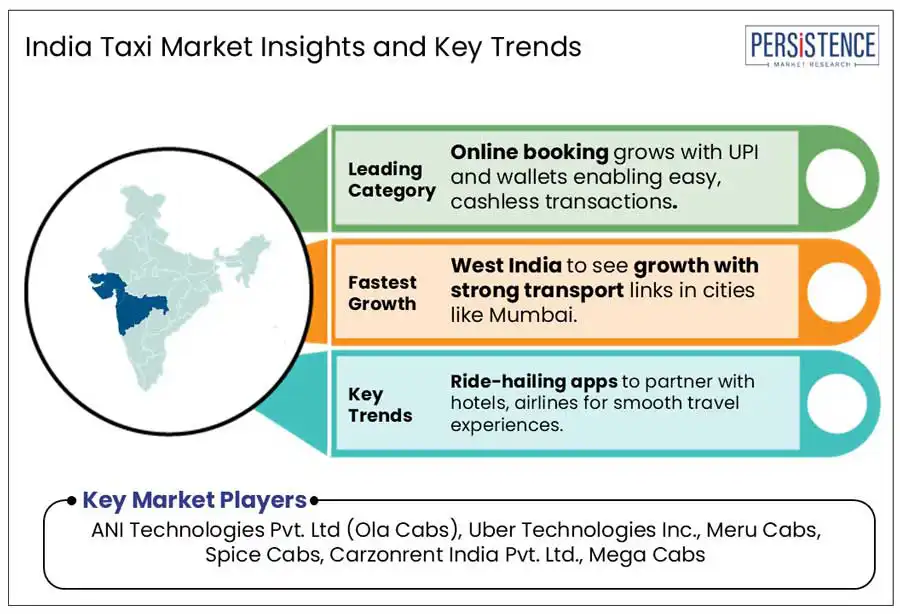

Increasing penetration of smartphones and rising number of app-based aggregators are envisioned to spur demand for taxi services in India. In tier 2 and tier 3 cities, conventional unorganized taxi services still hold a significant share. However, digital platforms and organized fleet operators such as Namma Yatri, Uber, Ola, BluSmart, and Rapido are striving to extend their footprint in these cities.

Key Industry Highlights

|

Market Attribute |

Key Insights |

|

India Taxi Market Size (2025E) |

US$ 21,071.7 Mn |

|

Market Value Forecast (2032F) |

US$ 44,303.1 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

11.2% |

|

Historical Market Growth (CAGR 2019 to 2024) |

8.3% |

Despite its extensive reach, India’s public transport system remains poorly integrated, overcrowded, and inconsistent, mainly in peri-urban and fast-growing urban areas. Rising reliance on taxi services, particularly for last- and first-mile connectivity, is mainly propelled by this infrastructure gap. A 2023 report by NITI Aayog stated that compared to more than 50% of urban commuters in countries across Southeast Asia such as Malaysia and Thailand, only 18% utilize public transport as their main means of travel in India.

Although most tier 1 cities have buses and metros, the network coverage is constrained by population density and daily travel demand. The issue is worsened during early morning hours or late nights when public transport is unavailable or unsafe. Hence, several taxi platforms have come up with digital payments, GPS tracking, and 24/7 availability to fill this gap.

Despite rapid digital transformation and expansion, India taxi market growth is estimated to be hampered to a certain extent with increasing operational challenges. A key drawback is projected to be the rising discontent among taxi drivers, particularly those connected to aggregator services such as Ola and Uber. Lack of transparency in incentive and fare structures, income instability, and high operational costs are a few factors pushing this unrest.

Commission rates on aggregator platforms range from 20% to 30% per ride. As incentive rules are complex and subject to frequent changes, drivers often report inconsistent earnings. A 2023 survey conducted by the Indian Federation of App-based Transport Workers (IFAT), for instance, revealed that around 74% of Uber and Ola drivers found the incentive system unfair and confusing. About 65% of drivers stated that compared to pre-2020 levels, their incomes had dropped significantly. As drivers are unable to communicate directly with aggregators, this issue has become more prevalent.

Key taxi service providers in India are predicted to gain new opportunities with the launch of bike taxis. They are focusing on providing flexible, quick, and cost-effective mobility solutions in the country, specifically in semi-urban and urban areas. Bike taxis have also become a significant source of income for thousands of people in the country.

As of 2023, Rapido, for example, claims to have onboarded more than 500,000 captains or bike taxi drivers across India. Several of these drivers are part-time workers, delivery riders, or students with supplementary income. The company has kept its onboarding cost low as all that is required is a smartphone, a two-wheeler, and a valid driving license. A few platforms such as GoBike and She Cab have further launched women-specific services for safe commuting. These companies are experimenting with all-women fleets, creating job opportunities for women.

A leading trend in India is poised to be the boom of green and Electric Vehicle (EV) fleets. The government’s Faster Adoption and Manufacturing of Electric Vehicles (FAME II) scheme, for example, has been playing a key role in bolstering electric mobility. The scheme provides subsidies for electric four-wheelers, three-wheelers, and two-wheelers for usage for commercial purposes or public transportation.

Several companies in India are striving to enter the electric taxi space. BluSmart Mobility, for instance, is considered the country's first-ever all-electric ride-hailing platform. It operates in Bengaluru and Delhi-NCR with a fleet of more than 6,000 EVs, mainly MG ZS EVs and Tata Tigor EVs. The company has saved over 18,000 metric tons of carbon dioxide emissions by completing more than 10 Mn electric trips as of late 2023. Similar initiatives by emerging companies are projected to help enhance sustainability in India.

Based on booking type, the market is bifurcated into online and offline booking. Among these, the online segment is estimated to lead with a share of nearly 56.2% in 2025. It is attributed to high reliability, user convenience, and growth of digital infrastructure.

According to the Telecom Regulatory Authority of India (TRAI), the country currently has more than 850 Mn internet users and 750 Mn smartphone users. This high digital penetration has spurred demand for online taxi booking platforms. These platforms also provide real-time fare predictions, surge-free options, coupons, and discounts. Hence, customers tend to be often attracted toward this transparency.

Offline booking, on the other hand, is poised to exhibit average growth through 2032, backed by limited availability. Compared to online platforms providing access to taxis 24/7, offline taxis rely on availability at airports, bus stands, railway stations, or by hailing on roads. These options are considered both limited and unpredictable in terms of scope.

By service type, the market is bifurcated into ride-hailing and ridesharing. Out of these, the ride-hailing segment will likely dominate by generating around 58.6% of India taxi market share in 2025, says Persistence Market Research. Increasing demand for last-mile, short-distance connectivity in urban areas is expected to spur the segment.

Ride-hailing platforms are not limited to a specific vehicle type. These provide EVs, sedans, hatchbacks, bikes, and autos on a single interface. This flexibility often appeals to a wide customer base, right from working professionals choosing AC sedans to college students opting for low-cost bike rides. Between 2022 and 2023, for instance, Ola witnessed a 200% surge in rides in its auto segment, specifically in Bhopal, Lucknow, and Chennai.

Ridesharing services are envisioned to showcase decent growth in the foreseeable future due to evolving commuting patterns, rising traffic issues, and economic necessity. Ridesharing enables users to split fares, making cab rides more affordable than solo travel. As per a recent study, around 35 to 40% of urban app-based taxi users opt for shared rides in India when available.

With more than 40% of all online taxi bookings in North India coming from the national capital alone, Delhi-NCR leads the regional market. Several local platforms have emerged providing services across various segments, including electric taxis, bike taxis, auto, and economy. More than 1.2 crore vehicle trips are made in the city every day, which surges demand for app-based taxi booking platforms that save money on parking and fuel.

Uttarakhand and Himachal Pradesh are also anticipated to see high demand for taxi services bolstered by tourism. In Nainital, Manali, Mussoorie, and Shimla, local taxi unions are still at the forefront of business. However, online booking trend is rapidly rising through aggregator platforms such as MakeMyTrip, Savaari, and Gozo Cabs. Taxi bookings from Delhi to hill stations increased by 42% during the summer season of 2023. A steady shift toward app-based outstation cab bookings was seen during this period.

West India is expected to account for a share of about 42.6% in 2025. India’s financial capital, Mumbai, is predicted to be the dominant market in the region. As per Maharashtra Transport Department, around 3.5 Mn daily taxi rides took place in the city in 2023. Mumbai is also home to both modern app-based and traditional taxis, which together account for more than 65% of all private taxi rides.

Pune, a significant education and technology hub is estimated to be another key market for ride-hailing apps. According to the 2023 Mobility Report, the movement of students and IT workers in neighborhoods such as Magarpatta and Hinjewadi drove an 18% year-on-year surge in app-based taxi trips in Pune. In West India, one of the busiest intercity taxi routes, the Ahmedabad to Vadodara route, has become a significant source of income for app-based taxi booking platforms.

In East India, Kolkata appears to be heading toward rapid growth as it is a significant hub for both novel ride-hailing services and conventional yellow taxis. Uber revealed a 25% year-on-year growth in the city in 2023, mainly propelled by a rising middle-class, weekend tourism, and officegoers. Increasing interstate travel to nearby states such as Bihar and Odisha is also projected to create new opportunities for taxi service providers.

In Odisha, ride-hailing services are presumed to see a steady increase in Bhubaneshwar, with major providers extending their presence in the city. Uber, for example, broadened its operations in 2023 by 30% in the city, highlighting surging demand for taxis among students and working professionals. The smart city project in Bhubaneswar has further enhanced infrastructure, creating a high demand for ride-hailing services.

India taxi market is fragmented due to the presence of various players with high competition. Most of these players are focusing on embracing new strategies and technologies to attract a large customer base and generate high shares. Government agencies are also investing huge sums in the development of innovative taxi services. Bike taxis are anticipated to witness significant innovations in India as customers prefer cost-effective and quick transportation services.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Booking Type

By Service Type

By Vehicle

By Region

To know more about delivery timeline for this report Contact Sales

The India taxi market is projected to be valued at US$ 21,071.7 Mn in 2025.

Increasing number of app-based aggregators and emergence of dynamic pricing models are the key market drivers.

The market is poised to witness a CAGR of 11.2% from 2025 to 2032.

Launch of bike taxis for quick transportation and introduction of EV taxi fleets are the key market opportunities.

ANI Technologies Pvt. Ltd (Ola Cabs), Uber Technologies Inc., and Meru Cabs are the key players.