Bullet-Resistant Glass Market Segmented By Polycarbonate, Acrylic, Glass-clad Polycarbonate, Poly-vinyl Butyral Product in Financial Services, Automotive, Buildings

Industry: Chemicals and Materials

Published Date: August-2016

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 111

Report ID: PMRREP11440

Bullet-resistant glass is produced using ballistic materials such as polycarbonate, acrylic, glass-clad polycarbonate, and thermoplastics that can withstand any damage from small projectiles and bullets. Bullet-resistant glass is offered in varying thickness according to end user demand.

End users of bulletproof security glass include financial services industry, automotive industry, construction industry, and others such as marine industry and aerospace industry.

In this report, the bullet-resistant glass market in India is categorized by product type, BRG standard, application, and state. By product type, the market is segmented into polycarbonate, acrylic, glass-clad polycarbonate, and poly-vinyl butyral (PVB). By BRG standard, the market has been segmented according to European Standard ‘EN 1063’, classifying bullet-resistant glass from class B1 to B7 and special class (SG1 and SG2) depending upon the protection level required.

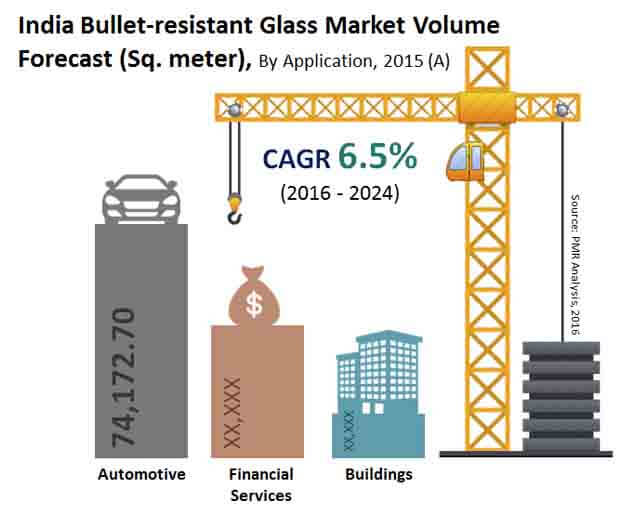

In terms of volume, the India bullet-resistant glass market was pegged at 129.8 ‘000 sq. m. in 2015 and is anticipated to grow substantially over the forecast period. PMR forecasts the bullet-resistant glass market in India to expand at a volume CAGR of 6.5% over 2016–2024 based on various factors, regarding which PMR offers in-depth insights in the report.

Increasing economic output and defense investments as well as growth of construction, financial, and automotive sectors are factors expected to significantly impact growth of the bullet-resistant glass market in India. The automotive sector is the largest end-user for bullet-resistant glass in India, with increasing number of HNWIs opting for armored vehicles, which in turn drives demand for bullet-resistant glass.

Furthermore, ongoing infrastructural developments in the financial sector offer various opportunities for bullet-resistant glass manufacturers in India, as financial institutions, especially in rural areas, are vulnerable to burglary and vandalism.

Failure of locally manufactured bullet-resistant glass to meet international quality standards, high costs of raw materials, and low-cost imports from China are factors anticipated to adversely hamper the growth of the bullet-resistant glass market in the country over the forecast period.

Key trends identified in the bullet-resistant glass market in India are a focus of players to provide customized bullet-proofing solutions to customers, partnering with defense organizations to meet specific product needs, and focus on providing value-added products that provide add-on features such as heat insulation/fireproof and UV protection.

By product type, glass-clad polycarbonate segment is anticipated to maintain dominant share over the forecast period and expand at a volume CAGR of 7.6% over 2016–2024. PVB and polycarbonate segments are expected to collectively account for 46.0% share of the bullet-resistant glass market in terms of volume by the end of 2024. The market share of an acrylic segment is anticipated to be minimal over the forecast period due to a use of acrylic in applications requiring low levels of protection.

By application, an automotive segment is expected to remain dominant over the forecast period; however, financial services segment is expected to register robust growth and expand at a volume CAGR of 7.2% over 2016–2024. Demand for bullet-resistant glass from building segment is expected to remain low in India owing to high costs of the product. In building segment, commercial buildings sub-segment is expected to expand at the highest CAGR of 5.1% in terms of volume over the forecast period.

India Bullet-resistant Glass Market Volume Forecast (Sq. M.) by Application, 2015–2024

By BRG class, BR4, BR5, and BR6 segments are anticipated to account for over 3/4th of the total market volume by the end of 2016 and expand at volume CAGRs of 7.0%, 6.4%, and 6.1%, respectively, over the forecast period. BR1 and BR2 segments are expected to hold minimal shares throughout the forecast period.

The report on the bullet-resistant glass market in India is also segmented on the basis of states into Delhi, Maharashtra, Tamil Nadu, Karnataka, Gujarat, Punjab, Haryana, Uttar Pradesh, West Bengal, Madhya Pradesh, and rest of India. Demand for bullet-resistant glass is expected to be the highest in Maharashtra over the forecast period, followed by Tamil Nadu and Delhi.

Some key players profiled in the report are Saint-Gobain India Pvt. Ltd., Asahi India Glass Limited, Gujarat Guardian Ltd., Duratuf Glass Industries (P) Ltd., Jeet & Jeet Glass and Chemicals Pvt. Ltd., Gold Plus Glass Industry Limited, FG Glass Industries Pvt. Ltd., Chandra Lakshmi Safety Glass Ltd., Fuso Glass India Pvt. Ltd., Art-n-Glass Inc., and Gurind India Pvt. Ltd.

| Attribute | Details |

|---|---|

|

By Product Type |

|

|

By Application |

|

|

BRG Class |

|

|

State |

|

To know more about delivery timeline for this report Contact Sales