ID: PMRREP33137| 250 Pages | 21 Feb 2025 | Format: PDF, Excel, PPT* | Healthcare

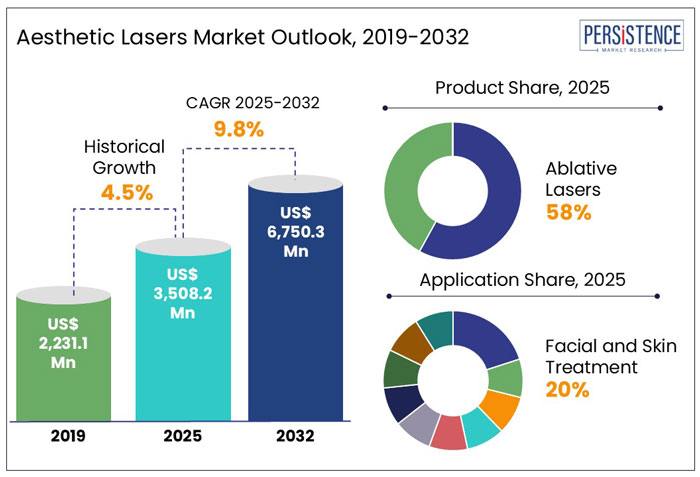

The Global Aesthetic Lasers Market is expected to grow from US$ 3,508.2 Mn in 2025 to US$ 6,750.3 Mn in 2032, at a substantial CAGR of 9.8% from 2025 to 2032.

As assessed by Persistence Market Research, aesthetic laser products are expected to account for a market value of US$ 6,750.0 Mn by the end of 2032. Overall, aesthetic laser sales accounted for approximately 25% revenue share of the global aesthetics market in 2024.

| Attribute | Key Insights |

|---|---|

|

Aesthetic Lasers Market Size (2025) |

US$ 3,508.2 Mn |

|

Projected Market Value (2032) |

US$ 6,750.0 Mn |

|

Global Market Growth Rate (2025-2032) |

9.8% CAGR |

|

Market Share of Top 5 Countries |

57.1% |

The global market for aesthetic lasers recorded a historic CAGR of 4.5% from 2019 to 2024.

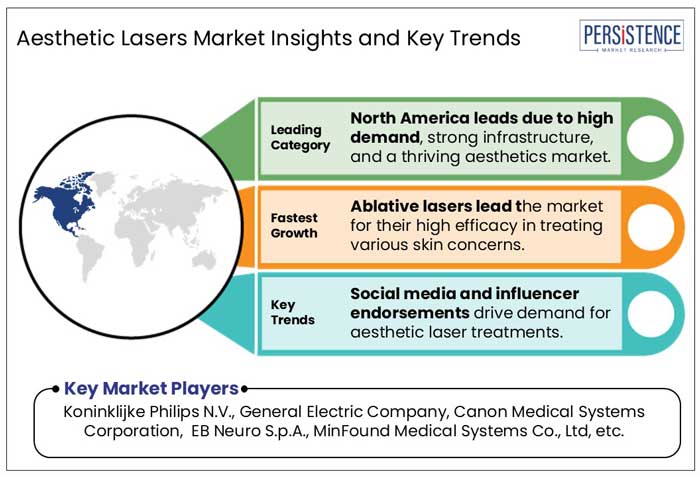

The aesthetic lasers market has experienced significant growth over the past decade, driven by rising consumer demand for minimally invasive cosmetic procedures, advancements in laser technologies, and the increasing acceptance of aesthetic treatments among a broader demographic. Historically, the market has been shaped by technological innovations that have improved the safety, efficacy, and versatility of laser-based treatments, making them more accessible to both practitioners and patients. The expansion of medical tourism, particularly in regions known for affordable yet high-quality aesthetic procedures, has also contributed to market growth. Additionally, factors such as the growing aging population, rising disposable incomes, and the influence of social media on beauty standards have played a crucial role in boosting demand for laser-based skin rejuvenation, hair removal, and body contouring treatments.

Looking ahead, the aesthetic lasers market is poised for continued expansion, with the introduction of more sophisticated and customizable laser devices catering to diverse skin types and treatment needs. The increasing integration of artificial intelligence and machine learning into laser systems is expected to enhance precision and patient outcomes, making treatments safer and more effective.

“Technological Advancements Leading to Increased Product Adoption”

Technological advancements in laser treatments have led to the growth of the market and will continue to do so in the future. This has shifted procedures to more advanced techniques that are pain-free and require minimal time. Compared to past procedures, today, the market is highly developed with advanced equipment and techniques.

For example,

Manufacturers are also involved in increased research and development to introduce more cost-effective and advanced technology. These increasing research and development activities by market players will soon result in the introduction of more advanced and new technologies. These factors are expected to improve the acceptance and adoption of aesthetic lasers, resulting in high market growth throughout the forecast period.

“High Cost of Aesthetic Laser Procedures”

Since aesthetic lasers are technologically advanced, the manufacturing costs for these devices are also quite high. Moreover, regulatory impositions upon medical devices can hinder the licensing process and could present delays in product launch activities, thus restraining the growth of the market. The maintenance of these facilities also adds up to the cost of the service.

Increased cost is a challenge that is hampering overall market growth and also restrains some of the population from adopting these procedures. This is especially a barrier for lower-middle-income groups.

For instance,

Why is the U.S. Aesthetic Lasers Market Booming?

“High Adoption of Non-Invasive Aesthetic Treatment Procedures in the U.S.”

The U.S. accounted for around 86.6% share in the North American aesthetic lasers market in 2024.

This high market share is due to the increased adoption of non-invasive laser treatment procedures in the U.S. It is associated with increased success rates of these procedures among the population. People in the country are now quite aware that for conditions such as fine lines, skin tightening, scar repair, and removing tattoos, laser procedures are the topmost choice.

For instance,

Will Germany Be a Lucrative Market for Aesthetic Laser Product Providers?

“Increasing Product Manufacturers & Number of Clinics”

Germany held around 11.2% share of the global aesthetic lasers market in 2024.

Germany will continue to be a lucrative market for aesthetic products because of the growing number of aesthetic clinics and the increased number of manufacturers of aesthetic products in the country.

Market players are involved in working on improvements in their product portfolios to improve aesthetic lasers. There are several manufacturers headquartered in Germany who sell products in the country as well as globally.

For instance,

How is China Emerging as a Prominent Market for Aesthetic Lasers?

“Growing Personal Income Leading to Greater Adoption Rates”

China held a market share of 8.7% of the global aesthetic lasers market in 2024.

Increase in the income of the Chinese population is leading to higher adoption of laser procedures in the country, although there is a significant chance of more demand growth for aesthetic laser products in the future.

Currently, aesthetic laser procedures are gaining popularity in the country with increased requirements of the population for improved physical appearance. There are also many Chinese manufacturers involved in aesthetic laser production.

Which Type of Aesthetic Laser Accounts for High Market Share?

“High Demand for Ablative Lasers across Regions”

Ablative lasers held 52.6% share of the overall aesthetic lasers market in 2024.

The procedures using ablative lasers have been seen to be effective in treating severe aging symptoms such as wrinkles, scars, and discoloration. These procedures also promote the growth of collagen, thus improving the firmness and texture of the skin.

For Which Application are Aesthetic Lasers Most Widely Used?

“Hair Removal Procedures Driving High Need for Aesthetic Lasers”

Hair removal procedures held the largest market share, by application, at around 22.2% in 2024.

This is because it is one of the most common and demanding procedures among the general population. Getting rid of unwanted hair on the body and enhancing beauty has led to an increase in the adoption of this treatment procedure, which is also less time-consuming.

Top producers are developing technologically innovative products to enhance their product ranges globally. Major industry contenders in the aesthetic lasers market space are engaged in consolidation strategies, including mergers and acquisitions.

For instance:

The global aesthetic lasers market is expected to be valued at US$ 3,508.2 Mn in 2025.

Sales of aesthetic lasers are expected to surge at 9.8% CAGR and be valued at US$ 6,750.0 Mn by 2032.

Global demand for aesthetic lasers had increased at a 4.5% CAGR from 2019 to 2024.

The U.S., Germany, China, the U.K., and France account for most demand for aesthetic lasers, currently holding 57.1% market share.

The U.S. currently accounts for 86.6% share of the North American market.

Cynosure, Inc., Cutera, Inc., and Alma Lasers are the top three manufacturers of aesthetic laser products.

China had held a share of 8.7% in the global aesthetic lasers market in 2024.

Hair removal applications had held the highest market share of 22.2% in 2024.

| Attribute | Details |

|---|---|

|

Forecast Period |

2025-2032 |

|

Historical Data Available for |

2019-2024 |

| Market Analysis Units | Value: US$ Bn/Mn, Volume: As applicable |

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

| Report Highlights |

|

|

Customization & Pricing |

Available upon Request |

Aesthetic Lasers Market by Product:

Aesthetic Lasers Market by Application:

Aesthetic Lasers Market by End User:

Aesthetic Lasers Market by Region:

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author