Industry: Consumer Goods

Published Date: March-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 167

Report ID: PMRREP35141

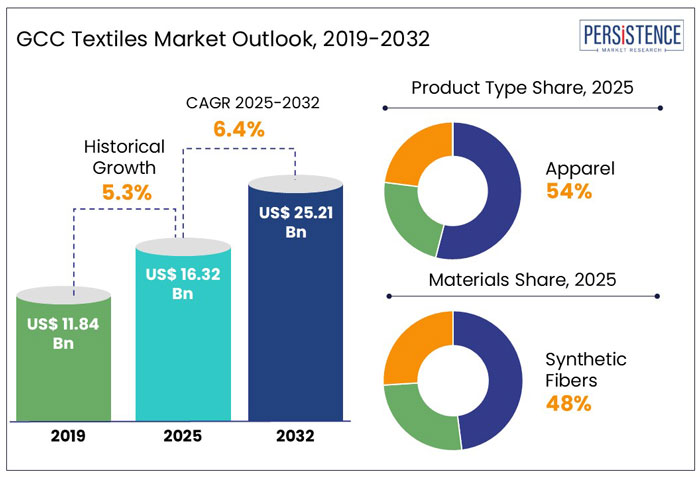

The GCC Textiles market size is anticipated to rise from US$ 16.32 Bn in 2025 to US$ 25.21 Bn by 2032. It is projected to witness a CAGR of 6.4% from 2025 to 2032.

The Gulf Cooperation Council (GCC) textile industry is experiencing rapid growth, driven by rising urbanization in the region, and expanding tourism and hospitality sectors. In 2025, the UAE and Saudi Arabia are projected to dominate textile demand, particularly in apparel, home furnishings, and luxury fashion.

The UAE's textile trade exceeded US$ 4.5 Bn in 2023, with Dubai positioning itself as a major global hub. Similarly, Saudi Arabia’s Vision 2030 initiative is encouraging domestic textile manufacturing, reducing import reliance, and fostering local production. For instance, in January 2024, Saudi Arabia launched a US$ 50 Mn textile manufacturing hub to enhance modest fashion and traditional garments, aligning with growing demand for Islamic fashion.

Meanwhile, events such as The UAE's Moda Dubai Expo 2024 has boosted international collaborations in the luxury textile segment, with sustainability trends and retail infrastructure growth solidifying the GCC's role as a key textile player.

Key Highlights of the GCC Textiles Market

|

Global Market Attributes |

Key Insights |

|

GCC Textiles Market Size (2025E) |

US$ 16.32 Bn |

|

Market Value Forecast (2032F) |

US$ 25.21 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

6.4% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.3% |

Trade Policies Drive GCC Textile Growth with Technical Breakthroughs

As per Persistence Market Research, the GCC textiles industry experienced a CAGR of 5.3% between 2019 and 2024, driven by technological advancements, novel trade policies, and economic diversification efforts.

As per the World Bank’s Gulf Economic Update, the region's shift toward non-oil sectors have enhanced textile production capabilities. The UAE and Saudi Arabia are at the forefront, investing in automated weaving and smart textiles to compete globally.

In 2023, Saudi Arabia announced a US$ 1 Bn investment in sustainable textile manufacturing, focusing on eco-friendly fibers and digital production techniques.

In order to provide improved working conditions and higher productivity for textile workers, the Global Health Research and Policy (2024) research emphasizes the significance of the labor and health sectors. Additionally, Expo 2020 Dubai and Saudi Arabia’s Vision 2030 initiative has attracted foreign investment, positioning the GCC as a growing hub for high-tech textiles and sustainable fashion production.

Tourism Boom in the Gulf Countries Fuels Investments in Hotel Textile Industry

In the estimated timeframe from 2025 to 2032, the global market for GCC textiles is likely to showcase a CAGR of 6.4%. The expansion of the GCC tourism and hospitality industry is increasing demand for hotel textiles such as bed linens, towels, and decorative fabrics. The UAE, Saudi Arabia, and Qatar are leading the growth, with major hotel chains investing in luxury textiles to enhance guest experiences. For example,

Dubai’s hotel occupancy rate reached 82% in 2023, according to the Dubai Department of Economy and Tourism, driving demand for high-quality hospitality textiles. This growth trend is envisioned to be utilized by industry giants in hospitality industry. Such as, Jumeirah Group and Marriott Middle East have expanded textile procurement from GCC-based manufacturers to meet sustainability standards.

After hosting the FIFA World Cup 2022, Qatar saw a 12% year-on-year increase in hotel demand, fueling investments in premium textiles. The trend is pushing GCC textile firms to focus on luxury and sustainable materials, strengthening local manufacturing capabilities.

Growth Driver

Retail and E-commerce Expansion Fuels Textile Industry Growth in GCC

Textile items are becoming more accessible to consumers because of the GCC's fast growth in retail infrastructure, which includes shopping centers along with e-commerce websites.

The UAE and Saudi Arabia are driving the shift towards shopping infrastructure, with Saudi Vision 2030 aiming for a 20% rise in the retail sector's GDP contribution in 2025. The Mall of Saudi, a US$ 4.3 Bn project scheduled to be completed in 2026, is anticipated to feature fast-fashion and luxury brands, increasing demand for home textiles and clothing.

With platforms like Noon, Amazon UAE, and Namshi reporting a 35% year-over-year rise in fashion and home textile sales in 2023, e-commerce sales are also transforming the textile industry in the region. The demand for premium textiles will be fueled by the UAE's e-commerce industry, which is projected to reach a peak of US$ 9.2 Bn by 2026. As major brands expand online and offline retail channels, textile accessibility continues to rise, benefiting local manufacturers and international brands operating in the GCC region.

Financial Distresses in the Gulf Trade Operations Challenges Textile Production

The fabrics industry in the Gulf region is challenged by high import dependency and limited domestic production. As the region imports over 85% of its textile and fabric needs, relying heavily on manufacturers from China, India, and Bangladesh, who offer lower-cost alternatives. Despite efforts under Saudi Vision 2030 and the UAE’s Operation 300bn to localize manufacturing, domestic production remains insufficient to meet demand.

Water scarcity is another critical barrier in the region. The textile industry is one of the most water-intensive sectors, yet the GCC is one of the driest regions globally, with average annual rainfall below 100mm. High energy costs for desalination and industrial operations further inflate manufacturing expenses in the forthcoming years.

Variations in oil prices also affect consumer spending and economic stability, which changes the demand for high-end and low-end textiles. Furthermore, operational difficulties are brought on by a lack of manpower and a reliance on foreign workers, who make up more than 80% of the workforce in the United Arab Emirates and Saudi Arabia. For the market to thrive, such issues must be resolved through trade policy changes, investment in research and development, and sustainable production.

Shift Towards the Sustainable Luxury Items Presents Lucrative Prospects

The textile market of the GCC region is envisioned to shift toward sustainability, with companies integrating eco-friendly materials and ethical production processes. The Saudi State of Fashion Report 2024 highlights that 65% of consumers in Saudi Arabia prefer sustainable fashion, pushing brands to adopt greener manufacturing practices. For instance,

The GCC's high-net-worth population, which contributes more than 21% of global luxury spending, is fueling the growth of luxury textiles. Saudi Arabia's efforts to create a prestigious textile manufacturing sector are in line with Vision 2030, which promotes domestic production for sale to other countries.

The emergence of eco-conscious consumerism and the luxury fashion segment is redefining textile manufacturing practices, with greater investment in premium, sustainable textiles to satisfy changing customer demands.

Product Type Insights

Novel Fashion Trends in Apparel Pave the Way in the GCC Countries

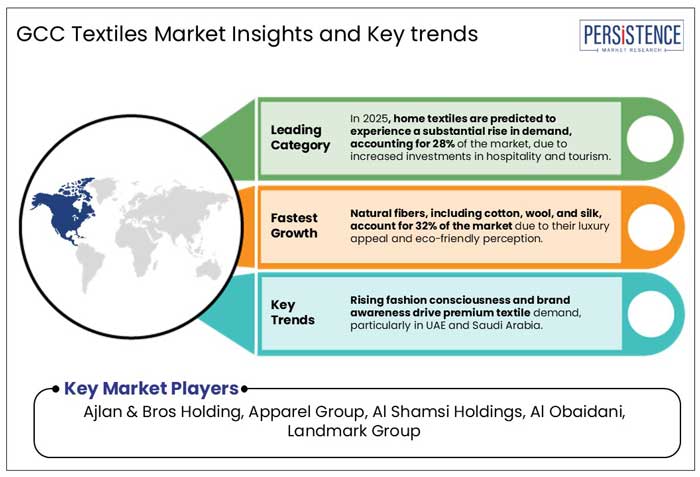

The GCC textile market continues to expand, driven by the diverse needs of apparel, home textiles, and industrial textiles. Apparel remains the dominant segment, projected to hold 54% of the market in 2025, fueled by the demand for modest fashion, luxury brands, and sportswear. With Saudi Arabia and the UAE leading the region’s fashion scene, global and local brands are catering to evolving consumer preferences.

At the same time, home textiles are experiencing significant demand, accounting for 28% of the market, owing to increased investments in hospitality and tourism. The region’s focus on luxury living and premium-quality home essentials has boosted the demand for high-end bed linens, towels, and upholstery fabrics.

On the industrial side, companies like Advanced Fabrics (SAAF) are making strides in high-performance textiles for protective wear, filtration systems, and geotextiles used in the construction, automotive, and medical industries. As innovation and sustainability reshape the market, the GCC emerges as a key player in the global textile industry.

Materials Insights

Synthetic Fibers Leave a Mark On GCC Textile Market with Its Affordability and Durability

The GCC textile market is experiencing steady growth, with natural fibers, synthetic fibers, and blended fabrics meeting diverse industry needs. In 2025, synthetic fibers are set to lead the market, making up 48% of the total supply, owing to their affordability, durability, and versatility. Saudi Basic Industries Corporation (SABIC) is playing a key role in advancing polyester and polypropylene fiber production, aligning with the region’s push toward sustainable and circular economy practices.

At the same time, natural fibers like cotton, wool, and silk hold 32% of the market, valued for their luxurious feel and eco-friendliness. The Saudi Cotton Initiative, launched in March 2024, aims to boost local cotton production and reduce reliance on imports.

Blended fabrics, offering a mix of comfort and performance, are also gaining popularity. In December 2024, Fabrica Kraft introduced eco-friendly blended textiles in Saudi Arabia and the UAE, catering to the rising demand for sustainable fashion and home textiles. As the region moves toward eco-conscious manufacturing and innovation in fiber production, the future of the GCC textile industry looks promising.

The GCC textile industry is controlled by fierce competition between local manufacturers, regional companies, and global brands. While multinational companies predominate in the luxury and fast-fashion categories, local businesses concentrate on traditional and cultural textiles.

Government programs encouraging sustainability and homegrown manufacturing have made competition fiercer. Businesses in specialized markets stand out owing to innovations in sustainable practices and smart fabrics.

The emergence of e-commerce in the GCC region has heightened competition as companies strive to satisfy the changing demands of tech-savvy customers.

Key Industry Developments

|

Report Attributes |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Materials

By Region

To know more about delivery timeline for this report Contact Sales

The market is set to reach US$ 16.32 Bn in 2025.

Natural fibers, synthetic fibers, and blended fabrics are all types of materials utilized in various industries.

Ajlan & Bros Holding, Apparel Group, Al Shamsi Holdings, Al Obaidani, Landmark Group are a few leading players.

The industry is estimated to rise at a CAGR of 6.4% through 2032.

3D printing is revolutionizing the textile industry by providing customization, sustainability, innovation, waste reduction, and on-demand production for intricate designs.