Industry: Chemicals and Materials

Published Date: June-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 160

Report ID: PMRREP10864

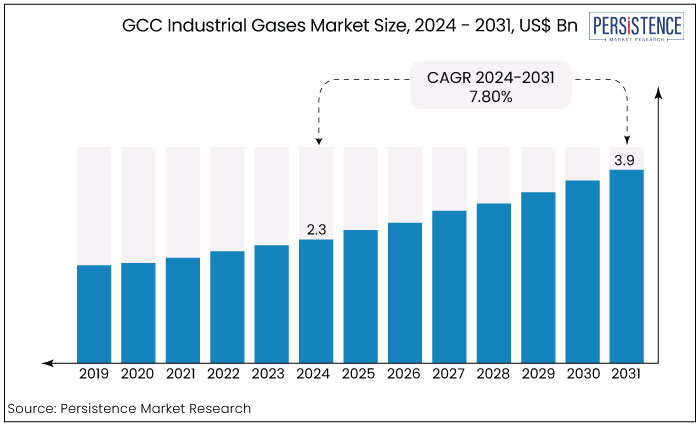

The market for GCC industrial gases surpassed a valuation of US$2 Bn in 2021 and will possibly reach around US$2.3 Bn in the year 2024. Between the forecast years 2024 and 2031, the market for industrial gases in GCC countries is expected to witness a CAGR of 7.8%.

Key Highlights of the Market

|

Report Attributes |

Details |

|

Market Size (2024E) |

US$2.3 Bn |

|

Market Estimation (2031F) |

US$3.9 Bn |

|

Forecast Growth Rate (CAGR 2024 to 2031) |

7.80% |

|

Historical Growth Rate (CAGR 2019 to 2023) |

6.80% |

The market for GCC industrial gases is a thriving sector with significant growth potential. The market encompasses the production, distribution, and sale of various industrial gases used across numerous industries in the Gulf Cooperation Council (GCC) countries, viz., Saudi Arabia, Kuwait, United Arab Emirates (UAE), Qatar, Bahrain, and Oman.

Industrial gases find wide applications in various sectors like chemicals, pharmaceuticals, oil & gas refining, F&B processing, metal production & fabrication, and healthcare. This will continue to keep the demand afloat.

The growth outlook of GCC’s industrial gases looks promising. Rising awareness of advanced medical practices is expected to further increase demand for medical-grade gases.

Technological advancements like cryogenic separation techniques could improve efficiency, and gas utilization.

The growing emphasis on advanced healthcare facilities and the need for efficient and reliable energy sources will continue to drive the demand for industrial gases in the GCC region. Focus on sustainability may also lead to the adoption of eco-friendly gas production methods.

The mounting energy needs in the region necessitate the use of industrial gases in sectors like power generation, and oil & gas processing. The GCC's focus on diversifying its economy beyond oil and gas is driving industrial expansion, leading to increased demand for industrial gases.

The increasing consumption of processed food and beverage products is creating a demand for gases like nitrogen, and carbon dioxide as they are extensively employed in packaging applications by the food processing sector.

Moreover, the rapidly developing medical infrastructure across the region continues to demand industrial gases for a variety of applications that majorly include oxygen therapy, and medical imaging.

Over the historical period, the market for industrial gases has enjoyed steady growth in GCC. While it surpassed the revenue worth US$2 Bn in 2021, notably rising energy demand, and a developing healthcare sector primarily drove the growth.

The COVID-19 pandemic caused a temporary setback. Lockdowns, and the resultant drop in demand from end-use sectors like food and beverage processing led to a measurable dip for the market in 2020.

However, the exploding demand for oxygen within healthcare and medicine partially offset this decline.

The GCC industrial gases market witnessed a relatively quick rebound post-pandemic, and projections suggest a continued upward trajectory through the end of forecast year.

Market evolution reflects changing needs. Growing focus on economic diversification is driving demand for gases in advanced manufacturing, and renewable energy sectors.

The outlook for the GCC industrial gases market is promising. Ongoing industrialization, a growing healthcare sector, and a focus on sustainability present significant growth opportunities.

Rising Energy Demand, Rapid Industrialization, and Economic Diversification

While the GCC countries traditionally rely on their oil and gas revenues, they have been actively diversifying their economies over the recent past.

Growing focus on industrial development across various sectors like manufacturing, construction, and petrochemicals serves as a significant booster to the growth of the industrial gases market in GCC.

These gases play crucial roles in numerous industrial processes, including steel production, metal welding, metal cutting, and chemical processing.

On the other hand, nitrogen is widely used for inert gas welding and purging pipelines, while oxygen is used for oxyfuel cutting. High-purity gases are critical for manufacturing electronic components, and integrated circuits.

As the GCC countries establish and expand their industrial base, the demand for industrial gases will naturally rise in tandem.

This industrial growth creates a multiplier effect for the market, with increased gas consumption feeding back into further industrial development.

Sophistication of Healthcare Sector

The GCC region is witnessing rapid advancements in its healthcare sector, translating into the brisk growth in demand for medical-grade industrial gases.

Hospitals require a steady supply of medical-grade oxygen for critical care patients that are to be subject to oxygen therapy. Moreover, medical-grade gases like nitrous oxide are widely used as anesthetics during surgeries.

The field of diagnostics is also transforming at an explosive pace and gases like helium are gaining extensive traction in medical imaging as they are used in MRI machines.

High Energy Costs

The production of industrial gases requires substantial energy input. Since the cost of electricity is high in the GCC region, it can limit profit margins for manufacturers and potentially hinder market expansion.

Safe and Effective Transportation

Electricity, natural gas, and diesel fuel serve as major energy sources for production and distribution of industrial gases. The efficiency, and cost of energy remains a major challenge facing most industry players.

Safe and efficient transportation of industrial gases, especially in bulk quantities, requires a robust pipeline network, and storage infrastructure.

Moreover, transportation costs mainly depend on gas pipelines that distribute large volumes of industrial gases to customers. Distribution costs for cylinder gases are even higher.

Besides, both high pressure cylinders, and liquid tanks have safety issues and require skilled manpower for proper handling.

The maintenance, and optimization of gas pipelines, tanks, and cylinders for transportation of industrial gases is thus anticipated to be one of the biggest challenges in the GCC industrial gases market.

The Rise of Advanced Manufacturing, and Growing Focus on Renewables

3D printing and other advanced manufacturing techniques require specialized gases, creating a niche market for gas suppliers.

The growing focus on renewables like hydrogen fuel cells opens doors for companies supplying hydrogen gas.

Increasing Inclination Towards Digitalization, and On-site Gas Generation

Growing implementation of digital solutions for logistics management, inventory control, and customer service reflects a lucrative opportunity as it can help with operational optimization, and enhanced customer experience.

On the other hand, the on-site gas generation technology allows for the production of industrial gases directly at customer locations, which reduces the transportation costs to a large extent, leading to a manifold increase in efficiency.

Oxygen and Nitrogen Remain at the Forefront

By gas type, oxygen, nitrogen, carbon dioxide, and hydrogen are estimated to remain the leading segments throughout the forecast period.

Oxygen and nitrogen form the backbone of the GCC industrial gases market. By gas type, oxygen, nitrogen, carbon dioxide, and hydrogen are estimated to remain the leading segments throughout the forecast period.

Argon is estimated to emerge as the fastest growing segment in the GCC industrial gases market. The increasing demand for various applications will propel market growth over the forecast period.

While industrial oxygen is essential for processes like steel production, metal welding, and medical applications like respiratory therapy. Its high demand is driven by ongoing industrialization, and a growing healthcare sector.

On the other hand, nitrogen continues to gain momentum because of its crucial role in inert gas welding, purging pipelines, and food preservation.

The rising demand from food and beverages industry and focus on efficient oil & gas production contribute to its increasing demand.

As the focus on clean energy intensifies, hydrogen is recently emerging as a promising fuel source. GCC countries that are rich in natural gas have the potential to become major players in hydrogen production.

While its overall demand might be lower compared to others, helium plays a vital role in medical imaging, especially MRI machines, and advanced technologies like aerospace applications.

However, limited supply, and irreplaceable nature of helium continue to make it a valuable segment.

Energy and Oil and Gas - Key Area of Application

This sector forms the bedrock of the GCC industrial gas market and accounts for a significant share of the demand pie.

Industrial gases like nitrogen are used for well stimulation, pressure maintenance, and inerting pipelines during oil and gas production. Natural gas itself is a feedstock for hydrogen production, a potential future fuel source.

Industrial gases like hydrogen and natural gas play a role in powering turbines for electricity generation.

The GCC's continued focus on its oil and gas reserves and the ongoing need for reliable power generation ensure this segment remains a major driver for industrial gas demand.

Oxygen: Critical for steel production through the oxidation process and essential for metal cutting and welding applications.

Nitrogen: Used to create an inert atmosphere during various metalworking processes to prevent oxidation and ensure product quality.

Argon: Provides an inert gas shield for welding processes involving reactive metals like titanium and aluminum.

The growth of the GCC's metals and metallurgy sector, driven by industrialization and infrastructure development, will continue to propel the demand for these industrial gases.

KSA Wears the Crown with More than 50% Revenue Share in GCC

The Kingdom of Saudi Arabia stands the strongest, holding the largest share of the industrial gases pie of the region. KSA currently occupies over 50% share of the GCC industrial gases market, attributing to a large, established industrial base.

Dynamic activities in key sectors, including oil and gas, steel production, and petrochemicals will predominantly pivot the supremacy of KSA throughout the period of projection as these sectors create remarkable demand for industrial nitrogen, oxygen, and hydrogen.

KSA's robust industrial foundation, coupled with its massive energy sector, creates a continuous and substantial demand for industrial gases, solidifying its position as the leader in the GCC market.

Saudi Arabia's crude oil production saw an impressive 14% yearly rise in 2022, whereas the liquid fuels production reflected a solid 12% annual increase the same year.

While KSA remains the leading oil and gas producer in the region, the demand for industrial gases for exploration, processing, and refining activities will also grow incessantly, pushing its primacy in the GCC industrial gases market.

UAE Shines as the Potential Frontrunner in GCC’s Industrial Gases Landscape

While KSA holds the top spot currently, the UAE is emerging as a strong contender in the GCC industrial gases market.

In addition to its strategic geographical location, the UAE expects large gains from its world-class infrastructure that collectively position it as the hub for trade, and logistics.

Industrial gas companies that are seeking an established presence across the region are thus likely to concentrate their strategic moves in the UAE, thereby cater to a wider market.

Diversification of the UAE’s economy much beyond oil and gas will continue to work to the advantage amidst the leaders in industrial gases.

However, the growth of major industries like construction, manufacturing, and tourism will also be game-changing for the industrial gases market in the UAE.

Air Liquide led the global industrial gas supply scene in 2022, followed by the Linde Group. Air Products and Chemicals Inc. also occupied a vital position as one of the leading gas companies in the GCC industrial gases market the same year.

The market is highly consolidated with large players holding nearly 45-55% share of the GCC overall regional market, with presence through local distributors, and suppliers.

The GCC industrial gases market is characterized by the presence of few big players from Qatar, and UAE. Established gas companies from all over the globe are looking forward to expanding their operations in the GCC.

Key strategies primarily include the focus on reduced operational/transportation costs, which is anticipated to provide a highly competitive edge to market players.

February 2024

Oman’s Duqm Refinery is all set to revolutionise oil and gas industry in GCC with the joint venture between Oman’s OQ Group, and Kuwait Petroleum International. It has been the largest collaboration of its kind between GCC countries.

December 2022

Air Liquide's partnership with Saudi Aramco to build an air separation unit in Jazan, Saudi Arabia. This signifies confidence in the market's growth potential and could lead to increased competition and innovation.

March 2021

Saudi Arabia declared its plans for a large-scale green hydrogen project powered by renewable energy. This could create a new segment in the industrial gas market and contribute to the region's diversification efforts.

|

Attribute |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

|

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Pricing |

Available upon Request |

By Gas

By Application

By Mode of Supply

By Country

To know more about delivery timeline for this report Contact Sales

As of 2024, the GCC market for industrial gases has been estimated to record revenue worth US$2.3 billion.

Rapid pace of industrialization, and growing demand form oil & gas and healthcare sectors are primarily driving the demand in GCC industrial gases market.

The Kingdom of Saudi Arabia stands currently occupies over 50% share.

By gas type, oxygen, nitrogen, carbon dioxide, and hydrogen are estimated to remain the leading segments throughout the forecast period.

Some of the key companies in GCC industrial gases market are Air Liquide, The Linde Group, and Air Products and Chemicals Inc.