Industry: Food and Beverages

Published Date: January-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 188

Report ID: PMRREP35054

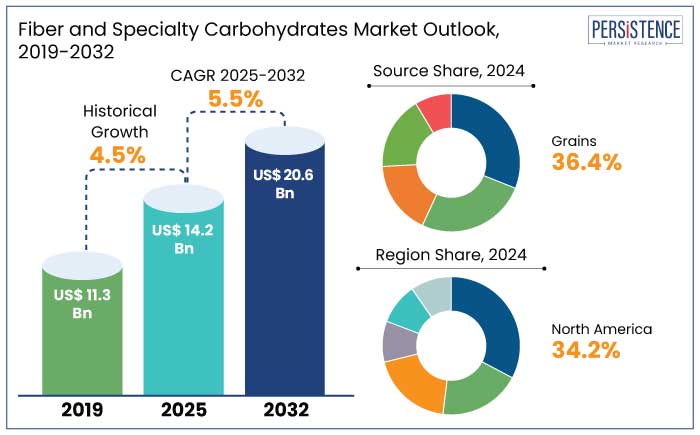

The global fiber and specialty carbohydrates market is projected reach the size of US$ 14.2 Bn by 2025. It is anticipated to experience a CAGR of 5.5% during the forecast period to reach a value of US$ 20.6 Bn by 2032.

A 2023 report highlighted that 57% of consumers globally prefer products with natural ingredients and clear labels, especially in developed economies including the U.S. and Europe. Companies are therefore increasingly adopting clear labeling practices to highlight the natural origins of fibers and specialty carbohydrates, especially plant-based fibers like oat fiber, pea fiber, and chicory root inulin.

Based on a study conducted by the United Nations, the global population aged 65 and over are estimated to grow by 16% by 2032. This creates a substantial demand for specialized nutritional products, including those containing fiber and specialty carbohydrates. Brands are predicted to continue to develop fiber and carbohydrate products designed specifically for seniors like low-glycemic fibers, prebiotic supplements, and products targeting bone health.

Key Highlights of the Industry

|

Market Attributes |

Key Insights |

|

Fiber and Specialty Carbohydrates Market Size (2025E) |

US$ 14.2 Bn |

|

Projected Market Value (2032F) |

US$ 20.6 Bn |

|

Global Market Growth Rate (CAGR 2025 to 2032) |

5.5% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

4.5% |

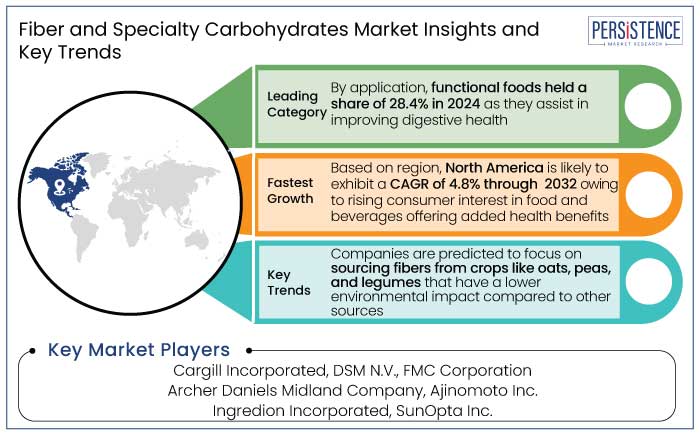

North America fiber and speciality carbohydrates market held a share of 34.2% in 2024. A 2022 report by the International Food Information Council (IFIC) revealed that 76% of U.S. consumers considered digestive health an important factor in their food choices, driving the demand for fiber-rich products. Around 53% of consumers in the U.S. stated that they are seeking foods that can support their immune health, a factor that is directly related to fibers and prebiotics.

The functional food market in North America has witnessed rapid expansion, with growing interest in foods and beverages that offer added health benefits beyond basic nutrition. This trend has directly contributed to the increasing use of fibers and specialty carbohydrates in food products.

Consumers in the region are increasingly interested in clean-label products, which feature simple, transparent ingredient lists and avoid artificial additives and preservatives. A 2023 survey revealed that 57% of consumers in North America are actively seeking products that are free from artificial ingredients and contain simple, natural components. This consumers’ preference is increasing the importance of fiber and specialty carbohydrates in clean-label foods.

Grains accounted for a share of 36.4% in 2024. A study by the Whole Grains Council indicated that whole grains including oats, barley, and wheat contain 3 to 5 grams of fiber per serving. This is approximately 10% to 20% of the daily recommended fiber intake for adults, making them key sources in fiber and speciality carbohydrates market.

A 2022 report by the International Food Information Council (IFIC) revealed that 63% of consumers in the U.S. reported that they actively seek foods with added fiber for digestive health, positioning grain-based fibers as one of the preferred sources. Barley beta-glucan, a soluble fiber, has been shown to lower LDL cholesterol by 5% to 10%, further driving demand.

Grains are a natural, plant-based source of fiber, making them particularly attractive to the growing population of consumers following plant-based, vegan, and vegetarian diets. Grains are highly versatile and can be used in various food categories, including breakfast cereals, snacks, baked goods, beverages, and dairy substitutes.

As consumer interest in gluten-free, fiber-enriched, and low-sugar products grows, grains are progressively being incorporated into a wide range of functional foods.

Functional foods accumulated a share of 28.4% in 2024. Consumers across the globe are increasingly seeking food products that offer additional health benefits, such as improving digestive health, boosting immunity, supporting weight management, and reducing the risk of chronic diseases.

Functional foods containing fibers and specialty carbohydrates, like prebiotics and low-glycemic ingredients, are becoming essential in this context. One of the main health benefits driving the demand for functional foods is improved digestive health.

Functional foods that help with weight management and regulate blood sugar are witnessing an increase in popularity. A 2022 report indicated that 58% of consumers in the U.S. are actively seeking immune-boosting foods. Manufacturers are constantly innovating and developing new products to meet the growing demand for functional foods.

Potential growth in the global fiber and specialty carbohydrates market is predicted to be driven by advancements in personalized nutrition and genetic testing as they will create new opportunities for tailored fiber and carbohydrate solutions. Products specifically designed to meet the specific dietary requirements of consumers are likely to further boost growth.

The demand for fibers derived from ecofriendly and sustainable sources will witness growth, as consumers around the world continue to prioritize sustainability. The aging population, especially in developed countries, is predicted to drive the demand for functional fibers that support digestive health, weight management, and heart health.

The growing plant-based and vegan food trends are predicted to continue promoting the use of plant-derived fibers and carbohydrates.

The fiber and specialty carbohydrates market showcased a CAGR of 4. 5% during the historical period. Growth in the period was attributed to rising consumer awareness of digestive health, obesity prevention, and immunity. The COVID-19 pandemic resulted in an increased focus on immune health and digestive wellness, thereby boosting the demand for functional ingredients like fibers and specialty carbohydrates.

According to a 2022 survey by IFIC, 54% of U.S. consumers considered gut health a top priority in their diets, thereby driving the demand for prebiotic fibers such as inulin, fructooligosaccharides (FOS), and galactooligosaccharides (GOS). The trend towards reducing sugar intake also played a significant role in the demand for alternative sweeteners and low-glycemic specialty carbohydrates like isomaltulose, maltodextrin, and polydextrose.

Expansion in the assessment period is predicted to be driven by innovations in product formulations, thereby increasing the demand for clean-label and organic ingredients. Growth of functional beverage and dietary supplements markets is likely to further surge demand.

Rising Demand for Functional and Health Foods

As 76% of consumers globally identify digestive health as essential to their overall well-being, there is a growing emphasis on dietary fibers like inulin, FOS, and GOS, which act as prebiotics. Rising use of fiber enriched foods to support gut microbiota is further fostering demand.

Soluble fibers like psyllium and resistant starch along with specialty carbohydrates like polydextrose, are widely used in weight management products for their ability to enhance feelings of fullness. Inclusion of fiber as a functional ingredient is central to the expansion of the industry.

Approximately 537 million adults were living with diabetes in 2021, driving demand for diabetic-friendly, fiber-rich foods. Specialty carbohydrates, such as isomaltulose and sugar alcohols, are increasingly used in functional foods aimed at reducing the risk of diabetes and promoting blood sugar management.

Expansion of the Functional Beverage Segment

Consumer demand for beverages offering health benefits, including digestive health, hydration, and energy impels the fiber and specialty carbohydrates market. Around 60% of global consumers prefer beverages that contribute to specific health goals like boosting immunity and improving digestion.

Soluble fibers like inulin, polydextrose, and beta-glucans are widely used in functional beverages for their prebiotic properties and ability to improve gut health. Digestive health is a top priority for consumers, with 76% associating gut health with overall wellness, driving demand for beverages fortified with fibers.

Specialty carbohydrates such as isomaltulose and maltodextrin are increasingly used in sports and energy drinks for sustained energy release. Specialty carbohydrates like fructooligosaccharides (FOS) and galactooligosaccharides (GOS) are added to beverages for their role in supporting gut microbiota.

Sports and energy drinks accounting for 33% of the functional beverage market mainly relies onspeciality carbohydrates like isomaltulose and soluble fibers for sustained energy and improved performance. Fibers and speciality carbohyrates are progressively used in readytodrink (RT) formats to enhance texture and provide added nutritional benefits.

Technical Challenges in Product Formulation

Based on a study conducted by the Institute of Food Technologists (IFT), about 25% of consumers report a negative sensory experience when consuming high-fiber products due to undesirable textures and flavors. The addition of high fiber content in beverages can cause cloudiness or undesirable separation.

Fiber enrichment in beverages like smoothies, juices, and functional drinks may require additional emulsifiers or stabilizers to maintain the visual appeal of the product. Fibers and specialty carbohydrates must be compatible with other ingredients in the formulation.

For example, fibers like inulin can interact with proteins or fats, affecting their solubility, stability, or texture. According to a 2023 study from the International Food Science and Technology Journal, around 40% of product developers report issues related to fiber interfering with other ingredients' performance, particularly in dairy and plant-based beverages.

The inclusion of fibers and specialty carbohydrates can affect the shelf-life of products, especially when they are exposed to air, moisture, and light. A study by the Global Food Quality Assurance (GQA) revealed that 35% of manufacturers face challenges in maintaining the shelf life of fiber enriched foods and beverages owing to the fibers tendency to absorb moisture and alter texture.

Aging Population and Growing Demand for Specialized Nutrition

By 2030, 1 in 6 people across the globe are predicted to be aged 60 or older, and the number of individuals aged 65+ is estimated to reach 1.4 billion by 2050 according to the United Nations. Older adults require dietary solutions that address age-related challenges like weakened immunity, bone health, cardiovascular health, and digestive issues. This creates significant demand for fibers and specialty carbohydrates.

Insoluble fibers, such as wheat bran, and soluble prebiotic fibers, like inulin, help promote gut motility and balance gut microbiota. Specialty carbohydrates like galactooligosaccharides (GOS) and inulin enhance calcium absorption, supporting bone density. This is critical for preventing osteoporosis, which affects 1 in 3 women and 1 in 5 men aged 50 and above globally.

Products targeting bone health, such as fortified dairy and plant-based beverages, often incorporate these fibers and carbohydrates. Prebiotic fibers and specialty carbohydrates like FOS and GOS enhance the gut microbiota, which plays a crucial role in immune function.

For seniors, immunity is a critical focus area, especially post-pandemic. A survey conducted revealed that 65% of older adults prioritized foods with immunity-boosting properties, driving innovation in fortified products.

Increasing Preference toward Pet Nutrition by Pet Owners

Around 75% of pet owners actively seek pet food that promoted digestive health, thereby driving the demand for fiber-enriched products. Pets highly benefit from prebiotic fibers like inulin and FOS, that support gut microbiota balance and enhance digestion. These fibers are widely used in formulations targeting pets with sensitive stomachs.

Pet obesity is a growing concern, with studies showing that 56% of dogs and 60% of cats in the U.S. are overweight or obese. Specialty carbohydrates like isomaltulose and resistant starch are increasingly used in pet food to provide slow-releasing energy and support blood sugar regulation, especially for diabetic pets.

Ingredients like GOS and FOS are used in pet foods to enhance gut health, which plays a critical role in immunity. These prebiotic fibers are linked to decreasing inflammation and enhancing nutrient absorption, essential for pets with chronic health conditions.

Oat fiber, beet pulp, and chicory root are commonly used in natural and clean-label pet foods. About 65% of pet owners prefer natural ingredients, aligning with trends in human nutrition.

Companies in the fiber and specialty carbohydrates market are developing products with enhanced functionality, like high-fiber, low-calorie, or prebiotic properties. They are creating customized solutions for specific applications like bakery, beverages, or dietary supplements.

Businesses are also offering natural and minimally processed ingredients to align with consumer demand for transparency. They are progressively investing in research and development activities to enhance extraction techniques and create novel fiber and carbohydrate derivatives.

Brands are also exploring health benefits of fibers and specialty carbohydrates, such as gut health improvement and diabetes management. They are partnering with academic institutions for clinical studies and validation.

Organizations are offering diverse range of products, such as soluble and insoluble fibers, resistant starch, or polyols. They are also catering to niche markets like sports nutrition, infant nutrition, and elderly health.

Recent Industry Developments

Leading Players in the Industry

|

Attributes |

Detail |

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization and Pricing |

Available upon request |

By Source

By Application

By Distribution Channel

By Region

To know more about delivery timeline for this report Contact Sales

The market is anticipated to reach a value of US$ 20. 6 Bn by 2032.

Grains held a market share of 36.4% in 2024.

North America held a 34.2% market share in 2024.

Prominent players in the market include Eyesight Technologies Limited, Cognivue, and Infineon technologies AG.

The market is predicted to witness a CAGR of 5.5% through 2032.