Fatty Amides Market Segmented By Erucamide, Oleamide, Stearamide, Behenamide Product in Beads, Powder and Pastilles Form

Industry: Chemicals and Materials

Published Date: November-2022

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 253

Report ID: PMRREP10004

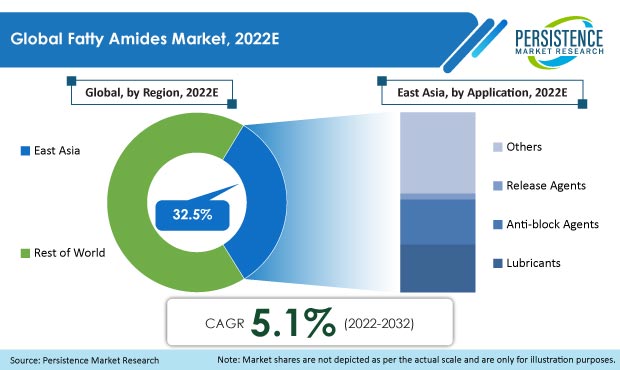

According to Persistence market research’s most recent market study, the global fatty amides market is valued at US$ 289.3 Mn in 2022. Worldwide sales of fatty amides are expected to witness steady growth at 5.1% CAGR and reach a market valuation of US$ 474.7 Mn by 2032.

Consumption of fatty amides amounts to 1.3% share of the global oleochemicals market. In the present scenario, the development of sustainable, bio-based chemical compounds has accelerated as consumers have become more aware of the benefits of oleochemicals in terms of the environment and economics. Oleochemicals are crucial biochemical elements of marine, animal, and vegetable oils. Therefore, the demand for fatty amides is also increasing in parallel in the global market.

Fatty amides, often termed fatty acid amides, are derivatives of organic fatty acids where an OH group is replaced by an NH2 (amine) group. Depending on the type of product, fatty amides are differentiated as erucamide, oleamide, stearamide, and behenamide. Products containing fatty amides are available in beads, powders, and sometimes also the pastilles form.

Fatty amides are commonly used as sliding agents and anti-block agents for producing polyolefin films and sheets that have applications in the packaging industry. These are solid lubricants that are found to be chemically and thermally stable. They function as an exterior and interior lubricant and are also used as an anti-blocking agent in the production of pellets, ink, resin powder, and films.

As a high-quality addition and processing aid, fatty amides are in high demand in the plastics industry. Rising demand for plastic is predicted to drive demand growth of fatty amides over the course of the forecast period.

| Attributes | Key Insights |

|---|---|

|

Fatty Amides Market Size (2021A) |

US$ 277.3 Mn |

|

Estimated Market Value (2022E) |

US$ 289.3 Mn |

|

Projected Market Value (2032F) |

US$ 474.7 Mn |

|

Value CAGR (2022-2032) |

5.1% |

|

Collective Value Share: Top 3 Countries (2022E) |

41.4% |

This recent research by Persistence Market Research indicates that the demand for fatty amides increased significantly between 2017 and 2021. Demand was driven in part by the rapid increase in the usage of fatty amides in a wide variety of applications such as lubricants, release agents, anti-block agents, slip agents, and dispersants.

As per this survey, the fatty amide market is expected to progress at a CAGR of 5.1% between 2022 and 2032. The primary element driving the sales of fatty amides throughout the forecast period is an increase in the adoption of bio-based lubricants. Also, companies are building long-term capabilities and increasing investments in R&D. Continuous R&D efforts for high-performance and cost-effective products and solutions will foster the demand for fatty amides over the coming years.

Rapid growth in the demand for bio-based lubricants is set to boost the sales of fatty amides as well. Consumers are becoming more aware of the need to protect the environment from greenhouse gas emissions, which is boosting the market for bio-based lubricants. These factors include the rising prices of petrochemicals, depletion of crude oil reserves, and growing awareness about environmental protection.

On the other hand, these components have exceptional performance and can adhere to stringent government regulations, notably those that deal with carbon emissions, because they are environmentally safe and don't release any dangerous chemicals into the environment. Additionally, by prolonging the equipment's lifespan and reducing friction, energy consumption, and maintenance costs, bio-based lubricants offer performance benefits.

All these factors are contributing to the demand growth for bio-based lubricants, which automatically drives the growth of the fatty amides market.

The market for fatty amides is anticipated to benefit from the expanding rubber industry around the world. It is used as an internal lubricant in rubber. Its applications include torque reduction in rubber. Consumption of natural rubber reached 1,270,000 tons in 2019-2020, supported by economic development, higher import duties, and anti-dumping duties on tires.

Nimble growth of the plastic and lubricant industries will drive the demand for fatty amides over the forecast period. Fatty amides are highly sought-after in the plastics sector because they make excellent additives and processing aids. Demand for plastic products has shown an upward graph in the past few years. This will create a lucrative opportunity for fatty amide suppliers to grow in the years ahead.

The volatility of raw material prices, as well as the availability of product replacements, are potential restrictions to the growth of the fatty amides market. Major fluctuations in the cost of raw materials affect the profits of fatty amide manufacturers. This rapid spike in the price is due to high manufacturing expenses, which is limiting the growth of the fatty amides market.

In the recent past, major fatty amide manufacturers have channelized their efforts toward the development of alternatives to conventional fatty amide slip agents and anti-block agents. Silicone-based chemicals, which are widely used in paints and coatings, plastics, and other industries, are likely to replace fatty amides over the decade.

U.S. - Prominent Consumer of Fatty Amides

The U.S. is expected to remain one of the prominent consumers of fatty amides globally owing to the increasing demand from various application sectors, especially lubricants. Presently, the U.S is estimated to account for 18% share of the global market for fatty amides.

The U.S is one of the prominent hubs for lubricant manufacturing companies; therefore, demand from lubricant industries majorly drives the sales of fatty amides in the country. Apart from the lubricant industry, there is high demand for fatty amides in plastic, rubber, and medicine, thereby driving overall U.S. market expansion.

Fatty Amide Suppliers Lining Up in China

The Chinese fatty amide industry currently accounts for around 19% of the value shares of the worldwide market and is valued at US$ 52.6 Mn. China is anticipated to be one of the top markets for fatty amide demand during the course of the projected timeframe.

China is expected to create a huge opportunity for fatty amide manufacturers over the forecast period owing to the promising growth of several end-use industries. The country also enjoys the strong production capacity of manufacturers based in China. Besides, the country is the largest producer of erucamide, witnessing high growth in this segment.

High Application of Fatty Amides in Production of Slip Agents

Fatty amides find major applications in the production of slip agents. The segment is expected to consume around 33.2% of the fatty amides produced globally.

Fatty amides, namely behenamide, oleamide, and stearamide, find application as slip agents in the manufacturing of films and sheets, especially in polyolefin films and sheets. Fatty amides are becoming more and more popular as slip agents due to the growing need to reduce friction in polyolefin film during processing, increase in disposable income, and growth of the middle-class population that has increased the demand for packaged foods.

Erucamide Product Type to Hold Dominating Market Share

Based on product type, the market is segmented into erucamide, oleamide, behenamide, and stearamide. The erucamide segment is anticipated to hold a dominating share of the global market and account for a value share of 74.3%.

Erucamide is recognized as a slip agent for the processing of polyolefin films; it is used as a sealant chemical and adhesive, anti-adhesive agent, and lubricant additive in several end-use industries, including personal care, food packaging, plastics, and rubber.

Due to erucamide's good compatibility with numerous end-use sectors and applications, the market for erucamide fatty amides is expanding, thereby driving the growth of the overall market for fatty amides.

Major players are channeling efforts toward expanding their production capacities to strengthen their market share and cater to the growing demand for fatty amides. Market expansion is anticipated to be aided by the growing number of partnerships and collaborations among key players that are looking to increase their presence in the market.

Market participants are also spending substantial capital to improve their fatty amide production capacities to meet the growing needs of end consumers.

| Attribute | Details |

|---|---|

|

Forecast Period |

2022-2032 |

|

Historical Data Available for |

2017-2021 |

|

Market Analysis |

|

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available Upon Request |

By Product Type:

By Product Form:

By Application:

By Region:

To know more about delivery timeline for this report Contact Sales

The global market for fatty amides stands at US$ 289.3 Mn in 2022.

Fatty amide demand is anticipated to witness a growth rate of 5.1% through 2032 in terms of value.

Croda International Plc., PMC Biogenix Inc., Fine Organic Industries Pvt. Ltd., Nippon Fine Chemicals Co. Ltd., Kao Corporation, Italmatch Chemicals S.p.A., Sichuan Tianyu Oleochemical Co., Ltd., Nippon Kasei Chemical Company Limited, Haihang Industries Co., Ltd., Mohini Organics Pvt. Ltd., and Pukhraj Additives LLP are key suppliers of fatty amides.

Key producers of fatty amides account for 70%-75% share of the global market.

High fatty amides demand comes from the U.S., China, and South Korea.

The market for fatty amides in China is forecasted to expand at 6.9% CAGR over the decade.

Croda International Plc., PMC Biogenix Inc, Fine Organic Industries Pvt. Ltd, Nippon Fine Chemicals Co. Ltd., and Kao Corporation are major exporters of fatty amides.