Dimer Fatty Acid Market Segmented By Standard, Distilled, Distilled and Hydrogenated Product Type in Standard Dimer Acid, Distilled Dimer Acid, Distilled & Hydrogenated Dimer Acid Application

Industry: Chemicals and Materials

Published Date: February-2022

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 282

Report ID: PMRREP33012

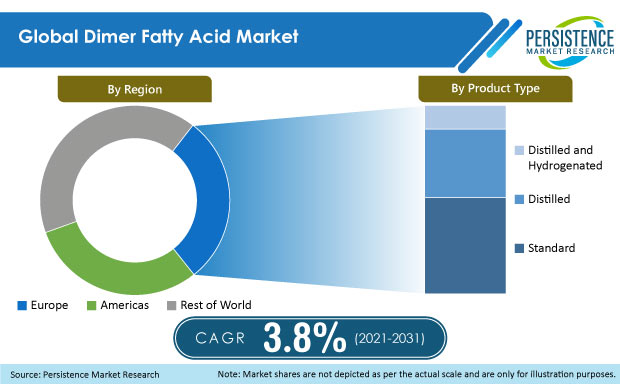

Demand for dimer fatty acid is projected to increase at a steady 3.8% CAGR from 2021 to 2031, with the market value increasing from US$ 559 Mn in 2021 to US$ 812.5 Mn by 2031.

| Attribute | Key Insights |

|---|---|

|

Dimer Fatty Acid Market Size (2020A) |

US$ 540.3 Mn |

|

Projected Year Value (2031F) |

US$ 812.5 Mn |

|

Value CAGR (2021-2031) |

3.8% |

|

Collective Value Share: Top 3 Countries (2020A) |

54.5% |

Worldwide dimer fatty acid sales accounted for nearly 2.8% of the global oleo chemicals market as of 2020. Rising demand for dimer fatty acid to be used in hot melt adhesives along with increasing construction spending to improve local infrastructure will continue pushing sales over the coming years.

Sales of dimer fatty acid increased at 1.1% CAGR from 2016 to 2020, with countries such as the U.S., China, Germany, and Japan accounting for a substantial portion of the global market SHARE. Sales prospects in 2020 were dampened due to the outbreak of COVID-19, which reduced demand for dimer fatty acid from several application domains such as non-reactive polyamides and oilfield chemicals.

Increase in R&D investments to find better production methods of dimer fatty acid is driving market expansion. Demand for inexpensive pure chemicals is expected to continue pushing sales of standard dimer fatty acid through 2031.

Overall, the global dimer fatty acid market is projected to expand at 3.8% CAGR over the forecast period of 2021 to 2031.

The huge potential that exists in the oil & gas sector is anticipated to have a positive impact on dimer fatty acid consumption, as it is required for manufacturing chemicals for drilling activities, such as inverted oil-based mud and drilling fluid additives for both, water-based and oil-based mud systems.

Oil & gas production and reserve numbers in many regions are expected to grow significantly. MEA is a vast continent, which remains as one of the last exploration frontiers for oil & gas, as evidenced by significant oil & gas discoveries worldwide.

Over the recent past, oil & gas production in North America, especially in the U.S., has witnessed substantial increase. Demand for oilfield chemicals is expected to gather momentum toward the latter half of the forecast period.

Surge in the production of oilfield chemicals is expected to provide an impetus to the demand for dimer fatty acid and compel market players to boost their capacities.

What is the Demand Outlook for Dimer Fatty Acid in China?

“Large Presence of Local Dimer Fatty Acid Manufacturers”

As per Persistence Market Research’s analysis, China is projected to account for nearly 26.8% of the global market share, creating an incremental opportunity of US$ 81.2 Mn by 2031. This can be attributed to the presence of many local dimer fatty acid manufacturers in the country.

China is expected to remain the most dominating country producing dimer fatty acid across the globe. Dimer fatty acid suppliers in China are increasing their production capacities to cater to the potential demand surge over the coming years.

Why is Consumption of Dimer Fatty Acid Rising in the U.S.?

“Increasing Use of Dimer Fatty Acid in Oilfield Chemicals”

The U.S. is projected to account for approximately 86.2% of the North America dimer fatty acid market in 2031.

Rebounding of the U.S. economy is anticipated to fuel demand for dimer fatty acid over the coming time frame. Moreover, extensive dimer fatty acid usage in oilfield chemicals, which have wide applications in refining, well drilling, and hydraulic fracturing, is expected to bolster demand growth of dimer fatty acid in the country.

Which Country is Leading the Europe Dimer Fatty Acid Market?

“Germany Enhancing Dimer Fatty Acid Production Process”

Germany is projected to account for 25.4% of the Europe dimer fatty acid market share by 2031. The country is investing highly in research & development for the production process of dimer fatty acid so as to produce less waste.

Germany is slowly becoming a hub for the production of chemicals that can be used in laboratories. This is expected to propel sales of dimer fatty acid over the assessment period.

Which Dimer Fatty Acid Type Will Drive Profits of Market Players?

“Sales of Distilled & Hydrogenated Dimer Fatty Acid Increasing Rapidly”

Sales of distilled & hydrogenated dimer fatty acid is expected to increase at a significant 4.3% CAGR over the forecast period of 2021 to 2031.

There is increasing demand for high-quality products for surface coatings, printing inks, adhesives, and oilfield chemicals. Distilled & hydrogenated dimer acid is generally used in high performance applications. Due to this very reason, distilled and hydrogenated dimer fatty acids are gradually becoming more popular and witnessing a steady rise in sales.

The chemical is also used to synthesize high quality polyamide resins. Owing to these factors, sales of distilled and hydrogenated dimer fatty acid are projected to constantly increase over the forecast period.

Which Application of Dimer Fatty Acid is Prominent?

“Dimer Fatty Acid Application in Non-Reactive Polyamides Continuing to Gain Traction”

Application of standard dimer fatty acid in non-reactive polyamides is projected to create an absolute dollar opportunity of US$ 46.2 Mn during the period of 2021 to 2031, on account of increasing construction spending.

The non-reactive polyamides segment is anticipated to generate the highest revenue because demand for dimer acid-based polyamide resins is expected to grow rapidly in many regions owing to high demand for surface coatings from the automobile industry. This will continue providing tailwinds to dimer fatty acid sales over the coming years.

The impact of the COVID-19 pandemic on the chemicals and materials industry was moderate. Sales of many chemicals and materials plummeted due to disruptions in supply chains and transportation restraints. Several production facilities in many countries were entirely shut down because of lockdowns, which had a direct impact on the sales of dimer fatty acid.

However, chemicals such as hot melt adhesives, sealants, and surfactants were in continuous usage during the pandemic due to their need in households and residential areas. Also, as numerous production facilities have reopened, the industry is progressively rebounding from losses, resulting in positive sales prospects of dimer fatty acid. Increasing sales of distilled dimer fatty acid due to rising demand for high purity chemicals is expected to augment market growth over the coming years.

Leading dimer fatty acid producers are entering into strategic business agreements and are focusing on expansion of their global footprint through the construction of new production units. Apart from this, market players are increasing investments in R&D to find better production methods of dimer fatty acids and also improve dimer fatty acid synthesis.

For instance:

| Attribute | Details |

|---|---|

|

Forecast Period |

2021-2031 |

|

Historical Data Available for |

2016-2020 |

|

Market Analysis |

|

|

Key Regions Covered |

|

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon Request |

Dimer Fatty Acid Market by Product Type:

Dimer Fatty Acid Market by Application:

Dimer Fatty Acid Market by Region:

To know more about delivery timeline for this report Contact Sales

The dimer fatty acid market experienced 1.1% CAGR and was valued at US$ 540.3 Mn in 2020.

The dimer fatty acid industry is currently worth US$ 559 Mn.

Dimer fatty acid demand is set to increase at 3.8% CAGR and reach a valuation of US$ 812.5 Mn by 2031.

Expanding production capacities, increasing focus of R&D on better production processes, and production of high grade chemicals are driving sales of dimer fatty acid.

China, the U.S., Germany, Japan, and France and major producers and exporters of dimer fatty acid.

Kraton Corporation, Croda International Plc., Oleon NV, Jiangsu Yonglin Oleochemical Co., Ltd., and Jiangxi Longwell Industrial Co., Ltd. are the top 5 market players with around 55% to 60% market share.

The North America dimer fatty acid market is projected to expand at a steady 3.3% CAGR during the forecast period.

East Asia is expected to hold a market share of 32.6% by the end of 2031.

China is anticipated to hold a market share of 26.8% by 2031.