Industry: Healthcare

Published Date: March-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 250

Report ID: PMRREP5465

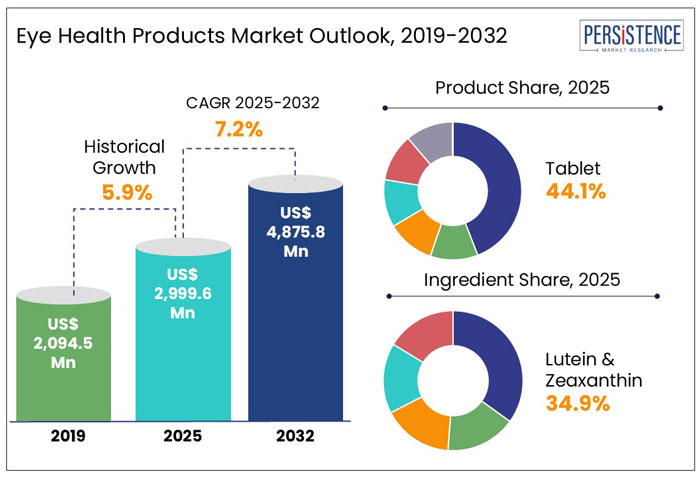

The worldwide revenue from the eye health products market is projected to reach approximately US$ 2,999.6 Mn in 2025, with the global market estimated to surge ahead at a CAGR of 7.2% to reach a valuation of US$ 4,837.8 Mn by the end of 2032.

|

Attributes |

Key Insights |

|

Eye Health Products Market Size (2025) |

US$ 2,999.6 Mn |

|

Projected Market Value (2032) |

US$ 4,837.8 Mn |

|

Global Market Growth Rate (2025-2032) |

7.2% |

|

Historical Market Growth Rate (CAGR 2019 to 2024) |

5.9% |

The global eye health products market recorded a historic CAGR of 5.9% from 2019 to 2024. The increasing prevalence of myopia and vision impairment has been linked to the rising use of screens and virtual meetings. High myopia increases the risk of degenerative eye diseases like cataracts and glaucoma. Additionally, millennials are increasingly adopting eye health products due to susceptibility to myopia and digital eye fatigue.

Several manufacturers and government bodies are raising awareness about eye health, driven by the ageing population and rising eye-related disorders. Public bodies are promoting nutritional supplements as preventive medicine to reduce treatment costs.

A notable example is ENTOD Pharmaceuticals’ nationwide campaign in India on World Sight Day 2024, focusing on children's eye health. The initiative included eye care camps across 12 states, free eye drops and supplements, and educational videos in 12 regional languages.

The global eye health products market is set for significant growth due to increasing eye disorders in the globe. Supplements like Flavonoids effectively address various eye conditions like macular degeneration, retinopathy, cataracts, and dry eye syndrome. The eye health products market is expected to expand to a CAGR of 7.2%, reaching US$ 4,875.8 Mn by 2032.

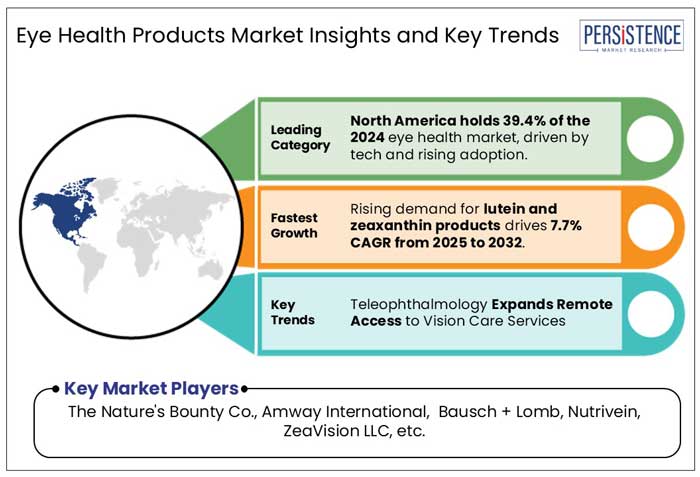

“Rising Demand for Novel Eye Health Supplement Ingredients”

Lutein, Zeaxanthin, Vitamin A, and Vitamin C collectively account for approximately 60% of all eye health products in 2024. To enhance differentiation, companies are actively developing novel ingredient formulations that provide additional benefits for eye health. Emerging ingredients such as astaxanthin, blueberries, omega-3 long-chain PUFAs, DHA, and genistein are being integrated into new product offerings.

However, clinical validation remains limited, as companies seldom conduct comprehensive studies to verify efficacy. Cyanotech Corporation has undertaken multiple clinical trials to assess the impact of astaxanthin on eye health, reinforcing its commitment to scientific validation. Additionally, in 2024, blueberry anthocyanins gained regulatory approval as a new raw food material due to their antioxidant properties, which may help reduce eye fatigue and improve vision.

“Expanding Distribution Channels for Greater Market Accessibility”

To drive sales and expand market reach, companies are leveraging multiple distribution channels. Traditional retail outlets, including supermarkets, hypermarkets, pharmacies, and specialty stores, continue to dominate vitamin and mineral-based product sales. However, with rising internet penetration and the growing convenience of online shopping, e-commerce has witnessed substantial growth, a trend expected to persist.

To enhance product accessibility, manufacturers are increasingly partnering with hypermarkets and digital retail platforms to strengthen their distribution networks. For instance, Valeant Pharmaceuticals collaborated with major retail chains such as Costco, Kroger, Walmart, Walgreens, Rite Aid, and Amazon to extend the availability of its eye health products across multiple sales channels.

“Growing Influence of Branding and Digital Advertisements”

Changing consumer lifestyles, characterized by poor dietary habits, sedentary routines, and prolonged screen exposure, have heightened awareness regarding eye health. Consumers increasingly rely on various information sources, including social media, online platforms, television advertisements, and published articles, to stay informed about eye care solutions.

These channels play a crucial role in influencing purchasing decisions by providing insights into new product innovations and benefits. Consequently, companies are aligning their product development strategies with evolving consumer preferences, launching targeted eye health solutions that cater to market demand.

“Stringent Regulatory Framework & Product Recalls”

During the projected period, the eye health products market expansion is predicted to be hampered by stringent regulations surrounding manufacturing, product safety, and efficacy claims. Regional differences in regulations exist. Some regions do not permit any efficacy or health benefit claims, whereas others do.

Therefore, in order to avoid regulatory actions, manufacturers need to be careful about the claims they choose to make on labels and while promoting their products.

Product recalls and directives from regulatory authorities across different regions, including summons, can render products unmarketable. Consequently, such recalls are expected to hinder market growth.

“Broad Availability of Eye Care Products”

North America led the global eye health products market with approximately 39.4% of the share in 2024. This growth is fueled by the broad availability of eye care products across retail pharmacies, supermarkets, and e-commerce platforms.

High consumer awareness about vision health, combined with frequent innovations in eye supplements, has further driven market expansion. Additionally, the region benefits from strong healthcare infrastructure and regulatory support, ensuring product accessibility and quality. These factors collectively contribute to North America’s dominance in the global eye health product market.

In May 2024, HealthyCell introduced an ultra-absorbable supplement that supports vision health with a blend of carotenoids and essential micronutrients, including lutein, zeaxanthin, astaxanthin, lycopene, vitamin A, and vitamin E.

“Better Regulatory Scenarios for Eye Health Products”

Europe held approximately 25.0% of the global eye health products market in 2024, presenting a lucrative opportunity for manufacturers. The region benefits from well-structured regulatory frameworks that ensure product safety, efficacy, and quality. Advancements in formulation technologies and increased investments in research contribute to market expansion. With favorable regulations and a focus on high-quality standards, Europe remains an attractive region for manufacturers aiming to strengthen their presence in the eye health segment.

In 2022, Alcon launched Systane Complete Preservative-Free Lubricant Eye Drops. This product received approval under the Medical Device Regulation (MDR 2017/745), reflecting Europe's stringent regulatory standards. Alcon's investment in developing preservative-free formulations demonstrates a commitment to innovation in eye health products, contributing to market expansion in the region.?

“Large Patient Pool to Create High Demand for Eye Health Products”

Asia Pacific accounted for 20.1% of the global eye health products market in 2024, with strong growth prospects over the decade. The region’s expanding patient pool, driven by rising cases of myopia and other vision-related issues, is a key factor fueling demand.

In 2022, report by China's National Disease Control and Prevention Administration revealed that the overall myopia rate among Chinese children and adolescents was 51.9%.

Increasing screen exposure from digital devices has further heightened concerns about eye strain, prompting consumers to seek preventive solutions. Additionally, growing healthcare investments and the availability of cost-effective eye health supplements contribute to market expansion, positioning Asia Pacific as a prominent market for manufacturers.

The Seva Foundation published a brief highlighting of findings from a landmark study on eye health investments. The study revealed that every $1 invested in cataract or refractive error correction yielded $36 in benefits for society. With a remarkable return on investment of 36:1, funding for eye care in low- and middle-income countries is expected to deliver substantial benefits. This increasing investment is crucial to addressing the significant funding gap in global eye health.

“Stability and Extended shelf-life Increases Preference for Tablets for Eye Health and Vision Support”

Tablets dominated the eye health products segment, holding approximately 44.1% of the market share in 2024. Their widespread adoption is driven by affordability, ease of consumption, and precise dosage control.

Tablets also offer better stability and extended shelf-life compared to liquid formulations, ensuring long-term potency. They allow the combination of essential nutrients like lutein, zeaxanthin, and vitamins in a single dose, enhancing their effectiveness. With growing consumer preference for cost-effective and convenient supplements, tablets remain the preferred choice for eye health support.

“AMD – the Most Common Cause of Blindness”

Age-related macular degeneration held the majority of the segment share at around 69.8% at the end of 2024.

Age-related macular degeneration (AMD) remains the leading cause of blindness, significantly impacting vision by damaging the macula, which controls sharp central vision. The growing reliance on digital screens and exposure to environmental stressors have heightened concerns about eye health.

As a result, the demand for preventive solutions, including supplements with lutein, zeaxanthin, and omega-3 fatty acids, has surged. Consumers are increasingly turning eye to health products to support long-term vision, driving market growth for protective formulations aimed at reducing the risk of AMD-related vision loss.

According to an NIH publication from May 2023, there were approximately 200 million cases of macular degeneration globally in 2020. The BrightFocus Foundation projects that this number will rise to 288 million by 2040.

The global market for eye health supplements is highly competitive due to the presence of numerous established players and new entrants striving to gain market share. Companies are focusing on product innovation, expanding distribution channels, and forming strategic partnerships to strengthen their market position. Additionally, increasing consumer awareness about eye health and the rising prevalence of vision-related disorders are fueling demand, further intensifying competition among manufacturers.

Key instances include:

|

Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Mn/Mn |

|

Geographical Coverage |

|

|

Segments Covered |

|

|

Key Companies Covered |

|

|

Report Highlights |

|

|

Customization & Pricing |

Available upon Request |

By Products:

By Ingredient:

By Indication:

By Distribution Channel

By Region:

To know more about delivery timeline for this report Contact Sales

The global eye health products market is estimated to increase from US$ 2,999.6 Mn in 2025 to US$ 4,875.8 Mn in 2032.

The global eye health products market is driven by rising eye disorders, increasing awareness regarding eye care, and demand for vision supplements drive market growth.

The global eye health product market is projected to record a CAGR of 7.2% during the forecast period from 2025 to 2032.

Bausch & Lomb Incorporated, Amway International, The Nature's Bounty Co, Vitabiotics Ltd, ZeaVision LLC Company among others are a few key players.

North America is projected to hold the largest share of the industry in 2025