Industry: Healthcare

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Report Type: Ongoing

Report ID: PMRREP14122

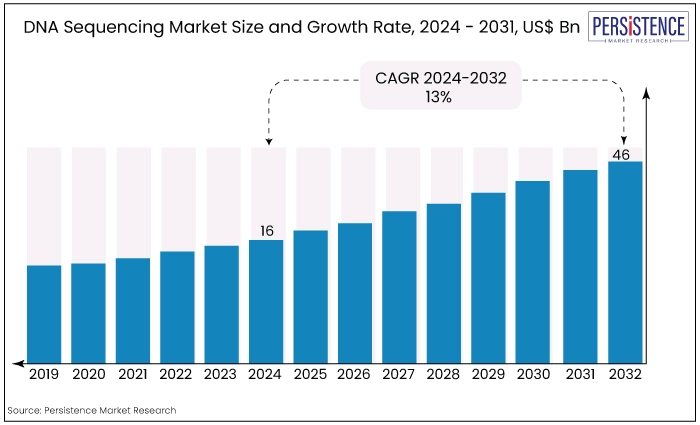

The market is estimated to reach a valuation of US$45 Bn by the year 2031, at a CAGR of 13%, during the forecast period 2024 to 2031.

Key Highlights of the Market

|

Attributes |

Key Insights |

|

Market Size (2024) |

US$16 Bn |

|

DNA Sequencing Market Size (2031) |

US$45 Bn |

|

Forecast Growth Rate (CAGR 2024 to 2031) |

13% |

|

Historical Growth Rate (CAGR 2019 to 2023) |

7% |

The rapid advancement of bioinformatics and technology has facilitated the identification of DNA variations, thereby enabling the identification of variants that are associated with an elevated risk of disease.

The scope of DNA sequencing is also being expanded by using next-generation and whole-genome sequencing technologies in clinical diagnosis applications. It is anticipated that these developments will contribute to the global DNA sequencing market growth during the forecast period.

The healthcare industry has been significantly impacted by the ongoing evolution of sequencing technologies, which has revolutionized the field of genomics.

The significant enhancement in sequencing speed is a critical component of technological progress. The rate at which genetic information can be decoded has been significantly accelerated by NGS platforms, including those developed by Illumina.

Parallel processing is implemented on these platforms, which facilitates the simultaneous examination of numerous DNA fragments. This increase in speed has far-reaching implications, enabling researchers and clinicians to process large volumes of genomic data more efficiently than ever.

Further, Illumina Inc., a leading company in the industry introduced its Connected Insights cloud-based software, which is intended to simplify the tertiary analysis of clinical NGS data. It is anticipated that these initiatives will stimulate market growth over the forecast period.

The global DNA sequencing market has witnessed robust growth from 2019 to 2023, witnessing a CAGR of 7%, driven by significant advancements in sequencing technologies, expanding applications in various sectors, and increasing demand for personalized medicine and genetic research.

In 2019, the global market continued its upward trajectory, supported by technological innovations such as next-generation sequencing (NGS), which allowed for faster, more accurate, and cost-effective sequencing.

The market saw considerable investment in research and development, aimed at enhancing sequencing platforms and reducing sequencing costs.

By 2021, the DNA sequencing market saw continued expansion, driven by increased adoption of NGS in clinical diagnostics, oncology research, and agriculture.

Advances in bioinformatics and data analytics further improved the interpretation of sequencing data, expanding the market's scope beyond traditional research applications.

Growing Demand for Personalized Medicine

The growth of the DNA sequencing industry is driven by the increasing need for personalized medication. This method customizes medical therapy according to an individual's genetic composition, made possible by thorough genetic examination via DNA sequencing.

Sequencing technologies have made significant progress in terms of speed, accuracy, and cost-effectiveness, thus increasing the accessibility of personalized therapy.

Healthcare practitioners can detect genetic variants that can impact an individual's likelihood of developing an illness or how they respond to therapy.

Furthermore, DNA sequencing is progressively employed for illness prevention, early identification, and focused treatment. The application of this technology is widespread across several medical disciplines, including oncology, pharmacogenomics, and uncommon genetic illnesses.

Moreover, DNA sequencing is utilized in several fields such as research, medicine development, and agriculture, which contributes to the growth of the market.

Advancement in Next-Generation Sequencing Technology

The progress in next-generation sequencing (NGS) technology is driving the expansion of the DNA sequencing market share. These advancements provide expedited, more precise, and cost-efficient DNA sequencing solutions in contrast to conventional techniques.

Advancements in NGS technologies continually advance the speed, capacity, and precision of sequencing, enabling researchers to effectively address intricate genomic tasks.

Novel sequencing chemicals and bioinformatics tools enhance analytical capabilities, enabling a more profound understanding of genetic data.

The declining expense of NGS promotes equal access to genome sequencing, hence facilitating progress in precision medicine, cancer genomics, and agricultural biotechnology.

High Cost of Sequencing Technologies

The high costs associated with DNA Sequencing Market technology limit the market's growth over the forecast period. Even though technical developments have improved accuracy and speed, the costs continue to be prohibitive for a significant number of researchers and healthcare professionals.

Both the initial investments in equipment and the continuous expenses for consumables provide financial problems, which significantly restrict accessibility.

With this, access is mostly restricted to institutions that have sufficient funding, which hinders the process of democratizing genetic research and tailored medicine.

Technological Advancements

Innovations in NGS with continued advancements in NGS technologies, such as improved sequencing speed, accuracy, and reduced costs, will unlock newer market opportunities.

Innovations like single-molecule sequencing and Nano pore sequencing promise even greater scalability and efficiency. Further, the application of artificial intelligence and IoT devices caters to the growth of the DNA sequencing market.

The application of artificial intelligence (AI) and machine learning (ML) algorithms in genomic data analysis will enhance the interpretation of sequencing results. This will enable more precise diagnostics, predictive modelling for disease risks, and personalized treatment strategies.

Bioinformatics

Due to the large quantity of genomic data being produced, there is a growing need for sophisticated bioinformatics tools, and data analytics platforms.

Companies that specialize in bioinformatics solutions for the analysis, interpretation, and storage of genomic data will discover increasing opportunities.

Further, the demand for direct-to-consumer (DTC) genetic testing services is increasing due to consumer fascination with tracing their history, assessing health risks, and receiving personalized lifestyle recommendations.

Companies providing these services can benefit from the growing public awareness and need for genetic information, which creates a pool of opportunities in the global market.

Consumables Remain the Leading Market Segment with 48% Revenue Share

|

Market Segment by Product & Services |

Market Value Share 2023 |

|

Consumables |

48% |

Based on products & services segment, the global DNA sequencing market is further sub-segmented into consumables, instruments and services, where consumables segment occupies around 48% of the total market share.

An important element in the expansion of market share is the increasing availability of reagents and kits specifically tailored for different stages of library assembly, such as DNA fragmentation, adaptor ligation, and quality control.

Several of these tools are distinguished by their simplified and efficient processes, pre-prepared components, and ability to deal with low-input and formalin-fixed specimens.

Further, the services segment is expected to experience the highest CAGR during the projected period.

Sequencing services available in the global market include comprehensive data analysis, library preparation, identification and quantification of protein binding sites on DNA, genome-wide DNA methylation profiling, shotgun sequencing, primer walking sequencing, bacterial artificial chromosome end sequencing, and expressed sequence tags.

Due to this, the demand for the services category is anticipated to be propelled by the presence of multiple providers supplying these services.

85% Market Share Concentrated in NGS

|

Market Segment by Technology |

Market Value Share 2023 |

|

NGS |

85% |

Based on technology, the global DNA sequencing market is further classified into next generation sequencing, Sanger sequencing, and third generation sequencing, where the next generation sequencing segment dominates the market share with almost 85% of the market share.

The significant advancements in these technologies, together with the decreasing time and expense associated with sequencing, have rendered genome sequencing more inexpensive and precise.

Furthermore, NGS technology is increasingly being used as a standard clinical diagnostic test, especially during the COVID-19 pandemic, leading to a beneficial effect on the revenue share of this category.

The segment of third-generation sequencing is expected to experience the highest CAGR during the projection period. This method addresses the limitations of second-generation sequencing by including a simplified sample preparation process that eliminates the requirement for PCR amplification.

This results in a reduction in both the time and cost associated with sequencing. In addition, this method has the capability to produce lengthy reads that are several kilobases in length, which helps address assembly challenges and repetitive regions in complicated genomes.

Sequencing to Surge Ahead by Workflow, Accounts for 55% Market Share

|

Market Segment by Workflow |

Market Value Share 2023 |

|

Sequencing |

55% |

Based on workflow, the market is further segmented into Pre-sequencing, Sequencing and Data Analysis, where the sequencing segmentation dominates the global DNA sequencing market share.

In terms of workflow, the sequencing segment dominated the market in 2023, capturing the biggest share of revenue at 55%. This phase facilitates the analysis of the genome's sequence and the interactions between DNA and proteins.

Due to its significant contribution, it plays a crucial role in the complete DNA sequencing process in research and discovery studies, leading to its dominant position.

Sequencers possess the capacity to provide a substantial volume of data within a relatively short timeframe, hence expediting comprehension of human health and the development of remedies for diseases.

In addition, prominent companies including Illumina, Inc., and Thermo Fisher Scientific, Inc. offer innovative platforms for sequencing workflow.

North America Responsible for Nearly Half of Global Market Revenue

|

Region |

Market Value Share 2023 |

|

North America |

50% |

In 2023, North America had the highest market share, accounting for 50.70% of the revenue. The DNA sequencing market expansion in the North American region is being driven by the widespread use of DNA sequencing technology and the presence of key industry players.

Moreover, the players operating in the United States are implementing several strategic measures to enhance their market presence in the country, hence facilitating regional expansion of the Market.

The US exerted significant influence on the North American market due to its extensive expertise in genomics, oncology, and research based on whole-genome sequencing.

The significant adoption of DNA sequencing technology in this region can be linked to several causes, including advanced research and medical infrastructure, ample financing, a highly skilled workforce, and corporations advocating for improved research methodologies to uncover new technologies for diagnosis and therapies.

The European DNA Sequencing market is projected to see a substantial compound annual growth rate (CAGR) in the forecast period.

The growth can be attributed to the rising investments in research and development (R&D) and ongoing scientific research, which has resulted in an increased demand for cutting-edge NGS technologies.

The global market is highly competitive, with several leading DNA sequencing market companies providing better commercial opportunities to their end consumers while utilizing new and high-end technologies into the industry.

Major players in the DNA sequencing industry are utilizing high-end technologies to cater to the growing needs of the end consumers in the DNA sequencing industry.

November 2023

Illumina Inc. introduced its global health access initiative to cater to public health sequencing tools in underdeveloped nations.

August 2023

PacBio signed an acquisition deal with Apton Biosystems to acquire its business and accelerate the development of a Short-read sequencer.

August 2023

PacBio signed a partnership and collaboration deal with the University of Washington to enhance and analyze the ability of HiFi long-read WGS.

|

Attributes |

Details |

|

Forecast Period |

2024 - 2031 |

|

Historical Data Available for |

2019 - 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Companies Profiled |

|

|

Pricing |

Available upon request |

By Products & Services

By Technology

By Workflow

By Application

By Region

To know more about delivery timeline for this report Contact Sales

The market is estimated to exhibit a CAGR of 13% during the forecast period.

North America is the leading region in the market.

The DNA sequencing market is segmented based on product & Services, workflow, application and technology.

PerkinElmer Genomics, PacBio, BGI, Bio-Rad Laboratories, Inc., and Myriad Genetics are some of the major companies in the market.

Next-generation sequencing technology is the dominant technology-wise segment of the DNA sequencing market.