Industry: IT and Telecommunication

Published Date: February-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 185

Report ID: PMRREP10574

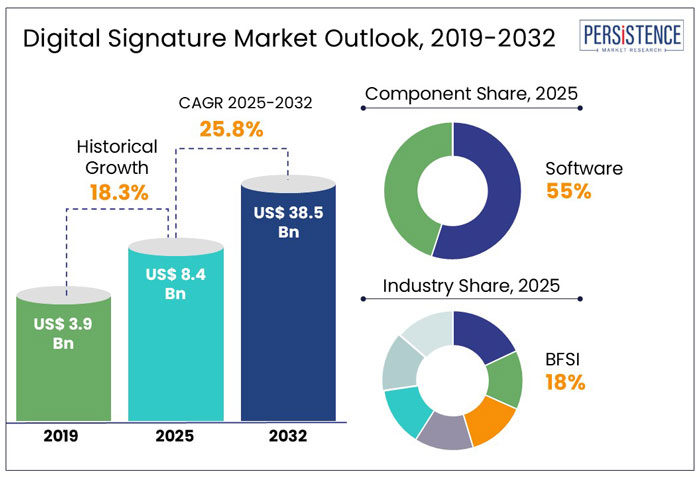

The digital signature market is estimated to increase from US$ 8.4 Bn in 2025 to US$ 38.5 Bn by 2032. The market is projected to record a CAGR of 25.8% during the forecast period from 2025 to 2032.

The global market is experiencing rapid growth, driven by increasing need for secure and efficient digital transaction solutions. AI integration in digital signatures streamlines authentication processes, making these quicker and more user-friendly. Blockchain technology ensures data integrity and security, providing tamper-proof verification of digital signatures.

Asia Pacific is anticipated to witness the fastest growth, attributed to government initiatives enhancing digital experiences. Rising adoption of digital technologies in countries like India and China is also set to create new avenues.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Market Size (2025E) |

US$ 8.4 Bn |

|

Projected Market Value (2032F) |

US$ 38.5 Bn |

|

Global Market Growth Rate (CAGR 2025 to 2032) |

25.8% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

18.3% |

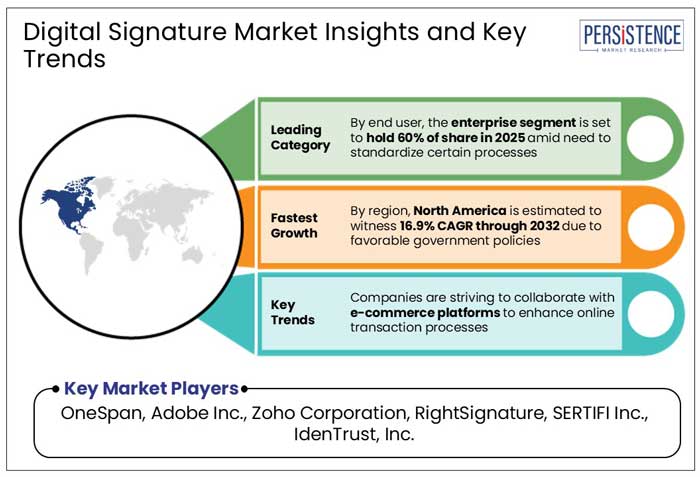

North America stands at the forefront of the digital signature market, accounting for 32% of the global share. It is anticipated to rise at a CAGR of 16.9% through 2032. The region boasts a robust technological landscape, facilitating the seamless integration of digital signature solutions across diverse sectors.

Supportive laws, such as the Electronic Signatures in Global and National Commerce Act (E-SIGN) in the U.S., provide a solid legal foundation for using digital signatures, ensuring their validity and enforceability. Banking, financial services, insurance (BFSI), healthcare, and legal services have embraced digital signatures to enhance security, streamline operations, and comply with regulatory standards. Presence of prominent companies, including DocuSign, Adobe, and Entrust Corporation, drives innovation and accessibility in the digital signature landscape.

North America hosts several key players in the market, including DocuSign, Adobe, and Entrust Corporation. Their continuous innovation and comprehensive service offerings contribute significantly to regional growth. North America's commitment to digital transformation, underpinned by strong regulatory and technological foundations, continues to drive adoption of digital signatures across various sectors.

Based on component, the market is divided into software and services. Among these two categories, the software segment dominates the market due to rising reliance on digital signature software solutions. It will likely hold a share of 55% in 2025.

Digital signature software solutions facilitate secure and efficient electronic document signing. Organizations across various industries increasingly adopt these software solutions to streamline workflows, reduce paper-based processes, and ensure compliance with regulatory standards.

Digital signature software offers convenience and enhanced security, making it indispensable in today's digital transactions landscape. As businesses prioritize digital transformation, demand for robust and user-friendly digital signature software is set to rise, further solidifying its leading position in the market.

Based on industry, the market is segmented into BFSI, defense, government, retail and consumer goods, healthcare, education, and IT and telecom. Among these, the BFSI segment is set to lead the market with 18% of total share in 2025.

The banking, financial services, and insurance (BFSI) industry has a high demand for digital signatures. BFSI companies are subject to strict regulatory compliance requirements, such as Know your Customer (KYC) and Anti-Money Laundering (AML) regulations. These require safe and tamper-proof methods of document authentication and verification.

Digital signatures also provide a secure and tamper-proof method for signing and verifying electronic transactions, protecting sensitive financial information from cyber threats and fraud. The BFSI industry’s high demand for digital signatures is driven by the need for regulatory compliance, increased security, high efficiency, and the ability to conduct transactions remotely.

A digital signature is an electronic signature employed to confirm the identity of the document's originator or authenticator. It ensures that the message or document's original content has not been altered. To achieve this, it implements a combination of hashing functions and public key cryptography.

Digital signatures can confirm the authenticity of electronic transactions, including e-contracts, financial transactions, and online purchases. These can also verify and authenticate the integrity of digital documents, including legal documents, invoices, and contracts.

Digital signatures are frequently implemented in government services to safeguard online transactions, including visa applications and tax filings. Digital signatures generally offer a secure and convenient method of ensuring the authenticity of electronic transactions and safeguarding against fraud, manipulation, and other security risks.

The global digital signature industry is surging due to rising demand for secure and efficient electronic transactions. This is particularly evident in sectors such as finance, government, healthcare, and legal.

During the historical period from 2019 to 2023, the adoption of digital signatures steadily rose, driven by the global shift toward digitalization and the need for secure online transactions. The market witnessed a CAGR of 18.3% in the historical period.

The COVID-19 pandemic further accelerated this trend as organizations sought remote solutions to maintain business continuity. Companies like DocuSign capitalized on this demand, evolving from e-signature providers to comprehensive digital contract management platforms.

Over the forecast period, the digital signature industry is poised for continued growth. Integrating unique technologies such as AI and blockchain will likely help enhance security measures and streamline workflows.

AI can also facilitate real-time signature verification and automate document management, while blockchain ensures tamper-proof storage and verification of signed documents. Such technological developments, coupled with increasing trends of remote work and e-commerce, are anticipated to drive the widespread adoption of digital signatures. These are anticipated to help in solidifying their role as a cornerstone in the digital economy.

Increasing Demand for Safe Online Transactions

Rapid growth of e-commerce, digital banking, and remote work has fueled demand for secure online transactions, positioning digital signatures as essential for ensuring authenticity and security. For instance,

As cyber threats continue to rise, businesses and individuals are prioritizing solutions that safeguard sensitive data while maintaining regulatory compliance. Digital signatures use encryption technology to provide a tamper-proof seal, enhancing trust in online transactions.

Growing focus on cybersecurity and the convenience of paperless processes drive widespread adoption across industries such as finance, healthcare, and legal services. With secure digital signature solutions emerging as a key industry need, this trend is likely to sustain market growth over the forecast period.

Integration of Blockchain and AI Technologies

Incorporation of blockchain and artificial intelligence (AI) into digital signature solutions is revolutionizing the global market. Blockchain ensures transparency and tamper-proof document verification, while AI enables automated authentication and fraud detection, creating a more robust and user-friendly signing experience.

Such unique technologies help address long-standing challenges, including document forgery and compliance risks, making digital signatures more appealing to legal, real estate, and logistics industries. Blockchain digital signatures and AI-driven authentication solutions are becoming popular worldwide. This technological evolution is enhancing security and fueling market growth by meeting the changing demands of a tech-savvy global audience.

Lack of Awareness and Legal Infrastructure in Emerging Markets

Despite the high popularity of digital signatures, limited awareness and inadequate legal infrastructure remain significant growth restraints, especially in emerging markets. Several organizations and individuals are unaware of digital signatures' benefits and legal validity, leading to slow adoption rates.

In countries with underdeveloped regulatory frameworks, businesses may face challenges in ensuring compliance and gaining trust in technology. This issue is compounded by inconsistent laws governing electronic signatures across different regions, making it difficult for global enterprises to standardize processes.

Search terms like digital signature compliance issues and e-signature regulations by country reflect these concerns. To overcome this barrier, leading players must invest in educational campaigns and collaborate with governments to establish clear, supportive legal frameworks that encourage adoption.

Rapid Shift toward Remote Work and Hybrid Models

The global shift toward remote work and hybrid models has permanently changed how businesses operate, creating a significant demand for secure, efficient digital workflows. In remote environments, digital signatures have become essential for contract approvals, legal agreements, and onboarding processes.

Industries like real estate, legal, and HR are rapidly adopting these solutions to maintain productivity without compromising security. Terms like remote work digital signatures and e-signature solutions for hybrid work are gaining popularity as organizations prioritize seamless document handling. By offering features like cloud-based platforms, multi-device compatibility, and novel security, vendors can tap into this rising demand and strengthen their market position. For example,

Integration with Novel Technologies like AI

Integration of digital signatures with cutting-edge technologies like blockchain, artificial intelligence (AI), and cloud computing represents a transformative opportunity. Blockchain ensures tamper-proof document verification, while AI streamlines authentication and fraud detection, delivering enhanced security and user experience.

Cloud-based digital signature solutions, often sought after using search terms like cloud e-signature platforms, allow businesses to scale operations and access documents anytime, anywhere. Such advancements address key industry challenges, making digital signatures indispensable in healthcare, legal, and financial services. Companies that invest in these innovations will likely be able to respond to evolving customer needs and gain a competitive edge in this dynamic market.

The digital signature market is highly competitive, with key players vying to innovate and extend their global presence. Established companies like DocuSign, Adobe, and OneSpan dominate, offering robust solutions with unique security features and seamless integrations.

Emerging players, including SignNow and HelloSign, focus on user-friendly interfaces and cost-effective pricing to attract SMEs. Regional vendors catering to localized needs further shape the competitive landscape, especially in Asia Pacific and Latin America.

Partnerships, acquisitions, and technological developments like blockchain integration and AI-driven authentication are critical strategies driving competition. Companies leverage their unique strengths to differentiate themselves and capture the high demand in this dynamic market.

Recent Industry Developments

|

Attributes |

Details |

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization and Pricing |

Available upon request |

By Component

By End User

By Industry

By Region

To know more about delivery timeline for this report Contact Sales

The global digital signature market is anticipated to be valued at US$ 8.4 Bn in 2025.

The global market is estimated to be valued at US$ 38.5 Bn by 2032.

The market is estimated to exhibit a CAGR of 25.8% from 2025 to 2032.

OneSpan, Adobe Inc., and Zoho Corporation are few of the key players.

North America leads the global market for digital signatures in terms of share.