Industry: Industrial Automation

Published Date: October-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 185

Report ID: PMRREP34880

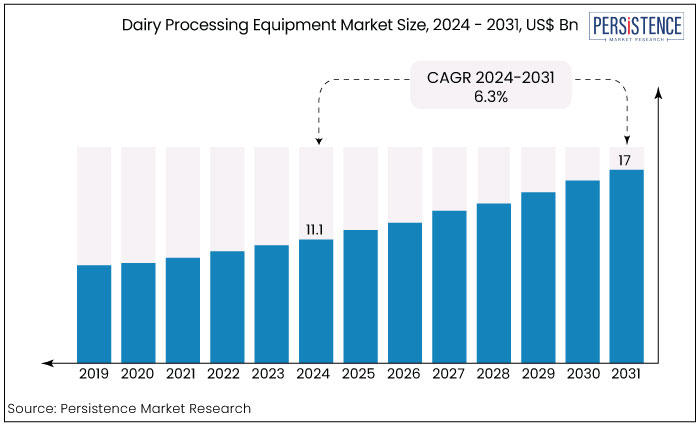

The dairy processing equipment market is estimated to increase from US$ 11.1 Bn in 2024 to an astounding US$ 17 Bn by 2031. The market is projected to record a CAGR of 6.3% during the forecast period from 2024 to 2031.

The market for milk processing machines is set to be driven by rising investments in modern milking technologies and surging demand for pure dairy products from millennials. Government bodies are also offering subsidies and tax rebates on the purchase of milk processing equipment, especially in developing countries.

The Government of India, for example, provides the Dairy Processing and Infrastructure Development Fund (DIDF). It focuses on developing robust milk processing, value addition, and chilling facilities. It offers funds to develop new facilities, milk chilling infrastructure, automated milk testing equipment, and upgrade dairy processing facilities.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Dairy Processing Equipment Market Size (2024E) |

US$ 11.1 Bn |

|

Projected Market Value (2031F) |

US$ 17 Bn |

|

Global Market Growth Rate (CAGR 2024 to 2031) |

6.3% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

5.2% |

|

Region |

Market Share in 2024 |

|

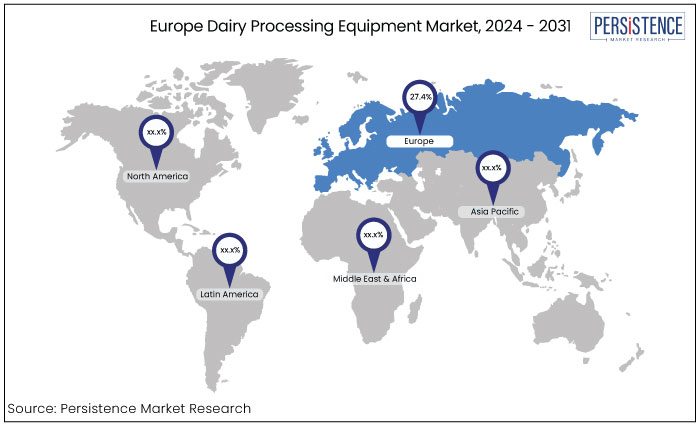

Europe |

27.4% |

Europe is home to over 600,000 dairy farms and 12,000 processing facilities, making its dairy sector a significant player in the global economy. As per the European Union (EU), in 2022, the region produced approximately 160 million tons of raw milk.

The removal of milk quotas in April 2015 further enhanced production and processing capabilities, responding to the rising consumption of dairy products. However, Germany is expected to rise slowly at 1.3% CAGR through 2031. Increasing animal welfare concerns are prompting local consumers to shift toward plant-based dairy alternatives. This is likely to push manufacturers to innovate in areas like oat-based products and almond milk, bolstering sales.

Asia Pacific Dairy Processing Equipment Market Leads with India at Forefront

Asia Pacific is gradually becoming a key player in the global market, witnessing significant growth in both production and consumption of dairy products. With high disposable income, consumers’ purchasing habits and preferences are changing. It is hence creating novel growth prospects for companies operating in the dairy processing equipment industry.

India and China, for instance, stand out as leading producers, processors, and exporters of dairy products in Asia Pacific. The former ranks among the largest producers of raw milk. As per the Agricultural & Processed Food Products Export Development Authority (APEDA), between 2023 and 2024, India exported nearly 63,738.47 metric tons of milk and dairy products worth US$ 272.64 Mn to the world. The numbers are likely to increase in future years, establishing new pathways.

|

Category |

Market Share in 2024 |

|

Equipment Type - Pasteurizers |

23.8% |

The dairy industry relies on several key processing equipment types, including homogenizers, membrane filters, separators, and pasteurizers. Among these, pasteurizers are set to dominate in the foreseeable future, with a share of 23.8% in 2024.

Pasteurizers play a key role in ensuring milk products are safe for consumption while extending their shelf life. Designed for thermal treatment, these are considered vital for processing milk and various other dairy products, making them indispensable in the industry.

|

Category |

Market Share in 2024 |

|

Application - Processed Milk |

29.6% |

The processed milk segment has emerged as the leading application in the dairy processing equipment industry. It is projected to capture about 29.6% of the total market share in 2024.

A few key producers of processed milk include Australia, New Zealand, India, the Netherlands, and Germany. Demand is estimated to surge as this type of milk is produced using the Ultra-High Temperature (UHT) treatment. It helps in eliminating harmful bacteria and extending the milk’s shelf life to several weeks and even months. Unlike raw milk, processed milk does not require refrigeration until it is opened. These beneficial properties are anticipated to make it highly preferred among individuals with busy lifestyles.

The global dairy processing equipment industry will likely showcase considerable growth in the forecast period. It is attributed to increasing participation of leading companies in events and shows associated with processing equipment technology.

For example,

As consumer preferences shift toward high-quality dairy products, investments in modern processing technologies like homogenizers and automation systems are rising. Increasing global population also pushes demand for healthier products made with milk, boosting dairy processing equipment sales.

The dairy processing equipment market analysis shows that the industry showcased a steady CAGR of 5.2% in the historical period between 2019 and 2023. This growth was primarily fueled by rising demand for yogurt, butter, and cheese as individuals stayed home during the pandemic back in 2020.

Demand for organic dairy products increased during the pandemic as people were becoming more conscious of their health. In addition, innovations, such as cold pasteurization technology emerged in the historical period, creating new opportunities. The launch of ultraviolet (UV) processing further boosted sales as it promoted energy-efficiency and sustainability.

In the forecast period, the market is projected to witness a CAGR of 6.3% through 2031. High demand for cheese across the globe with rising number of pizzerias and fast-food outlets is expected to boost sales. Manufacturers are likely to focus on investing in cutting-edge cheese making equipment to streamline production, packaging, and marketing.

High Demand for Dairy-based Snacks and Beverages to Propel Sales

Growing demand for dairy products is a key factor driving the dairy processing equipment market growth. As individuals become more aware of the nutritional benefits of these products and change their eating habits, the need for various processing equipment increases. Lifestyle changes, such as the rising preference for convenient, ready-to-eat items, also play a significant role in boosting demand.

Increasing popularity of dairy-based snacks and beverages, such as ice cream, smoothies, milkshakes, and yogurt, is further set to fuel demand. Additionally, growing trends toward specialty and functional dairy products, like those rich in probiotics, are projected to support demand. Dairy processors across the globe are hence investing in unique equipment to improve production, maintain quality, and adhere to safety standards.

The rat race to launch pure dairy projects for people of all ages is anticipated to boost demand for cutting-edge processing equipment in the next ten years.

Booming Fast Food Industry to Open New Growth Avenues

The ever-increasing fast-food industry worldwide is expected to accelerate demand for cow milk production machines. Fast food outlets often use specialized dairy processing equipment to cater to varying consumer needs, such as for the preparation of desserts, coffee beverages, cheese, and milkshakes.

The launch of state-of-the-art dairy-infused products by various chains like Starbucks and McDonald’s is further projected to augment demand. These outlets have started offering flavored coffee with milk, yogurt parfaits, and cheeseburgers that require flexible processing equipment, thereby creating high demand.

High Energy Costs May Lead to Operational Issues

Rising energy prices are significantly increasing operational costs for dairy processing facilities, which may affect profitability. Processes like pasteurization and refrigeration consume a lot of energy, highlighting the need for more energy-efficient equipment.

Growing environmental concerns and strict regulations are further pushing dairy processors to adopt sustainable practices, leading them to invest in energy-saving technologies. The challenge of reducing carbon footprints while meeting strict emission standards adds complexity to their operations. This is projected to decline the dairy processing equipment market revenue to a certain extent.

Dairy Processors Embrace Unique Technologies to Promote Sustainability

Increasing adoption of automation and rising demand for high-quality dairy products are expected to create novel opportunities for dairy processing equipment vendors. Ongoing innovations in homogenizer technology are gaining traction as these are likely to help improve product consistency and extend shelf-life.

There is also a notable shift toward new equipment that prioritizes sustainability and energy efficiency. Dairy processors are anticipated to embrace these advanced technologies to improve operational efficiency and comply with stringent environmental regulations.

For instance,

Supportive Government Schemes like DBI and CAP to Create Opportunities

Surging government and non-government funding for small and medium enterprises as well as start-ups is projected to create a new opportunity in the dairy processing equipment market. Programs like the European Union’s (EU) Common Agricultural Policy (CAP) and the Dairy Business Innovation (DBI) Initiatives of the U.S. are expected to promote innovation.

The EU’s School Fruit, Vegetables, and Milk Scheme and direct payments from the European Agricultural Guarantee Fund (EAGF) would also help small businesses invest in modern dairy processing technologies. In the U.S., the DBI offers technical support and grants. It enables dairy companies to diversify and enhance their operations. With around US$ 23 Mn allocated for DBI initiatives, it supports innovations in efficiency, quality, and sustainability. Such initiatives worldwide are projected to bolster growth.

The global market for dairy processing equipment is experiencing considerable growth. To take advantage of this promising landscape, several companies are rolling out new products and utilizing innovative technologies to open the door to novel opportunities.

Key players are implementing unique strategies, including diversification of their product lines, geographic expansion, and investments in research and development activities. By pursuing these approaches, they aim to remain competitive, adapt to changing consumer preferences, and foster continued growth in the market.

Recent Industry Developments

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Equipment Type

By Application

By Region

To know more about delivery timeline for this report Contact Sales

The market is predicted to rise from US$ 11.1 Bn in 2024 to US$ 17 Bn by 2031.

GEA Group, Krones AG, IDMC Limited, and SPX Corporation are a few key manufacturers.

It is used to process milk and other dairy products across dairy plants.

Yes, the dairy processing equipment industry is set to record a 6.3% CAGR through 2031.

Buckets, milk containers, automatic milking machines, pasteurizers, and parlor equipment are used.