Libya Market Study on Dairy Products: Milk & Cream Segment Generating High Revenues for Industry Players

Industry: Food and Beverages

Published Date: September-2022

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 165

Report ID: PMRREP33157

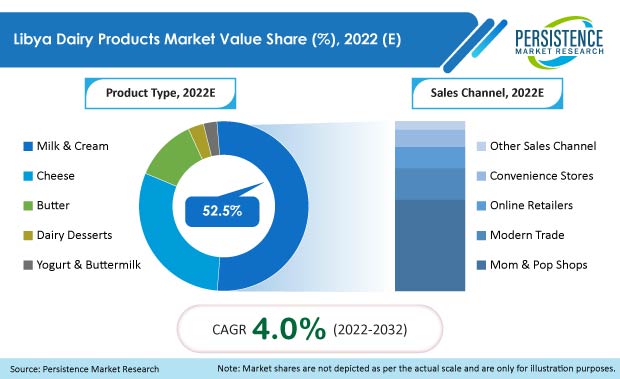

The Libya dairy products market is valued at US$ 588.9 Mn in 2022 and is expected to exhibit a CAGR of 4% and reach US$ 873.3 Mn by the end of 2032.

In the Libyan market, the milk & cream segment dominates with a majority volume share of around 84% and is anticipated to expand at a CAGR of 3.2% over the decade.

| Report Attribute | Details |

|---|---|

|

Libya Dairy Products Market Size (2022E) |

US$ 588.9 Mn |

|

Projected Market Value (2032F) |

US$ 873.3 Mn |

|

Value CAGR (2022-2032) |

4% |

|

Estimated Market Volume (2032F) |

508,469 Tons |

During the historical study period of 2017-2021, the Libyan dairy market experienced an annual growth rate of 2.9%. The market is anticipated to witness an optimistic growth trend going forward due to numerous factors such as rising consumer demand for flavored dairy products, increasing preference for healthy and nutritious food products, rising health awareness, and strong from the household sector.

Intensifying pressure of globalization, strengthening intensity of competition, and rapid adaptation of state-of-the-art technologies have prompted dairy product manufacturers in Libya to ramp up their capacity and introduce new and innovative products. As a result, the dairy sector in this country is anticipated to expand at 4% CAGR during the forecast period of 2022-2032.

Factors such as increasing disposable income, rising urbanization, superior nutritional profile of dairy products, and continuous changing trends in the food and beverage industry are facilitating market growth, which is anticipated to reach a valuation of US$ 873.3 Mn by 2032.

“Technological Advancements in Dairy Sector in the Country”

In the last few years, dairy farms have evolved significantly due to development in technology, allowing manufacturers to produce high-quality products for consumers. Dairy producers who have their farms utilize the latest technology to scrutinize animal health, production, and feed intake to maximize profitability. Precision dairy farming technology is rising and plays a vital role for large dairy product manufacturers to scrutinize each stage of operation, from animal feed to the packing of dairy products.

Similarly, manufacturers in Libya and key importers operating in the Libyan market are adopting modern technology to increase the efficiency of production and enhance their business operations. The extraction of dairy flavors from dairy ingredients is a complex process. As a result, manufacturers are utilizing advanced extraction techniques to increase the speed of production, which will help improve their stance in the dairy market in Libya.

“Young Libyan Population Consuming More Dairy Products”

Libya is undergoing an economic rebound, along with financial recovery.

As a result, Libya sees high demand for food and consumer products for mothers, infants, and the young population. Thus, the high number of youngsters who consume milk and other dairy products for essential nutrients is driving the market in the country.

The younger section of the population is more receptive to experimental flavors. Modern consumers are defining eating and lifestyle patterns for the future. As a result, key players in Libya are exploiting consumer insights and producing products as per market demand. Moreover, young people who are mostly in a hurry prefer ready-to-eat and ready-to-drink products. Manufacturers are taking advantage of this trend and are offering dairy products in tetra pack and bottle forms.

“Import Dependency Offers Unique Growth Opportunities for Market Players”

Over the coming years, Libya hopes to improve its economic condition through the development of infrastructure and by increasing foreign trade, encouraging conglomerate companies to invest in its market, and improving education throughout the country. Today, Libya depends on imports for most consumer foods and essential commodities, while domestic food production meets only a fraction of the total demand.

The country possesses unique opportunities and is projected as a billion-dollar market for consumer goods, including infant foods, frozen meats, and cheese. As a result, large dairy goods manufacturers around the world can leverage this opportunity by establishing their footprint in the Libyan market and offering high-quality dairy products that are cheaper than those that are imported products.

Large companies investing in Libya can offer new consumer-oriented products through modern state-of-art facilities at competitive prices, which will help bolster their sales in the country. Thus, investments by world-renowned dairy players will positively impact the market and act as a catalyst for market expansion over the coming years.

“Innovation in Product Development to Top the Agenda”

Innovation is becoming progressively important in the food and beverage industry as a means of driving margins and growth. Similarly, innovation plays a vital role in the dairy industry. Manufacturers in Libya as well as importers from North African and Middle Eastern regions are striving to extend their dairy-based offerings. In recent years, producers have been utilizing cutting-edge technology, advanced equipment, and a high level of expertise to develop creative products by understanding market needs and utilizing consumer insights.

Moreover, dairy players today are keen on introducing and launching innovative dairy products that are healthy and offer additional nutritional benefits to consumers. Innovations in the dairy products segment will provide lucrative growth opportunities for the future.

“Rising Vegan Population in Libya”

The increasing vegan population in Libya is a major concern for market players, with vegan, organic, and lactose-free diets becoming more popular. Vegan products do not contain any animal components and are made of ingredients originating from sources such as fruits, vegetables, herbs, and other plant parts, and are free from dairy ingredients. Growing consumer awareness regarding the health benefits of inculcating vegan products into their diets is one of the factors that may hinder the demand for dairy products in Libya.

Several manufacturers in the food and beverage industry are trying to develop dairy-free products to attract more consumers, which might slow down the sales of dairy products. Moreover, the rising consumption of lactose-free products, and, in particular, lactose-free milk, will create major concerns in the dairy market. Hence, dietary changes, a shift in consumer behavior, and increasing preference for vegan and lactose-free food would hamper market growth to some extent.

Which Dairy Product Type Has the Highest Potential in the Market?

The product types considered in the scope of the report include milk & cream, cheese, butter, dairy desserts, and yogurt & buttermilk. Among these product types, demand for butter is expected to increase the fastest at 5.4% CAGR and reach a market valuation of US$ 117.9 Mn by the end of 2032.

Butter is utilized for the preparation of numerous local and international cuisines across Libya, due to which, the product is expected to remain widely popular across the country.

Why are Mom & Pop Shops Immensely Popular in Libya?

Based on sales channel, the mom & pop shops category accounts for the highest market share of 53.4% at present, currently valued at US$ 314.2 Mn. Owing to the large presence of mom & pop shops across the country, the segment will continue to lead over the coming years as well.

Manufacturers of dairy products are increasingly focusing on increasing their production facilities through state-of-the-art machinery to cater to the growing consumer demand. Companies are also emphasizing quality management systems to increase customer satisfaction and grow their customer base.

|

Attribute |

Details |

|---|---|

|

Forecast period |

2022-2032 |

|

Historical data available for |

2017-2021 |

|

Market analysis |

USD million for value |

|

Key market segments covered |

|

|

Key companies profiled |

|

|

Report coverage |

|

|

Customization & pricing |

Available upon request |

By Product Type:

By Sales Channel:

To know more about delivery timeline for this report Contact Sales

The Libya dairy products market has expanded at 2.9% CAGR and is currently worth US$ 588.9 Mn.

Prominent manufacturers of dairy products in Libya include Al- Naseem, Sütaş Süt Ürünleri A.Ş, Guney Sut, and HB Group, accounting for 55% to 65% market share.

Consumption of dairy products in Libya in 2022 is pegged at 366,736 tons.

Sales of dairy products in the country are forecasted to increase at 4% CAGR through 2032.

Rising demand for flavored dairy products, consumers demanding natural products, and increasing production capacity are the key market trends in this space.

The milk & cream segment dominates the Libyan landscape with 52.5% market share.