Industry: Automotive & Transportation

Published Date: November-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 189

Report ID: PMRREP34903

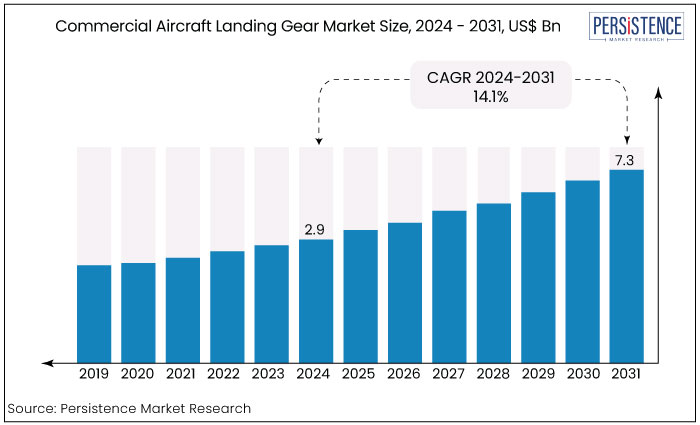

The global commercial aircraft landing gear market is projected to witness a remarkable CAGR of 14.1% during the forecast period from 2024 to 2031. It is anticipated to increase from US$ 2.9 Bn recorded in 2024 to a staggering US$ 7.3 Bn by 2031.

The commercial aircraft landing gear market is driven by the rapid expansion of the global aviation industry, with rising air travel demand across major regions pushing the need for new aircraft. Key end use sectors, including commercial airlines and cargo operators, are continually investing in fleet expansion and modernization to meet this growing demand, positioning the landing gear market for steady growth.

With airlines seeking fuel-efficient, durable components, landing gear manufacturers are focusing on advanced materials and lightweight designs that enhance operational efficiency, safety, and sustainability.

According to the International Air Transport Association (IATA), global passenger numbers are expected to reach over 4 billion annually by 2024, driven by economic growth and increased connectivity in emerging markets. This trend aligns with data from the U.S. Federal Aviation Administration (FAA), which projects sustained aircraft demand in the U.S. and international markets. This further emphasizes the critical role of high-quality, reliable landing gear in meeting future aviation needs.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Commercial Aircraft Landing Gear Market Size (2024E) |

US$ 2.9 Bn |

|

Projected Market Value (2031F) |

US$ 7.3 Bn |

|

Global Market Growth Rate (CAGR 2024 to 2031) |

14.1% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

10.3% |

|

Country |

CAGR through 2031 |

|

U.S. |

13.5% |

In North America, the United States is expected to register a substantial CAGR of 13.5% through 2031. The country holds a prominent share in the region’s commercial aircraft landing gear market, supported by its robust aviation sector and the presence of leading aircraft manufacturers and suppliers. As home to companies like Boeing, the U.S. benefits from continuous demand for both new aircraft and maintenance services, reinforcing its market dominance.

The U.S. leads the region through extensive investments in R&D, advanced manufacturing facilities, and a well-established network of OEMs and aftermarket service providers. Compared to other North American countries, the U.S. has a more extensive fleet, covering both commercial and cargo aircraft, which supports sustained demand for landing gear systems and components.

One prominent competitor in the U.S. market is Collins Aerospace, which recently launched an advanced lightweight landing gear system, designed to enhance fuel efficiency and reduce emissions. This development highlights the U.S. industry’s commitment to innovation and sustainability, aligning with global trends in aviation.

|

Country |

CAGR through 2031 |

|

India |

14.7% |

In South Asia & Oceania, India is expected to drive growth in the commercial aircraft landing gear market, with an estimated CAGR of around 14.7% through 2031. This strong growth is attributed to India’s expanding aviation sector and increasing air travel demand, positioning the country as a key player in the region's commercial aircraft landing gear market.

The country's strong economic growth and government initiatives aimed at boosting domestic aircraft manufacturing have accelerated market development, making India a key player in the region. India leads through large-scale fleet expansions and increasing investments in MRO (Maintenance, Repair, and Overhaul) capabilities, which are crucial for supporting the country's commercial airline sector.

Unlike other countries in the region, India has a growing base of low-cost carriers that continuously upgrade and maintain their fleets, driving demand for landing gear systems and services. A notable competitor in the Indian market is Safran Landing Systems, which recently announced a joint venture with Hindustan Aeronautics Limited (HAL) to establish a new MRO facility. This facility aims to support the maintenance needs of both domestic and international airlines, enhancing Safran’s footprint in the Indian market.

|

Category |

CAGR through 2031 |

|

Gear Type- Main Landing Gear |

14.0% |

The main landing gear segment in the commercial aircraft landing gear market is expected to lead with a projected CAGR of around 14.0% in the coming years. This gear type commands a significant global market share due to its critical function in bearing the aircraft's weight during landing, takeoff, and taxiing. This component is critical for ensuring stability and durability, given the heavy loads it bears making it a priority area for airlines and manufacturers.

Globally, main landing gear systems lead due to their application in both narrow- and wide-body aircraft, which are widely used by commercial airlines. These gears undergo frequent upgrades to enhance load-bearing capacity and reduce weight, aligning with airlines' goals to improve fuel efficiency and performance.

Safran Landing Systems is a prominent competitor in the main landing gear category and recently introduced an advanced lightweight main landing gear solution aimed at reducing fuel consumption. This development underscores Safran's commitment to innovation in response to the market's need for more efficient and sustainable aviation components.

|

Category |

CAGR through 2031 |

|

Aircraft Type- Narrow-Body Aircraft |

13.8% |

In terms of aircraft type, the narrow-body aircraft segment is anticipated to secure at a CAGR of 13.8% during the period from 2024 to 2031. Globally, narrow-body aircraft type holds a substantial share of the commercial aircraft landing gear market, driven by strong demand for short- and medium-haul flights, which account for the majority of airline operations worldwide. Their cost-effectiveness and efficiency in passenger travel over regional routes make them highly preferred by airlines worldwide.

Globally, narrow-body aircraft lead due to extensive use by low-cost carriers and major airlines that prioritize operational efficiency. The demand for narrow-body fleets is especially strong in high-growth regions like Asia Pacific, where increasing passenger traffic has fueled airline expansion and the need for reliable, durable landing gear systems.

A notable competitor in this segment is Collins Aerospace, which recently launched an upgraded landing gear system tailored specifically for narrow-body aircraft. This new system focuses on enhancing durability and reducing maintenance costs, supporting airlines’ need for more cost-effective and resilient components.

The commercial aircraft landing gear market is set for robust growth, driven by the increasing demand for new aircraft and fleet expansions to meet rising global air travel.

Emerging markets in Asia Pacific and the Middle East, in particular, present substantial opportunities as airlines in these regions prioritize fleet modernization and expand MRO (Maintenance, Repair, and Overhaul) facilities. Lightweight materials and advanced technologies are gaining traction, creating avenues for innovation in landing gear systems.

Currently, a prominent trend in the global market is the shift towards lighter, more durable landing gear that enhances fuel efficiency and reduces overall operational costs. Key players are investing in new materials like titanium and composite alloys, which meet airlines' demands for sustainable solutions without compromising performance or safety. This trend toward lightweight landing gear aligns closely with the requirements of major end-users, including commercial airlines and cargo operators.

As fuel costs rise, efficient landing gear systems play a critical role in helping airlines improve performance, reduce fuel consumption, and lower maintenance costs, which are essential factors in the highly competitive commercial aviation industry.

The global commercial aircraft landing gear industry achieved a steady CAGR of 10.3% during the historical period from 2019 to 2023. This growth was primarily supported by consistent fleet expansion and a rise in air travel worldwide, contributing to the market's sustained development. Significant advancements in materials and design have enhanced landing gear performance, making them more resilient and efficient to meet the rigorous demands of modern aviation.

Ongoing demand for fuel efficiency, durability, and reduced maintenance cycles continues to elevate the market, with a strong focus on innovation across the sector. This need for optimized landing gear aligns closely with airlines' cost-efficiency goals and environmental considerations.

Sales of Commercial Aircraft Landing Gear are estimated to record a CAGR of 14.1% during the forecast period between 2024 and 2031.

Rising Demand for Fuel-Efficient Aircraft

The demand for lightweight and durable landing gear has surged globally with airlines increasingly focused on fuel efficiency. Advanced materials like titanium and composites are now commonly used in landing gear to reduce aircraft weight, directly impacting fuel consumption. This emphasis on efficiency is also driven by regulatory pressures and sustainability goals. To meet this demand, manufacturers are innovating, creating opportunities for lighter, cost-effective solutions that align with both economic and environmental objectives.

Growing MRO Sector and Fleet Expansion

Fleet expansions, especially in emerging markets like Asia-Pacific, have heightened the need for robust maintenance, repair, and overhaul (MRO) services. With increased aircraft traffic, the demand for landing gear components and replacements has accelerated, creating a solid foundation for market growth.

This trend is underscored by airlines’ need to maintain high safety standards, especially in high-growth regions with expanding aviation infrastructure.

Technical Complexity and Stringent Regulatory Compliance Impact Market Growth

The intricate engineering and high standards required for commercial aircraft landing gear systems present significant challenges, as even minor design deviations can affect aircraft safety and performance. These complex requirements necessitate extensive R&D, which lengthens development timelines and can slow the pace of innovation.

Additionally, strict regulatory frameworks across different regions place heavy demands on manufacturers to meet varied certification standards, adding to the complexity of production. This regulatory burden often limits flexibility and delays the introduction of new technologies, constraining overall market growth potential.

Expansion of Aviation Infrastructure in India

India's rapidly growing aviation sector presents substantial opportunities for the commercial aircraft landing gear market.

The demand for new aircraft is set to rise. This growth is supported by ongoing investments in airport infrastructure and the establishment of new MRO facilities with increasing passenger traffic and a strong push from the government to enhance regional connectivity. As airlines expand their fleets to accommodate this rising demand, the need for advanced landing gear systems will also increase, creating a favorable environment for manufacturers and suppliers.

In 2023, Boeing announced plans to invest in an aerospace manufacturing facility in India, focusing on the production of advanced landing gear components to support the expanding regional aircraft market.

Technological Advancements in Automation

The shift toward automation in aircraft manufacturing is another opportunity for growth in the commercial aircraft landing gear market. Countries like Germany and the U.S. are investing in smart manufacturing technologies that enhance precision and efficiency in landing gear production.

The integration of artificial intelligence and robotics can streamline assembly processes, reduce lead times, and improve overall product quality, catering to the increasing expectations of airlines for reliable performance.

In March 2023, Airbus unveiled its new automated assembly line for landing gear components, significantly reducing production time and enhancing quality control, thereby positioning itself as a leader in the evolving aerospace manufacturing landscape.

The competitive landscape of the global commercial aircraft landing gear market is characterized by the presence of key players such as Safran Landing Systems, Collins Aerospace, and Liebherr-Aerospace. These companies dominate the market through advanced technologies and established relationships with leading aircraft manufacturers. Their extensive product portfolios and experience in the aerospace sector enable them to cater to diverse customer needs across different aircraft types.

Manufacturers are actively pursuing strategic collaborations, mergers, and investments in research and development to enhance market growth. For instance, companies are focusing on developing lightweight landing gear solutions and automated manufacturing processes to improve efficiency and reduce turnaround times. This strategic emphasis not only strengthens their market position but also aligns with the growing demand for fuel-efficient and reliable aircraft systems.

Recent Industry Developments

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Gear Type

By Aircraft Type

By End User

By Region

To know more about delivery timeline for this report Contact Sales

Yes, the market is set to reach US$ 7.3 Bn by 2031.

Regional & Business Jets Holds Prominent Growth Rate in Commercial Aircraft Landing Gear Market.

North America is estimated to witness a Growth rate of around 13.7%.

Safran Landing Systems is considered the leading player in Commercial Aircraft Landing Gear.

OEM Holds Dominating Market Share in Commercial Aircraft Landing Gear.