Industry: Consumer Goods

Published Date: December-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 186

Report ID: PMRREP35002

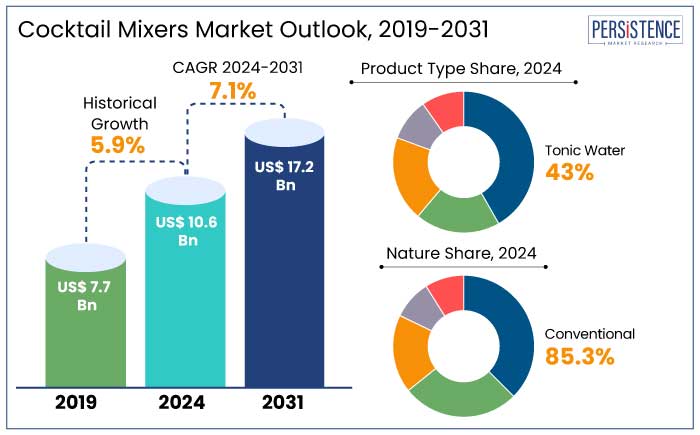

The global cocktail mixers market is anticipated to reach a valuation of US$ 10.6 Bn by 2024. It is anticipated to experience a CAGR of 7.1% during the forecast period to reach a value of US$ 17.2 Bn by 2031.The home mixology trend is estimated to continue to expand as consumers seek personalized drinking experiences. Customized mixers, cocktail kits, and virtual bartending tutorials are predicted to grow by 15% annually during the forecast period. By 2031, home consumption is likely to contribute to 50% of the market’s revenue.

Consumers are willing to pay a premium price for mixers that improve the quality and uniqueness of cocktails, including craft, small-batch, and artisanal products. Growing consumer awareness regarding health is estimated to drive the demand for mixers having natural ingredients along with functional benefits like added vitamins and botanicals.

Key Highlights of the Industry

|

Market Attributes |

Key Insights |

|

Cocktail Mixers Market Size (2024E) |

US$ 10.6 Bn |

|

Projected Market Value (2031F) |

US$ 17.2 Bn |

|

Global Market Growth Rate (CAGR 2024 to 2031) |

7.1% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

5.9% |

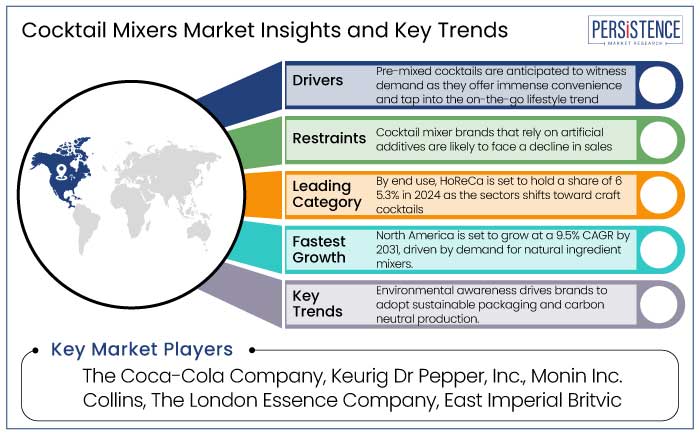

North America is estimated to account for a share of 37.3% in 2024. The region is home to a vibrant cocktail culture that influences global trends. Consumers in North America, particularly in the U.S. and Canada, have shown a preference for premium and highly-quality mixers. The premium cocktail mixer segment accounted for 40% to 45% of the market in North America in 2023.

Consumers in the region are aware of the health impact of their food and beverage choices. Consequently, they are posing a robust demand for mixers made with natural ingredients, low or no sugar, and those providing functional benefits.

Prominent retailers in the region including Whole Foods, Walmart, and Target have expanded their offerings of cocktail mixer to cater to the growing consumer demand. In 2023, retail stress contributed to 60% to 65% of total sales in North America.

Tonic water is estimated to emerge as the leading product type with a share of 43% in 2024. Consumers prefer tonic waters that are crafted with natural ingredients like quinine, botanicals, and organic sweeteners. Tonic water is very versatile and pairs well with a variety of alcoholic beverages, making it a go-to mixer for several drinks.

Tonic water is increasingly seen as a staple product for bars, restaurants, and consumers at home owing to the growing popularity of cocktails. Tonic water is particularly favoured for its balance of bitter sand sweet flavours, enabling consumers to experiment with new recipes and tastes. The widespread availability of tonic water in convenient formats like cans, bottles, and small-size containers further contributes to their popularity.

Conventional cocktail mixers are projected to emerge as a leading segment with a share of 85.3% in 2024. Conventional cocktail mixers are typically less expensive compared to their organic or premium counterparts.

Affordability of conventional mixers makes them accessible to a broad audience, starting from home enthusiasts to professional bars and restaurants. Established familiarity of conventional mixers makes them a go-to-choice for cocktails, especially in casual settings.

Conventional cocktail mixers are readily available in most grocery stores, supermarkets, and retail outlets. This widespread availability allows them to maintain a dominant position in retail as well as food service sectors. Conventional mixers are a standard choice in bars and restaurants owing to their cost-effectiveness and ability to cater to large crowds.

HoReCa is predicted to lead the end use segment with a share of 65.3% in 2024. The demand for cocktails in bars, restaurants, and hotels has witnessed significant growth over the past few years, fuelled by domestic and internation travel and dining-out experiences. Cocktail-based drinks have become an integral part of bar menus in many HoReCa establishments.

Several restaurants and bars are focusing on offering premium cocktails that require high-quality mixers. There is a growing trend in the HoReCa sector toward craft cocktails that are made using high-quality ingredients, including premium mixers. As more consumers seek authentic an artisanal drinking experiences, bar and restaurants are investing in premium cocktail mixers to meet demand.

Potential growth in the global cocktail mixers market is predicted to be driven by continued demand for premiumization. Low-calorie, organic, and functional mixers are likely to emerge as the dominating category owing to the rising health awareness.

Manufacturers are adopting eco-friendly packaging and sourcing practices for brand differentiation amid growing concerns regarding sustainability. Brands are likely to diversify their product portfolio by offering personalized mixers or cocktail kits through online platforms.

The cocktail mixers market growth was robust at a CAGR of 5.9% during the historical period. Growth during the period was mostly fueled by urbanization that fostered the adoption of Western drinking habits, especially in emerging markets. Preimmunization of mixers started to gain momentum with brands like Fever-Tree and Q Mixers leading the market.

The pandemic led to a significant shift in consumer behavior. The closure of bars and restaurants spiked the demand for cocktail mixers as people recreated bar-quality cocktails at home.

Online sales of mixers rose dramatically as consumers during the period turned to e-commerce platforms. DIY cocktail kits became a trend with 40% rise in searches for “cocktail recipes, during lockdowns. In 2023, premium mixers accounted for approximately 35% of the global market sales.

Rising Demand for Premium and Craft Mixers

The craft cocktail movement that emphasizes on fresh, high-quality ingredients, and innovative recipes, fuelling the demand for premium mixers that match the sophistication of high-end spirits. Increasing availability of artisanal mixers like those offered by Fever-Tree and Q Mixers, reflecting this trend. Based on Bacardi’s 2023 Cocktail Trends Report, 58% of consumers prioritize premium mixers to elevate their at-home drinking experience.

Premium mixers usually use real fruit juices, natural botanicals, and sustainably sourced ingredients that appeal to health-conscious and flavour-driven consumers. For instance, Fever-Tree, a leading premium mixer brand uses natural quinine sourced from the Democratic Republic of Congo, highlighting its commitment to quality and authenticity.

Premium and craft mixer brands often experiment with unique and globally inspired flavours, thereby catering to adventurous palates. Brands like Monin and Fentimans have introduced mixers with uncommon flavours to differentiate their offerings.

Customization and Personalization

Modern consumers, particularly millennials and Gen Z, prioritize experiences over products and demand brands to cater to their individuality. A survey in 2023 revealed that 71% of consumers express their frustration when their shopping experience feels impersonal, thereby driving the demand for customized products.

Several brands are now offering personalized cocktail kits where consumers can choose mixers, ingredients, and recipes based on their preferences. Companies like Shaker & Spoon enable users to select kits tailored to specific spirits, occasions, or flavour profiles, thereby creating highly personalized experience.

Brands are offering mixers or kits that are designed for specific events, thereby catering to unique consumer requirements. Around 65% of consumer value products that improve celebratory experiences, thereby making event-specific customization a growing segment. Brands including Cocktail Courier provide holiday-themed kits or mixers for occasions like Valentine’s Day and Halloween.

Health Concerns over Artificial Ingredients

Rising health awareness has led consumers to scrutinize ingredient labels for artificial sweeteners, colours, and flavours. A report by the Internal Food Information Council (IFIC) in 2023 revealed that 74% of consumers prioritize health when choosing beverages and 67% actively avoid products with artificial ingredients.

Cocktail mixer brands that rely on artificial additives are likely to face a decline in sales, especially among health-conscious and younger demographics. High sugar content in mixers has come under scrutiny owing to the global focus on decrease sugar intake. Artificial sweeteners like saccharin, used as substitutes, also face resistance owing to health concerns.

The World Health Organization (WHO) released updates guidelines in 2023, recommending decreased sugar consumption and caution against long-term use of artificial sweeteners. Approximately, 48% of consumers across the globe avoid beverages with artificial sweeteners, thereby emphasizing the challenge for brands using these ingredients.

Expansion of Home Mixology

The Covid-19 pandemic and lockdowns resulted in a surge in at-home cocktail-making. The trend has since continued as consumers have embraced home entertaining as a personalized and cost-effective alternative to going out. The U.S. registered a 36% rise in sales of cocktail mixers in 2020, thereby reflecting the demand for home bartending tools and ingredients.

DIY cocktail kits provide pre-measure ingredients and recipes, thereby simplifying the cocktail-making process for beginners while enabling enthusiasts to replicate bar-quality drinks at home. Brands offering customizable kits witness higher consumer engagement and loyalty.

The lockdown instilled an interest in consumers to learn mixology techniques. This trend has been further amplified by social media platforms where creators shared cocktail tutorials and recipes. A survey conducted by Bacardi in 2022 revealed that 58% of consumer worldwide experimented with cocktail-making at home in the previous year.

Health and Wellness Trends

A growing number of consumers are actively deceasing their sugar intake owing to health concerns like obesity, diabetes, and general well-being. This spikes the demand for low-calorie and sugar-free cocktail mixers.

Based on statistics provided by the International Food Information Council (IFIC), 74% of consumers in 2023 stated that they are lowering their sugar intake and 43% were seeking beverages labelled as “low sugar” or “no sugar.” For instance, Skinny Mixes, a brand specializing in low-calorie cocktail mixers, reported a 30% increase ins ales year-over-year, reflecting the rising demand for such products.

The rise of sober-curious and moderation trends has created a demand for non-alcoholic for non-alcoholic mixers that cater to mocktail enthusiasts. As consumers seek products that align with specific dietary preferences or restrictions, including gluten-free, vegan, and allergen-free mixers.

A study conducted in 2023 found that 39% of global consumers are actively avoiding allergens like gluten and diary, thereby driving the demand for clean-label mixers. Brands like DRY Botanical Bubbly and Ficks focus on providing mixers that are free from common allergens while maintaining great taste.

Companies in the cocktail mixers market are working on launching mixers with innovative, exotic, and seasonal flavours to attract adventurous consumers. They are also developing low-calories, organic, natural, and non-alcoholic mixers to cater to the health-conscious demographic.

Businesses are creating premium mixers with high-quality ingredients to appeal to discerning consumers. They are progressively using eco-friendly packaging and sustainably sources ingredients to align with the growing environmental concerns.

Brands are leveraging digital marketing to reach their target audience. They are working on building a strong brand narrative by emphasizing on heritage, craftmanship, and sustainability. Organizations are expanding their product lines to include mixers for specific spirits or multipurpose mixers. They are also introducing pre-mixed, ready-to-drink options for convenience. Businesses are partnering with retailers to produce exclusive mixers under private labels.

Recent Industry Developments

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Nature

By End Use

By Distribution Channel

By Region

To know more about delivery timeline for this report Contact Sales

The market is anticipated to reach a value of US$ 17.2 Bn by 2031.

Rise in product launched and other innovation by brands is driving growth in the market.

North America is predicted to emerge as the leading region in the industry with a share of 37.3% in 2024.

Some of the prominent players in the market are The Coca-Cola Company, Keurig Dr Pepper, Inc., and Monin Inc.

The market is predicted to witness a CAGR of 7.1% through the assessment period.