Comprehensive Snapshot for Bio-succinic Acid Market Including Regional and Country Analysis in Brief

Industry: Chemicals and Materials

Published Date: April-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 180

Report ID: PMRREP35247

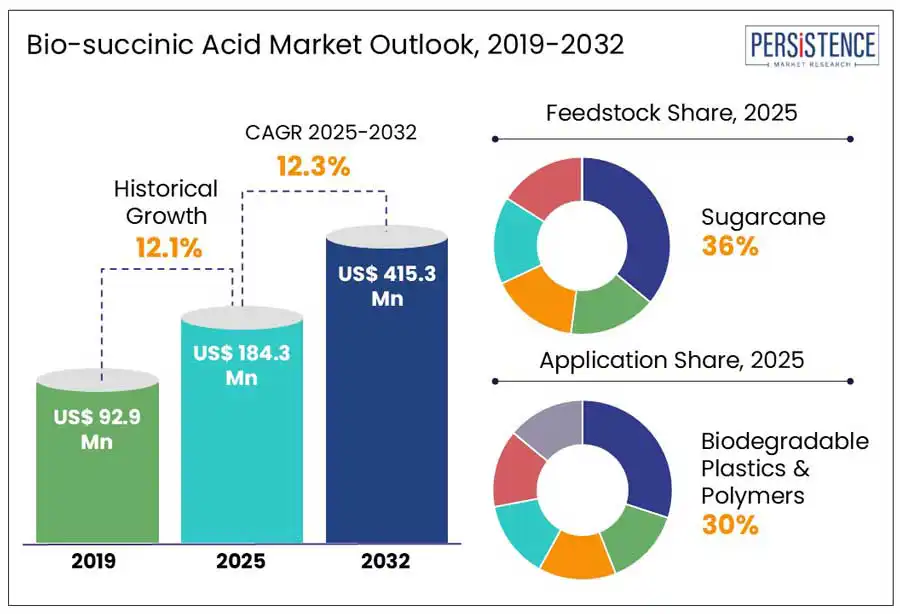

The global bio-succinic acid market size is anticipated to rise from US$ 184.3 Mn in 2025 to US$ 415.3 Mn by 2032. It is projected to witness a CAGR of 12.3% from 2025 to 2032. As per the Persistence Market Research report, the bio-succinic acid market is rapidly expanding, driven by growing demand for sustainable chemicals in biodegradable plastics, resins, coatings, food, and pharmaceuticals, by reducing carbon emissions, and enhancing green manufacturing globally. Each ton of bio-based SA (succinic acid) produce reduce CO? emissions by approximately 4.50–5.00 tons compared to fossil-fuel-based methods. Bio-based SA manufacturing can achieve a reduction of over 60% in GHG emissions relative to conventional petrochemical processes.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Bio-succinic Acid Market Size (2025E) |

US$ 184.3 Mn |

|

Market Value Forecast (2032F) |

US$ 415.3 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

12.3% |

|

Historical Market Growth (CAGR 2019 to 2024) |

12.1% |

With increasing concerns over plastic pollution, carbon emissions, and environmental sustainability, industries such as packaging, automotive, consumer goods, and agriculture are shifting towards eco-friendly materials and adopting biodegradable plastics. Out of total bioplastics production, biodegradable plastics such as polylactic acid (PLA), PBS, and polybutylene adipate terephthalate (PBAT) constituted approximately 55.5%, equating to roughly 1.17 million tonnes.

Bio-succinic acid is a crucial raw material in the production of biodegradable polymers like polybutylene succinate (PBS) and polybutylene adipate terephthalate (PBAT), which are gaining widespread acceptance as eco-friendly solutions. Governments worldwide, including the EU's Single-Use Plastics Directive and China’s biodegradable plastic mandates, are enforcing strict policies to curb plastic pollution. As industries accelerate their shift toward low-carbon and biodegradable materials, the demand for bio-succinic acid is expected to surge, boosting market growth and innovation in bioplastics.

Conventional petroleum-derived succinic acid is produced using well-established, cost-effective processes, whereas bio-based production involves fermentation, requiring expensive feedstocks such as sugarcane, corn, and wheat, and costly purification steps which results in higher production cost. Additionally, lower yields and high energy consumption further scale up production expenses. The estimated cost of bio-succinic acid ranges from US$2.50 to US$4.00 per kg, while petroleum-based succinic acid costs around US$1.00 to US$1.50 per kg.

Despite the growing demand for sustainable chemicals, many manufacturers hesitate to switch to bio-succinic acid due to its higher minimum selling price (MSP) and economic uncertainties. Industries such as plastics, resins, and coatings rely heavily on cost-effective raw materials, making it difficult for bio-succinic acid to compete with cheaper petrochemical counterparts.

The growing regulatory restrictions on phthalate-based plasticizers are creating a significant opportunity for bio-succinic acid derivatives. Phthalates, commonly used as plasticizers in PVC, coatings, adhesives, and consumer goods, have been linked to health hazards such as endocrine disruption and reproductive toxicity. In 2024, the U.S. Food and Drug Administration (FDA) removed 23 phthalates from authorized use in food-contact applications, reflecting updated safety evaluations. Similarly, the U.S. Consumer Product Safety Commission (CPSC) permanently banned di(2-ethylhexyl) phthalate (DEHP), dibutyl phthalate (DBP), and benzyl butyl phthalate (BBP) in children's toys and childcare products (above 0.1%).

Phthalates such as DEHP, DBP, and BBP in plastics and food packaging face strict regulations globally, driving demand for eco-friendly alternatives such as bio-based succinic acid. This leads to the development of phthalate-free plasticizers like bio-based 1,2-cyclohexane dicarboxylic acid diisononyl ester (DINCH) and PBS, with companies focusing on sustainable, non-toxic options for food packaging, automotive, and consumer goods.

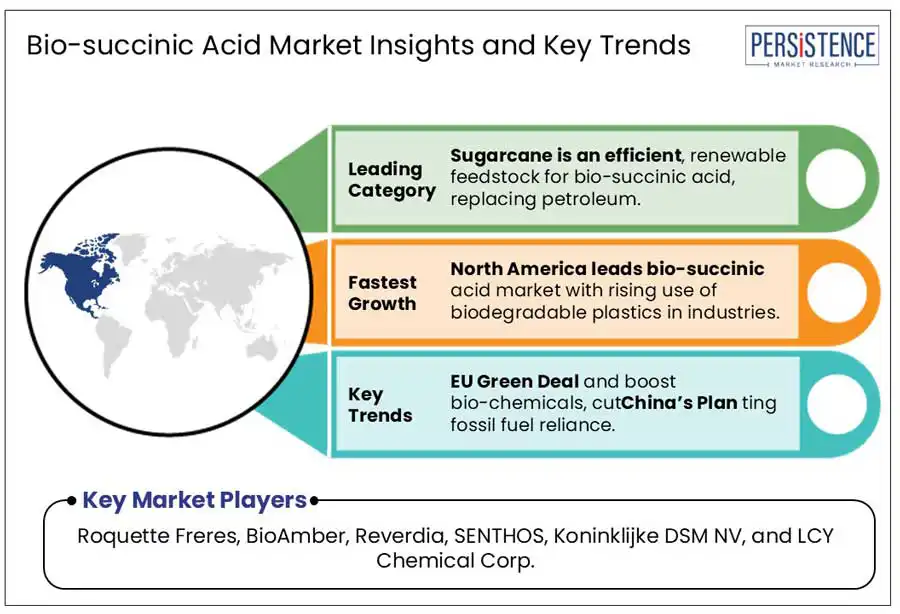

Sugarcane serves as a highly efficient and renewable feedstock for bio-succinic acid production, offering a sustainable alternative to petroleum-based methods. The process begins by extracting juice from crushed sugarcane, rich in sucrose, which is then fermented using engineered microorganisms to produce succinic acid. This bio-based approach requires less energy and generates fewer harmful by-products compared with traditional petroleum-dependent processes, thereby reducing greenhouse gas emissions and reliance on non-renewable resources. Roquette’s Biosuccinium™, a leading bio-succinic acid product, is derived from renewable sugarcane feedstock, offering a low-carbon alternative to fossil-based chemicals A study was designed and simulated biorefineries capable of processing sugarcane into succinic acid, achieving an annual production capacity of 26,800 metric tonnes. Additionally, sugarcane bagasse, the fibrous residue post juice extraction, has been utilized as a low-cost feedstock for succinic acid production. This approach adds value to agricultural waste, and aligns with circular economy principles by maximizing resource utilization.

Biodegradable plastics and polymers are emerging as a crucial market segment for bio-succinic acid, driven by growing environmental concerns and regulatory mandates to reduce plastic waste. Bio-succinic acid is a key building block in the production of polybutylene succinate (PBS), a biodegradable polymer used in food packaging, agricultural films, and disposable cutlery. PBS offers excellent biodegradability and mechanical properties, making it a viable alternative to traditional petroleum-based plastics. PTT MCC Biochem is a leading company in the biodegradable plastics industry, producing and selling BioPBS™, a bio-based polybutylene succinate (PBS) that incorporates bio-succinic acid derived from renewable resources and 1,4-butanediol (BDO).The demand for biodegradable plastics is growing rapidly due to regulatory bans on single-use plastics and increasing consumer preference for eco-friendly alternatives. PTT MCC Biochem’s investment in bio-based PBS technology highlights the increasing role of bio-succinic acid in developing sustainable materials.

North America dominates the bio-succinic acid market, primarily due to the growing adoption of biodegradable plastics across various industries such as packaging, automotive, and consumer goods. As of 2023, North America holds a 20% share of the global bioplastics production capacity, positioning it as the second-largest producer worldwide. The U.S. and Canada have witnessed a significant rise in sustainable packaging solutions, spurred by increasing environmental concerns and regulatory frameworks promoting bio-based materials. The United States dominates biodegradable plastics demand, contributing approximately 93% to the North American market. Canada and Mexico account for 5.3% and 1.9%, respectively.

Major players such as DuPont, Myriant, and BASF are actively investing in bio-succinic acid production to support the shift toward sustainable materials. With government initiatives supporting bio-based product development and major investments in biorefineries, North America is expected to maintain its leading position in the global bio-succinic acid market.

Europe is at the forefront of the bio-succinic acid market, driven by stringent environmental regulations and strong sustainability initiatives. The European Union's Green Deal and Circular Economy Action Plan are key policies promoting the transition to bio-based chemicals and biodegradable plastics. The Single-Use Plastics Directive (SUPD) has accelerated demand for bio-based alternatives, particularly in packaging and consumer goods.

Carbon taxation policies and incentives for bio-based industries have encouraged companies to shift towards bio-succinic acid for applications like biodegradable polymers, resins, and coatings. Countries like Germany, France, and the Netherlands have set ambitious targets for reducing greenhouse gas (GHG) emissions, further boosting the adoption of bio-based materials.

Asia Pacific is witnessing a rapid growth, primarily due to the abundant availability of renewable feedstocks such as sugarcane, corn, and wheat. Countries like China, India, Thailand, and Indonesia have vast agricultural resources, enabling cost-effective production of bio-based succinic acid. China is a major sugarcane producer, with sugarcane accounting for about 85% of its total sugar production. In 2023, China produced approximately 104.57 million metric tons of sugarcane. The region’s strong agro-based economy ensures a steady supply of raw materials, reducing dependency on fossil-based alternatives.

Government initiatives promoting bio-based chemicals and rising demand for biodegradable plastics and sustainable materials are driving market expansion. China’s Five-Year Plan and India’s National Policy on Biofuels encourage investments in bio-based industries, fostering local production and reducing imports of petrochemicals.

The global bio-succinic acid market is highly competitive and dynamic, with numerous players focusing on technological advancements, cost reduction, and large-scale commercialization. Companies are investing in innovative fermentation techniques and feedstock diversification to enhance production efficiency and sustainability. Strategic collaborations, joint ventures, and government partnerships are driving market expansion.

The industry is also witnessing increased patent filings and R&D activities to develop high-purity bio-succinic acid for diverse applications. With growing demand for biodegradable plastics, resins, and specialty chemicals, market participants are expanding their production capacities and global reach, making competition more intense across key regions.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Mn/Mn, Volume: As applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

To know more about delivery timeline for this report Contact Sales

The Bio-succinic Acid market is estimated to be valued at US$ 184.3 Mn in 2025.

Increasing preference for biodegradable plastics across industries is the key demand driver for the Bio-succinic Acid market.

In 2025, North America dominates with a 21.2% share in the global Bio-succinic Acid market.

Among the application segment, demand from the Biodegradable Plastics & Polymers segment is expected to grow rapidly.

Roquette Freres, BioAmber, Reverdia, and SENTHOS are the leading players in the Bio-succinic Acid market.