Industry: Industrial Automation

Published Date: September-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 169

Report ID: PMRREP34790

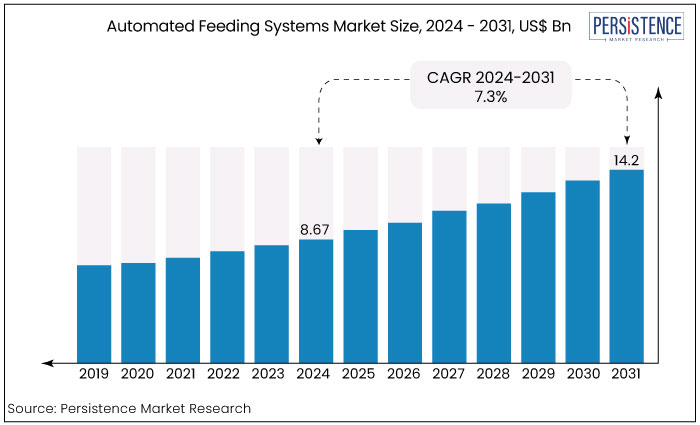

The automated feeding systems market is estimated to increase from US$8.67 Bn in 2024 to US$14.2 Bn by 2031. The market is projected to record a CAGR of 7.3% during the forecast period from 2024 to 2031. Sustainability trends and demand for organic farming present significant opportunities for market expansion. Growing adoption of IoT and precision farming technologies to optimize feed efficiency caters to market growth.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Automated Feeding Systems Market Size (2024E) |

US$8.67 Bn |

|

Projected Market Value (2031F) |

US$14.2 Bn |

|

Global Market Growth Rate (CAGR 2024 to 2031) |

7.3% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

6.7% |

|

Region |

Market Share in 2024 |

|

North America |

34% |

The market expansion in the region is propelled by numerous critical factors including a severe labour shortage in the agriculture sector, which has hastened the implementation of automation and robots to sustain productivity and efficiency. North America market to gain 34% market share in 2024.

Strong poultry production in the region drives the demand for automated feeding systems. Agriculture and Agri-Food Canada (AAFC) reported that Canada produced poultry and egg products valued at approximately USD 4.0 billion.

The U.S. automated feeding systems market is anticipated to expand at a CAGR of 11.2% from 2024 to 2031. The market's expansion in the country can be ascribed to governmental initiatives including grants and subsidies for technological adoption in agriculture. Furthermore, the existence of leading automated feeding system suppliers like BouMatic, propels market expansion further.

|

Category |

Market Share in 2024 |

|

Component - Hardware |

64% |

Based on component, the automated feeding services market is segmented into hardware, software and services. Among these, the hardware segment dominates the market. The hardware segment's expansion is due to the scalability and versatility of contemporary automated feeding equipment and the increasing innovation and introduction of new automated feeding systems incorporating advanced technology.

|

Category |

Market Share in 2023 |

|

System - Conveyor Feeding |

48% |

Based on system, the market is classified into rail-guided feeding system, conveyor feeding system, and self-propelled feeding system. Among these, the conveyor feeding system dominates the market due to the scalability and efficiency of these systems.

Conveyor feeding systems optimize the feed distribution process, minimizing the time and work necessary for animal feeding. This efficiency is especially advantageous for extensive agricultural enterprises. Furthermore, these systems guarantee uniform and accurate feed distribution, which is essential for sustaining optimal nutrition and health of the cattle.

The self-propelled feeding systems segment is anticipated to achieve the most significant compound annual growth rate throughout the projection period.

The segment's expansion is ascribed to the versatility and mobility provided by self-propelled feeding systems. These systems exhibit significant mobility and flexibility enabling them to traverse diverse areas of the farm and distribute feed to several sites without being confined to predetermined routes or infrastructure.

The advancements in robotics, sensors, and artificial intelligence have improved the reliability, efficiency, and user-friendliness of self-propelled feeding systems.

Automated systems provide accurate regulation of feed distribution and consumption, enhancing feed efficiency and minimizing feed waste. Implementing precision feeding and real-time monitoring facilitates personalized feeding methods designed to meet the specific requirements of each animal, hence enhancing growth rates and total production.

Automated feeding systems enhance animal health and welfare by providing consistent and timely feeding schedules. Livestock production presents numerous problems, with a significant issue being a scarcity of labourers. This necessitates the adoption of intelligent, sustainable, and digital agricultural practices.

Digital farming integrates intelligent and sustainable agriculture practices fostering connectivity and collaboration across the agricultural community. It employs digital technologies to enhance agricultural practices, including sensors affixed to cattle.

Automated feeding systems diminish the need for physical work in livestock feeding enabling farms to minimize labour expenses and mitigate labour shortages. The future of livestock production is bright with the increasing utilization of new technologies including Artificial Intelligence (AI). These technologies offer substantial potential for the market.

Ongoing technological improvements including sensors, data analytics, and automation software are set to revolutionize the efficacy and efficiency of automated feeding systems, ushering in a new era of productivity and sustainability.

The automated feeding systems market has experienced significant growth historically due to the increasing adoption of automation in livestock management. Key drivers include labor shortages, rising awareness of livestock health and productivity, and advancements in precision farming technology.

Between 2019 and 2023, the market experienced a steady CAGR driven by the demand for efficient feed management systems in dairy farms and large-scale livestock operations.

The market is projected to maintain a robust growth trajectory with a CAGR expected around 7.3%. Factors fueling future growth include the increasing emphasis on reducing feed waste, optimizing feeding processes, and the rising demand for automated systems in emerging markets.

The integration of the Internet of Things (IoT) and smart farming solutions is expected to further boost market adoption. Europe and North America remain key regions but Asia Pacific is forecasted to see the highest growth due to expanding livestock farming and technological advancements in agriculture.

Labour Shortages and Increasing Labour Costs

One of the key growth drivers for the automated feeding systems market is the increasing shortage of skilled labour in the agriculture and livestock sectors. Farm labour is becoming increasingly scarce in both developed and developing countries.

Managing large-scale livestock farms particularly in regions like Europe and North America requires a significant workforce to ensure animals are properly fed and cared for. Automated feeding systems offer a cost-effective solution by reducing dependency on human labour and enabling farmers to streamline operations.

The systems can be programmed to deliver precise amounts of feed at scheduled times, ensuring that livestock receive consistent nutrition while reducing manual input. As a result, farmers are able to improve productivity while cutting down on operational costs making automation an attractive investment.

Advancements in Precision Farming Technologies

The rapid evolution of precision farming technologies has significantly contributed to the growth of the automated feeding systems market. Precision agriculture involves the use of data and technology to optimize farming practices improving efficiency and yields.

Automated feeding systems are part of this technological revolution, utilizing sensors, data analytics, and IoT (Internet of Things) solutions to track livestock feeding patterns and needs in real time. Such systems help ensure that animals are fed the right quantity and quality of feed based on their individual requirements reducing waste and improving overall farm productivity.

The integration of automated systems with farm management software allows farmers to monitor feed usage, animal health, and performance remotely enhancing decision-making and operational efficiency. As technology continues to advance, the ability to connect these systems with other farm automation tools will further boost market growth by improving the accuracy and reliability of livestock feeding processes.

High Initial Investment and Maintenance Costs

One of the primary restraints for the growth of the automated feeding systems market is the high initial investment required for system installation and implementation.

Automated feeding systems especially those integrated with advanced technologies like IoT, sensors, and software platforms come with substantial upfront costs that can be prohibitive for small and medium-sized farms. Such systems require regular maintenance, which can add to operational expenses.

The cost of skilled technicians to service the equipment and software may further increase the overall expenditure. The high costs can discourage adoption for farmers operating with limited budgets or in regions with less developed agricultural infrastructure especially when the return on investment (ROI) is not immediate.

Integration of IoT and Smart Farming Technologies

One of the most transformative opportunities in the automated feeding systems market is the integration of the Internet of Things (IoT) and smart farming technologies. As IoT devices become more accessible and affordable, farmers can leverage real-time data to accurately monitor livestock health, feeding patterns, and environmental conditions.

Sensors can be embedded in feeding systems to track feed consumption, adjust feed quantities, and even predict feeding needs based on the animals' health and growth stages. This data-driven approach allows farmers to optimize feed efficiency, reduce wastage, and improve overall productivity.

The ability to remotely monitor and manage feeding processes via mobile apps or cloud-based platforms enhances operational control making this integration one of the critical drivers of future market growth. IoT-enabled automated feeding systems also enable predictive maintenance minimizing downtime and reducing costs related to equipment failure.

The presence of several key players, including Lely, GEA Group, DeLaval, and Trioliet, characterizes the competitive landscape of the automated feeding systems market. These companies are leading the market through innovations in precision farming and automation technologies.

The market is highly competitive, with players focusing on expanding their product portfolios, integrating IoT solutions, and improving feed efficiency to differentiate themselves.

Mergers, acquisitions, and strategic partnerships are common strategies to strengthen market presence and expand geographically. Small and niche companies are also entering the market with specialized solutions tailored to specific livestock needs, particularly in emerging markets. The competitive environment encourages continuous innovation, fostering new feeding technologies, data analytics, and sustainability developments.

Recent Industry Developments in the Automated Feeding Systems Market

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Component

By System

By Livestock

By Region

To know more about delivery timeline for this report Contact Sales

Advancements in precision farming technologies fuels the demand for the market

A few of the key market players are Fullwood JOZ, BouMatic, DAIRYMASTER are some of the key players in the market.

The hardware segment to record a significant market share.

North America is set to account for a significant share of the market.

Integration of IoT offers a prominent opportunity in the market.