- Executive Summary

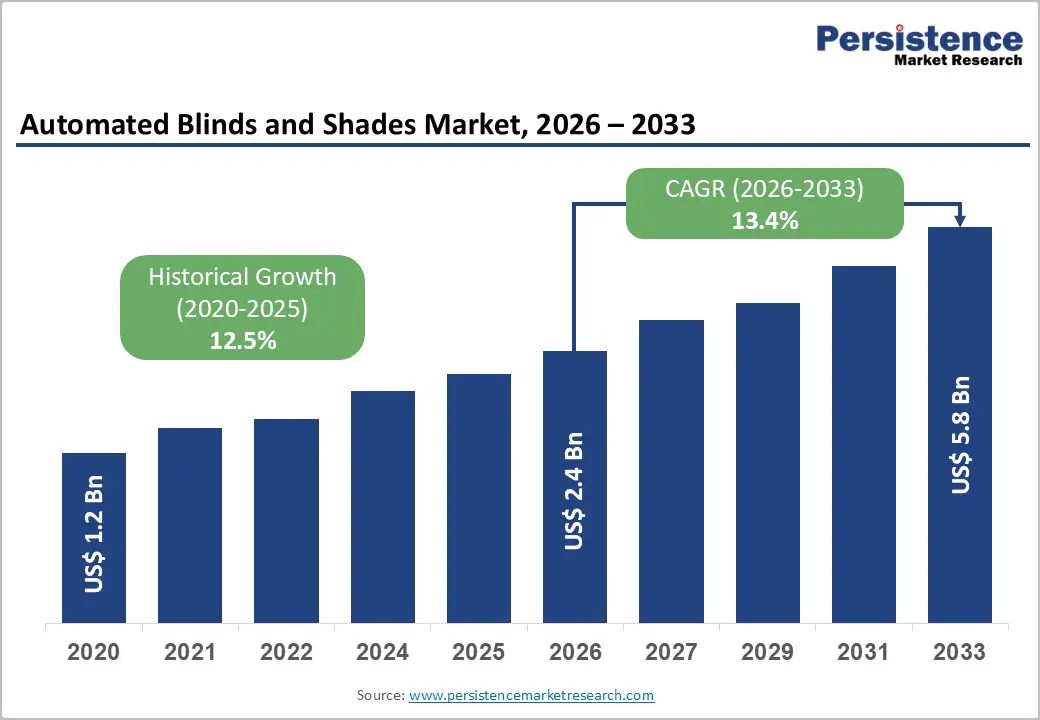

- Global Automated Blinds and Shades Market Snapshot 2026 and 2033

- Market Opportunity Assessment, 2026-2033, US$ Bn

- Key Market Trends

- Industry Developments and Key Market Events

- Demand Side and Supply Side Analysis

- PMR Analysis and Recommendations

- Market Overview

- Market Scope and Definitions

- Value Chain Analysis

- Macro-Economic Factors

- Global GDP Outlook

- Global Construction & Real Estate Growth

- Smart Home & Building Automation Adoption

- Energy Efficiency Regulations & Green Building Policies

- Forecast Factors - Relevance and Impact

- COVID-19 Impact Assessment

- PESTLE Analysis

- Porter's Five Forces Analysis

- Geopolitical Tensions: Market Impact

- Regulatory and Technology Landscape

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Trends

- Price Trend Analysis, 2020 - 2033

- Region-wise Price Analysis

- Price by Segments

- Price Impact Factors

- Global Automated Blinds and Shades Market Outlook: Historical (2020 - 2025) and Forecast (2026 - 2033)

- Key Highlights

- Global Automated Blinds and Shades Market Outlook: Product Type

- Introduction/Key Findings

- Historical Market Size (US$ Bn) Analysis by Product Type, 2020-2025

- Current Market Size (US$ Bn) Forecast, by Product Type, 2026-2033

- Fully-automatic

- Semi-automatic

- Market Attractiveness Analysis: Product Type

- Global Automated Blinds and Shades Market Outlook: End Use

- Introduction/Key Findings

- Historical Market Size (US$ Bn) Analysis by End Use, 2020-2025

- Current Market Size (US$ Bn) Forecast, by End Use, 2026-2033

- Residential

- Apartment Buildings

- Individual Residences (Villas, Rou Houses, Bungalows, etc.)

- Commercial

- Retail

- Hospitality, Leisure and Entertainment

- Offices

- Healthcare

- Educational Institutions

- Others

- Residential

- Market Attractiveness Analysis: End Use

- Global Automated Blinds and Shades Market Outlook: Installation

- Introduction/Key Findings

- Historical Market Size (US$ Bn) Analysis by Installation, 2020-2025

- Current Market Size (US$ Bn) Forecast, by Installation, 2026-2033

- New Installations

- Retrofit

- Market Attractiveness Analysis: Installation

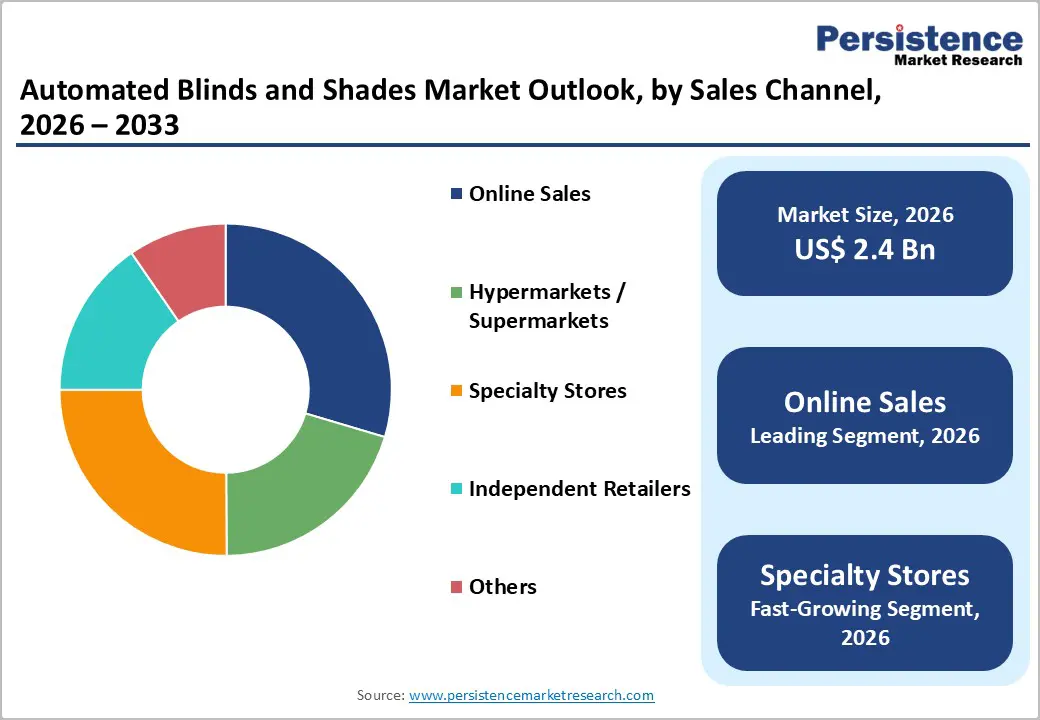

- Global Automated Blinds and Shades Market Outlook: Sales Channel

- Introduction/Key Findings

- Historical Market Size (US$ Bn) Analysis by Sales Channel, 2020-2025

- Current Market Size (US$ Bn) Forecast, by Sales Channel, 2026-2033

- Hypermarkets / Supermarkets

- Specialty Stores

- Independent Retailers

- Online Sales

- Others

- Market Attractiveness Analysis: Sales Channel

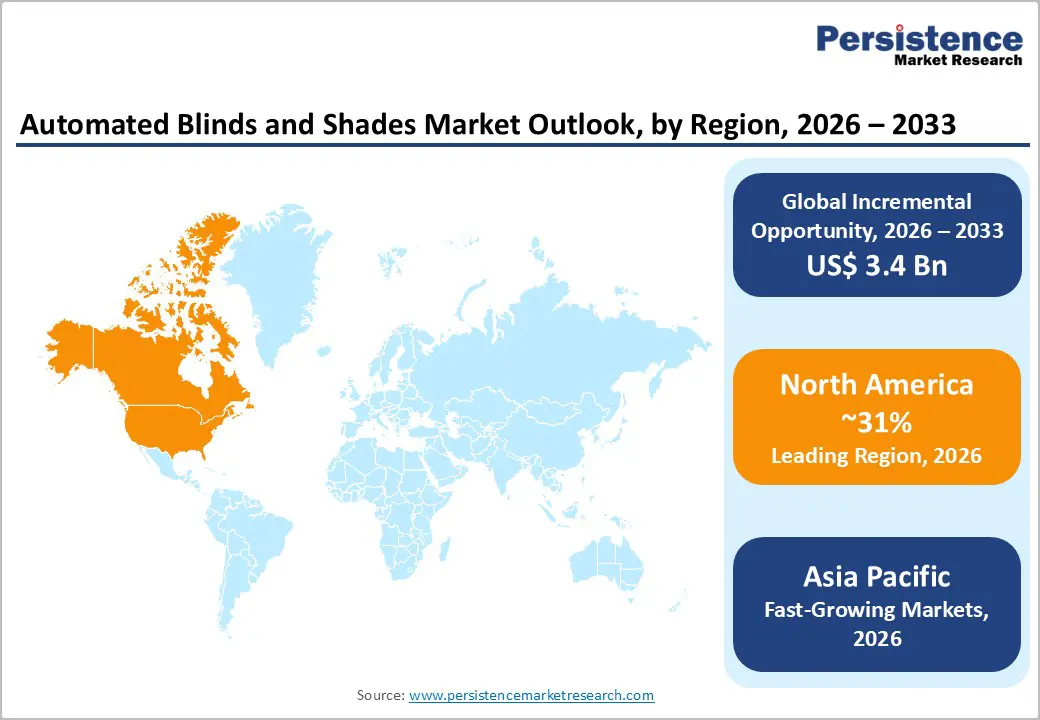

- Global Automated Blinds and Shades Market Outlook: Region

- Key Highlights

- Historical Market Size (US$ Bn) Analysis by Region, 2020-2025

- Current Market Size (US$ Bn) Forecast, by Region, 2026-2033

- North America

- Europe

- East Asia

- South Asia & Oceania

- Latin America

- Middle East & Africa

- Market Attractiveness Analysis: Region

- North America Automated Blinds and Shades Market Outlook: Historical (2020 - 2025) and Forecast (2026 - 2033)

- Key Highlights

- Pricing Analysis

- North America Market Size (US$ Bn) Forecast, by Country, 2026-2033

- U.S.

- Canada

- North America Market Size (US$ Bn) Forecast, by Product Type, 2026-2033

- Fully-automatic

- Semi-automatic

- North America Market Size (US$ Bn) Forecast, by End Use, 2026-2033

- Residential

- Apartment Buildings

- Individual Residences (Villas, Rou Houses, Bungalows, etc.)

- Commercial

- Retail

- Hospitality, Leisure and Entertainment

- Offices

- Healthcare

- Educational Institutions

- Others

- Residential

- North America Market Size (US$ Bn) Forecast, by Installation, 2026-2033

- New Installations

- Retrofit

- North America Market Size (US$ Bn) Forecast, by Sales Channel, 2026-2033

- Hypermarkets / Supermarkets

- Specialty Stores

- Independent Retailers

- Online Sales

- Others

- Europe Automated Blinds and Shades Market Outlook: Historical (2020 - 2025) and Forecast (2026 - 2033)

- Key Highlights

- Pricing Analysis

- Europe Market Size (US$ Bn) Forecast, by Country, 2026-2033

- Germany

- Italy

- France

- U.K.

- Spain

- Russia

- Rest of Europe

- Europe Market Size (US$ Bn) Forecast, by Product Type, 2026-2033

- Fully-automatic

- Semi-automatic

- Europe Market Size (US$ Bn) Forecast, by End Use, 2026-2033

- Residential

- Apartment Buildings

- Individual Residences (Villas, Rou Houses, Bungalows, etc.)

- Commercial

- Retail

- Hospitality, Leisure and Entertainment

- Offices

- Healthcare

- Educational Institutions

- Others

- Residential

- Europe Market Size (US$ Bn) Forecast, by Installation, 2026-2033

- New Installations

- Retrofit

- Europe Market Size (US$ Bn) Forecast, by Sales Channel, 2026-2033

- Hypermarkets / Supermarkets

- Specialty Stores

- Independent Retailers

- Online Sales

- Others

- East Asia Automated Blinds and Shades Market Outlook: Historical (2020 - 2025) and Forecast (2026 - 2033)

- Key Highlights

- Pricing Analysis

- East Asia Market Size (US$ Bn) Forecast, by Country, 2026-2033

- China

- Japan

- South Korea

- East Asia Market Size (US$ Bn) Forecast, by Product Type, 2026-2033

- Fully-automatic

- Semi-automatic

- East Asia Market Size (US$ Bn) Forecast, by End Use, 2026-2033

- Residential

- Apartment Buildings

- Individual Residences (Villas, Rou Houses, Bungalows, etc.)

- Commercial

- Retail

- Hospitality, Leisure and Entertainment

- Offices

- Healthcare

- Educational Institutions

- Others

- Residential

- East Asia Market Size (US$ Bn) Forecast, by Installation, 2026-2033

- New Installations

- Retrofit

- East Asia Market Size (US$ Bn) Forecast, by Sales Channel, 2026-2033

- Hypermarkets / Supermarkets

- Specialty Stores

- Independent Retailers

- Online Sales

- Others

- South Asia & Oceania Automated Blinds and Shades Market Outlook: Historical (2020 - 2025) and Forecast (2026 - 2033)

- Key Highlights

- Pricing Analysis

- South Asia & Oceania Market Size (US$ Bn) Forecast, by Country, 2026-2033

- India

- Southeast Asia

- ANZ

- Rest of SAO

- South Asia & Oceania Market Size (US$ Bn) Forecast, by Product Type, 2026-2033

- Fully-automatic

- Semi-automatic

- South Asia & Oceania Market Size (US$ Bn) Forecast, by End Use, 2026-2033

- Residential

- Apartment Buildings

- Individual Residences (Villas, Rou Houses, Bungalows, etc.)

- Commercial

- Retail

- Hospitality, Leisure and Entertainment

- Offices

- Healthcare

- Educational Institutions

- Others

- Residential

- South Asia & Oceania Market Size (US$ Bn) Forecast, by Installation, 2026-2033

- New Installations

- Retrofit

- South Asia & Oceania Market Size (US$ Bn) Forecast, by Sales Channel, 2026-2033

- Hypermarkets / Supermarkets

- Specialty Stores

- Independent Retailers

- Online Sales

- Others

- Latin America Automated Blinds and Shades Market Outlook: Historical (2020 - 2025) and Forecast (2026 - 2033)

- Key Highlights

- Pricing Analysis

- Latin America Market Size (US$ Bn) Forecast, by Country, 2026-2033

- Brazil

- Mexico

- Rest of LATAM

- Latin America Market Size (US$ Bn) Forecast, by Product Type, 2026-2033

- Fully-automatic

- Semi-automatic

- Latin America Market Size (US$ Bn) Forecast, by End Use, 2026-2033

- Residential

- Apartment Buildings

- Individual Residences (Villas, Rou Houses, Bungalows, etc.)

- Commercial

- Retail

- Hospitality, Leisure and Entertainment

- Offices

- Healthcare

- Educational Institutions

- Others

- Residential

- Latin America Market Size (US$ Bn) Forecast, by Installation, 2026-2033

- New Installations

- Retrofit

- Latin America Market Size (US$ Bn) Forecast, by Sales Channel, 2026-2033

- Hypermarkets / Supermarkets

- Specialty Stores

- Independent Retailers

- Online Sales

- Others

- Middle East & Africa Automated Blinds and Shades Market Outlook: Historical (2020 - 2025) and Forecast (2026 - 2033)

- Key Highlights

- Pricing Analysis

- Middle East & Africa Market Size (US$ Bn) Forecast, by Country, 2026-2033

- GCC Countries

- South Africa

- Northern Africa

- Rest of MEA

- Middle East & Africa Market Size (US$ Bn) Forecast, by Product Type, 2026-2033

- Fully-automatic

- Semi-automatic

- Middle East & Africa Market Size (US$ Bn) Forecast, by End Use, 2026-2033

- Residential

- Apartment Buildings

- Individual Residences (Villas, Rou Houses, Bungalows, etc.)

- Commercial

- Retail

- Hospitality, Leisure and Entertainment

- Offices

- Healthcare

- Educational Institutions

- Others

- Residential

- Middle East & Africa Market Size (US$ Bn) Forecast, by Installation, 2026-2033

- New Installations

- Retrofit

- Middle East & Africa Market Size (US$ Bn) Forecast, by Sales Channel, 2026-2033

- Hypermarkets / Supermarkets

- Specialty Stores

- Independent Retailers

- Online Sales

- Others

- Competition Landscape

- Market Share Analysis, 2025

- Market Structure

- Competition Intensity Mapping

- Competition Dashboard

- Company Profiles

- Somfy Group

- Company Overview

- Product Portfolio/Offerings

- Key Financials

- SWOT Analysis

- Company Strategy and Key Developments

- Hunter Douglas N.V.

- Lutron Electronics Co., Inc.

- Springs Window Fashions

- Legrand SA

- Nice SpA

- IKEA Group

- Budget Blinds (Home Franchise)

- Mechoshade Systems LLC

- Rollease Acmeda

- Graber (Springs Industries)

- Elero GmbH

- Bali Blinds & Shades

- AutomationDirect (Hikvision)

- Somfy Group

- Appendix

- Research Methodology

- Research Assumptions

- Acronyms and Abbreviations

Loading page data

Please wait a moment