Industry: Healthcare

Published Date: March-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 194

Report ID: PMRREP32293

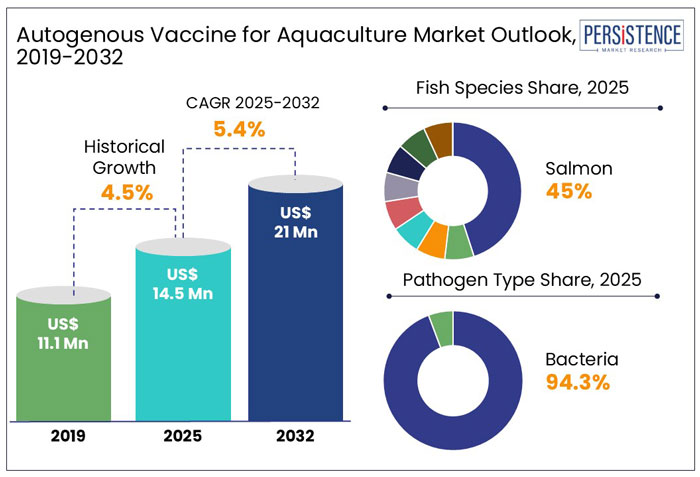

The global Autogenous Vaccine for Aquaculture Market is set to be valued at US$ 14.5 Mn in 2025, with the global market estimated to surge ahead at a CAGR value of 5.4% to reach a valuation of US$ 21.0 Mn by the end of 2032.

As assessed by Persistence Market Research, the Salmon fish species are slated to hold around 45.0% share in the Autogenous vaccine for aquaculture market by 2032. Overall, Autogenous Vaccine for Aquaculture market is set to account for approximately 9.5% of US$ 152.1 Mn global Autogenous Vaccine market in 2025.

|

Global Market Attributes |

Key Insights |

|

Autogenous Vaccine for Aquaculture Market Size (2025E) |

US$ 14.5 Mn |

|

Market Value Forecast (2032F) |

US$ 21.0 Mn |

|

Projected Growth (CAGR 2025-2032) |

5.4% |

|

Historical Market Growth (CAGR 2019 to 2024) |

4.5% |

The global market for Autogenous Vaccines for Aquaculture recorded a historic CAGR of 4.5% in the 2019 to 2024 period.

Commercial autogenous aquaculture vaccines are licensed vaccines that enable an aquatic species to build a host immune response. Long-term aquaculture cultivation and increased aquaculture output have caused aquaculture farming to decline, which has increased the prevalence of viral diseases or zoonotic infections.

Due to increased rates of infection and newly emerging zoonotic infections causing significant financial fatalities, disease profiling across aquatic species has recently become more complicated. This trend is expected to boost the demand for aquaculture vaccines worldwide. The disease management paradigm in aquaculture production has had to change as a result of this scenario.

In other words, commercial fish aquaculture vaccines are being developed and marketed to reduce the adverse effects of antibiotic usage, prevent disease, produce safer food, and enhance external factors like the quality of the farming environment.

The growing support by authorities towards zoonotic prevention and aquaculture biosecurity has positively impacted steady growth in the aquaculture related market. The global autogenous vaccine for aquaculture market is thus likely to show high growth over the coming years a CAGR value of 5.4% and reach a global market size of US$ 21.0 Million by 2032.

“Emergence of Resistance to Certain Antibiotics Surged the Demand for Autogenous Vaccines”

Over the past ten years, a plethora of new aquaculture vaccines have been introduced for the management of zoonotic infection or disease profiling among aquatic species, and more research and development are currently underway. In tropical and subtropical areas, there is a rising demand for aquaculture vaccines, according to the veterinary healthcare sector. The demand for vaccinations is rising as a result of the emergence of resistance to certain antibiotics and chemotherapeutic drugs.

Third-generation DNA vaccine development and commercialization against aquatic pathogens is a developing area of research and development in the autogenous vaccines for aquaculture market. DNA vaccines are thought to provide long-lasting immune protection and are incredibly effective.

What is the Regulatory Impact on Global Sales of Autogenous Vaccines for the Aquaculture Market?

“Protracted Regulatory Procedures May Hinder the Commercialization of Autogenous Vaccines”

Most countries have their regulatory agencies and processes for approving autogenous vaccines for aquaculture. Multiple applications for approval for each country are seen to be a major barrier to the speedy commercialization of autogenous vaccines for fisheries. Additionally, the cost of fragmented product distribution is so high that a services provider needs to wait years to receive all regulatory approvals.

In such cases, one company is prohibited from releasing new or improved products before receiving all permits. Prior to commencing to distribute their products, autogenous vaccines manufacturers need to wait for regulatory licenses. Such terms are anticipated to slow the market's expansion for autogenous aquaculture vaccinations.

Why is the North America Autogenous Vaccine for Aquaculture Market Growing?

“Supports Towards Sustainable Seafood Marks Opportunities in the North America”

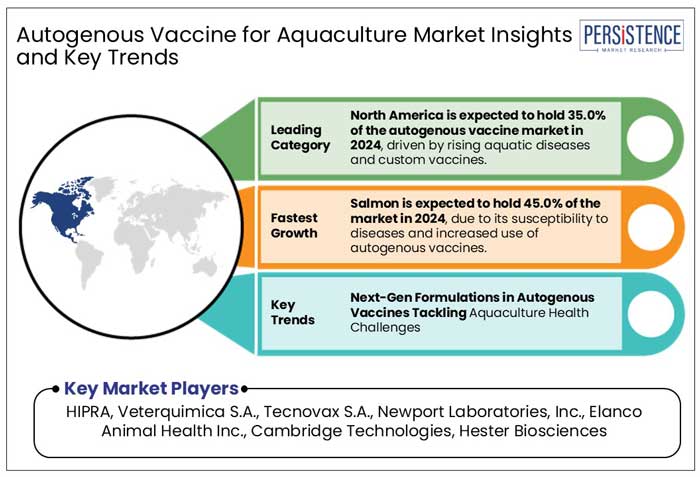

The North America accounted for nearly 35.0% market share in the global autogenous vaccine for aquaculture market in 2024 and a similar trend is projected to the forecast period. North America autogenous vaccine for aquaculture market is experiencing significant growth due to the increasing demand for sustainable seafood and rising concerns over disease outbreaks in fish farms.

In the United States, the aquaculture sector is expanding rapidly as seafood consumption increases, driving fish farmers to adopt customized vaccines that reduce antibiotic dependency and align with sustainability goals. Regulatory backing from USDA and FDA promotes the use of autogenous vaccines, especially for species lacking commercial vaccine options.

Canada also plays a crucial role, particularly in salmon aquaculture, with strong investments in R&D and government initiatives to enhance fish farming sustainability.

How Big is the Opportunity in Europe Autogenous Vaccines for Aquaculture Market?

“Norway Leads Europe's Push for Antibiotic-Free Aquaculture Vaccines”

Europe accounted for 30.5% of the global market share in 2024, and it is expected to remain a key growth hub for autogenous aquaculture vaccines throughout the forecast period. The increasing demand for antibiotic-free fish meals and the region’s expanding aquaculture production are major drivers of market growth.

Norway’s fish farming industry is emerging as a leading global supplier of high-quality, antibiotic-free seafood, particularly to North America and Europe. Norwegian fish farming companies, backed by government support, are rapidly adopting commercial aquaculture vaccines, reducing the reliance on antibiotics.

Favorable insurance policies, high per capita seafood consumption, and the presence of top manufacturers have further strengthened vaccine adoption in Norway, which remains one of the world’s largest markets for commercial aquaculture vaccines. Additionally, the EU’s Blue Economy initiative and investments in R&D are fostering sustainable fish farming, reinforcing Europe’s position as a lucrative market for autogenous vaccines.

How is Latin America Emerging as a Prominent Market for Autogenous Vaccines for the Aquaculture industry?

“Chile Ranks Second in Salmon Production and Exports”

Latin America is rapidly emerging as a key market for autogenous vaccines in aquaculture, fueled by the region’s growing fish and shrimp farming sectors. Countries like Chile, Brazil, and Ecuador are witnessing rising demand for customized vaccines, as producers and governments emphasize reducing antibiotic use and enhancing sustainability in aquaculture.

With its comparative and competitive advantages, Chile has developed sustainable aquaculture, benefiting from salmon’s low carbon footprint and water efficiency.

Additionally, new technologies, such as underwater robotics and online environmental monitoring, are being adopted to enhance sustainability.

Which Fish Species Type is Anticipated to Drive the Global Autogenous Vaccines for the Aquaculture Market Growth?

“Salmon Dominates the Global Market Due to High Demand and Increased Disease Prevention Efforts”

Salmon is expected to account for more than 45.0% of the market share in the global autogenous vaccine for aquaculture market during the forecast period, due to the rising demand for salmon as fish food in developed countries. In addition, salmon species are preferred for aquaculture cultivation in important vaccine nations like Chile and Norway.

According to FAO (2022), aquatic animal production saw a 0.2% rise from 2019 but remained 0.6% below the 2018 peak. While capture fisheries declined in 2019 and 2020, aquaculture continued growing, albeit at a slower pace, reaching 157 million tonnes for human consumption in 2020, the second-highest recorded.

Which Pathogen Type Drives Demand the Most for Autogenous Vaccines for Aquaculture Market?

“Rising Demand for Bacterial Linked Autogenous Vaccines for Enhanced Disease Protection in Aquaculture.”

Bacteria held the largest market share of around 94.3% in 2024. The USDA's Aquatic Animal Health Research has determined that bacterial species from more than 20 genera are the primary causes of aquatic illnesses. They have an impact on more than 20 species of freshwater and marine fish. Aquatic diseases are thought to be responsible for hundreds of millions of dollars in annual economic losses in the aquaculture sector.

A novel vaccine known as DNA vaccination has recently been constructed using the DNA of an infectious pathogen. It functions by introducing viral or bacterial DNA (and expressing it, causing the immune system to recognize it) into animal cells. The primary bacterial virulence mechanism would be neutralized by focusing on the known bacterial proteins that are involved in complement inhibition.

Which End User Segment Drives the Demand for the Product?

Fish farming companies dominate the global market, holding an impressive 80.1% share in 2024. This segment is expected to maintain its stronghold over the forecast period, driven by the rapid expansion of aquaculture farming. As global seafood consumption rises, fish farming companies are capitalizing on lucrative opportunities, enhancing production capabilities, and adopting sustainable practices to meet increasing demand.

The growing emphasis on high-yield aquaculture techniques, coupled with advancements in fish breeding and disease management, has further strengthened the position of fish farming companies. Additionally, government initiatives promoting aquaculture sustainability and the increasing popularity of farmed fish due to overfishing concerns are fueling market growth.

With the sector's dominance expected to persist, key industry players are focusing on innovation and efficiency to maximize yield, reduce environmental impact, and cater to the rising demand for quality seafood worldwide.

Companies in the autogenous vaccines for aquaculture market are focusing on strategic acquisitions of new, and innovative ideas, and partnerships that improve the value chain. The leading manufacturers of commercial aquaculture vaccines are concentrating extensively on the subject that aquaculture farmers are facing and addressing their needs for sustainable fish aquaculture farming through the introduction of efficient and practical commercial aquaculture vaccine development and production. This strategy is anticipated to increase their sales footprint in the global autogenous vaccines for the aquaculture market.

For instance:

|

Report Attributes |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Fish Species:

By Pathogen Type:

By Route of Administration:

By End User:

By Region:

To know more about delivery timeline for this report Contact Sales

The global Autogenous Vaccine for Aquaculture market is estimated to reach US$ 14.5 Mn in 2025.

Rising aquatic disease outbreaks, antibiotic resistance, increasing aquaculture production, and growing demand for species-specific disease prevention solutions are driving the global market.

The market is projected to record a CAGR of 5.4% during the forecast period from 2025 to 2032.

HIPRA, Veterquimica S.A., Tecnovax S.A., Marinova, Dopharma, Newport Laboratories, Inc., Elanco Animal Health Inc. (Merck Animal Health), among others.

North America is projected to hold the largest share of the industry in 2025.