Aircraft Seats Market Segmented By Wide Body Aircraft (WBA), Narrow Body Aircraft (NBA), Regional Transport Aircraft (RTA) Type with Economy Class, Premium Economy Class, Business Class, First Class with Retrofit, Line Fit Type in 9G, 16G Seat Type

Industry: Automotive & Transportation

Published Date: September-2022

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 235

Report ID: PMRREP33165

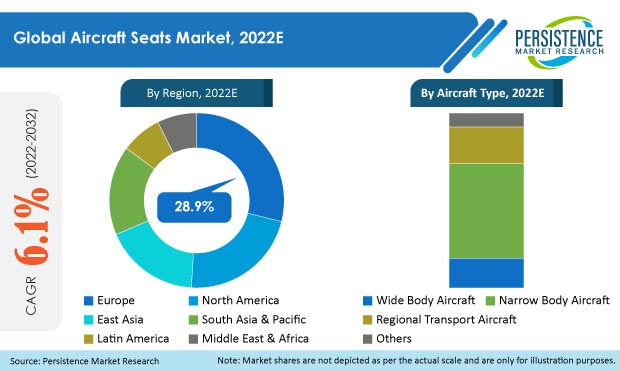

The global market for aircraft seats is worth US$ 4.35 Bn in 2022. By 2032, the market is anticipated to reach a value of US$ 7.83 Bn, expanding at a robust CAGR of 6.1%.

Over the assessment period (2022-2032), a significant rise in tourism and air travel is anticipated to increase aircraft seat installations across the world.

|

Aircraft Seats Market Size (2021A) |

US$ 4.13 Bn |

|

Estimated Market Value (2022E) |

US$ 4.35 Bn |

|

Forecasted Market Value (2032F) |

US$ 7.83 Bn |

|

Value CAGR (2022-2032) |

6.1% |

|

Collective Value Share: Top 3 Countries (2022E) |

38.1% |

Significant factors driving the need for aircraft seating around the world include increased usage of airways for comfortable business travel and rising international trade agreements for the production of commercial and defense aircraft. Because of the region's rapid expansion in the manufacturing and industrial sectors, Europe will offer a significant opportunity for OEM manufacturers to expand their businesses.

The market for aircraft seats exhibited a CAGR of 5.1% over the historic period of 2017 to 2021. Further, as per current estimates, the market is set to expand at 6.1% CAGR during the period 2022 to 2032. Significant increase in the market growth rate during the forecast period is due to increasing tourism after the pandemic, as there is a direct relation between tourism and aviation.

Due to rapid expansion in potential smart seat prototype designs, demand for comfortable aircraft seats is now high. With high investments made by countries such as the U.S. Germany, China, and India for the expansion of urban air mobility, the market in these countries has higher growth potential.

Despite a promising future, the sector will still face several obstacles, including the shortage of profitable airlines in emerging economies, skyrocketing fuel prices as an impact of mineral and crude oil price volatility, and a weak supply chain that could slow market expansion. In the near future, these variables are anticipated to have an impact on the market's year-over-year growth.

When progressively resuming air travel, passengers' concerns go beyond safety as pandemic limitations persist. They continue to desire a comfortable in-flight experience with entertainment, connection, and services that are accepted as standards in the sector.

The term "entertainment" describes the leisure activities offered to air passengers while they are flying. The need for greater IFE throughout the 1990s influenced aircraft cabin lighting designs in a significant way. Before that, the best a passenger could hope for was to watch a movie on a screen at the front of the cabin while listening to it through a headphone jack on the seat.

IFE has recently been widened to include in-flight connection, which now offers services such as web browsing, text messaging, cell phone use (where allowed), wireless streaming, and more. For this reason, all types of airlines-large and small-use in-flight entertainment and communications (IFEC) to attract passengers to board again.

This is a terrific illustration of how proactive technology deployments may be combined with smart alliances to deliver a service that customers want. The industry's IT companies are developing products that link clients’ on-the-ground and in-flight profiles. Mirroring, which allows seat-back screens to show what is displayed on a phone or tablet screen, is still a simpler option. They are also attempting to expand the IFEC system's use, such as by integrating it with call buttons to enable socially disengaged communications with the cabin crew.

Such factors will drive an increase in air travel and boost the market for aircraft seats over the decade.

The military & defense sector's rising demand for aircraft is one of the main drivers fueling industry expansion. The main variables influencing airplane spending worldwide are changing threats and rising geopolitical instability. The need for cutting-edge military aircraft with multi-mission capability is still being driven by political conflicts and territorial disputes.

Additionally, a few nations are aiming to update their fleets by swapping older models for more recent versions that cost less to operate and maintain. Many countries are concentrating on lowering their dependency on foreign suppliers for their military hardware. Several developing nations are also being compelled to start military aircraft production projects due to the high costs associated with purchasing foreign aircraft. They are concentrating on lowering their dependency on foreign suppliers for their military hardware.

Market participants are concentrating on locally produced military aircraft and improving their home-grown platform development skills through technology transfer agreements, which is a factor that will augment market growth.

The opportunity for the aviation sector in emerging markets is tremendous. This potential has not yet, however, been tapped very much. The aircraft seats market is dominated by industrialized nations such as the U.S. Five main airlines-Midwest Airlines, Frontier Airlines, American Airlines, Northwest Airlines, and AirTran Airlines, have combined operations since 2008 to boost revenues.

Along with its stable labor market, the U.S. has benefited from low oil prices, fiscal and monetary policies, and the financial distress of the private sector, all of which have helped enhance its standing globally. The nation also has a high proportion of consumer expenditure, which raises the demand for air travel. The lack of adequate infrastructure as well as other new fees levied by aviation agencies in regions such as Asia and Africa, among others, have contributed to an increase in airfare costs, which has dented aircraft seats market progress.

An average airline now spends up to 38% of its budget on jet fuel, up from 27% before 2019. For some low-cost airlines, this can even reach 50%. Spot jet fuel costs have increased by more than 80% in New York this year, while prices vary by area and are influenced by local taxes and refining expenses.

Several U.S. carriers have so far been able to pay the higher fuel expenses, but only by passing those costs onto passengers in the shape of higher ticket prices. As soon as airlines started to recover from the COVID-19 pandemic, the industry was confronted with a new problem: a sharp increase in fuel prices. At the time of writing, the cost of jet fuel has risen by over 90% since the beginning of 2022 and is currently 120% more expensive than it was in 2021.

Additionally, the invasion of Ukraine by Russia resulted in decreased shipments of processed goods and crude oil, particularly to Europe. This has driven up the prices of crude oil as well as middle distillates such as diesel and jet fuel on a global scale. In addition to these local price hikes for jet fuel, which have reached US$ 8 per gallon, local logistical challenges in satisfying the unexpected rise in aviation demand in regions like the Northeast United States have contributed to additional global price rises.

These factors are set to dent the demand growth for airline seats to a certain extent over the coming years.

Commercial Defense Benefiting Aircraft Seats Market in China

China is expected to remain one of the top global consumers of aircraft seats due to considerable demand for aircraft production. The market in China is expected to increase at 7.6% CAGR between 2022 and 2032.

The large presence of prominent corporations, the availability of plentiful resources, and increased investments in product innovations are only a few of the factors driving the rise of the aircraft seating market in the country.

Additionally, China is working harder to increase the self-sufficiency of its aviation industry. By 2025, it already has plans to produce vital parts for commercial engines in Shanghai. A new wide-bodied passenger jet is already being produced in China and Russia. This investment is expected to have a positive impact on the aircraft seats industry in China.

Growth Outlook of Aircraft Seats Market in India

The world's fastest-growing market for aircraft seats is expected to be India. The country is predicted to consume electricity at the third-highest rate in the world. Market expansion is being impacted by rising urbanization as well as substantial developments in the manufacturing and industrial sectors.

As such, the country's aircraft seats industry will offer enormous growth potential opportunities to market players over the coming years.

Military & Defence Aircraft – High-Potential End User in the U.S.

During the study period, the U.S. market for aircraft seats is expected to expand at 5.4% CAGR and is predicted to offer an opportunity worth US$ 1.3 billion.

Growing investments by the U.S. in defense aircraft are anticipated to increase the market for aircraft seats in the country. Also, increasing investments in advanced innovations in aircraft seats by major players concentrated in the country is a plus for this regional market.

Key Aircraft Seat Type

Based on seat type, the 16 G segment is projected to expand at the highest CAGR during the forecast period.

New seats undergo a series of tests to determine their strength, similar to crash tests that have to meet FAA safety standards.

Retrofit Type Seats - Segment to Watch

The use of aircraft seating is anticipated to increase at 6.3% CAGR in the retrofit segment throughout the projection period. The main factors driving segment demand are the constant demand for various types of aircraft across developed and developing businesses, which is due to the growing necessity for a reliable supply of aircraft seats.

For instance, in September 2022, Emirates accelerated its plans to update the interior cabins of the 120 Airbus A380 also the Boeing 777, the two largest commercial aircraft types now in use. The two-year, multibillion-dollar project, which will begin in November 2022 and involve the complete overhaul of four aircraft, will be under the direction of Emirates Engineering. By the time development is concluded in April 2025, there will be around 4,000 new premium & economy seats constructed, first-class suites rebuilt, and more than 5,000 business class seats given an aesthetic upgrade.

|

Attribute |

Details |

|

Forecast Period |

2022-2032 |

|

Historical Data Available for |

2017-2021 |

|

Market Analysis |

|

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available Upon Request |

By Aircraft Type:

By Seat Class:

By Fit Type:

By Seat Type:

By Region:

To know more about delivery timeline for this report Contact Sales

The global market for aircraft seat stands at a valuation of US$ 4.35 Bn in 2022.

Worldwide aircraft seat demand is anticipated to increase at 6.1% CAGR from 2022 to 2032.

Narrow body aircraft and wide body aircraft, together, will account for 70% market share.

Hong Kong Aircraft Engineering Company Limited, STELIA Aerospace (Airbus SE), Safran SA, RECARO Holding GmbH, Collins, Aerospace (Raytheon Technologies), Thompson Aero Seating Limited, JAMCO Corporation, Crane Aerospace & Electronics, Acro Aircraft Seating, GEVEN SpA, Causeway Aero Group, and Adient Aerospace are key market players.

Around 48% share of the total market is accounted for by major players in the market.

Top countries driving market demand are China, India, and the U.S.